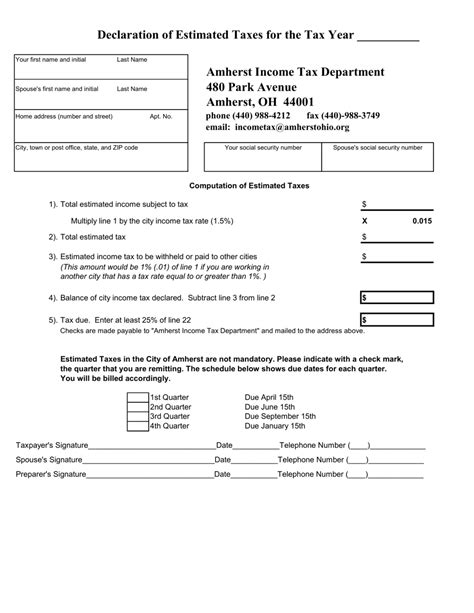

Amherst Taxes

Amherst Taxes: Navigating the Complex World of Taxation with Expertise and Precision

Introduction: Understanding the Amherst Tax Landscape

In the realm of taxation, Amherst stands as a vibrant and diverse community with its own unique tax considerations. For residents, businesses, and property owners alike, navigating the complex tax landscape can be a daunting task. This comprehensive guide aims to shed light on the intricacies of Amherst taxes, offering expert insights and practical advice to ensure compliance and optimal financial outcomes.

The tax system in Amherst is multifaceted, encompassing various types of taxes such as income tax, property tax, sales tax, and more. Each type of tax has its own set of rules, regulations, and deadlines, making it crucial for taxpayers to stay informed and proactive. Whether you're a recent transplant, a long-time resident, or a business owner, understanding the tax obligations specific to Amherst is essential to avoid penalties and make the most of available deductions and credits.

This guide will delve into the specifics of Amherst's tax system, providing a deep dive into the types of taxes applicable, the deadlines and requirements for filing, and the strategies to minimize your tax burden. We will explore the unique tax considerations for individuals, families, and businesses, offering practical tips and real-world examples to illustrate the concepts. By the end of this guide, you should have a clear understanding of your tax responsibilities and the confidence to navigate the Amherst tax landscape with ease.

Types of Taxes in Amherst: A Comprehensive Overview

Amherst, like many other communities, imposes a variety of taxes to fund essential services and infrastructure. Understanding the different types of taxes and how they apply to you is crucial for effective tax planning and compliance. Here’s a breakdown of the key taxes you may encounter in Amherst:

1. Income Tax

Income tax is a significant source of revenue for Amherst and is levied on the earnings of individuals, businesses, and other entities. The tax rates and brackets vary depending on income levels and filing status. Amherst’s income tax system is progressive, meaning that higher income earners pay a higher percentage of their income in taxes. It’s important to note that Amherst’s income tax is in addition to federal and state income taxes, so residents and businesses must navigate a multi-layered tax system.

2. Property Tax

Property tax is another crucial component of Amherst’s tax system. Property owners are subject to this tax, which is calculated based on the assessed value of their real estate. The tax rates for property tax can vary depending on the type of property (residential, commercial, or industrial) and the location within Amherst. Property tax funds are primarily used to support local schools, emergency services, and other community services.

3. Sales and Use Tax

Sales and use tax is imposed on the sale of goods and services within Amherst. This tax is typically included in the price of goods at the point of sale, making it a transparent cost for consumers. Businesses are responsible for collecting and remitting this tax to the appropriate authorities. Additionally, Amherst may have specific regulations regarding sales tax on certain products or services, such as exemptions for certain items or special tax rates for certain industries.

4. Other Taxes and Fees

In addition to the aforementioned taxes, Amherst may also levy other taxes and fees to support specific initiatives or services. These can include:

- Excise Taxes: Taxes on specific goods like gasoline, tobacco, or alcohol.

- Vehicle Registration Fees: Fees for registering and maintaining motor vehicles.

- Business License Fees: Fees for businesses to operate within Amherst.

- Special Assessment Fees: Charges for specific improvements or services provided by the municipality.

Understanding the types of taxes applicable to you is the first step in effective tax planning. By being aware of these taxes and their specific requirements, you can ensure compliance and take advantage of any deductions or credits that may be available.

Tax Deadlines and Requirements: Staying on Top of Your Obligations

Meeting tax deadlines and fulfilling the associated requirements is a critical aspect of tax compliance. Amherst, like other jurisdictions, has specific dates by which taxpayers must file their returns and remit their taxes. Missing these deadlines can result in penalties and interest charges, so it’s essential to stay organized and plan accordingly.

Income Tax Deadlines

For individual income tax returns, the general deadline in Amherst is April 15th, which aligns with the federal tax deadline. However, it’s important to note that certain circumstances may warrant an extension. For instance, if you are abroad on the tax deadline or if you require additional time to gather necessary documents, you can request an extension. Keep in mind that an extension to file does not extend the deadline to pay any taxes owed.

For businesses, the tax deadlines may vary depending on the legal structure of the entity. Partnerships and S-corporations typically have a March 15th deadline, while C-corporations have a similar deadline to individuals: April 15th. Again, extensions are available, but it's crucial to understand the specific requirements and limitations.

Property Tax Deadlines

Property tax deadlines in Amherst are typically set at specific intervals throughout the year. The exact dates may vary, but generally, property owners can expect to receive a tax bill and have a set timeframe to pay the assessed amount. Failure to pay property taxes on time can result in penalties, interest charges, and, in extreme cases, loss of the property through tax foreclosure.

Sales and Use Tax Deadlines

Businesses that collect sales tax must remit these funds to the appropriate authorities on a regular basis. The frequency of these payments can vary depending on the volume of sales and the specific regulations in Amherst. Common remittance frequencies include monthly, quarterly, or annually. Late payments of sales tax can result in penalties and interest, so it’s crucial for businesses to stay on top of their obligations.

Understanding the tax deadlines and requirements specific to Amherst is crucial for effective tax planning. By staying informed and organized, taxpayers can avoid unnecessary penalties and ensure a smooth tax filing process.

Tax Planning Strategies: Minimizing Your Tax Burden

Tax planning is a strategic process that involves analyzing your financial situation and implementing legal strategies to minimize your tax liability. While tax compliance is a legal obligation, there are often opportunities to reduce your tax burden and optimize your financial outcomes. Here are some effective tax planning strategies to consider:

1. Maximize Deductions and Credits

Amherst, like many jurisdictions, offers a range of deductions and credits that can significantly reduce your tax liability. Deductions are expenses that you can subtract from your taxable income, thereby lowering the amount of income subject to tax. Some common deductions include mortgage interest, property taxes, charitable contributions, and certain business expenses. By itemizing your deductions, you may be able to reduce your taxable income and save on taxes.

Credits, on the other hand, are direct reductions of your tax liability. They are often more valuable than deductions because they dollar-for-dollar reduce your tax bill. Examples of tax credits include the Child Tax Credit, the Earned Income Tax Credit, and the Residential Energy Efficiency Credit. These credits can make a significant difference in your tax liability, so it's crucial to understand your eligibility and claim them on your tax return.

2. Optimize Retirement Contributions

Contributions to certain retirement plans can offer significant tax advantages. For example, contributions to a traditional IRA or 401(k) plan are typically tax-deductible, which means they reduce your taxable income for the year. Additionally, the earnings on these contributions grow tax-deferred until you withdraw them in retirement, further reducing your tax burden.

Amherst may also offer specific retirement savings plans or incentives that can enhance your tax planning. For instance, some states have their own versions of a 529 plan, which is a tax-advantaged savings plan for education expenses. By taking advantage of these plans, you can save for your future while also reducing your current tax liability.

3. Utilize Tax-Efficient Investment Strategies

Investment decisions can have a significant impact on your tax liability. By employing tax-efficient investment strategies, you can minimize the tax implications of your investments. For instance, capital gains (profits from the sale of investments) are taxed at different rates depending on whether they are short-term or long-term gains. Holding investments for longer periods can result in more favorable tax treatment.

Furthermore, certain types of investments, such as municipal bonds, offer tax-free income, which can be especially beneficial for taxpayers in higher tax brackets. By diversifying your investment portfolio with tax-efficient assets, you can reduce your overall tax burden and maximize your investment returns.

Tax planning is a complex but rewarding process. By understanding the tax landscape in Amherst and implementing effective strategies, you can minimize your tax liability and maximize your financial outcomes. Remember, it's always advisable to consult with a tax professional to ensure you're taking advantage of all the deductions, credits, and strategies available to you.

Amherst’s Tax Incentives and Programs: Maximizing Your Benefits

Amherst, like many communities, recognizes the importance of fostering economic growth and supporting its residents and businesses. To achieve these goals, Amherst offers a range of tax incentives and programs that can provide significant benefits to taxpayers. These initiatives are designed to encourage investment, promote job creation, and support community development. Here’s an overview of some of the tax incentives and programs available in Amherst:

1. Business Tax Incentives

Amherst aims to attract and retain businesses by offering a variety of tax incentives. These incentives can take several forms, including:

- Tax Credits: Businesses that meet certain criteria, such as creating new jobs or investing in research and development, may be eligible for tax credits. These credits can reduce the business’s tax liability, making it more financially attractive to operate in Amherst.

- Tax Abatements: In certain cases, Amherst may offer tax abatements to businesses, which involve a reduction or elimination of taxes for a set period. This incentive is often used to encourage businesses to locate in underdeveloped areas or to promote specific industries.

- Enterprise Zones: Amherst may designate specific areas as enterprise zones, offering businesses within those zones reduced tax rates and other benefits. These zones are typically established to stimulate economic development in struggling communities.

2. Residential Tax Incentives

Amherst also provides tax incentives to encourage homeownership and support residents. Some of these incentives include:

- First-Time Homebuyer Programs: Amherst may offer programs that provide tax credits or other benefits to first-time homebuyers. These programs are designed to make homeownership more affordable and accessible.

- Property Tax Deferral Programs: In certain circumstances, Amherst may allow eligible homeowners to defer a portion of their property taxes. This can be particularly beneficial for seniors or low-income individuals who may struggle to pay their property taxes.

- Energy Efficiency Incentives: Amherst may offer tax credits or rebates for homeowners who invest in energy-efficient upgrades to their properties. These incentives promote sustainability and reduce energy costs for residents.

3. Community Development Programs

Amherst’s tax incentives and programs often extend beyond individual taxpayers and businesses to support community development as a whole. Some of these programs include:

- Historic Preservation Tax Credits: Amherst may offer tax credits to encourage the preservation and rehabilitation of historic properties. These credits can be significant, providing a financial incentive to restore and maintain the community’s architectural heritage.

- Community Investment Programs: Amherst may have programs that provide tax incentives for businesses and individuals to invest in community development projects. These projects could include infrastructure improvements, affordable housing initiatives, or initiatives to support local businesses.

- Green Initiatives: Amherst may offer tax incentives for initiatives that promote sustainability and environmental stewardship. This could include tax credits for installing renewable energy systems, implementing energy-efficient practices, or participating in recycling programs.

By taking advantage of these tax incentives and programs, taxpayers in Amherst can not only reduce their tax liability but also contribute to the growth and development of their community. It's important to stay informed about the specific programs and eligibility criteria, as these initiatives can change over time to meet the evolving needs of the community.

Tax Filing and Payment Options: A Guide to Smooth Transactions

Filing your taxes and making payments can be a straightforward process when you have the right tools and information. Amherst, like many jurisdictions, offers various options for tax filing and payment, catering to different preferences and circumstances. Here’s a comprehensive guide to help you navigate the tax filing and payment process in Amherst:

1. Online Filing and Payment

Amherst’s tax department recognizes the convenience and efficiency of online filing and payment options. Many taxpayers opt for this method, as it allows them to complete their tax obligations from the comfort of their homes or offices. To file your taxes online, you’ll need to visit the Amherst tax department’s official website and access the online filing system. This system typically guides you through the process, step by step, ensuring that you provide all the necessary information.

Online payment options are often integrated into the filing system, allowing you to make payments directly from your bank account or using a credit or debit card. These payment methods are secure and provide a convenient way to settle your tax liabilities without having to visit a physical location.

2. Electronic Filing (e-Filing)

For those who prefer a more traditional approach, Amherst also offers the option of electronic filing, or e-filing. With e-filing, you’ll need to use specialized software or work with a tax professional who can submit your tax return electronically on your behalf. This method is particularly beneficial for complex tax returns or for taxpayers who are more comfortable with a paperless process.

3. Paper Filing

While online and electronic filing are the preferred methods, Amherst also accommodates taxpayers who prefer to file their taxes on paper. You can obtain the necessary forms from the tax department’s website or by visiting a local tax office. Fill out the forms accurately and completely, and ensure that you include all the required documentation and supporting materials.

When filing your paper return, you'll also need to consider the method of payment. Amherst may accept checks, money orders, or cash payments, but it's essential to follow the specific guidelines provided by the tax department to ensure your payment is processed correctly.

4. Payment Plans and Installment Agreements

If you’re unable to pay your tax liability in full at the time of filing, Amherst may offer payment plans or installment agreements. These arrangements allow you to pay your taxes over time, often with a small fee or interest charge. To qualify for a payment plan, you’ll need to demonstrate financial hardship or a valid reason why you cannot pay the full amount immediately.

Amherst's tax department will provide guidance on the application process and the terms of the payment plan. It's important to note that failing to adhere to the terms of the payment plan can result in penalties and interest, so it's crucial to make timely payments and stay in communication with the tax department.

By understanding the various tax filing and payment options available in Amherst, you can choose the method that best suits your needs and preferences. Whether you opt for online filing, e-filing, paper filing, or a payment plan, staying organized and proactive will ensure a smooth and stress-free tax filing experience.

Tax Preparation Services: Ensuring Accuracy and Expertise

Tax preparation is a critical process that requires attention to detail and a deep understanding of tax laws and regulations. While some taxpayers feel confident preparing their own taxes, others may benefit from the expertise and guidance of tax professionals. Tax preparation services can provide invaluable assistance, ensuring accuracy and optimizing your tax outcomes. Here’s an overview of the benefits of tax preparation services and how they can help you navigate the complex world of taxes:

1. Expertise and Knowledge

Tax laws and regulations can be intricate and constantly evolving. Tax professionals, such as certified public accountants (CPAs) or enrolled agents (EAs), have extensive knowledge and experience in interpreting and applying these laws. They stay up-to-date with the latest tax changes and can provide expert advice tailored to your specific situation.

By working with a tax professional, you can leverage their expertise to ensure that your tax return is accurate and complete. They can identify deductions, credits, and other tax benefits that you may have overlooked, maximizing your tax savings.

2. Error Reduction

Tax returns can be complex, and even small errors can have significant consequences. Tax preparation services can help reduce the risk of errors by carefully reviewing your financial information and ensuring that all necessary forms and schedules are completed accurately. Their attention to detail can save you from potential audits and penalties.

3. Time and Effort Savings

Preparing your taxes can be a time-consuming process, especially if you have a complex financial situation. Tax preparation services can handle the bulk of the work, allowing you to focus on your personal or business commitments. They can gather the necessary documents, organize your financial data, and complete the tax return on your behalf, saving you valuable time and effort.

4. Specialized Services

Tax professionals offer a range of specialized services beyond basic tax