Las Vegas Sales Tax Rate

When it comes to understanding the sales tax landscape in Las Vegas, Nevada, it's crucial to delve into the specific rates and regulations that govern this bustling city. The sales tax system in Las Vegas, like in many other places, is an essential component of the local economy, providing revenue for various public services and infrastructure projects. This article aims to provide a comprehensive breakdown of the Las Vegas sales tax rate, its composition, and how it impacts businesses and consumers alike.

Understanding the Las Vegas Sales Tax Rate

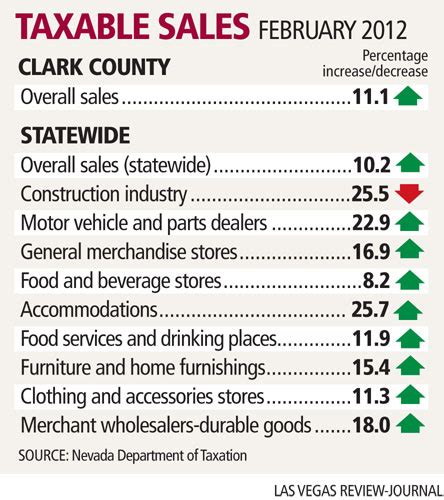

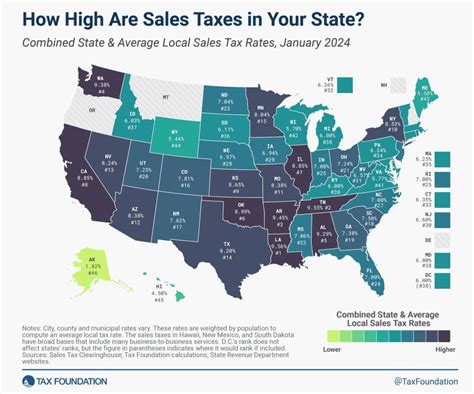

The sales tax rate in Las Vegas, Nevada, is a multi-tiered system that consists of several components, each serving a distinct purpose in funding various public initiatives. The rate is determined by a combination of state, county, and city taxes, with additional taxes applied for specific purposes such as tourism and infrastructure development.

As of [current year], the standard sales tax rate in Las Vegas is set at 8.1%, which is comprised of the following:

| Tax Component | Rate (%) |

|---|---|

| State Sales Tax | 4.6% |

| County Sales Tax | 2.5% |

| City Sales Tax | 1.0% |

However, it's important to note that the sales tax rate in Las Vegas can vary depending on the specific location within the city. Certain areas, such as the Las Vegas Strip and downtown, may have additional taxes applied due to their unique tourism and development needs.

Additional Taxes for Tourism and Development

Las Vegas, being a major tourist destination, has implemented additional taxes to support its vibrant tourism industry. These taxes are often earmarked for specific purposes, such as convention centers, cultural attractions, and infrastructure projects. As a result, the sales tax rate can be higher in these areas, providing a dedicated funding stream for these initiatives.

For instance, the Las Vegas Strip, a world-renowned entertainment hub, has a 1.5% additional sales tax, bringing the total rate to 9.6%. This additional tax is specifically directed towards funding the Las Vegas Convention and Visitors Authority, which promotes tourism and manages the city's convention facilities.

| Location | Additional Tax (%) | Total Sales Tax Rate (%) |

|---|---|---|

| Las Vegas Strip | 1.5% | 9.6% |

| Downtown Las Vegas | 0.5% | 8.6% |

Impact on Businesses and Consumers

The varying sales tax rates in Las Vegas can have a significant impact on both businesses and consumers. For businesses, especially those operating in the tourism sector, understanding and complying with the correct sales tax rate is crucial for accurate tax collection and reporting. Failure to do so can result in penalties and legal consequences.

Consumers, on the other hand, should be aware of the sales tax rates when making purchases, especially when comparing prices between different locations within Las Vegas. The difference in sales tax rates can influence purchasing decisions and overall consumer spending habits. It's essential for shoppers to consider the total cost, including sales tax, when making their choices.

Sales Tax Exemptions and Special Considerations

While the sales tax rate in Las Vegas generally applies to most goods and services, there are certain exemptions and special considerations to be aware of. These exemptions are put in place to encourage certain economic activities or support specific industries.

Grocery and Food Exemptions

In Las Vegas, certain food items and groceries are exempt from sales tax. This exemption is designed to reduce the tax burden on essential items and ensure that basic necessities are more affordable for residents. However, it’s important to note that the exemption only applies to specific categories of food and not all grocery items.

For instance, unprepared food items, such as fruits, vegetables, meat, and dairy products, are generally exempt from sales tax. However, prepared foods, including meals from restaurants or pre-packaged deli items, are subject to the standard sales tax rate.

Tourism-Related Exemptions

Las Vegas, being a popular tourist destination, offers certain sales tax exemptions to encourage tourism-related activities. These exemptions often apply to specific services or experiences that are unique to the city’s tourism industry.

One notable exemption is for shows and performances. Tickets for live performances, concerts, and theatrical shows are exempt from sales tax, making them more attractive to visitors. This exemption aims to promote the city's vibrant entertainment scene and encourage tourism spending in this sector.

Online Sales and Remote Sellers

With the rise of e-commerce, the sales tax landscape for online sales and remote sellers has become more complex. In Las Vegas, online retailers and remote sellers are generally required to collect and remit sales tax based on the destination of the shipment, following the same rates as brick-and-mortar stores.

However, there are certain thresholds and exemptions for small businesses and remote sellers. These exemptions aim to support small businesses and reduce the administrative burden of tax compliance. It's crucial for online businesses to stay informed about these regulations to ensure they are compliant with the sales tax laws in Las Vegas.

Sales Tax Collection and Remittance

Sales tax collection and remittance is a critical process that ensures the proper allocation of funds to various public services and projects. In Las Vegas, businesses are responsible for collecting sales tax from customers at the point of sale and then remitting these funds to the appropriate tax authorities.

The process of sales tax collection and remittance involves several key steps:

- Registration: Businesses operating in Las Vegas must register with the Nevada Department of Taxation to obtain a sales tax permit. This permit allows them to legally collect and remit sales tax.

- Tax Calculation: Businesses are required to calculate the sales tax on each transaction based on the applicable rate for the location of the sale. This involves applying the correct tax rate and ensuring accurate tax calculations.

- Collection: During the point of sale, businesses collect the sales tax from customers and include it in the total amount due.

- Remittance: On a regular basis, usually monthly or quarterly, businesses must remit the collected sales tax to the Nevada Department of Taxation. This process involves filing tax returns and ensuring timely payment.

Sales Tax Audits and Compliance

To ensure compliance with sales tax laws, the Nevada Department of Taxation conducts audits of businesses. These audits are designed to verify that businesses are correctly calculating, collecting, and remitting sales tax. Failure to comply with sales tax regulations can result in penalties, interest, and even legal consequences.

Businesses should maintain accurate records of sales transactions, including the breakdown of sales tax collected. This documentation is crucial during audits and helps demonstrate compliance with the sales tax regulations in Las Vegas.

Future Implications and Trends

The sales tax landscape in Las Vegas is subject to change as the city’s economy and population evolve. As new development projects, infrastructure initiatives, and tourism strategies emerge, the sales tax rates and regulations may adapt to meet these changing needs.

One potential future trend is the exploration of destination-based sales tax rates. This approach would allow for more targeted taxation based on the specific location of a sale, ensuring that funds are directed towards the development and maintenance of the area where the sale took place. Such a system could provide a more equitable distribution of tax revenue across different parts of Las Vegas.

Additionally, with the ongoing digital transformation of the economy, the sales tax system may need to adapt to accommodate the unique challenges of online sales and remote sellers. Finding a balance between tax compliance and supporting the growth of e-commerce businesses will be crucial for the future of sales tax regulations in Las Vegas.

How often do sales tax rates change in Las Vegas?

+Sales tax rates in Las Vegas are subject to change periodically, typically every few years. These changes are often driven by legislative decisions and the need to fund specific public initiatives. It’s important for businesses and consumers to stay informed about any updates to the sales tax rates.

Are there any sales tax holidays in Las Vegas?

+Currently, Las Vegas does not have specific sales tax holidays like some other states. However, certain promotional periods or events may offer tax-free shopping for specific items, such as back-to-school supplies or energy-efficient appliances. It’s advisable to check with local authorities or retailers for any such promotions.

How do I register my business for sales tax in Las Vegas?

+To register your business for sales tax in Las Vegas, you need to obtain a sales tax permit from the Nevada Department of Taxation. This process involves completing an application, providing business details, and paying the applicable fees. It’s recommended to consult their official website for the most up-to-date registration guidelines.