Az Gov Taxes

Welcome to an in-depth exploration of Arizona's (AZ) state tax system, a topic of utmost importance for individuals and businesses operating within the state. Arizona's tax structure, much like that of other states, plays a pivotal role in shaping the financial landscape and economic policies. This article aims to provide a comprehensive guide, delving into the intricacies of AZ state taxes, their impact on various sectors, and the strategies employed by taxpayers to optimize their financial obligations.

Understanding AZ State Taxes

Arizona’s tax system is a comprehensive framework that encompasses various revenue streams, including income tax, sales tax, property tax, and corporate taxes. Each of these tax categories serves a specific purpose, contributing to the state’s overall revenue and, consequently, its ability to fund public services, infrastructure, and economic initiatives.

Income Tax: A Pillar of AZ’s Revenue Generation

Arizona’s income tax structure is designed to generate a significant portion of the state’s revenue. The state imposes a progressive income tax, meaning that as taxable income increases, so does the tax rate. This system ensures that individuals and businesses with higher incomes contribute a larger share of their earnings to the state’s coffers.

For individuals, Arizona's income tax brackets range from 2.59% to 4.50%, depending on taxable income. This means that as income rises, taxpayers move into higher tax brackets, facing incrementally higher tax rates. This progressive system aims to maintain fairness and ensure that those with greater financial means contribute proportionally more to the state's finances.

| Tax Rate | Taxable Income Range |

|---|---|

| 2.59% | $0 - $10,000 |

| 2.88% | $10,001 - $25,000 |

| 3.36% | $25,001 - $50,000 |

| 4.24% | $50,001 - $150,000 |

| 4.50% | Over $150,000 |

Similarly, Arizona imposes corporate income taxes on businesses operating within the state. The corporate income tax rate is set at 4.9%, which applies to the net income of corporations, limited liability companies (LLCs), and S corporations.

Sales Tax: Funding Daily Operations

Sales tax is a critical component of Arizona’s tax system, contributing to the state’s ability to fund daily operations and essential services. Arizona’s sales tax rate is set at 5.6%, with local governments and municipalities authorized to levy additional sales taxes, resulting in a combined rate that can vary across the state.

For instance, in the city of Phoenix, the total sales tax rate is 8.6%, comprising the state's base rate of 5.6% and a local rate of 3%. This means that when you make a purchase in Phoenix, you contribute not only to the state's revenue but also to the city's specific funding needs, which can include infrastructure projects, public safety, and other local initiatives.

| City | Total Sales Tax Rate |

|---|---|

| Phoenix | 8.6% |

| Tucson | 7.55% |

| Mesa | 8.05% |

| Scottsdale | 8.1% |

| Glendale | 8.6% |

Sales tax is applicable to a wide range of goods and services, including retail purchases, restaurant meals, and even certain services. However, Arizona does offer exemptions for specific items, such as groceries, prescription drugs, and certain medical devices. These exemptions aim to reduce the tax burden on essential items and services, benefiting consumers and encouraging economic activity.

Property Tax: Supporting Local Communities

Property tax is another vital source of revenue for Arizona, with proceeds largely allocated to fund local communities and essential services. The property tax system in Arizona is managed by county assessors, who are responsible for determining the assessed value of properties within their jurisdictions.

The assessed value of a property is then used to calculate the property tax due. This value is typically based on the market value of the property, with adjustments made for factors like location, improvements, and any applicable exemptions. The property tax rate, set by local governments, is applied to the assessed value to determine the tax liability.

For instance, if a homeowner in Maricopa County has a property with an assessed value of $200,000 and the county's property tax rate is 1%, the annual property tax would amount to $2,000. This tax is used to fund local schools, fire departments, police services, and other community needs.

Tax Strategies and Planning in Arizona

Navigating Arizona’s tax landscape requires careful planning and a comprehensive understanding of the state’s tax laws. Here are some key strategies and considerations for individuals and businesses operating in Arizona.

Maximizing Tax Credits and Incentives

Arizona offers a range of tax credits and incentives to encourage economic development, support specific industries, and assist taxpayers in various situations. These incentives can significantly reduce tax liabilities, making them a crucial aspect of tax planning.

For instance, the Research and Development Tax Credit provides a credit against income tax for qualified research expenses incurred by businesses. This credit aims to foster innovation and technological advancements within the state. Similarly, the Job Creation Tax Credit offers incentives to businesses that create new full-time jobs, encouraging economic growth and job creation.

Individuals can also benefit from tax credits, such as the Low Income Tax Credit, which provides a refund for certain low-income taxpayers, and the Elderly and Disabled Homeowner's Property Tax Refund, which offers relief for qualifying elderly and disabled homeowners.

Efficient Tax Filing and Payment Methods

Arizona provides various options for taxpayers to file their returns and make payments, offering convenience and flexibility. The Arizona Department of Revenue (ADOR) accepts tax returns electronically, ensuring a faster processing time and reducing the risk of errors. Taxpayers can use the ADOR’s online filing system or engage tax professionals to ensure accuracy and take advantage of all available deductions and credits.

Additionally, Arizona offers multiple payment methods, including credit card, debit card, and electronic funds transfer (EFT). These methods provide convenience and security, allowing taxpayers to manage their financial obligations efficiently.

Navigating Tax Obligations for Businesses

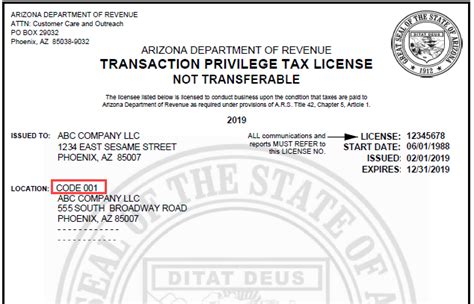

Businesses operating in Arizona face a unique set of tax obligations, including transaction privilege tax (TPT), use tax, and various licensing and registration requirements. TPT, often referred to as a sales tax, is levied on the privilege of doing business in Arizona and is applicable to various transactions, including sales, rentals, and services.

Businesses must register with the ADOR and obtain a TPT license, which involves providing detailed information about their operations, products, and services. This process ensures that businesses comply with Arizona's tax laws and helps the state effectively manage its revenue streams.

The Impact of AZ State Taxes on the Economy

Arizona’s tax system plays a critical role in shaping the state’s economic landscape, influencing investment, business growth, and consumer spending. The state’s tax policies and rates can significantly impact the cost of doing business, affect consumer purchasing power, and influence overall economic growth.

Attracting Investments and Businesses

Arizona’s tax structure, particularly its corporate income tax rate, can be a significant factor in attracting new businesses and investments. A competitive tax rate can make the state more appealing to companies looking to expand or relocate, contributing to economic growth and job creation.

Additionally, Arizona's tax incentives and credits, such as the Arizona Enterprise Zone Tax Credit and the Qualified Facility Tax Credit, offer significant benefits to businesses operating within specific areas or engaging in qualifying activities. These incentives can offset the cost of doing business, making Arizona an attractive destination for investment.

Consumer Spending and Sales Tax

Sales tax is a critical component of Arizona’s economy, influencing consumer spending habits and retail sales. While a higher sales tax rate can reduce purchasing power, Arizona’s moderate sales tax rate, coupled with exemptions for essential items, aims to strike a balance between generating revenue and encouraging consumer spending.

Furthermore, the state's ability to allow local governments to levy additional sales taxes provides flexibility to fund specific community needs and projects, ensuring that the revenue generated is invested back into the local economy.

Impact on Real Estate and Property Tax

Property tax is a significant consideration for homeowners and investors in Arizona. The state’s property tax system, managed by county assessors, ensures that property values are assessed fairly and that tax rates are set to fund essential community services.

While property tax can be a burden for homeowners, it also contributes to the overall health of the real estate market. A well-managed property tax system can encourage investment, support community development, and ensure that local services are adequately funded.

Future Outlook and Potential Changes

Arizona’s tax landscape is subject to continuous evaluation and potential changes, influenced by economic trends, political decisions, and the state’s evolving needs. As the state’s economy grows and adapts to new challenges, its tax system must also evolve to remain competitive and effective.

Proposed Tax Reforms and Initiatives

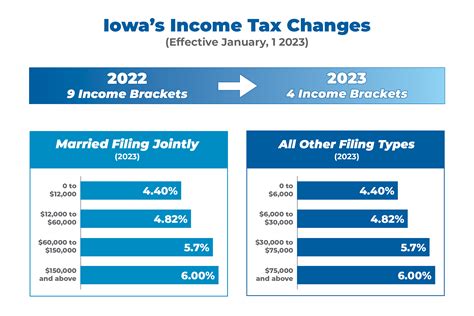

Arizona’s policymakers and tax experts continuously explore ways to improve the state’s tax system, making it more efficient, fair, and responsive to the needs of its citizens and businesses. Proposed reforms may include adjustments to tax rates, modifications to tax brackets, and the introduction of new tax incentives or credits.

For instance, discussions around income tax reform aim to simplify the tax code, reduce complexities, and ensure that the system remains progressive and equitable. This could involve streamlining tax brackets, adjusting tax rates, or introducing new deductions to benefit specific demographics.

Potential Impact of Economic Shifts

Economic shifts, such as changes in consumer spending patterns, shifts in the business landscape, or fluctuations in the real estate market, can significantly impact Arizona’s tax revenue. For instance, a decrease in consumer spending due to economic downturns can lead to reduced sales tax revenue, affecting the state’s ability to fund essential services.

Similarly, changes in the business environment, such as shifts in industry trends or the emergence of new technologies, can influence the state's corporate tax revenue. Arizona's tax system must remain agile and responsive to these shifts to ensure it can adapt and continue generating the revenue needed to support the state's economic and social infrastructure.

The Role of Technology in Tax Administration

Advancements in technology are increasingly shaping the way Arizona manages its tax system. The ADOR is leveraging technology to improve tax administration, streamline processes, and enhance taxpayer services. This includes the development of user-friendly online platforms, mobile apps, and digital tools to make tax filing and payment more accessible and efficient.

Additionally, technology is playing a critical role in enhancing tax compliance and reducing fraud. Advanced data analytics and machine learning algorithms are being utilized to identify potential tax evasion, improve audit processes, and ensure that taxpayers are fulfilling their obligations accurately and timely.

How often does Arizona update its tax rates and laws?

+Arizona’s tax rates and laws are subject to change based on legislative decisions and economic conditions. The state legislature can propose and enact changes to tax policies, which typically go into effect for the following tax year. Therefore, it’s essential to stay updated with the latest tax information to ensure compliance.

Are there any tax holidays or sales tax exemptions in Arizona?

+Yes, Arizona does offer certain tax holidays and sales tax exemptions. For instance, the state has designated specific days as tax-free shopping days for school supplies and clothing. Additionally, there are exemptions for groceries, prescription drugs, and certain medical devices. These exemptions aim to reduce the tax burden on essential items and encourage consumer spending.

How can I stay updated with the latest tax information and changes in Arizona?

+Staying informed about Arizona’s tax landscape is crucial for compliance and planning. The Arizona Department of Revenue (ADOR) provides a wealth of resources, including tax guides, updates, and notifications on its website. Additionally, subscribing to ADOR’s email updates and following reputable tax news sources can ensure you receive timely information on any changes or updates.