Car Charity Tax Deduction

In the world of charitable giving, one often overlooked aspect is the potential for tax deductions when donating vehicles to charitable organizations. This practice, known as car charity tax deduction, offers a unique opportunity for individuals to support their favorite causes while also benefiting financially. In this comprehensive guide, we will delve into the intricacies of car charity tax deductions, exploring the benefits, the process, and the potential impact on both donors and charitable organizations.

The Benefits of Car Charity Tax Deductions

Car charity tax deductions provide a win-win scenario for both donors and charities. For donors, it offers a way to make a meaningful contribution to a cause they care about while also reducing their tax liability. By donating a vehicle, individuals can claim a tax deduction based on the fair market value of the car, which can result in significant savings during tax season.

From a charitable perspective, car donations are a valuable source of funding. Many non-profit organizations rely on donated vehicles to generate revenue, which can then be used to support their missions and programs. These donations can help cover operational costs, fund research, or provide direct aid to those in need.

Financial Benefits for Donors

The financial advantages of car charity tax deductions are substantial. Depending on the value of the vehicle and the donor’s tax bracket, the deduction can lead to significant tax savings. For instance, consider a donor who contributes a car valued at 5,000. If they fall within the 25% tax bracket, this donation could reduce their tax liability by 1,250. Over time, these savings can add up, especially for individuals who consistently donate vehicles.

Moreover, car donations can also simplify the tax filing process. Instead of dealing with the complexities of calculating depreciation or tracking maintenance costs, donors can claim a straightforward deduction based on the vehicle's fair market value.

Impact on Charitable Organizations

For charities, car donations are a boon. These organizations often face tight budgets and rely on donations to sustain their operations. By accepting vehicle donations, they can auction or sell the cars, using the proceeds to fund their initiatives. This additional revenue stream can be critical, allowing them to expand their reach and impact.

Furthermore, car donations also offer charities an opportunity to engage with a broader donor base. By promoting their vehicle donation programs, they can attract donors who may not have considered traditional monetary contributions. This diversification of funding sources is crucial for long-term sustainability.

The Process of Car Charity Tax Deductions

Understanding the process of car charity tax deductions is essential for both donors and charities. Here’s a step-by-step guide to ensure a smooth and compliant transaction.

Choosing a Reputable Charity

The first step is selecting a charitable organization that aligns with your values and interests. Research the charity’s mission, reputation, and financial stability. Look for organizations with transparent financial reporting and a clear track record of using donations effectively. Consider reaching out to the charity to discuss their vehicle donation program and ask about their process and the impact of such donations.

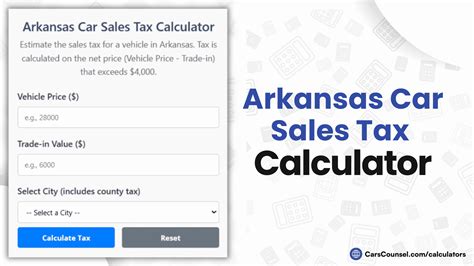

Assessing the Vehicle’s Value

Determining the fair market value of the vehicle is crucial for both the donor and the charity. This value will dictate the tax deduction amount and should be based on factors such as the car’s make, model, condition, and mileage. Donors can use online valuation tools or consult with a qualified appraiser to get an accurate assessment.

Donation and Receipt

Once the charity and vehicle value have been determined, the donor can initiate the donation process. This typically involves completing a donation form provided by the charity, which may include details such as the vehicle’s VIN, make, model, and any outstanding liens or loans. The charity will then schedule a convenient time for pickup or drop-off of the vehicle.

After the donation is complete, the charity will provide the donor with a receipt detailing the date, location, and value of the donation. This receipt is a critical document for tax purposes and should be retained for record-keeping.

Tax Deduction Calculation

The tax deduction amount is based on the fair market value of the vehicle, as determined by the donor and confirmed by the charity. It’s important to note that there are different deduction rules depending on whether the vehicle is sold by the charity or used in their operations. For instance, if the charity uses the vehicle for more than a minimal period, the donor’s deduction may be limited to the cost of repairs made by the charity.

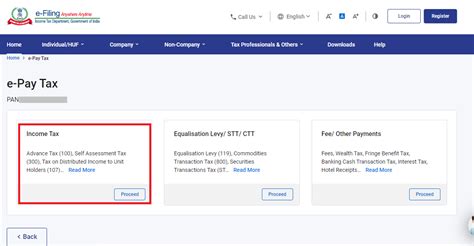

Filing Taxes

When it comes time to file taxes, donors should consult with a tax professional to ensure they are claiming the appropriate deduction. The tax form and documentation requirements may vary depending on the donor’s country and tax laws. It’s crucial to maintain accurate records and have the necessary documentation to support the claimed deduction.

Maximizing the Impact of Car Charity Tax Deductions

To ensure the most significant impact from car charity tax deductions, donors and charities can take certain steps to optimize the process.

Donor Considerations

Donors can maximize the benefits of car charity tax deductions by being proactive in their approach. Here are some tips:

- Choose a high-value vehicle: Opting to donate a vehicle in good condition with a higher fair market value can result in a larger tax deduction.

- Donate to multiple charities: Consider spreading your donations across different organizations to support a variety of causes and potentially receive multiple tax benefits.

- Keep detailed records: Maintain a clear record of the donation process, including the vehicle's value, the charity's information, and the donation receipt. This documentation is essential for tax purposes.

- Consult a tax advisor: Seek professional advice to ensure you are claiming the correct deduction and maximizing your savings.

Charity Strategies

Charities can also take steps to maximize the impact of car donations. Here are some strategies:

- Promote the program: Actively promote your vehicle donation program through various channels, including social media, websites, and community events. Highlight the benefits to donors and the impact their donations will have on your organization.

- Offer convenient options: Provide donors with flexible donation options, such as pickup services or drop-off locations, to make the process as seamless as possible.

- Provide clear guidance: Ensure your donation process is transparent and well-documented. Provide donors with clear instructions and timely communication to build trust and encourage future donations.

- Utilize proceeds effectively: Use the proceeds from vehicle sales or auctions to fund specific projects or initiatives. This can help demonstrate the direct impact of car donations on your organization's mission.

Case Studies: Real-World Examples

To illustrate the impact of car charity tax deductions, let’s explore a few real-world examples.

Case Study 1: Supporting Medical Research

John, a passionate advocate for cancer research, decided to donate his old car to a reputable medical research charity. The car, a well-maintained sedan with low mileage, was valued at 8,000. John's donation not only helped fund critical research but also provided him with a tax deduction of 2,000, which he used to offset his income tax liability. This donation allowed John to contribute to a cause he believed in while also receiving a financial benefit.

Case Study 2: Empowering Education

Sarah, a former teacher, wanted to give back to the education sector. She donated her SUV, valued at 6,500, to a charity that provides educational resources to underserved communities. The charity sold the SUV at auction, using the proceeds to purchase much-needed supplies and technology for local schools. Sarah's donation not only supported education but also resulted in a tax deduction of 1,625, reducing her tax burden and encouraging her to continue supporting this cause.

Case Study 3: Environmental Initiatives

David, an environmental enthusiast, decided to contribute to a charity focused on sustainable transportation. He donated his hybrid car, valued at 12,000, which the charity used in its daily operations. David's donation not only helped reduce the charity's operational costs but also allowed him to claim a tax deduction of 3,000. This encouraged David to explore other ways to support environmental causes through charitable donations.

Future Implications and Opportunities

Car charity tax deductions offer a unique and sustainable way for individuals to support their communities and causes. As this practice gains traction, we can expect to see several implications and opportunities.

Increased Awareness and Participation

With more individuals becoming aware of the tax benefits of car donations, we can anticipate a rise in participation. This could lead to a significant increase in funding for charitable organizations, enabling them to expand their reach and impact. Additionally, as more donors engage with charities through vehicle donations, it may foster stronger community connections and encourage further charitable giving.

Enhanced Transparency and Accountability

To maintain trust and compliance, charities may need to enhance their transparency and accountability practices. This could involve providing more detailed information about the impact of vehicle donations, as well as ensuring proper record-keeping and reporting. By doing so, charities can build and maintain the confidence of their donors, leading to sustained support over the long term.

Innovation in Donation Processes

As technology continues to advance, we may see innovations in the way car donations are facilitated. Charities could explore online platforms and mobile apps to streamline the donation process, making it more convenient and accessible for donors. Additionally, these innovations could include features like real-time tracking of donation impact and personalized donation suggestions based on individual preferences.

FAQ

Can I claim a tax deduction for any type of vehicle donation?

+Yes, you can claim a tax deduction for a wide range of vehicle donations, including cars, trucks, SUVs, motorcycles, and even boats. However, the deduction rules may vary depending on the type of vehicle and how it is used by the charity.

How do I determine the fair market value of my vehicle for tax purposes?

+You can use online valuation tools or consult with a qualified appraiser to determine the fair market value of your vehicle. It’s important to consider factors such as make, model, condition, and mileage when assessing the value.

Are there any restrictions on the charities I can donate to for tax deductions?

+Yes, to claim a tax deduction, you must donate to a qualified charitable organization. These organizations are typically registered with the appropriate tax authorities and meet specific criteria. It’s important to verify the charity’s status before making a donation.

What documentation do I need to keep for tax purposes after donating a vehicle?

+You should retain the donation receipt provided by the charity, which includes details such as the date, location, and value of the donation. Additionally, you may need to keep records of any communications with the charity and any relevant tax forms related to the donation.

Can I claim a tax deduction if I donate a vehicle with outstanding loans or liens?

+Yes, you can still claim a tax deduction for a vehicle with outstanding loans or liens. However, the deduction may be reduced by the amount of the outstanding debt. It’s important to consult with a tax professional to understand the specific rules and regulations in your jurisdiction.