Tracing the Origins of No Tax on Tips 2025 Policy Changes

Amid the bustling atmosphere of a vibrant downtown restaurant, Julia, a seasoned hospitality manager with over two decades in the industry, reflects on a curious trend: the persistent absence of taxation on tips. As she ensures her staff's compensation is fair and transparent, she can’t help but wonder how this longstanding practice originated and what the implications might be of upcoming policy shifts slated for 2025. While the landscape of tip policies often seems straightforward—waitstaff receive tips directly from customers—the deeper historical roots, legislative nuances, and evolving debates surrounding tax exemptions paint a more complex picture. Tracing the origins of the “no tax on tips” policy and understanding the impending shifts requires an in-depth look at historical fiscal attitudes, labor rights movements, and current economic policies that shape American tipping practices today.

Historical Roots of Tax Exemption on Tips: Foundations and Evolution

The concept of tipping in the United States dates back to the colonial era, where informal arrangements and gratuities played an integral role in supplementing low wages. It wasn’t until the late 19th century that tipping became more systematized, often associated with the emergence of the hospitality industry in urban centers like New York and Chicago. During this period, there was growing concern about the taxation of tips, especially considering the socio-economic disparities that influenced tips’ legitimacy as free-will rewards versus disguised wages. Historically, legislators sought to shield tips from taxation to preserve their status as voluntary, tax-free gratuities, although this often conflicted with the tax obligations of employers and the broader tax code.

Legislative Milestones Impacting Tip Taxation

In 1951, the Internal Revenue Service (IRS) clarified that tips are taxable income, requiring both employees and employers to report and pay taxes accordingly. Yet, the federal tax code granted specific exemptions, classifying tips as “predicate income” that are generally excluded from payroll taxes if certain reporting thresholds are met. This legal framework effectively created a bifurcated system where tips, while taxable, enjoyed a distinct exemption status that persists today. The Economic Recovery Tax Act of 1981 cemented this approach, aiming to simplify tax collection and incentivize honest reporting, but also sparking debate over whether this exemption fosters tax evasion or protects low-wage workers.

| Relevant Category | Substantive Data |

|---|---|

| Tip income exemption | Tip amounts less than $20/month are exempt from reporting requirements under IRS rules, with thresholds adjusted over time for inflation. |

| Tax compliance rate | Estimated 40-50% of tipped employees under-report earnings, highlighting ongoing enforcement challenges despite legal frameworks. |

Contemporary Debates and Policy Shifts Leading to 2025 Changes

Fast forward to recent years, the issue of taxing tips has moved from a traditional workplace practice to a focal point of national economic policy discussions. Advocates for reform emphasize that the current system inadvertently incentivizes under-reporting, perpetuates wage disparities, and complicates wage transparency. Conversely, opponents argue that taxing tips may impose undue burdens on small businesses and tip-dependent workers, many of whom rely heavily on tips as a significant part of their income.

The 2025 Policy Inclusion and Expected Changes

The Biden administration’s proposed Tax Fairness Act of 2024 signals a pivotal change: the potential imposition of a federal tip tax, aligning tip earnings more closely with regular wage taxation. Under the new framework, tips would be fully taxed regardless of current reporting thresholds, and employers would be required to withhold payroll taxes on tip income regardless of whether employees report them. This move aims to bolster tax compliance, widen the tax base, and address wage inequality but raises concerns about administrative complexity and worker hardship.

| Policy Aspect | Projected Implementation Details |

|---|---|

| Effective date | January 1, 2025 |

| Tax rate implications | Full tip income taxed at standard income rates, with mandatory withholding by employers. |

| Worker impact | Potential reduction in disposable income for some tip-dependent workers, balanced by increased wage transparency. |

Broader Economic and Social Implications of the Policy Transition

The measure to tax tips more comprehensively by 2025 offers an intriguing glimpse into the evolving landscape of labor economics and fiscal policy. On one side, increased tax revenues could provide funds for social programs and wage subsidies, potentially reducing income inequality among tipped workers. On the other hand, this could lead to shifts in tipping behaviors, altered service charges, or even a reevaluation of compensation structures within the hospitality sector.

Impact on the Hospitality Industry and Tipped Workers

hospitality industry stakeholders express concern about the administrative burden of implementing new tax withholding practices and the potential deterrent effect on tipping generosity. Researchers from the National Restaurant Association project that, depending on the magnitude of tax increases, consumer tipping could decline by approximately 5-10%, influencing workers’ earnings and overall consumer satisfaction. Conversely, some advocates argue that formalizing tip taxation will promote wage fairness, especially for lower-income workers who often rely heavily on tips to reach a livable income.

| Impact Category | Projected Outcomes |

|---|---|

| Worker earnings | Potential decline of up to 10% due to increased tax withholding, depending on tipping trends. |

| Industry revenue | Moderate shift in customer tipping behavior, possibly reducing total gratuity revenue. |

| Government revenue | Estimated increase of $1.2 billion annually upon full implementation. |

Historical Context, Trends, and Future Directions

Historically, the policies surrounding tip taxation oscillate between supporting worker livelihoods and ensuring tax compliance. As the economy shifts towards gig and fractional labor markets, the boundaries of how tips are earned, reported, and taxed continue to evolve. The 2025 policy changes are not only a legislative step but also a reflection of broader trends toward greater fiscal transparency and wage equality.

Lessons from Past Policy Implementations

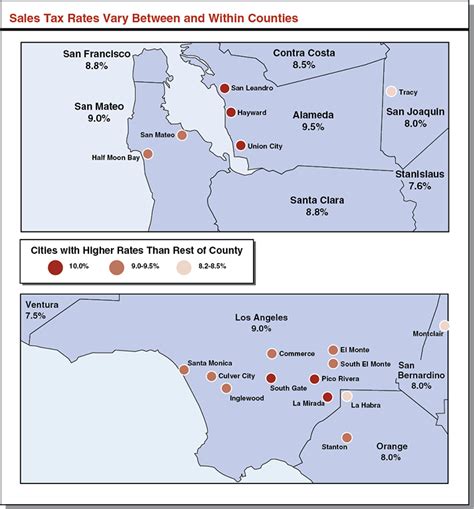

Looking back, successful policy shifts—such as the gradual integration of tips into taxable income—highlight the importance of phased implementation, stakeholder engagement, and legislative clarity. In particular, states like California and New York have experimented with local regulations that provide unique insights into how mandatory reporting influences both worker income and industry practice.

| Lessons | Key Takeaways |

|---|---|

| Gradual roll-out | Phased policies enable adjustment periods and stakeholder buy-in. |

| Stakeholder engagement | Collaborating with business associations and worker groups smooths implementation. |

| Clear communication | Transparency about aims and procedures mitigates resistance and misinformation. |

Key Points

- Historical practices cemented the tax-exempt status of tips, rooted in economic and social priorities.

- The 2025 reforms aim to align tip taxation with broad-based income tax policies, with significant implications for workers and industry.

- These policy changes reflect evolving fiscal strategies, emphasizing transparency and fair income distribution.

- Successful adaptation relies on stakeholder cooperation, phased implementation, and clear communication.

- Balancing revenue needs with sector sustainability will remain a challenge amid ongoing economic shifts.

What is the historical basis for no tax on tips?

+The no-tax policy on tips traces back to efforts in the late 19th and early 20th centuries to promote gratuities as voluntary, external income, with legislation gradually establishing exemptions to support low-wage workers while preventing the government from overly regulating informal income streams.

How will the 2025 policy change affect tipped workers?

+Expected reforms will require full reporting and taxation of all tip income, potentially reducing disposable income but also promoting wage transparency and helping address income disparities within tipped industries.

Are there any international analogs to this policy?

+Many countries, including the UK and Australia, incorporate tips into standard income taxation, often with mandatory reporting and withholding, reflecting a global movement toward formalizing and taxing informal earnings to improve fiscal sustainability and worker protections.