Alleviate Tax

Taxation is a complex and often unavoidable aspect of running a business or managing personal finances. While taxes are necessary for the functioning of society and governments, finding ways to legally minimize tax liabilities is a common goal for individuals and businesses alike. In this comprehensive guide, we will delve into the world of tax alleviation strategies, exploring effective methods, best practices, and real-world examples to help you navigate the tax landscape with confidence.

Understanding the Fundamentals of Tax Alleviation

Tax alleviation, also known as tax optimization or tax planning, is a strategic approach to managing your financial affairs to reduce the amount of tax you owe. It involves a thorough understanding of tax laws, regulations, and the identification of opportunities to minimize tax liabilities while remaining compliant with the law.

The goal of tax alleviation is to maximize the after-tax returns on your income, investments, and business operations. By implementing effective tax strategies, you can retain more of your hard-earned money, increase your purchasing power, and improve your overall financial health.

Key Principles of Tax Alleviation

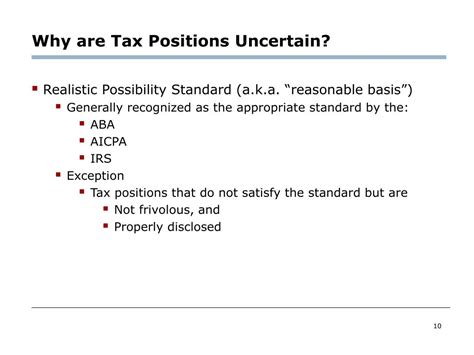

- Compliance and Legality: Tax alleviation strategies must always adhere to the legal framework of your jurisdiction. Engaging in illegal tax evasion practices can lead to severe penalties and legal consequences.

- Understanding Tax Laws: A deep understanding of tax laws, including income tax, corporate tax, sales tax, and any applicable deductions or credits, is crucial for effective tax planning.

- Proactive Planning: Tax alleviation is not a reactive process. It requires proactive planning throughout the year to ensure that your financial decisions are tax-efficient.

- Seeking Professional Advice: Consulting with tax professionals, such as certified public accountants (CPAs) or tax attorneys, can provide valuable insights and ensure that your tax strategies are tailored to your specific circumstances.

Strategies for Individual Taxpayers

For individuals, tax alleviation often focuses on maximizing deductions, credits, and optimizing investment strategies to reduce tax liabilities. Here are some key strategies to consider:

Maximizing Deductions

Deductions are expenses that can be subtracted from your taxable income, effectively reducing the amount of tax you owe. Common deductions for individuals include:

- Standard Deduction: This is a fixed amount that taxpayers can claim without itemizing their deductions. The standard deduction amount varies by filing status and is adjusted annually for inflation.

- Itemized Deductions: These are specific expenses that you can choose to deduct from your taxable income. Examples include medical expenses, state and local taxes, mortgage interest, charitable contributions, and certain business expenses.

- Tax Credits: Unlike deductions, tax credits directly reduce the amount of tax you owe dollar-for-dollar. Examples of tax credits include the Child Tax Credit, Earned Income Tax Credit, and the Credit for the Elderly or Disabled.

Strategic Investment Planning

Investment decisions can have a significant impact on your tax liabilities. Consider the following strategies:

- Tax-Advantaged Retirement Accounts: Contributions to traditional IRA or 401(k) plans are often tax-deductible, allowing you to reduce your taxable income in the year of contribution. Additionally, the investments within these accounts grow tax-deferred until withdrawal.

- Capital Gains and Losses: When selling investments, capital gains are taxed at a lower rate than ordinary income. Strategically timing the sale of investments to maximize capital gains or offset them with capital losses can reduce your tax liability.

- Tax-Efficient Investment Vehicles: Certain investment options, such as municipal bonds or real estate investment trusts (REITs), offer tax advantages. Municipal bond interest, for example, is often exempt from federal and state taxes, making it an attractive option for tax-efficient investing.

Tax Alleviation for Businesses

Businesses face a unique set of tax challenges and opportunities. Effective tax planning can significantly impact a company’s bottom line and overall financial performance. Here are some key strategies for businesses:

Business Structure and Entity Selection

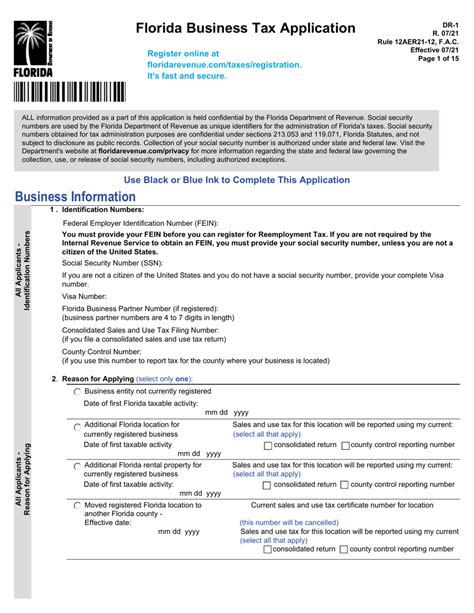

The choice of business structure can have a significant impact on tax liabilities. Different business entities, such as sole proprietorships, partnerships, limited liability companies (LLCs), and corporations, offer varying tax advantages and disadvantages.

- Pass-Through Entities: Sole proprietorships, partnerships, and LLCs are often pass-through entities, meaning business income is reported on the owners’ personal tax returns. This allows for the utilization of individual tax deductions and credits.

- Corporations: C-corporations are separate tax entities, which means they pay taxes on their profits. However, they also offer certain tax advantages, such as the ability to retain earnings and distribute dividends, which can be tax-efficient for business owners.

Business Deductions and Credits

Businesses have access to a wide range of deductions and credits that can reduce their tax liabilities. Some key deductions and credits include:

- Business Expenses: Business owners can deduct ordinary and necessary expenses incurred in the operation of their business. This includes rent, utilities, insurance, advertising, and employee salaries.

- Depreciation and Amortization: Businesses can deduct the cost of assets over their useful lives through depreciation and amortization. This allows businesses to recover the cost of investments over time, reducing their tax liabilities.

- Research and Development (R&D) Tax Credits: Businesses engaged in research and development activities may be eligible for tax credits. These credits encourage innovation and can provide significant tax savings for qualifying businesses.

Advanced Tax Planning Techniques

For those seeking more advanced tax alleviation strategies, there are several techniques that can be employed, often with the guidance of tax professionals. These strategies require a deeper understanding of tax laws and may involve more complex financial planning.

Tax-Efficient Estate Planning

Estate planning is an essential aspect of tax alleviation, especially for high-net-worth individuals and business owners. By utilizing trusts, gift-giving strategies, and life insurance policies, you can minimize estate and inheritance taxes, ensuring more of your wealth is passed on to your heirs.

International Tax Planning

For businesses with international operations or individuals with cross-border financial interests, international tax planning becomes crucial. This involves understanding the tax laws of different countries, establishing offshore entities, and optimizing tax liabilities across jurisdictions.

Tax-Loss Harvesting and Tax-Efficient Asset Allocation

Tax-loss harvesting is a strategy used by investors to offset capital gains with capital losses, reducing their overall tax liability. Additionally, strategic asset allocation can help minimize taxes on investment income, such as through the use of tax-efficient mutual funds or exchange-traded funds (ETFs).

| Tax Alleviation Strategy | Real-World Example |

|---|---|

| Maximizing Deductions | A self-employed individual deducts home office expenses, reducing their taxable income by $5,000 annually. |

| Strategic Investment Planning | An investor strategically sells appreciated stocks to offset capital gains with losses, reducing their tax liability by 20%. |

| Business Structure Optimization | A startup chooses an LLC structure, allowing for pass-through taxation and avoiding double taxation. |

| Tax-Efficient Estate Planning | A high-net-worth individual establishes a trust to minimize estate taxes, ensuring more wealth is passed on to heirs. |

Frequently Asked Questions

What is the difference between tax evasion and tax avoidance?

+Tax evasion is the illegal practice of deliberately misrepresenting or hiding information to reduce tax liabilities. It is a criminal offense and can result in severe penalties. On the other hand, tax avoidance is a legal strategy to minimize tax liabilities through proactive planning and the utilization of tax laws and regulations.

Can I deduct personal expenses as business expenses?

+Generally, personal expenses are not deductible as business expenses. However, certain expenses, such as using your home for business purposes (home office deduction) or vehicle expenses for business travel, may be deductible if they meet specific criteria.

Are there any tax advantages for investing in renewable energy?

+Yes, investing in renewable energy projects or equipment may qualify for tax credits and incentives. The federal government and many states offer tax credits and grants to promote the adoption of clean energy technologies.

Can I defer taxes by contributing to a retirement account?

+Yes, contributing to a traditional IRA or 401(k) plan allows you to defer taxes on the contributions and investment earnings until withdrawal. This strategy can be particularly beneficial for high-income earners.