Free Pa Tax Filing

Tax filing is an essential process for individuals and businesses alike, ensuring compliance with the law and helping taxpayers receive their rightful refunds. While some taxpayers may opt for professional assistance, many are eligible for free tax filing services, which provide a cost-effective and convenient way to complete their tax obligations. This article delves into the world of free tax filing, specifically focusing on the state of Pennsylvania, exploring its benefits, eligibility criteria, and the steps involved in availing this service.

The Significance of Free Tax Filing

In recent years, there has been a growing emphasis on making tax filing more accessible and affordable for all taxpayers. This has led to the development of various initiatives and programs that offer free tax preparation and filing services. These initiatives aim to empower individuals and small businesses, especially those with limited financial means, to navigate the complex world of taxes with ease.

Free tax filing services are particularly beneficial for individuals who meet certain income thresholds and have straightforward tax situations. These services provide a simplified approach to tax filing, ensuring that taxpayers can accurately report their income, claim eligible deductions and credits, and receive any refunds they are entitled to without incurring additional costs.

Understanding Pennsylvania’s Free Tax Filing Programs

The state of Pennsylvania, like many other states, recognizes the importance of providing accessible tax filing options to its residents. As such, it offers several programs and initiatives to assist taxpayers in filing their state and federal taxes at no cost.

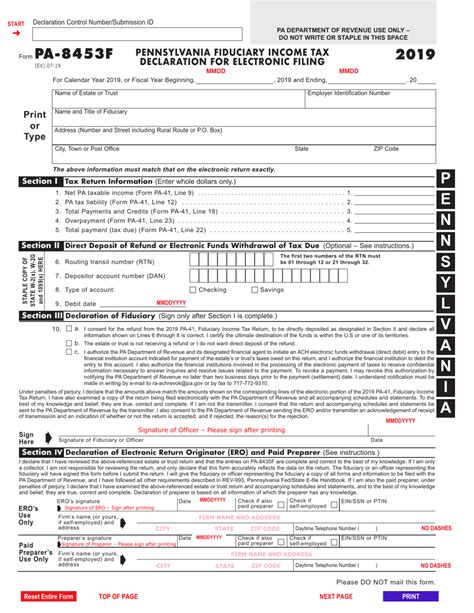

The Pennsylvania Department of Revenue’s Free File Program

The Pennsylvania Department of Revenue has partnered with various tax software providers to offer a Free File program to eligible taxpayers. This program is designed to help taxpayers with moderate to low incomes file their state and federal income tax returns electronically for free. The program is typically available from January 15th to October 15th each year.

To be eligible for the Free File program in Pennsylvania, taxpayers must meet the following criteria:

- Have an adjusted gross income of $73,000 or less for the tax year.

- Be a resident of Pennsylvania.

- Not require complex tax forms or schedules.

Eligible taxpayers can access the Free File program through the Pennsylvania Department of Revenue's website, where they can choose from a list of approved tax software providers. These providers offer user-friendly interfaces and step-by-step guidance to ensure a smooth filing process.

Voluntary Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE)

Pennsylvania also participates in the Voluntary Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs, which are federally funded initiatives. These programs provide free tax preparation assistance to eligible individuals, particularly those with low to moderate incomes, the disabled, and the elderly.

VITA and TCE programs are typically offered through local community organizations, such as libraries, community centers, and nonprofit agencies. These organizations provide trained volunteers who assist taxpayers in completing their tax returns. To find a VITA or TCE site near you, you can visit the IRS Free Tax Preparation Sites locator.

Pennsylvania’s Property Tax/Rent Rebate Program

In addition to free tax filing programs, Pennsylvania offers the Property Tax/Rent Rebate Program, which provides eligible Pennsylvania residents with a rebate on the property taxes or rent they pay. This program aims to ease the tax burden on seniors, those with disabilities, and low-income homeowners and renters.

To be eligible for the Property Tax/Rent Rebate Program, taxpayers must meet the following criteria:

- Be a Pennsylvania resident for the entire tax year.

- Have a yearly income of $35,000 or less for homeowners or $15,000 or less for renters.

- Have paid property taxes or rent during the eligible year.

Applications for the Property Tax/Rent Rebate Program are typically accepted from July 1st to December 31st each year. Taxpayers can apply online through the Pennsylvania Department of Revenue's website or by downloading and completing the appropriate forms.

Steps to Avail Free Tax Filing in Pennsylvania

Now that we’ve explored the various free tax filing programs available in Pennsylvania, let’s walk through the steps to take advantage of these services:

1. Determine Your Eligibility

The first step is to determine whether you meet the eligibility criteria for the specific free tax filing program you wish to use. Review the income thresholds, residency requirements, and other qualifications mentioned earlier in this article.

2. Choose Your Filing Method

Pennsylvania offers multiple methods for free tax filing. You can choose to use the Free File program, seek assistance from a VITA or TCE site, or opt for online tax preparation software. Consider your comfort level with technology and the complexity of your tax situation when making this decision.

3. Gather Your Documents

Regardless of the filing method you choose, you’ll need to gather the necessary documents to complete your tax return accurately. This may include your W-2 forms, 1099 forms, statements of interest and dividends, and any other relevant tax documents. If you’re claiming deductions or credits, ensure you have the necessary supporting documentation.

4. Prepare Your Taxes

If you’re using the Free File program or online tax preparation software, follow the step-by-step instructions provided by the software to input your tax information. For VITA or TCE assistance, visit the designated site and bring your tax documents with you. The volunteers will guide you through the process and ensure your return is accurate.

5. File and Receive Your Refund

Once your tax return is prepared, you can file it electronically through the Free File program or your chosen tax software. If you’re using VITA or TCE assistance, the volunteers will help you file your return. You can typically expect to receive your refund within a few weeks, depending on the method of filing and any delays in processing.

| Filing Method | Average Refund Time |

|---|---|

| Electronic Filing (Free File Program or Tax Software) | 2-3 weeks |

| Paper Filing (VITA or TCE Assistance) | 4-6 weeks |

Conclusion: Empowering Taxpayers with Free Filing Options

Free tax filing programs, such as those offered by the Pennsylvania Department of Revenue and the VITA and TCE initiatives, play a crucial role in ensuring that taxpayers, particularly those with limited means, have access to the resources they need to fulfill their tax obligations. These programs not only provide financial relief but also empower individuals to take control of their financial well-being.

By availing of these free tax filing options, Pennsylvanians can ensure they receive the refunds they are entitled to, maximize their eligible deductions and credits, and stay compliant with state and federal tax laws. Whether you're a first-time filer or a seasoned taxpayer, exploring the available free filing programs can simplify the tax process and make it more manageable.

Remember, while free tax filing programs offer significant benefits, it's essential to remain vigilant about your tax obligations and seek professional advice if you have complex tax situations. Stay informed, stay compliant, and take advantage of the resources available to make your tax journey smoother and more rewarding.

What are the income limits for the Free File program in Pennsylvania?

+To be eligible for the Free File program in Pennsylvania, you must have an adjusted gross income of $73,000 or less for the tax year.

Are there any age restrictions for the Property Tax/Rent Rebate Program?

+No, the Property Tax/Rent Rebate Program is open to all Pennsylvania residents who meet the income and residency requirements, regardless of age.

Can I file my taxes for free if I have a complex tax situation?

+While free tax filing programs are designed for taxpayers with straightforward tax situations, you may still be able to find free assistance through VITA or TCE sites. These programs often have volunteers who can assist with more complex tax scenarios.