Transaction Privilege Tax

Transaction privilege tax, often referred to as a sales tax, is a crucial aspect of revenue generation for many governments worldwide. It is a tax imposed on the privilege of conducting business or engaging in specific transactions within a particular jurisdiction. While it may seem like a simple tax on sales, it has a significant impact on businesses, consumers, and the overall economy. In this comprehensive guide, we will delve into the intricacies of transaction privilege tax, exploring its history, mechanics, and implications.

The Evolution of Transaction Privilege Tax

The concept of transaction privilege tax can be traced back to ancient civilizations, where taxes were levied on various economic activities. However, the modern form of sales tax as we know it today emerged in the early 20th century. The United States, for instance, introduced its first sales tax in the state of Mississippi in 1930, primarily to address budget deficits caused by the Great Depression.

Since then, transaction privilege tax has become a fundamental tool for governments to raise revenue, fund public services, and support economic development. Its implementation varies across jurisdictions, with different rates, exemptions, and collection methods.

How Transaction Privilege Tax Works

At its core, transaction privilege tax is a tax on the sale of goods and services. It is typically imposed at the point of sale, with the responsibility of collection and remittance falling on the seller. Here’s a step-by-step breakdown of how it works:

Taxable Transactions

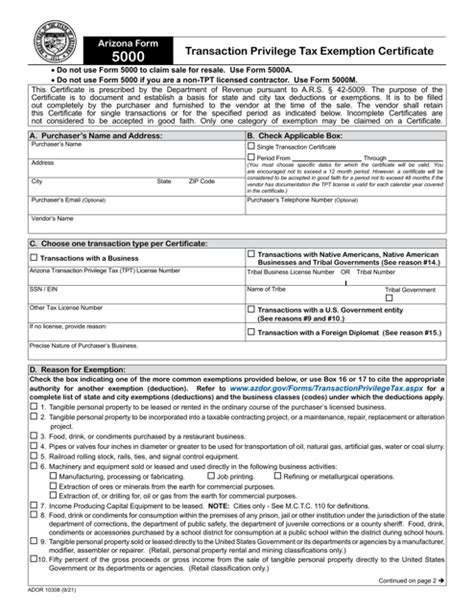

Transaction privilege tax applies to a wide range of transactions, including the sale of tangible personal property, certain services, and even the rental of property. Each jurisdiction defines its own list of taxable transactions, which may vary based on the nature of the business and the specific industry.

Tax Rate

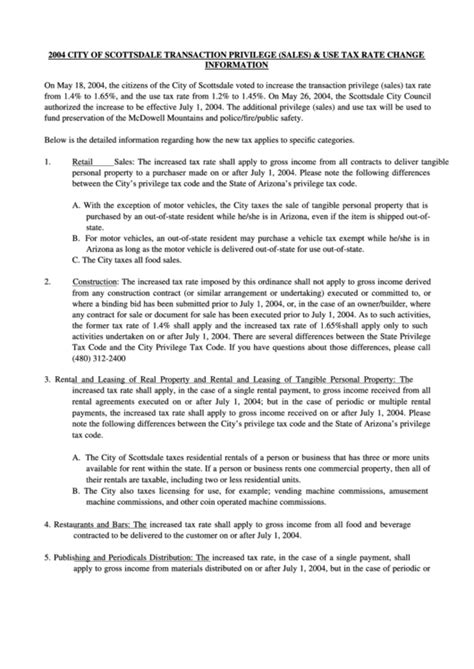

The tax rate is a critical component of transaction privilege tax. It is usually expressed as a percentage of the taxable amount. Rates can vary significantly, with some jurisdictions having a single rate for all transactions, while others have multiple rates based on the type of goods or services sold. For example, the state of Arizona has a state-wide sales tax rate of 5.6%, but individual cities and counties can impose additional taxes, resulting in varying effective rates across the state.

Exemptions and Exclusions

Not all transactions are subject to transaction privilege tax. Governments often provide exemptions and exclusions to promote certain industries, support social causes, or simplify tax administration. Common exemptions include sales of prescription drugs, groceries, and certain services like legal or medical services. Additionally, some jurisdictions offer tax holidays, during which certain items are temporarily exempt from tax, to stimulate consumer spending.

Collection and Remittance

The collection and remittance process is a crucial aspect of transaction privilege tax. Businesses are responsible for collecting the tax from their customers and remitting it to the appropriate tax authority. This process typically involves maintaining detailed records of taxable transactions, calculating the tax due, and filing regular tax returns. Non-compliance with these obligations can result in penalties and interest charges.

Registration and Licensing

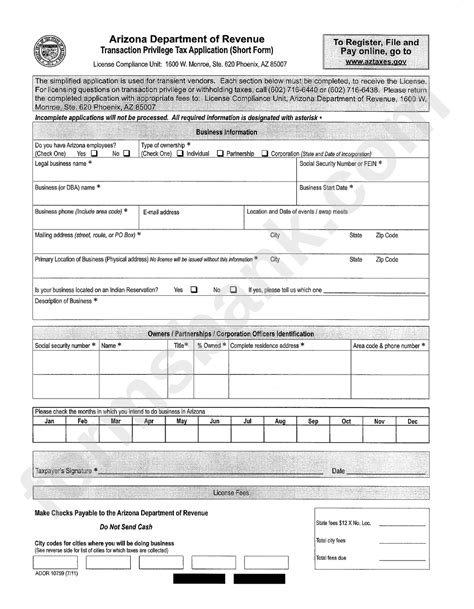

Businesses operating within a jurisdiction that imposes transaction privilege tax are generally required to register and obtain a license or permit. This registration process ensures that businesses are identified and held accountable for their tax obligations. Failure to register can lead to legal consequences and may impact a business’s ability to operate legally.

Impact on Businesses and Consumers

Transaction privilege tax has a direct impact on both businesses and consumers. For businesses, it represents an additional cost of doing business, as they are responsible for collecting and remitting the tax. This can affect pricing strategies, profit margins, and overall competitiveness. Additionally, businesses must invest time and resources into tax compliance, which can be a burden, especially for small businesses.

For consumers, transaction privilege tax is a visible cost added to the purchase price of goods and services. It can influence purchasing decisions, especially when consumers are price-conscious. In some cases, consumers may seek out tax-free alternatives, such as online shopping from out-of-state vendors, to avoid paying the tax.

Compliance and Audits

Compliance with transaction privilege tax regulations is essential for businesses to avoid legal issues and financial penalties. Tax authorities conduct audits to ensure businesses are accurately collecting and remitting the tax. These audits can be complex and time-consuming, requiring businesses to provide detailed records and documentation. Non-compliance can result in hefty fines, interest charges, and even criminal prosecution in severe cases.

Tax Planning and Strategies

Businesses often engage in tax planning to minimize their transaction privilege tax liabilities. This may involve restructuring their operations, leveraging tax incentives and exemptions, or exploring alternative business models. For example, some businesses may choose to sell their products online, where they can avoid charging sales tax if they don’t have a physical presence in the customer’s state.

Transaction Privilege Tax in Practice

To illustrate the practical implications of transaction privilege tax, let’s consider the case of a small business owner, Sarah, who operates a local bakery in a city with a transaction privilege tax rate of 7%. Sarah sells a variety of baked goods, from cakes to pastries, and her business has been thriving.

Calculating Tax Liability

Each month, Sarah calculates her tax liability by multiplying her total taxable sales by the tax rate. For example, if her bakery had 20,000 in taxable sales for the month, her tax liability would be 1,400 ($20,000 x 0.07). She must remit this amount to the tax authority by the specified deadline to avoid penalties.

Pass-Through Costs

The transaction privilege tax is typically passed on to the consumer, so Sarah includes the tax in the prices of her baked goods. This means that a customer purchasing a cake for 50 would actually pay 53.50, with $3.50 going towards the transaction privilege tax. While this may not seem like a significant increase, it can add up over time and impact consumer spending habits.

Exemptions and Opportunities

Sarah’s bakery may also benefit from certain exemptions. For instance, if she donates baked goods to a local charity event, those sales would be exempt from transaction privilege tax. Additionally, if Sarah expands her business to offer catering services, she may be eligible for different tax rates or exemptions based on the nature of the service provided.

The Future of Transaction Privilege Tax

As the economy and technology continue to evolve, transaction privilege tax faces several challenges and opportunities.

E-Commerce and Online Sales

The rise of e-commerce has presented unique challenges for transaction privilege tax. Online sellers often face complex tax regulations, especially when selling across multiple jurisdictions. States and countries are adapting their tax laws to address this issue, with some implementing laws that require online sellers to collect sales tax even without a physical presence in the state or country.

Simplification and Streamlining

Transaction privilege tax administration can be complex and time-consuming for businesses. Efforts are being made to simplify the process, such as implementing centralized tax collection systems and providing user-friendly tax software. These initiatives aim to reduce the burden on businesses and improve compliance.

Tax Policy Reform

Governments are also exploring tax policy reforms to address changing economic conditions and societal needs. Some jurisdictions are considering shifting the tax burden away from sales tax towards other forms of taxation, such as income or property taxes, to promote fairness and economic growth.

| Jurisdiction | Transaction Privilege Tax Rate |

|---|---|

| Arizona | 5.6% (state-wide) + local rates |

| California | 7.25% (state-wide) + local rates |

| Texas | 6.25% (state-wide) |

| New York | 4% (state-wide) + local rates |

| Florida | 6% (state-wide) |

Frequently Asked Questions

What is the difference between transaction privilege tax and sales tax?

+Transaction privilege tax and sales tax are essentially the same. The term “transaction privilege tax” is often used in certain jurisdictions to describe the tax imposed on the privilege of doing business, while “sales tax” is a more commonly used term to refer to the tax on the sale of goods and services.

Are there any alternatives to transaction privilege tax for governments to raise revenue?

+Yes, governments have various options for revenue generation, including income tax, property tax, corporate tax, and excise taxes. The choice of tax type depends on the jurisdiction’s economic goals and the desired impact on different segments of the population.

How do I register for transaction privilege tax in my jurisdiction?

+The registration process varies by jurisdiction. Typically, you’ll need to visit the official website of your state or local tax authority and follow the steps outlined there. It often involves filling out an application, providing business information, and obtaining a tax registration number.

Can I pass on the transaction privilege tax to my customers as a separate line item on the receipt?

+It depends on the regulations in your jurisdiction. Some places require the tax to be included in the final price, while others allow it to be shown as a separate line item. It’s important to consult the tax regulations or seek professional advice to ensure compliance.

Are there any tax incentives or credits available for businesses that comply with transaction privilege tax regulations?

+Yes, many jurisdictions offer tax incentives and credits to encourage compliance and support certain industries. These incentives can include tax breaks for investing in research and development, hiring new employees, or operating in designated economic zones. It’s worth exploring these opportunities to reduce your tax burden.