Tax Free Weekend In Arkansas

The Tax-Free Weekend in Arkansas is an annual event that offers residents a unique opportunity to save on certain items and provides a significant boost to the state's economy. This weekend is a popular shopping event that attracts consumers seeking to make essential purchases at reduced prices. In this article, we will delve into the details of Arkansas's Tax-Free Weekend, exploring its history, eligible items, impact on consumers and businesses, and offering valuable tips to make the most of this exciting shopping period.

A Brief History of Arkansas’s Tax-Free Weekend

The concept of a tax-free shopping period is not new, with many states across the United States implementing similar initiatives to stimulate local economies and assist residents with back-to-school preparations. In Arkansas, the tradition of a tax-free weekend began in 2001 as a response to the growing demand for relief from sales taxes on essential items. This event, initially known as the Sales Tax Holiday, has since become an anticipated fixture in the state’s calendar, drawing in shoppers from various backgrounds.

Over the years, the Tax-Free Weekend has evolved to accommodate the changing needs of consumers. Initially, the focus was primarily on back-to-school supplies and clothing, providing relief to families preparing for the new academic year. However, the event has expanded to include a wider range of items, catering to a broader audience and addressing diverse consumer needs.

Eligible Items and Categories

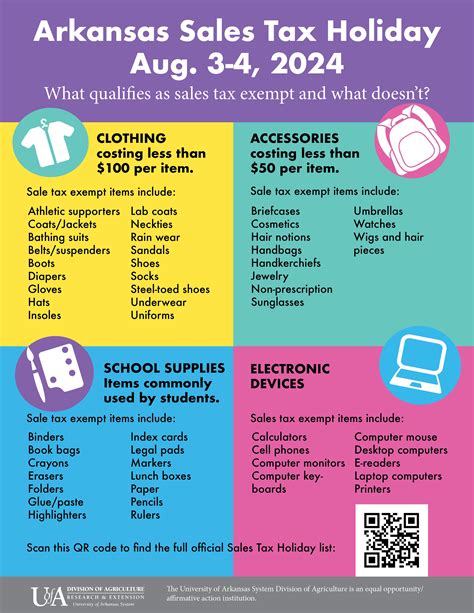

Arkansas’s Tax-Free Weekend is designed to benefit residents by offering exemptions on specific categories of items. Here’s a breakdown of the key eligible items and their respective limits:

Clothing and Footwear

One of the most popular categories during the Tax-Free Weekend is clothing and footwear. Arkansas residents can take advantage of this period to stock up on new outfits, shoes, and accessories without incurring sales tax. The state defines clothing as any item worn on the body for warmth or protection, including hats, gloves, scarves, and even jewelry. During the tax-free weekend, clothing and footwear items priced at $100 or less per item are exempt from sales tax.

School Supplies

In a move to support students and their families, Arkansas waives sales tax on a wide array of school supplies during this weekend. This category includes items such as notebooks, pens, pencils, calculators, book bags, lunch boxes, and other essential school accessories. The exemption applies to school supplies priced at $20 or less per item.

Computers and Technology

Recognizing the importance of technology in modern education and everyday life, Arkansas extends the tax exemption to computers and related accessories. This category includes desktop computers, laptops, tablets, printers, and other computer-related items. The tax-free limit for computers and technology is set at $1,000 or less per item.

Sports Equipment

Arkansas also encourages its residents to stay active by including sports equipment in the tax-free categories. This category encompasses items such as basketballs, footballs, soccer balls, baseball gloves, helmets, and other athletic gear. Sports equipment priced at $50 or less per item is exempt from sales tax during the designated weekend.

| Category | Tax-Free Limit |

|---|---|

| Clothing and Footwear | $100 or less per item |

| School Supplies | $20 or less per item |

| Computers and Technology | $1,000 or less per item |

| Sports Equipment | $50 or less per item |

It's important to note that while these categories are exempt from sales tax, certain items may have additional restrictions or qualifications. For instance, some items may be subject to county-specific tax rates, so it's advisable to check with local authorities for precise details.

Impact on Consumers and Businesses

Arkansas’s Tax-Free Weekend has a significant impact on both consumers and businesses in the state. For consumers, this event presents a golden opportunity to save money on essential purchases, particularly for those with limited budgets. The tax exemption allows families to stretch their dollars further, ensuring they can afford the items they need without breaking the bank.

From a business perspective, the Tax-Free Weekend provides a much-needed boost to retailers and local economies. This period sees a surge in customer footfall, with shoppers flocking to stores to take advantage of the tax breaks. Retailers often experience increased sales and revenue during this time, helping to offset any potential losses from the tax exemption. Additionally, the event encourages customers to explore new brands and products, fostering a vibrant and competitive retail environment.

Benefits for Local Economies

The economic impact of the Tax-Free Weekend extends beyond individual businesses. It stimulates local economies by generating additional revenue for the state and local governments through increased sales. This revenue can then be allocated towards essential services and infrastructure development, benefiting the community as a whole. Moreover, the event encourages consumer spending, which, in turn, supports job creation and economic growth.

Aiding Small Businesses

Small businesses, in particular, stand to benefit significantly from the Tax-Free Weekend. This period offers them an opportunity to showcase their products and services to a wider audience, potentially leading to new customer acquisitions and brand loyalty. By participating in the event, small businesses can enhance their visibility and competitiveness, solidifying their position in the local market.

Maximizing Your Tax-Free Shopping Experience

To make the most of Arkansas’s Tax-Free Weekend, here are some valuable tips to consider:

- Plan Your Shopping List: Before the event, create a comprehensive shopping list to ensure you don't miss out on any essential items. This will help you stay organized and make the most of your time during the tax-free period.

- Research Prices: Compare prices from different retailers to find the best deals. Many stores offer additional discounts and promotions during this time, so it's worth exploring various options to maximize your savings.

- Check Store Hours: Confirm the operating hours of your preferred stores to ensure you can visit them during the tax-free weekend. Some retailers may extend their hours to accommodate the increased footfall.

- Consider Online Shopping: If you prefer the convenience of online shopping, many retailers offer tax-free benefits on their websites as well. Ensure you choose a reputable online store and take advantage of any available online-exclusive deals.

- Stay Informed: Keep yourself updated on any changes or additional information regarding the Tax-Free Weekend. Follow official state websites and local news outlets to stay informed about any new eligible items, restrictions, or guidelines.

Conclusion

Arkansas’s Tax-Free Weekend is a testament to the state’s commitment to supporting its residents and local businesses. By offering a sales tax exemption on essential items, the state provides a much-needed boost to consumer purchasing power and stimulates economic growth. Whether you’re a student preparing for a new academic year, a family seeking affordable clothing, or a tech enthusiast looking for a new device, the Tax-Free Weekend offers an excellent opportunity to save money while supporting the local economy.

As you prepare for this exciting shopping event, remember to stay informed, plan your purchases, and take advantage of the tax-free benefits. Happy shopping, and may your Tax-Free Weekend be filled with smart purchases and happy savings!

When is the Tax-Free Weekend in Arkansas held each year?

+The Tax-Free Weekend in Arkansas typically occurs during the first weekend of August. However, it’s important to check the official state website for the exact dates each year, as they may vary slightly.

Are there any restrictions on the number of items I can purchase during the Tax-Free Weekend?

+There are no restrictions on the quantity of items you can purchase during the Tax-Free Weekend. However, each item must meet the specified tax-free limit for its respective category. For example, you can buy multiple clothing items priced at $100 or less per item without incurring sales tax.

Do online purchases also qualify for the tax exemption during the Tax-Free Weekend?

+Yes, online purchases from Arkansas-based retailers also qualify for the tax exemption during the Tax-Free Weekend. Ensure that the retailer is based in Arkansas to take advantage of the tax-free benefits.