Las Vegas Nevada Tax Rate

When considering any destination for business or investment, understanding the local tax landscape is crucial. This comprehensive guide will delve into the tax rates applicable to the vibrant city of Las Vegas, Nevada, providing a detailed analysis for those interested in exploring economic opportunities within this dynamic metropolis.

Understanding the Las Vegas Tax Structure

The tax system in Las Vegas, like any other jurisdiction, is multifaceted, encompassing various levies and rates. This section will break down the key components, offering a clear picture of the tax obligations for individuals and businesses.

Income Tax Rates

Nevada is renowned for its lack of personal income tax, a significant advantage for individuals and businesses alike. This means that residents of Las Vegas do not pay state income tax on their earnings, providing a substantial financial benefit.

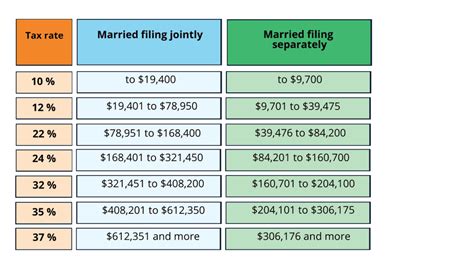

However, it's important to note that while there is no state income tax, federal income tax still applies. The Internal Revenue Service (IRS) imposes federal income tax rates based on an individual's or business's taxable income. These rates can range from 10% to 37%, depending on income brackets and filing status.

| Federal Income Tax Brackets (Single Filers) for 2023 | Tax Rate |

|---|---|

| $0 - $10,870 | 10% |

| $10,870 - $45,219 | 12% |

| $45,219 - $90,420 | 22% |

| $90,420 - $180,830 | 24% |

| $180,830 - $221,150 | 32% |

| $221,150 - $540,430 | 35% |

| $540,430 and above | 37% |

For businesses, the tax rate structure can be more complex, with additional considerations such as pass-through entities and corporate tax rates. It's essential to consult with tax professionals to navigate these intricacies effectively.

Sales and Use Taxes

Sales and use taxes are a significant part of the revenue stream for Las Vegas and Nevada. These taxes apply to the sale of goods and services and are collected by businesses, which then remit the funds to the state and local authorities.

The current sales tax rate in Las Vegas is 8.25%, which includes both the state and local tax rates. This rate can vary slightly depending on the specific jurisdiction within the city, as some local municipalities may have additional taxes.

| Sales Tax Rates in Las Vegas | Tax Rate |

|---|---|

| State Sales Tax | 6.85% |

| Clark County Sales Tax | 0.9% |

| Las Vegas City Sales Tax | 0.5% |

It's worth noting that there are specific exemptions and taxability rules for various goods and services. For instance, groceries are generally exempt from sales tax, while rental cars and certain entertainment services are taxable. Understanding these nuances is vital for businesses operating in Las Vegas.

Property Taxes

Property taxes in Las Vegas are assessed on real estate, both residential and commercial. These taxes are an essential revenue source for local governments, funding various public services and infrastructure projects.

The property tax rate in Las Vegas is relatively low compared to many other metropolitan areas. The assessed value of a property is determined by the Clark County Assessor's Office, and the tax rate is applied to this value. The current average tax rate is approximately 1.05%, which is among the lowest in the nation.

| Property Tax Rates in Las Vegas | Tax Rate |

|---|---|

| Average Effective Property Tax Rate | 1.05% |

Other Taxes and Fees

Beyond the core tax types, Las Vegas and Nevada impose various other taxes and fees. These can include:

- Hospitality tax: This tax is levied on hotel stays and certain tourism-related services.

- Business license fees: Businesses operating in Las Vegas are required to obtain licenses, which come with associated fees.

- Mining taxes: Nevada has a robust mining industry, and taxes are imposed on the extraction of minerals.

- Gaming taxes: The gaming industry, a cornerstone of Las Vegas's economy, is subject to specific taxes and regulations.

Economic Implications and Opportunities

The unique tax structure of Las Vegas has significant implications for its economy and business environment. The absence of a state income tax, combined with competitive sales and property tax rates, creates a favorable climate for economic growth and investment.

Attracting Businesses and Talent

Las Vegas’s tax-friendly environment is a powerful draw for businesses considering relocation or expansion. The absence of a state income tax means companies can offer competitive salaries without the burden of high tax rates, making it easier to attract top talent.

Furthermore, the low property tax rates make it more affordable for businesses to own or lease commercial real estate. This can lead to significant cost savings, especially for companies operating in sectors with high overhead costs.

Tourism and Entertainment Industry

The tourism and entertainment industries, which are central to Las Vegas’s economy, also benefit from the city’s tax structure. The low sales tax rate makes goods and services more affordable for visitors, enhancing the overall appeal of the destination. Additionally, the hospitality tax funds vital tourism infrastructure and marketing efforts, further boosting the industry’s competitiveness.

Investment and Real Estate Opportunities

Las Vegas’s tax landscape presents attractive opportunities for investors, particularly in the real estate sector. The low property tax rates make owning real estate more affordable, and the city’s strong economic growth prospects make it an appealing market for both residential and commercial investments.

Navigating Tax Obligations and Compliance

While Las Vegas’s tax rates are generally favorable, businesses and individuals must still navigate a range of tax obligations and regulations. Compliance with tax laws is essential to avoid penalties and legal issues.

Tax Registration and Reporting

Businesses operating in Las Vegas must register with the Nevada Department of Taxation and obtain the necessary licenses and permits. This process ensures compliance with tax laws and allows businesses to remit the appropriate taxes.

Regular tax reporting is a critical aspect of compliance. Businesses must accurately report their taxable income, sales, and other relevant data to the state and local authorities. Failure to do so can result in penalties and audits.

Tax Incentives and Programs

Nevada offers various tax incentives and programs to encourage business growth and investment. These can include tax abatements, credits, and grants, which can significantly reduce a business’s tax burden. It’s crucial for businesses to explore these opportunities and understand the eligibility criteria.

Conclusion: Las Vegas’s Tax-Friendly Advantage

Las Vegas’s tax rates and structure offer a competitive advantage for businesses and individuals. The absence of a state income tax, combined with low sales and property tax rates, creates a financially attractive environment. This tax-friendly landscape, coupled with the city’s dynamic economy and world-class entertainment offerings, makes Las Vegas a compelling destination for economic opportunities.

Are there any specific tax incentives for businesses in Las Vegas?

+Yes, Nevada offers a range of tax incentives to attract and support businesses. These include tax abatements, research and development tax credits, and sales and use tax exemptions for specific industries. It’s recommended to consult with tax professionals or the Nevada Department of Taxation for detailed information on these incentives.

How does Las Vegas’s tax structure compare to other major cities in the U.S.?

+Las Vegas’s tax structure is generally more favorable than many other major U.S. cities. The absence of a state income tax is a significant advantage, as is the relatively low sales and property tax rates. However, it’s important to consider the specific tax obligations and incentives offered by other cities to make a comprehensive comparison.

Are there any upcoming changes to Las Vegas’s tax rates or regulations?

+Tax laws and regulations can change periodically, so it’s essential to stay informed. While there are no major changes currently planned, it’s recommended to monitor local and state legislation for any updates. Consulting with tax professionals can ensure you stay up-to-date with the latest tax developments.