Tax Accountant Vacancies

In today's dynamic job market, tax accounting has emerged as a highly sought-after profession, offering a plethora of career opportunities. As businesses navigate complex tax landscapes, the demand for skilled tax accountants continues to rise, creating an abundance of job vacancies. This article delves into the world of tax accounting, exploring the roles, responsibilities, and qualifications that shape this field, while providing an in-depth analysis of the current job market and its prospects.

The Role of a Tax Accountant

Tax accountants are financial experts who specialize in tax compliance, planning, and strategy. Their primary responsibility is to ensure that individuals, businesses, and organizations adhere to tax regulations and laws, while also helping them optimize their tax positions and minimize financial liabilities. Tax accountants play a crucial role in maximizing tax efficiency and providing valuable financial insights to their clients or employers.

The specific duties of a tax accountant may vary depending on their area of specialization and the nature of their employer or client. However, some common responsibilities include:

- Tax Compliance: Ensuring accurate and timely filing of tax returns, including income tax, sales tax, payroll tax, and other applicable taxes.

- Tax Planning: Developing strategies to minimize tax liabilities, optimize tax efficiency, and maximize financial benefits for clients.

- Tax Research: Staying up-to-date with tax laws, regulations, and policy changes to provide accurate advice and guidance.

- Financial Analysis: Analyzing financial data and trends to identify opportunities for tax savings and improvements in financial performance.

- Consultation: Providing expert advice and guidance to clients on tax-related matters, including tax planning, business structure, and compliance.

Qualifications and Skills for Tax Accountants

Tax accountants typically possess a strong educational background in accounting, finance, or a related field. While a bachelor’s degree is often the minimum requirement, many tax accountants pursue advanced degrees or professional certifications to enhance their expertise and credibility.

Educational Requirements

A bachelor’s degree in accounting, finance, or a related field is the foundational requirement for tax accountants. These programs provide a solid understanding of accounting principles, financial analysis, and taxation. Courses in tax law, business law, and auditing are particularly relevant for aspiring tax accountants.

For those seeking advanced positions or specialized roles, a master's degree in accounting, taxation, or a related field can be advantageous. These programs offer in-depth knowledge of tax regulations, advanced tax planning strategies, and specialized areas such as international tax or corporate taxation.

Professional Certifications

Professional certifications are highly valued in the field of tax accounting. The most widely recognized certifications include the Certified Public Accountant (CPA) designation and the Enrolled Agent (EA) credential. These certifications demonstrate a high level of expertise and are often required for certain tax accounting roles, especially those involving public practice or working with high-net-worth individuals or corporations.

Key Skills for Tax Accountants

In addition to their educational qualifications, tax accountants require a unique skill set to excel in their profession. Here are some essential skills for tax accountants:

- Attention to Detail: Tax accounting demands meticulous attention to detail, as even small errors can have significant financial implications.

- Analytical Thinking: Tax accountants must possess strong analytical skills to interpret complex tax regulations, identify trends, and develop effective tax strategies.

- Communication Skills: Effective communication is vital for tax accountants, as they often need to explain complex tax concepts to clients or colleagues in a clear and concise manner.

- Problem-Solving Abilities: Tax accountants encounter a variety of challenges, from resolving tax issues to developing creative solutions for tax optimization. Strong problem-solving skills are essential for success in this field.

- Technical Proficiency: Proficiency in accounting software and tax preparation tools is crucial for tax accountants. They must be able to navigate these technologies efficiently to ensure accurate and timely tax compliance.

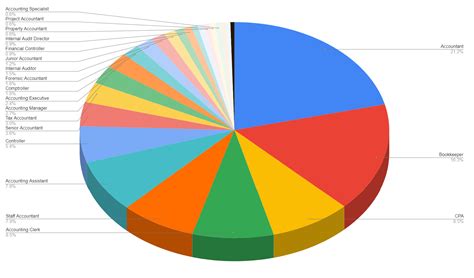

Tax Accountant Vacancies: Current Landscape and Trends

The job market for tax accountants is thriving, driven by a combination of factors, including economic growth, regulatory changes, and the increasing complexity of tax laws. As businesses expand and globalize, the demand for tax expertise has grown significantly.

Industry Sectors with High Demand

Tax accounting vacancies are prevalent across various industry sectors, with some sectors experiencing particularly high demand. These include:

- Accounting Firms: Accounting firms, both large and small, are consistently seeking tax accountants to meet the diverse needs of their clients. From individual tax returns to complex corporate tax planning, accounting firms offer a wide range of opportunities for tax professionals.

- Corporate Finance: Large corporations often have dedicated tax departments or teams, creating a steady demand for tax accountants within the corporate finance sector. These professionals play a crucial role in managing tax obligations, optimizing tax strategies, and ensuring compliance for the organization.

- Government Agencies: Government agencies, such as the Internal Revenue Service (IRS) or state tax authorities, employ tax accountants to enforce tax regulations, conduct audits, and provide taxpayer assistance. These positions offer a unique opportunity to contribute to public service while gaining valuable experience in tax enforcement and compliance.

- Legal Firms: Legal firms specializing in tax law often seek tax accountants to support their legal teams. Tax accountants in this sector assist with tax litigation, provide expert testimony, and offer strategic tax advice to clients.

Employment Opportunities and Salary Prospects

The employment prospects for tax accountants are highly favorable, with a range of opportunities available across various sectors. The specific salary prospects can vary depending on factors such as location, industry, experience, and specialization.

| Sector | Average Salary Range |

|---|---|

| Accounting Firms | $50,000 - $120,000 |

| Corporate Finance | $60,000 - $150,000 |

| Government Agencies | $45,000 - $90,000 |

| Legal Firms | $70,000 - $180,000 |

It's important to note that these salary ranges are estimates and can vary significantly based on individual circumstances and market conditions. Additionally, tax accountants with advanced certifications or specialized expertise may command higher salaries and more lucrative opportunities.

Future Outlook and Growth Opportunities

The future of tax accounting looks promising, with a steady growth trajectory projected for the coming years. As businesses continue to expand and tax laws evolve, the demand for tax expertise is expected to remain high. Tax accountants who stay updated with the latest tax regulations and continuously enhance their skills will have ample opportunities for career advancement and professional growth.

Furthermore, the increasing complexity of tax laws and the growing focus on international tax compliance present new challenges and opportunities for tax accountants. By staying ahead of the curve and adapting to changing tax landscapes, tax professionals can position themselves as valuable assets to their employers or clients.

Conclusion

The world of tax accounting offers a rewarding and dynamic career path for those with a passion for finance and a knack for navigating complex tax regulations. With a strong educational foundation, relevant certifications, and a diverse skill set, aspiring tax accountants can embark on a successful and fulfilling journey in this field. The current job market presents a plethora of opportunities, and by staying abreast of industry trends and developments, tax professionals can unlock their full potential and make a significant impact in the world of finance and taxation.

What are the key challenges faced by tax accountants in today’s market?

+Tax accountants often encounter challenges such as keeping up with rapidly changing tax laws, managing complex tax regulations, and ensuring compliance in an increasingly globalized business environment. Additionally, staying competitive in a highly specialized field and adapting to new technologies can be demanding.

How can tax accountants stay updated with the latest tax regulations and laws?

+Tax accountants can stay updated by subscribing to industry publications, attending conferences and seminars, joining professional associations, and participating in continuing education programs. Staying connected with industry peers and mentors can also provide valuable insights into emerging tax trends and best practices.

What are some tips for tax accountants to stand out in a competitive job market?

+To stand out, tax accountants can focus on developing specialized expertise in a particular area of taxation, such as international tax, estate planning, or corporate tax. Building a strong professional network, seeking mentorship opportunities, and continuously enhancing their technical skills can also set them apart from the competition.