Sales Tax Riverside

Sales tax is an essential aspect of doing business, impacting both consumers and retailers alike. In this comprehensive guide, we will delve into the world of sales tax in Riverside, exploring the intricacies, rates, and regulations that govern this California city. By understanding the sales tax landscape, businesses and consumers can navigate their financial obligations and make informed decisions.

Unraveling the Sales Tax Structure in Riverside

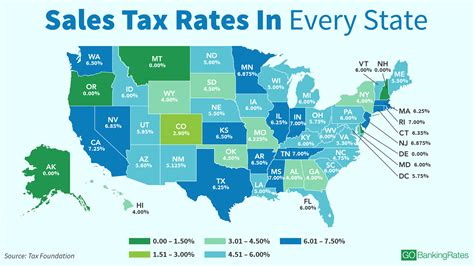

Riverside, located in the heart of Southern California, boasts a vibrant economy and a diverse range of businesses. The sales tax system in this city is a combination of state, county, and city taxes, each contributing to the overall rate. Let’s break down the components and explore the rates that affect Riverside’s residents and entrepreneurs.

California State Sales Tax

California, known for its diverse landscape and thriving industries, imposes a state sales tax rate of 7.25%. This base rate is applicable to most transactions, providing a foundation for the sales tax structure across the state.

| California State Sales Tax | Rate |

|---|---|

| Base Rate | 7.25% |

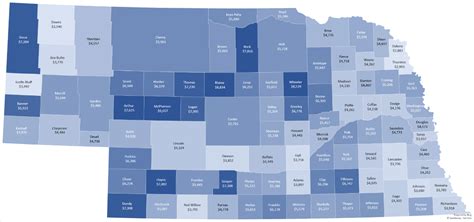

Riverside County Sales Tax

Riverside County, where the city of Riverside resides, adds an additional layer to the sales tax equation. The county tax rate is currently set at 0.50%, bringing the total county-wide sales tax to 7.75%. This rate is applied uniformly across the county, affecting all businesses and consumers within its boundaries.

| Riverside County Sales Tax | Rate |

|---|---|

| County Rate | 0.50% |

| Total County-Wide Rate | 7.75% |

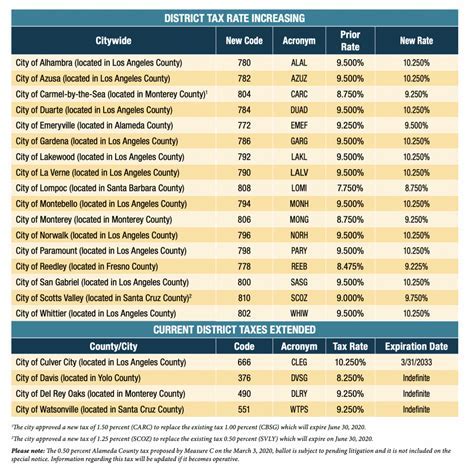

City of Riverside Sales Tax

The city of Riverside, a thriving urban center, imposes its own sales tax on top of the state and county rates. As of the latest records, the city sales tax rate stands at 0.25%, making the total sales tax in Riverside 8.00%. This additional tax supports the city’s infrastructure, public services, and economic development initiatives.

| City of Riverside Sales Tax | Rate |

|---|---|

| City Rate | 0.25% |

| Total Sales Tax in Riverside | 8.00% |

Impact on Businesses and Consumers

The sales tax landscape in Riverside has a significant impact on both businesses and consumers. Let’s explore how these tax rates affect the local economy and purchasing decisions.

Businesses: Navigating Compliance and Strategies

For businesses operating in Riverside, understanding and complying with sales tax regulations is crucial. Here’s how the sales tax rates can influence their operations:

- Tax Collection: Businesses are responsible for collecting and remitting sales tax to the appropriate authorities. The 8.00% sales tax rate in Riverside means businesses must factor this into their pricing strategies and accounting practices.

- Competitive Pricing: With a relatively low city sales tax rate, businesses in Riverside can offer competitive pricing compared to neighboring cities. This can attract customers and drive sales, especially for brick-and-mortar stores.

- Online Sales: For e-commerce businesses, the sales tax rates in Riverside apply to online transactions as well. Businesses must ensure compliance with remote sales tax regulations to avoid penalties.

- Tax Exemption Strategies: Understanding tax exemption rules can help businesses optimize their tax obligations. For instance, certain industries or products may be exempt from sales tax, providing an opportunity to reduce costs and enhance profitability.

Consumers: Understanding Tax Impact

Consumers in Riverside play a vital role in the local economy, and their purchasing decisions are influenced by the sales tax rates. Here’s how the tax structure affects their choices:

- Price Sensitivity: The 8.00% sales tax rate can impact consumers' purchasing power, especially for higher-priced items. Consumers may become more price-sensitive, comparing prices across different retailers to find the best deals.

- Online Shopping: With the convenience of online shopping, consumers in Riverside may explore options beyond the city limits. The sales tax rates in other cities or states can influence their purchasing decisions, especially for tax-free jurisdictions.

- Local Support: On the other hand, consumers may choose to support local businesses, recognizing the importance of their contributions to the community. The relatively low city sales tax rate can encourage local spending and boost the local economy.

- Tax-Inclusive Pricing: Some retailers in Riverside may choose to display tax-inclusive prices, simplifying the purchasing process for consumers. This transparency can enhance the shopping experience and build trust with customers.

Sales Tax Exemptions and Special Considerations

While the standard sales tax rates apply to most transactions, there are certain exemptions and special considerations that businesses and consumers should be aware of. These exemptions can provide relief and influence purchasing decisions.

Exemptions for Specific Goods and Services

California, and by extension Riverside, offers exemptions for certain goods and services, reducing the tax burden for consumers and businesses alike. Here are some notable exemptions:

- Grocery Items: Most food items purchased for home consumption, including produce, dairy, and staple foods, are exempt from sales tax. This exemption provides a significant relief for households and encourages healthy eating habits.

- Prescription Medications: Sales tax is not applicable to prescription drugs, making healthcare more affordable for Riverside residents. This exemption is particularly beneficial for individuals with chronic conditions or those on long-term medication.

- Educational Materials: Books, school supplies, and certain educational resources are exempt from sales tax. This encourages education and supports students and educators in the city.

- Manufacturing Machinery: Businesses engaged in manufacturing can benefit from the exemption on the sale or purchase of machinery and equipment used in the production process. This exemption promotes economic growth and innovation.

Special Considerations for Tourism and Entertainment

Riverside, known for its cultural attractions and vibrant tourism industry, offers some special considerations for visitors and entertainment-related purchases.

- Hotel Occupancy Tax: In addition to sales tax, Riverside imposes a hotel occupancy tax on short-term accommodations. This tax supports tourism promotion and infrastructure development in the city. Visitors should be aware of this additional tax when budgeting for their stay.

- Admission Fees: Certain entertainment venues and attractions may have admission fees that are subject to sales tax. This includes theme parks, museums, and cultural events. Consumers should consider these taxes when planning their leisure activities.

- Rental Car Tax: Renting a car in Riverside comes with an additional tax, known as the rental car tax. This tax supports transportation infrastructure and maintenance in the city. Travelers should factor this into their transportation costs.

Compliance and Enforcement: A Guide for Businesses

Ensuring compliance with sales tax regulations is crucial for businesses operating in Riverside. Non-compliance can lead to penalties, legal issues, and damage to the business’s reputation. Here’s a guide to help businesses navigate the compliance process.

Registering for Sales Tax Permits

Businesses in Riverside must obtain a Seller’s Permit from the California Department of Tax and Fee Administration (CDTFA). This permit authorizes the business to collect and remit sales tax to the state. The registration process involves providing business information, estimated sales projections, and tax identification numbers.

The CDTFA offers online registration, making the process more accessible and efficient. Businesses should ensure they complete the registration accurately and within the required timeframe to avoid delays and penalties.

Sales Tax Calculation and Remittance

Once registered, businesses must calculate the sales tax on each transaction accurately. The total sales tax rate in Riverside (8.00%) should be applied to the taxable portion of the sale. Businesses should maintain clear records of sales transactions, including the tax collected, to facilitate accurate remittance.

Sales tax remittance is typically done on a periodic basis, with deadlines set by the CDTFA. Late remittances or failures to remit can result in penalties and interest charges. Businesses should establish a robust accounting system to ensure timely and accurate tax payments.

Sales Tax Reporting and Audits

Businesses in Riverside are required to file periodic sales tax returns, providing details of taxable sales and the tax collected. These returns must be submitted within the designated timeframe to avoid penalties. The CDTFA offers online filing, making the process more efficient and convenient.

In addition to periodic returns, businesses may be subject to sales tax audits. Audits are conducted to ensure compliance and verify the accuracy of tax filings. Businesses should maintain comprehensive records, including sales invoices, receipts, and tax calculations, to facilitate the audit process and demonstrate compliance.

Future Outlook: Sales Tax in Riverside

As Riverside continues to thrive and evolve, the sales tax landscape may also undergo changes. Let’s explore some potential developments and their implications.

Potential Rate Changes

Sales tax rates in Riverside, like in any city, are subject to change. While the current rates are relatively stable, future economic conditions, infrastructure needs, or legislative decisions could lead to adjustments. Businesses and consumers should stay informed about any proposed changes to the tax structure.

Technological Innovations

The advancement of technology is transforming the sales tax landscape. With the rise of e-commerce and digital transactions, businesses must adapt their tax compliance systems. Integrating sales tax software and leveraging data analytics can streamline tax calculations and reporting, enhancing efficiency and accuracy.

Consumer Behavior and Preferences

Consumer preferences and purchasing behaviors can influence the sales tax environment. As consumers become more environmentally conscious, for example, there may be a shift towards supporting sustainable businesses. This could impact sales tax revenue and the allocation of funds towards environmental initiatives.

Economic Development and Tourism

Riverside’s economic development and tourism strategies can shape the sales tax landscape. If the city attracts more visitors or encourages the growth of specific industries, it may lead to increased sales tax revenue. This revenue can be reinvested into infrastructure, public services, and tourism promotion, creating a positive feedback loop.

Conclusion: Navigating Sales Tax in Riverside

Understanding the sales tax structure in Riverside is crucial for both businesses and consumers. By comprehending the rates, exemptions, and compliance requirements, individuals and enterprises can make informed decisions and contribute to the local economy effectively.

As Riverside continues to evolve, its sales tax landscape may undergo changes, offering new opportunities and challenges. Staying informed, adapting to technological advancements, and embracing sustainable practices can help businesses and consumers thrive in this dynamic environment.

Whether you're a business owner looking to optimize your tax obligations or a consumer seeking to make informed purchasing choices, this comprehensive guide provides the foundation for navigating the sales tax world in Riverside. By staying compliant, embracing innovation, and supporting the local community, we can all contribute to the prosperity of this vibrant city.

What is the total sales tax rate in Riverside, California?

+The total sales tax rate in Riverside is 8.00%, which includes the California state sales tax rate of 7.25%, the Riverside County sales tax rate of 0.50%, and the city of Riverside sales tax rate of 0.25%.

Are there any sales tax exemptions in Riverside?

+Yes, Riverside, like many other areas in California, offers sales tax exemptions for certain goods and services. Some common exemptions include grocery items, prescription medications, educational materials, and manufacturing machinery.

How does the sales tax rate in Riverside impact businesses and consumers?

+For businesses, the sales tax rate affects their pricing strategies, tax collection obligations, and competitive positioning. Consumers, on the other hand, consider the sales tax rate when making purchasing decisions, especially for larger purchases. The rate can impact their budget and price sensitivity.

What are some special considerations for sales tax in Riverside related to tourism and entertainment?

+Riverside imposes a hotel occupancy tax on short-term accommodations and sales tax on admission fees for entertainment venues. Additionally, there is a rental car tax for those renting vehicles in the city.

How can businesses ensure compliance with sales tax regulations in Riverside?

+Businesses should register for a Seller’s Permit with the California Department of Tax and Fee Administration (CDTFA), accurately calculate and collect sales tax on transactions, and file periodic sales tax returns. They should also be prepared for potential audits and maintain comprehensive records.