Fremont Sales Tax

The topic of sales tax is an important aspect of financial planning and budgeting for businesses and consumers alike. Fremont, a bustling city in California, has its own unique sales tax structure, which can impact the cost of goods and services for residents and visitors. In this comprehensive article, we will delve into the specifics of Fremont's sales tax, exploring its rates, categories, and implications. By understanding the intricacies of this tax, we can make more informed decisions regarding our financial transactions in this vibrant city.

Understanding Fremont's Sales Tax: A Comprehensive Guide

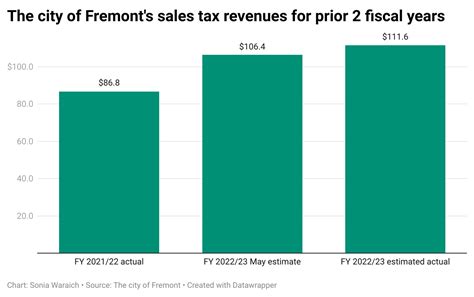

Sales tax in Fremont, California, plays a crucial role in the city's revenue generation and economic landscape. With a diverse population and a thriving business community, Fremont has implemented a sales tax system that contributes significantly to its overall financial health. Let's unravel the details of Fremont's sales tax, exploring its rates, applicable goods and services, and the impact it has on the local economy.

Sales Tax Rates in Fremont: A Detailed Breakdown

The sales tax in Fremont consists of a combination of state, county, and city taxes, each contributing to the overall rate. As of the latest data, the sales tax rate in Fremont is set at 9.25%, which is slightly higher than the state average. This rate includes the 7.25% state sales tax, an additional 0.75% county tax, and a 1.25% city tax.

It's important to note that this rate can vary depending on the specific location within Fremont. Some areas may have slightly different tax rates due to special assessments or district-specific taxes. For instance, certain business districts or redevelopment zones may have additional taxes to support local initiatives.

The California Board of Equalization provides a detailed breakdown of sales tax rates by city and county, offering transparency and clarity for businesses and consumers alike. This information is essential for accurate financial planning and compliance with tax regulations.

Goods and Services Subject to Sales Tax in Fremont

In Fremont, like most places in California, a wide range of goods and services are subject to sales tax. This includes tangible personal property, such as clothing, electronics, furniture, and vehicles. Additionally, services like repairs, installations, and certain professional services are also taxable.

However, it's worth mentioning that certain items are exempt from sales tax. These exemptions vary depending on state and local laws. For instance, groceries, prescription medications, and certain agricultural products are often exempt from sales tax. It's crucial for businesses and consumers to stay updated on these exemptions to ensure compliance and avoid unnecessary tax burdens.

The California Sales and Use Tax Law provides a comprehensive guide to taxable and exempt items, helping businesses and individuals navigate the complex world of sales tax regulations.

Impact of Sales Tax on Fremont's Economy

The sales tax in Fremont has a significant impact on the city's economic growth and development. It serves as a vital source of revenue for the city, funding essential services and infrastructure projects. The funds generated from sales tax contribute to improvements in education, public safety, transportation, and other vital areas.

Moreover, the sales tax encourages responsible financial management and planning for businesses operating in Fremont. By understanding and complying with sales tax regulations, businesses can avoid penalties and maintain a positive relationship with the city's tax authorities. This, in turn, fosters a stable and supportive business environment, attracting new enterprises and promoting economic prosperity.

The Fremont Chamber of Commerce often highlights the benefits of a well-managed sales tax system, emphasizing its role in creating a vibrant and sustainable economy. The chamber actively engages with local businesses, providing resources and support to ensure compliance and economic growth.

| Tax Component | Rate |

|---|---|

| State Sales Tax | 7.25% |

| County Tax | 0.75% |

| City Tax | 1.25% |

Sales Tax Compliance and Reporting in Fremont

Ensuring compliance with sales tax regulations is a critical aspect of doing business in Fremont. Businesses are required to register with the California Department of Tax and Fee Administration and obtain a seller's permit. This permit allows businesses to collect and remit sales tax to the appropriate authorities.

Registration and Permit Requirements

To obtain a seller's permit, businesses must complete the registration process through the California Department of Tax and Fee Administration website. The process typically involves providing basic business information, such as the business name, address, and contact details. Additionally, businesses may need to provide their federal tax identification number or employer identification number.

Once registered, businesses receive their seller's permit, which must be displayed at their place of business. This permit authorizes the business to collect and remit sales tax on behalf of the state and local authorities.

Sales Tax Calculation and Remittance

Businesses in Fremont are responsible for calculating the sales tax on each taxable transaction. This involves applying the appropriate tax rate to the taxable amount and ensuring accurate recording of sales tax receipts. It's crucial for businesses to maintain proper records to facilitate accurate tax reporting.

Sales tax remittance is typically done on a periodic basis, with deadlines set by the state and local authorities. Businesses must remit the collected sales tax to the California Department of Tax and Fee Administration by the due date to avoid penalties and interest charges.

Sales Tax Audits and Compliance Checks

To ensure compliance with sales tax regulations, the California Department of Tax and Fee Administration conducts periodic audits and compliance checks. These audits involve reviewing a business's sales tax records, including receipts, invoices, and sales reports. The purpose is to verify the accuracy of tax calculations and ensure proper remittance.

During an audit, businesses may be required to provide additional documentation, such as purchase orders, shipping records, and customer payment details. It's crucial for businesses to maintain organized and up-to-date records to facilitate a smooth audit process.

By adhering to sales tax compliance, businesses not only avoid penalties but also maintain a positive relationship with the tax authorities. This fosters a climate of trust and encourages a supportive business environment in Fremont.

Special Considerations: Exemptions and Discounts

While sales tax is a standard part of doing business in Fremont, there are certain exemptions and discounts that businesses and consumers should be aware of. These provisions can significantly impact the overall tax burden and financial planning.

Exemptions for Specific Industries

Certain industries in Fremont may be eligible for sales tax exemptions or reduced rates. For instance, manufacturers and resellers of certain products, such as machinery and equipment, may qualify for exemption from sales tax on the purchase of these items. This exemption is designed to encourage investment and growth in these sectors.

Additionally, certain nonprofit organizations and charitable entities may also be exempt from sales tax. This exemption helps support the vital work of these organizations, allowing them to allocate more resources to their missions rather than tax obligations.

Discounts and Incentives for Businesses

To attract and support businesses, Fremont offers various incentives and discounts. These initiatives can take the form of tax credits, grants, or reduced tax rates for qualifying businesses. For instance, businesses that create a certain number of jobs or invest in specific industries may be eligible for tax breaks.

These incentives are often tied to economic development goals, encouraging businesses to invest in the local community and create sustainable job opportunities. By offering these discounts, Fremont promotes a business-friendly environment, fostering growth and prosperity.

Sales Tax Holidays and Special Events

In Fremont, like many other places, there are occasions when sales tax is temporarily reduced or waived. These sales tax holidays are often held during specific periods, such as back-to-school season or major holidays. During these events, certain items, such as clothing or electronics, may be exempt from sales tax, providing consumers with significant savings.

Sales tax holidays are designed to stimulate consumer spending and boost the local economy. They provide an opportunity for consumers to save money and for businesses to attract more customers. It's important for businesses and consumers to stay informed about these special events to take advantage of the savings opportunities.

The Future of Sales Tax in Fremont: Trends and Predictions

As Fremont continues to evolve and grow, the sales tax landscape is likely to experience changes and adaptations. Here are some trends and predictions for the future of sales tax in Fremont:

Increased Focus on Online Sales

With the rise of e-commerce, the sales tax landscape is evolving to accommodate online sales. Fremont, like many other cities, is likely to see an increased focus on collecting sales tax from online retailers. This includes implementing measures to ensure that online sales are properly taxed, especially for businesses with a physical presence in the city.

Technological Advancements in Tax Collection

The tax collection process is becoming more efficient and streamlined with the integration of technology. Fremont may adopt advanced systems for tax calculation, reporting, and remittance. This could include the use of cloud-based platforms, automated tax software, and real-time data synchronization.

By embracing technological advancements, Fremont can enhance compliance, reduce administrative burdens for businesses, and improve overall tax collection efficiency.

Potential Tax Rate Adjustments

While sales tax rates are relatively stable, there is always the possibility of adjustments in the future. Factors such as economic conditions, infrastructure needs, and budgetary requirements may influence tax rate changes. Fremont may consider increasing or decreasing tax rates to meet its financial goals and adapt to changing economic circumstances.

Enhanced Tax Education and Support

To foster a culture of compliance and understanding, Fremont may invest in tax education and support initiatives. This could involve conducting workshops, providing online resources, and offering personalized assistance to businesses and taxpayers. By promoting tax literacy, the city can ensure better compliance and minimize instances of unintentional non-compliance.

These initiatives can help businesses navigate the complex world of sales tax regulations, leading to a more positive and collaborative relationship with the tax authorities.

What is the current sales tax rate in Fremont, California?

+The current sales tax rate in Fremont, California, is 9.25%. This rate includes the state sales tax, county tax, and city tax.

Are there any sales tax exemptions in Fremont?

+Yes, there are certain exemptions in Fremont. Groceries, prescription medications, and some agricultural products are commonly exempt from sales tax. It’s important to stay updated on specific exemptions to ensure compliance.

How can businesses register for a seller’s permit in Fremont?

+Businesses can register for a seller’s permit through the California Department of Tax and Fee Administration’s website. The process involves providing basic business information and obtaining a permit to collect and remit sales tax.

Are there any special sales tax holidays in Fremont?

+Yes, Fremont occasionally hosts sales tax holidays during specific periods, such as back-to-school season or holidays. These events offer temporary exemptions or reduced rates on certain items, providing savings for consumers.

How often do businesses need to remit sales tax in Fremont?

+Businesses in Fremont typically remit sales tax on a periodic basis, with deadlines set by the state and local authorities. It’s important for businesses to stay updated on these deadlines to avoid penalties and interest charges.