Sales Tax In Los Angeles County Ca

Sales tax is an essential component of the revenue system in the United States, with each state and, in some cases, local jurisdictions, implementing their own tax rates and regulations. This article will delve into the specifics of sales tax in Los Angeles County, California, exploring the rates, regulations, and how they impact businesses and consumers alike.

Understanding Sales Tax in Los Angeles County

Sales tax in Los Angeles County is a critical component of the county’s tax structure, contributing significantly to its revenue. The tax is levied on the sale of goods and services and is typically calculated as a percentage of the sale price. It is a vital source of income for the county, helping to fund various public services and infrastructure projects.

Los Angeles County's sales tax system is a complex interplay of state and local tax rates. The state of California imposes a base sales tax rate, while local governments, including Los Angeles County, have the authority to add their own local tax rates. This results in a combined sales tax rate that varies across different regions within the county.

For instance, the current state sales tax rate in California stands at 7.25%, one of the higher rates among U.S. states. However, this rate is just the foundation, with local jurisdictions adding their own taxes on top. In the case of Los Angeles County, the countywide sales tax rate is set at 2.25%, bringing the total sales tax to 9.5% for most areas within the county.

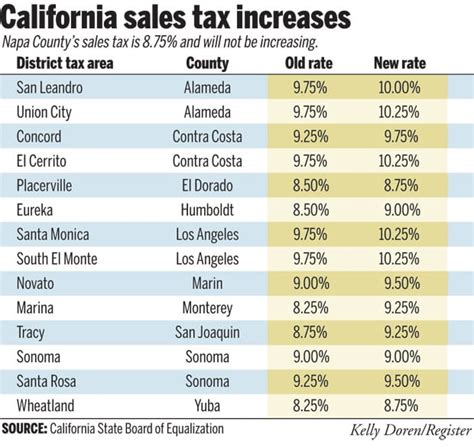

It's important to note that sales tax rates can vary even within Los Angeles County due to the presence of special districts and city-specific taxes. These additional taxes can significantly impact the overall sales tax rate. For example, the city of Los Angeles imposes a 1% city sales tax, bringing the total sales tax within the city limits to 10.5%. This means that consumers shopping in the city of Los Angeles pay a higher sales tax rate than those in other parts of the county.

The Impact of Sales Tax on Businesses

Sales tax in Los Angeles County has a significant impact on local businesses. For retailers, the sales tax adds an extra layer of complexity to their pricing and accounting processes. They must ensure they collect the correct amount of tax from customers and remit it to the appropriate tax authorities, which can be a time-consuming and error-prone process.

Businesses also need to stay abreast of any changes in sales tax rates, which can occur annually or even more frequently in some cases. These changes can impact their pricing strategies and potentially affect their competitiveness in the market. For instance, a business located in an area with a high sales tax rate may need to adjust its pricing to remain competitive with online retailers or businesses in neighboring areas with lower tax rates.

Moreover, sales tax compliance can be a significant burden for businesses, especially those with multiple locations or those selling products online. They must navigate the complex web of sales tax regulations, including registration, filing, and remittance requirements, for each jurisdiction they operate in. Failure to comply with these regulations can result in penalties and interest charges, further impacting a business's bottom line.

To mitigate these challenges, many businesses in Los Angeles County turn to sales tax automation solutions. These tools can help businesses automatically calculate and collect the correct sales tax, ensuring compliance with local regulations. By integrating sales tax automation into their systems, businesses can save time and reduce the risk of errors, allowing them to focus on their core operations and strategic growth.

Sales Tax and Consumer Behavior

The sales tax rate in Los Angeles County also has a direct impact on consumer behavior. Higher sales tax rates can discourage spending, as consumers may be less willing to pay more for goods and services. This can lead to a decrease in sales for businesses, especially those selling non-essential items.

However, sales tax can also influence consumer purchasing decisions in other ways. For instance, consumers may choose to shop in areas with lower sales tax rates, either within the county or in neighboring counties or states. This can result in a loss of sales tax revenue for Los Angeles County and a shift in consumer spending patterns.

Additionally, the sales tax rate can impact online shopping behavior. Consumers may be more inclined to purchase goods online from out-of-state retailers to avoid paying the higher sales tax rates in Los Angeles County. This trend, often referred to as "tax evasion" or "tax avoidance," can significantly affect local businesses and the county's overall tax revenue.

Sales Tax Compliance and Challenges

Ensuring compliance with sales tax regulations in Los Angeles County is a complex task for businesses. The county’s diverse tax landscape, with its varying rates and jurisdictions, makes it a challenging environment for tax compliance. Businesses must accurately calculate and collect sales tax, which can be a daunting task, especially for those with multiple locations or those selling across different tax jurisdictions.

One of the primary challenges businesses face is keeping up with changing tax rates and regulations. Sales tax rates can change annually or even more frequently, and these changes must be reflected in pricing and tax collection processes. Failure to do so can result in under- or over-collection of sales tax, leading to potential penalties and interest charges.

Another challenge is the complexity of sales tax regulations themselves. Sales tax laws can vary significantly from one jurisdiction to another, even within Los Angeles County. Businesses must navigate these variations, understanding which goods and services are taxable, what tax rates apply, and how to properly file and remit sales tax. This complexity can be a significant barrier, particularly for small businesses or those new to the region.

To address these challenges, many businesses in Los Angeles County are turning to sales tax automation solutions. These tools can help businesses automatically calculate the correct sales tax rate for each transaction, ensuring compliance with local regulations. By integrating sales tax automation into their systems, businesses can reduce the risk of errors, save time, and focus on their core operations rather than tax compliance.

Sales tax compliance is not just a matter of avoiding penalties and interest charges. It also impacts a business's reputation and customer trust. Consumers expect businesses to charge the correct tax rates and provide accurate receipts. Failure to do so can lead to customer dissatisfaction and even legal action, further emphasizing the importance of sales tax compliance.

Sales Tax Exemptions and Special Cases

While sales tax is generally applicable to most goods and services, there are certain exemptions and special cases in Los Angeles County. These exemptions can vary depending on the nature of the product, the seller, and the buyer.

For example, many food items are exempt from sales tax in California, including unprepared foods like bread, fruits, and vegetables. However, this exemption does not extend to restaurant meals or prepared foods, which are typically taxable. This distinction can be confusing for consumers and businesses alike, especially in a food-centric city like Los Angeles.

Another exemption is for clothing and footwear under a certain price threshold. In California, clothing and footwear items priced under $100 are exempt from sales tax. This exemption is designed to alleviate the tax burden on lower-income individuals and families. However, it can also create complexities for retailers, who must ensure they are correctly applying the exemption to qualifying items.

Additionally, there are special provisions for certain business-to-business transactions. In Los Angeles County, businesses can apply for a Seller's Permit, which allows them to make purchases tax-free if the items are for resale or for use in manufacturing. This exemption helps businesses keep their costs down and maintain their competitiveness in the market.

Understanding these exemptions and special cases is crucial for both businesses and consumers. Businesses must correctly apply these exemptions to avoid overcharging customers or facing compliance issues. Consumers, on the other hand, should be aware of these exemptions to ensure they are not overpaying for certain items. By staying informed about sales tax regulations, both parties can navigate the tax landscape more effectively.

Future of Sales Tax in Los Angeles County

The future of sales tax in Los Angeles County is likely to be shaped by several key factors, including technological advancements, economic trends, and changing consumer behavior. As e-commerce continues to grow, the challenge of collecting sales tax from online transactions will become increasingly important. Los Angeles County, like many other jurisdictions, will need to adapt its sales tax regulations to keep pace with these changes.

One potential development is the implementation of a statewide sales tax in California. Currently, sales tax rates vary widely across the state, with different counties and cities imposing their own rates. A statewide sales tax would simplify the tax landscape, making it easier for businesses and consumers to understand and comply with sales tax regulations. It could also lead to more consistent tax rates across the state, reducing the incentive for consumers to shop in lower-tax areas.

Another trend to watch is the increasing use of sales tax automation tools. As these tools become more sophisticated and affordable, more businesses in Los Angeles County are likely to adopt them. Sales tax automation can help businesses ensure compliance, reduce errors, and save time and resources. It can also make it easier for businesses to adapt to changing tax rates and regulations, a key advantage in a dynamic tax environment like Los Angeles County.

In the long term, the future of sales tax in Los Angeles County may also be influenced by broader economic trends and policy changes. For instance, if the state or local government faces budget deficits, there may be pressure to increase sales tax rates to generate more revenue. On the other hand, if the economy experiences a downturn, there may be calls to reduce sales tax rates to stimulate spending and support local businesses.

Regardless of the specific developments, one thing is certain: sales tax will remain a critical component of Los Angeles County's revenue system. As the county continues to grow and evolve, its sales tax regulations will need to adapt to meet the changing needs of businesses and consumers alike. By staying informed and adapting to these changes, businesses and consumers can navigate the sales tax landscape more effectively, contributing to the county's economic vitality.

How often do sales tax rates change in Los Angeles County?

+Sales tax rates in Los Angeles County can change annually or even more frequently. These changes are typically driven by local government decisions and economic conditions. It’s important for businesses and consumers to stay informed about these changes to ensure compliance and avoid penalties.

Are there any special sales tax holidays in Los Angeles County?

+Yes, Los Angeles County, like many other jurisdictions, sometimes observes special sales tax holidays. During these holidays, certain items, often back-to-school supplies or clothing, are exempt from sales tax for a limited time. These holidays can provide significant savings for consumers and boost sales for businesses.

How can businesses ensure they are compliant with sales tax regulations in Los Angeles County?

+Businesses can ensure compliance by staying informed about the latest sales tax rates and regulations. They should also consider using sales tax automation tools, which can help calculate and collect the correct sales tax for each transaction. Additionally, businesses should keep detailed records of their sales and tax filings to facilitate audits and ensure accuracy.