Online Sales And Sales Tax

The world of e-commerce is ever-evolving, and one of its most critical aspects is the management of sales tax. With the rapid growth of online sales, ensuring compliance with tax regulations has become a complex yet indispensable task for businesses of all sizes. This comprehensive guide delves into the intricacies of online sales and sales tax, offering insights into the challenges and opportunities they present.

Understanding the Complexity of Online Sales Tax

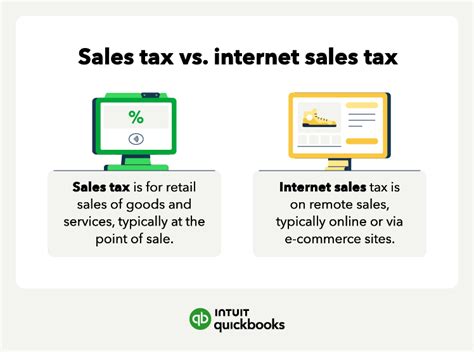

Online sales tax is a multifaceted issue, influenced by a myriad of factors including state, national, and international tax laws, as well as the unique characteristics of the e-commerce industry. As online businesses expand their reach across borders, the complexity of sales tax management intensifies, requiring a deep understanding of the legal and operational intricacies involved.

The Challenge of Nexus

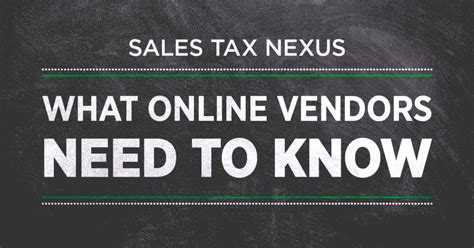

One of the primary challenges for online retailers is determining their tax nexus, which refers to the connection a business has with a state or jurisdiction that obligates it to collect and remit sales tax. Nexus can be established through various factors such as physical presence, economic presence, or even certain activities like affiliate marketing.

For instance, consider an online retailer that operates from California but ships products to customers across the United States. If the retailer has a warehouse or distribution center in Texas, it would likely have a physical presence nexus in that state and be required to collect and remit Texas sales tax on all orders shipped to Texas residents. This scenario becomes more complex when considering the varying tax rates and rules in different jurisdictions, making it a daunting task for businesses to stay compliant.

| State | Sales Tax Rate | Nexus Factors |

|---|---|---|

| California | 7.25% | Physical Presence, Economic Presence |

| Texas | 6.25% | Physical Presence, Affiliate Nexus |

| New York | 4% | Economic Presence, Marketplace Facilitator Law |

Sales Tax Registration and Collection

Once a business determines its tax nexus, the next step is to register with the appropriate tax authorities and collect sales tax from customers. This process involves obtaining sales tax permits, setting up systems to calculate and collect tax, and regularly filing sales tax returns.

For example, if an online retailer determines it has a tax nexus in multiple states, it would need to register for sales tax permits in each of those states. The retailer would then need to integrate its e-commerce platform with tax calculation software to accurately calculate tax rates based on the shipping address of each order. Finally, the retailer would be responsible for filing sales tax returns with each state on a periodic basis, typically quarterly or annually.

Strategies for Effective Sales Tax Management

Managing sales tax for online businesses requires a strategic approach to ensure compliance, minimize costs, and maintain a positive customer experience. Here are some key strategies to consider:

Utilize Sales Tax Automation Tools

Sales tax automation software can streamline the entire sales tax management process, from determining tax nexus to calculating tax rates, collecting sales tax, and filing returns. These tools can integrate with e-commerce platforms and accounting systems, ensuring accurate and efficient tax management.

For instance, popular sales tax automation platforms like Avalara and TaxJar offer features such as real-time tax rate calculation, automated tax filing, and tax exemption certificate management. These tools can significantly reduce the manual effort required for sales tax compliance, allowing businesses to focus on their core operations.

Implement Tax Exemption Strategies

Understanding tax exemption rules and implementing strategies to leverage them can help businesses minimize their sales tax obligations. This includes offering tax-exempt status to certain customer types (e.g., government entities, non-profits) and ensuring compliance with tax exemption certificate requirements.

Consider a scenario where an online retailer primarily serves businesses in the healthcare industry. By implementing a tax exemption strategy, the retailer could offer tax-exempt status to qualifying healthcare organizations, reducing the overall sales tax burden on the business and providing a competitive advantage in the healthcare market.

Stay Updated with Tax Law Changes

Sales tax laws are subject to frequent changes, and staying updated with these changes is crucial for compliance. This involves monitoring state and local tax law amendments, Supreme Court rulings, and other legislative actions that could impact your business’s tax obligations.

For example, the 2018 Supreme Court ruling in South Dakota v. Wayfair, Inc. significantly altered the landscape of sales tax nexus, expanding the concept of economic nexus and requiring online retailers with significant sales in a state to collect and remit sales tax, even without a physical presence. Businesses need to be vigilant in monitoring such developments to ensure they remain compliant.

The Future of Online Sales Tax

As e-commerce continues to thrive and sales tax regulations become more complex, the future of online sales tax management is poised for significant advancements. Here’s a glimpse into what the future might hold:

Standardization of Sales Tax Laws

Currently, sales tax laws vary greatly from state to state, making compliance a challenging task for businesses operating in multiple jurisdictions. However, there is a growing movement towards standardizing sales tax laws, which could simplify the tax management process and reduce compliance costs.

One notable initiative in this regard is the Streamlined Sales Tax Project (SSTP), a cooperative effort among states to simplify and modernize sales tax administration and policies. While the SSTP has made significant progress, full implementation and adoption by all states remain a work in progress.

Advanced Tax Technology

The rapid advancement of technology is expected to bring about innovative solutions for sales tax management. This includes the use of artificial intelligence and machine learning to automate tax calculations, improve accuracy, and streamline the tax filing process.

For instance, AI-powered tax calculation engines can analyze vast amounts of data in real-time, including customer locations, product categories, and tax rates, to provide accurate sales tax calculations. This technology can significantly reduce human error and improve the efficiency of sales tax management.

Integration with E-commerce Platforms

Sales tax management tools are likely to become more seamlessly integrated with e-commerce platforms, accounting software, and other business systems. This integration will enable automatic tax calculation, collection, and filing, further reducing the manual effort required for compliance.

Many leading e-commerce platforms, such as Shopify and WooCommerce, already offer sales tax calculation and collection features, often integrated with popular tax compliance software. As these integrations become more sophisticated, businesses will be able to manage their sales tax obligations with greater ease and accuracy.

Conclusion

Online sales tax management is a critical aspect of e-commerce, requiring careful consideration and strategic planning. By understanding the complexities of sales tax regulations, leveraging technology, and staying updated with the latest developments, businesses can ensure compliance, minimize costs, and maintain a positive customer experience.

What is sales tax nexus, and how does it affect online businesses?

+

Sales tax nexus refers to the connection a business has with a state or jurisdiction that obligates it to collect and remit sales tax. Online businesses must determine their nexus to ensure compliance with tax laws. Nexus can be established through physical presence, economic presence, or certain activities like affiliate marketing. Failure to identify and address nexus obligations can result in penalties and interest charges.

How can online retailers stay updated with changing sales tax laws and regulations?

+

Staying updated with sales tax laws is crucial for compliance. Online retailers can achieve this by subscribing to tax law updates from reputable sources, such as tax compliance software providers or legal databases. Additionally, monitoring news and developments in the e-commerce industry can provide valuable insights into potential changes in sales tax regulations.

What are the potential consequences of non-compliance with sales tax obligations for online businesses?

+

Non-compliance with sales tax obligations can have serious consequences for online businesses. These may include penalties, interest charges, and even legal action. Additionally, non-compliance can damage a business’s reputation and trust with customers, leading to a decline in sales and revenue.