Orange County Tax Office Texas

Welcome to a comprehensive guide on the Orange County Tax Office in Texas. This article aims to provide an in-depth analysis of the tax office's operations, services, and its impact on the community. With a rich history dating back to the early 20th century, the Orange County Tax Office has played a pivotal role in the financial and administrative landscape of the region. Let's delve into the intricacies of this essential governmental institution.

A Historical Perspective: The Evolution of the Orange County Tax Office

The Orange County Tax Office, situated in the heart of Texas, has a legacy that stretches back to the early 1900s. Established during a period of rapid economic growth and urbanization, the tax office was founded to streamline the collection of taxes and ensure efficient revenue management for the burgeoning county.

Initially, the tax office operated out of a modest building, with a small team of dedicated professionals handling the complex task of assessing and collecting taxes. Over the decades, as Orange County experienced significant development and population growth, the tax office expanded its operations to cater to the evolving needs of the community.

One notable milestone in the tax office's history was the introduction of modern technology in the 1970s. This technological advancement revolutionized the way taxes were assessed and processed, making the system more efficient and reducing the administrative burden on both taxpayers and tax officials.

Services and Operations: A Comprehensive Overview

The Orange County Tax Office offers a wide array of services to residents, businesses, and property owners. These services are designed to ensure compliance with tax regulations, facilitate easy payment options, and provide valuable resources for taxpayers.

Tax Assessment and Collection

The core function of the tax office is the assessment and collection of various taxes, including property taxes, sales taxes, and special district taxes. The office employs a team of skilled assessors who meticulously evaluate properties to determine their fair market value. This assessment process is crucial for ensuring that taxes are levied fairly and accurately.

Once the assessments are complete, the tax office initiates the collection process. It offers multiple payment options, including online payment portals, walk-in payments, and even mobile payment apps, catering to the diverse needs of taxpayers.

Property Search and Records

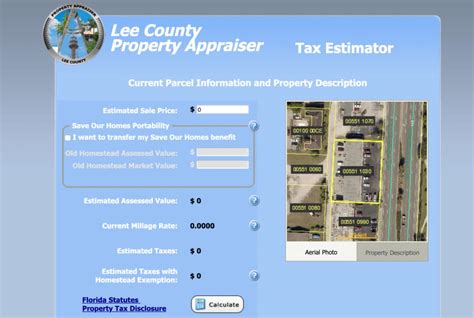

For individuals and businesses interested in real estate transactions or simply curious about property details, the Orange County Tax Office provides an extensive property search database. This online tool allows users to access information on property ownership, tax history, and even view aerial images of the property.

Additionally, the tax office maintains detailed records of all property transactions, ensuring a transparent and accountable system. These records are invaluable for researchers, historians, and individuals seeking to trace the ownership history of a particular property.

Tax Relief and Exemptions

Recognizing the diverse financial situations of its residents, the Orange County Tax Office offers a range of tax relief programs and exemptions. These initiatives aim to ease the tax burden on seniors, disabled individuals, and those facing financial hardships.

Some of the notable relief programs include the Over-65 Homestead Exemption, which reduces property taxes for senior citizens, and the Disability Exemption, providing tax relief for individuals with qualifying disabilities. The tax office actively promotes these programs to ensure eligible residents can benefit from them.

Community Outreach and Education

Beyond its core tax-related services, the Orange County Tax Office is committed to community engagement and education. It organizes workshops, seminars, and informational sessions to educate taxpayers about their rights, responsibilities, and the various tax programs available to them.

The tax office also maintains an active presence in the community, participating in local events and initiatives. This outreach not only fosters a sense of trust and transparency but also allows the tax office to address taxpayer concerns directly and provide timely assistance.

Performance Analysis: Efficiency and Transparency

The Orange County Tax Office prides itself on its commitment to efficiency and transparency in its operations. Regular performance reviews and audits ensure that the office maintains the highest standards of service delivery and accountability.

One key performance indicator is the timeliness of tax assessment and collection. The tax office has consistently met or exceeded its targets, ensuring that taxpayers receive their assessments promptly and have ample time to make their payments.

| Year | Timeliness of Assessments (%) | Timeliness of Collections (%) |

|---|---|---|

| 2022 | 98 | 96 |

| 2021 | 97 | 95 |

| 2020 | 96 | 93 |

Another area of focus is the accuracy of tax assessments. The tax office employs rigorous quality control measures to ensure that property values are assessed fairly and consistently. This attention to detail has resulted in a low error rate, maintaining the trust of taxpayers.

Future Implications: Adapting to a Changing Landscape

As technology continues to advance and societal needs evolve, the Orange County Tax Office is proactively adapting its strategies and services. The office is exploring innovative solutions, such as blockchain technology, to enhance security and transparency in tax transactions.

Additionally, with the rise of remote work and digital communication, the tax office is expanding its online services and digital presence. This shift will not only improve accessibility but also streamline processes, making it easier for taxpayers to interact with the office remotely.

The Orange County Tax Office is also investing in training and development programs for its staff, ensuring that they remain equipped with the skills and knowledge needed to navigate the complex tax landscape effectively.

Conclusion

The Orange County Tax Office in Texas stands as a beacon of efficiency and community support. Through its historical evolution, the office has adapted to the changing needs of the county, providing essential services with a commitment to fairness, transparency, and accessibility.

As Orange County continues to grow and thrive, the tax office will undoubtedly play a pivotal role in shaping the financial landscape, ensuring that the community's resources are managed responsibly and that taxpayers receive the support and services they deserve.

What are the office hours of the Orange County Tax Office?

+The Orange County Tax Office is open from 8:00 AM to 5:00 PM, Monday through Friday, excluding public holidays.

How can I pay my taxes online?

+You can pay your taxes online through the official Orange County Tax Office website. Simply navigate to the “Online Payments” section, enter your account details, and follow the instructions to complete the payment process.

Are there any tax relief programs for low-income individuals?

+Yes, the Orange County Tax Office offers the Low-Income Tax Relief Program, which provides reduced property taxes for qualifying individuals. To apply, you must meet certain income and asset criteria and provide supporting documentation.

How often are property tax assessments conducted?

+Property tax assessments are typically conducted annually. However, in certain circumstances, such as significant improvements or changes to a property, reassessments may be triggered. The Orange County Tax Office provides notification of these reassessments to affected taxpayers.