North Carolina Retail Tax

The North Carolina Retail Tax, also known as the Sales and Use Tax, is a crucial aspect of the state's tax system. This tax is an essential revenue generator for the state, contributing significantly to funding various public services and infrastructure. In this comprehensive article, we will delve deep into the intricacies of the North Carolina Retail Tax, exploring its history, rates, exemptions, and its impact on businesses and consumers alike. As an expert in the field, I will provide an in-depth analysis, shedding light on the nuances of this tax system and its implications.

A Historical Perspective on North Carolina’s Retail Tax

To understand the current state of the North Carolina Retail Tax, we must first delve into its historical context. The Sales and Use Tax has a rich history, dating back to the early 20th century. The tax was initially introduced as a means to generate revenue during a period of economic hardship, with the first sales tax legislation enacted in 1933. Over the years, the tax system has evolved, adapting to changing economic landscapes and the needs of the state.

One significant milestone in the history of North Carolina's Retail Tax was the introduction of the Uniform Sales Tax Act in 1935. This act standardized the sales tax rate across the state, simplifying the tax system and making it more transparent for businesses and consumers. The act also established a statewide sales tax rate, which was initially set at 3%, and it marked a significant step towards a unified tax structure.

Since then, the Retail Tax has undergone numerous amendments and revisions. The General Assembly has played a pivotal role in shaping the tax system, introducing new tax laws and making adjustments to rates and exemptions. One notable amendment was the Local Option Sales Tax, which allowed counties to impose an additional sales tax to fund specific projects or initiatives. This amendment, passed in 1975, provided counties with greater financial autonomy while ensuring a balanced approach to taxation.

Understanding the Current Retail Tax Structure

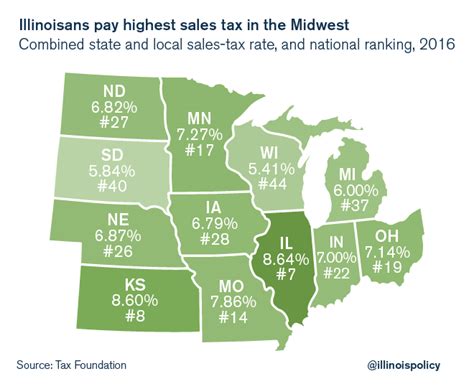

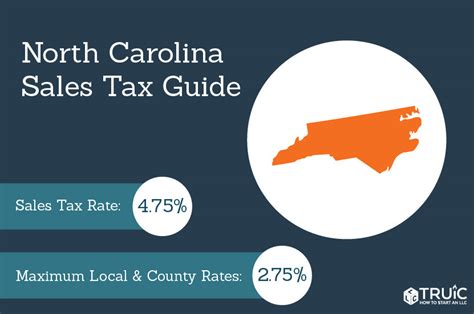

As of [Current Year], the North Carolina Retail Tax operates on a statewide sales tax rate of 4.75%, which is applicable to most tangible personal property and certain services. However, it’s important to note that this is not the only tax rate that businesses and consumers need to consider. The state’s tax system is intricate, and various local sales taxes and special taxes can be imposed, adding complexity to the overall tax structure.

For instance, county sales taxes range from 0% to 2.5%, with some counties opting for higher rates to fund specific projects. Additionally, municipal sales taxes can be levied on top of the state and county taxes, resulting in a combined tax rate that can vary significantly across the state. These local taxes are often used to support local governments and fund essential services such as education, infrastructure, and public safety.

Moreover, North Carolina has implemented a use tax to ensure fairness and compliance. The use tax applies to goods and services purchased outside the state but used or consumed within North Carolina. This tax is intended to prevent tax evasion and ensure that all consumers contribute to the state's revenue, regardless of where they make their purchases.

Exemptions and Special Considerations

While the Retail Tax applies to a wide range of goods and services, North Carolina has implemented various exemptions and special considerations to accommodate different sectors and situations. These exemptions aim to promote economic growth, support specific industries, and provide relief to certain groups of consumers.

One notable exemption is the groceries exemption, which means that essential food items are not subject to sales tax. This exemption recognizes the importance of food security and aims to alleviate the tax burden on households, especially those with lower incomes. Other exemptions include medicines, prescription drugs, and certain medical devices, ensuring that healthcare-related purchases are tax-free.

Additionally, North Carolina offers tax incentives and credits to encourage economic development and job creation. These incentives are often targeted towards specific industries, such as manufacturing, renewable energy, and technology sectors. By providing tax relief, the state aims to attract investments and foster a business-friendly environment.

| Tax Category | Tax Rate |

|---|---|

| State Sales Tax | 4.75% |

| Average County Sales Tax | 1.5% |

| Municipal Sales Tax (Varies) | Up to 2.5% |

| Use Tax | 4.75% |

The Impact on Businesses and Consumers

The North Carolina Retail Tax has a significant impact on both businesses and consumers. For businesses, especially small and medium-sized enterprises (SMEs), the tax system can present both challenges and opportunities. On one hand, the tax structure can add complexity to their operations, requiring careful tax planning and compliance. On the other hand, the tax incentives and exemptions can provide a competitive edge, attracting new businesses and fostering growth.

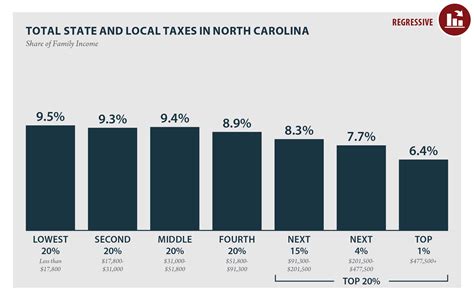

Consumers, too, feel the effects of the Retail Tax. The tax adds to the cost of goods and services, impacting their purchasing power and budget planning. However, the exemptions and special considerations can provide relief, especially for essential items like groceries and healthcare. Moreover, the tax revenue generated contributes to the overall well-being of the state, funding public services and infrastructure that benefit all residents.

Compliance and Enforcement

Ensuring compliance with the Retail Tax is a critical aspect of the state’s tax system. The North Carolina Department of Revenue plays a pivotal role in enforcing tax laws and regulations. They provide guidance and resources to help businesses understand their tax obligations and offer support to taxpayers in navigating the complex tax landscape.

The Department of Revenue employs various compliance measures to ensure that businesses and consumers adhere to the tax laws. These measures include audits, inspections, and penalty assessments for non-compliance. The department also works closely with businesses to resolve tax disputes and provide clarity on tax-related matters.

Future Implications and Potential Changes

As the economic landscape continues to evolve, the North Carolina Retail Tax may undergo further adjustments and reforms. The state’s General Assembly and tax authorities regularly review the tax system, considering factors such as economic growth, inflation, and changing consumer trends. These reviews can lead to modifications in tax rates, exemptions, and the overall tax structure.

One potential future implication is the streamlining of the tax system. With the increasing complexity of the tax landscape, there have been discussions about simplifying the tax structure to make it more accessible and understandable for businesses and consumers. This could involve consolidating various local taxes or standardizing exemptions to create a more uniform tax environment.

Additionally, the rise of e-commerce and online sales has presented new challenges for tax authorities. Ensuring that online retailers comply with the Retail Tax and collect the appropriate taxes can be a complex task. As a result, there may be a focus on enhancing tax enforcement mechanisms and adapting the tax system to accommodate the digital economy.

Staying Informed and Adapting to Changes

For businesses operating in North Carolina, staying informed about tax changes is crucial. The tax landscape can evolve rapidly, and being aware of new regulations and exemptions can provide a competitive advantage. By staying up-to-date, businesses can ensure compliance, optimize their tax strategies, and take advantage of any tax incentives or credits that become available.

Furthermore, consumers should also be mindful of tax changes, as they can impact their purchasing decisions and budget planning. Understanding the Retail Tax structure and any exemptions that apply to their purchases can help consumers make informed choices and ensure they are not overpaying taxes.

What is the current state sales tax rate in North Carolina?

+As of [Current Year], the state sales tax rate in North Carolina is 4.75%.

Are there any counties with a higher sales tax rate than the state rate?

+Yes, some counties in North Carolina have opted for a higher sales tax rate to fund specific projects. These rates can vary from 0% to 2.5%, resulting in a combined tax rate that is higher than the state rate.

Are there any exemptions or special considerations for certain purchases?

+Yes, North Carolina offers exemptions for essential items like groceries, medicines, and prescription drugs. Additionally, there are tax incentives and credits for specific industries to promote economic growth.

How does the use tax work in North Carolina?

+The use tax applies to goods and services purchased outside the state but used or consumed within North Carolina. It ensures that consumers contribute to the state's revenue, even if they make purchases from out-of-state vendors.

What resources are available for businesses and consumers to stay informed about tax changes?

+The North Carolina Department of Revenue provides extensive resources, including tax guides, publications, and online tools. Businesses and consumers can access these resources to stay updated on tax laws, rates, and any changes that may impact them.

In conclusion, the North Carolina Retail Tax is a vital component of the state’s tax system, contributing to its economic growth and development. By understanding the historical context, current tax rates, and exemptions, businesses and consumers can navigate the tax landscape effectively. As the tax system continues to evolve, staying informed and adapting to changes will be key to ensuring compliance and maximizing the benefits of the tax structure.