South Carolina Tax

South Carolina, often referred to as the Palmetto State, is a vibrant southern state in the United States, known for its rich history, diverse landscapes, and a thriving economy. When it comes to taxes, South Carolina offers a unique blend of tax policies that impact both residents and businesses. Understanding the tax landscape in this state is crucial for individuals and companies considering relocation or investment opportunities.

Unraveling the South Carolina Tax System

The tax system in South Carolina is designed to provide a balanced approach, catering to the needs of its citizens and the state’s economic growth. Let’s delve into the various aspects of South Carolina’s tax structure, exploring the types of taxes, rates, and their implications.

Income Tax: A Progressive Approach

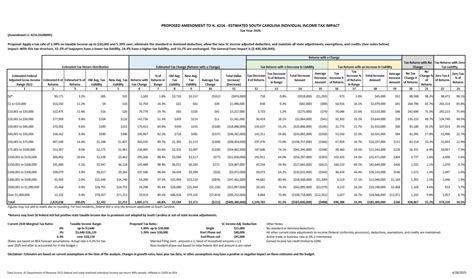

South Carolina employs a progressive income tax system, which means that higher income earners pay a larger percentage of their income in taxes. This approach aims to ensure fairness and contribute to the state’s revenue stream. Here’s a breakdown of the income tax brackets and rates:

| Income Bracket | Tax Rate |

|---|---|

| $0 - $2,999 | 0% |

| $3,000 - $5,999 | 2% |

| $6,000 - $9,999 | 3% |

| $10,000 - $12,999 | 4% |

| $13,000 and above | 5% |

For example, let's consider a single individual with an annual income of $45,000. Based on the tax brackets, they would fall into the 4% tax rate category for the portion of their income above $10,000. This progressive structure ensures that individuals with higher incomes contribute proportionally more to the state's revenue.

Sales and Use Tax: A Statewide Standard

South Carolina imposes a state sales and use tax on the sale of tangible personal property and certain services. As of [insert date], the standard sales tax rate is set at [current rate]%. However, it’s important to consider that local jurisdictions may also levy additional sales taxes, leading to varying rates across the state.

For instance, the city of Charleston has a local sales tax rate of [local rate]%, making the total sales tax rate for purchases within the city [combined rate]%. This additional tax revenue is often utilized for specific community projects and infrastructure development.

Property Tax: Local Assessments

Property taxes in South Carolina are assessed and collected by local governments, primarily counties and municipalities. The tax rates and assessment methodologies can vary significantly from one area to another. Factors such as property value, location, and the services provided by the local government influence the property tax rates.

Let's take Columbia, the state capital, as an example. The property tax rate in Columbia is [current rate]%, which is applied to the assessed value of the property. This rate may be subject to change based on budgetary needs and other local considerations.

Corporate Taxes: Attracting Businesses

South Carolina has implemented a competitive corporate tax structure to attract businesses and promote economic growth. The state offers a corporate income tax rate of [current rate]%, which is among the lowest in the region. This rate applies to the net income of C corporations and S corporations.

Additionally, South Carolina provides tax incentives and credits to encourage business investment. For instance, the state offers a Job Tax Credit, which provides a credit of [credit amount]% of the qualified new employees' wages for up to [number of years] years. This incentive aims to stimulate job creation and support the local economy.

Estate and Inheritance Taxes: A Relief for Residents

One notable aspect of South Carolina’s tax system is the absence of an estate tax. This means that residents do not have to pay a tax on the transfer of their assets upon death. Furthermore, the state does not impose an inheritance tax, providing a significant relief for heirs and beneficiaries.

The Impact of South Carolina’s Tax Policies

South Carolina’s tax policies have had a profound impact on the state’s economy and its residents. The progressive income tax structure ensures a fair distribution of tax burden, while the low corporate tax rates have attracted numerous businesses, creating job opportunities and boosting economic growth.

The state's decision to forgo estate and inheritance taxes has made it an attractive destination for high-net-worth individuals seeking to minimize tax liabilities. Additionally, the availability of tax credits and incentives has encouraged businesses to invest in the state, further strengthening the economy.

Economic Growth and Development

South Carolina’s tax policies have played a pivotal role in its economic growth and development. The competitive tax rates have made the state an attractive location for businesses, leading to increased job creation and investment. This, in turn, has contributed to a thriving job market and a boost in the state’s GDP.

For instance, the automotive industry has thrived in South Carolina, with major manufacturers setting up operations in the state. The combination of a skilled workforce, favorable tax rates, and a supportive business environment has made South Carolina a hub for automotive production.

Resident Tax Burden and Relief

While South Carolina’s tax system aims to strike a balance between revenue generation and taxpayer relief, it’s essential to consider the impact on residents. The progressive income tax structure ensures that higher-income earners contribute a larger share, providing a sense of fairness. However, the state’s sales and property taxes can vary significantly based on location, impacting residents differently.

To illustrate, a resident living in a rural area with a lower cost of living may experience a lower overall tax burden compared to someone residing in an urban center with higher property values and sales tax rates. The availability of tax credits and deductions can further alleviate the tax burden for eligible individuals.

Future Implications and Tax Reform

As South Carolina continues to evolve and adapt to economic changes, its tax policies may undergo reforms to remain competitive and responsive to the needs of its citizens and businesses. The state’s leaders and policymakers are continually evaluating the tax system to ensure it aligns with the state’s long-term goals and priorities.

Potential areas of focus for future tax reforms may include further simplifying the tax code, exploring additional tax incentives to attract specific industries, and addressing any disparities in the tax burden across different regions of the state.

Conclusion: Navigating South Carolina’s Tax Landscape

South Carolina’s tax system is a carefully crafted framework that aims to balance revenue generation with taxpayer relief. The state’s progressive income tax, competitive corporate rates, and absence of estate and inheritance taxes have contributed to its economic prosperity and made it an attractive destination for businesses and individuals alike.

Understanding the intricacies of South Carolina's tax policies is essential for anyone considering a move to or investment in the state. By familiarizing oneself with the tax rates, incentives, and potential deductions, individuals and businesses can make informed decisions and navigate the tax landscape effectively.

What is the current sales tax rate in South Carolina?

+The current sales tax rate in South Carolina is [current rate]% as of [insert date]. However, it’s important to note that local jurisdictions may impose additional sales taxes, leading to varying rates across the state.

Are there any tax incentives for businesses in South Carolina?

+Yes, South Carolina offers a range of tax incentives to attract businesses. These include the Job Tax Credit, which provides a credit of [credit amount]% of qualified new employees’ wages for up to [number of years] years. Other incentives may vary based on industry and location.

How does South Carolina’s tax system compare to other states in the region?

+South Carolina’s tax system is generally considered competitive within the region. Its corporate income tax rate of [current rate]% is among the lowest, making it an attractive destination for businesses. However, the state’s sales and property tax rates can vary significantly compared to other states, depending on local factors.