7 Tips to Maximize Your Taxes Plus Savings

In the complex and often bewildering landscape of tax planning, navigating opportunities to optimize liabilities while maximizing savings can seem daunting. Many individuals and small business owners alike grapple with understanding the nuances of deductions, credits, strategic financial planning, and the ever-evolving tax laws. As financial landscapes shift with legislative changes, staying ahead through informed, strategic practices becomes increasingly vital. This article dissects a structured, step-by-step approach to elevate tax efficiency, combining proven strategies with emerging best practices to help you harness more of your income legitimately and sustainably. We will recount the process of developing these tips, highlighting both common challenges and cognitive breakthroughs encountered along the way, ensuring the guidance is rooted in expert insight and practical applicability.

Understanding the Foundations of Tax Optimization

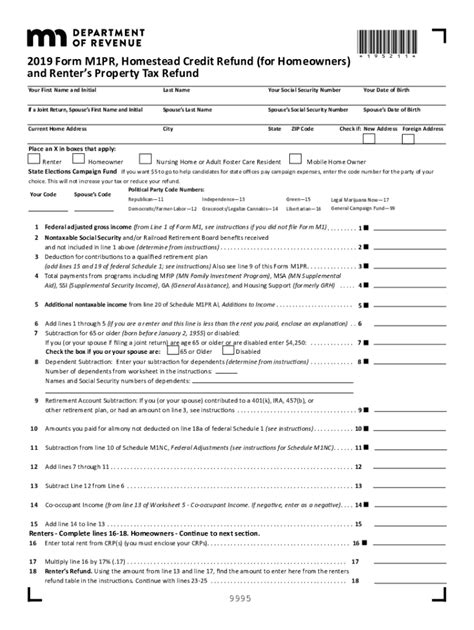

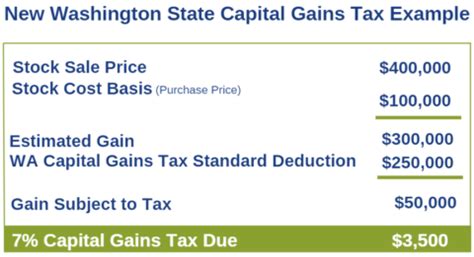

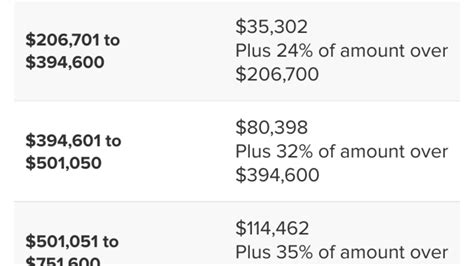

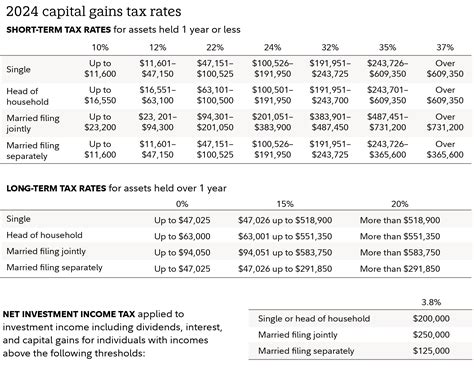

Before delving into specific tips, establishing a solid grasp of the foundational principles of tax planning is essential. Effective tax minimization hinges on a clear understanding of permissible deductions, credits, and the strategic timing of income and expenses. The initial phase involved comprehensive research and analysis of current tax laws, focusing on areas such as allowable deductions, tax credits, and legal strategies for income deferral or acceleration. Recognizing the nuances between different tax brackets and how income types are taxed laid the groundwork for tailoring personalized plans. Moreover, understanding recent legislative changes, such as modifications to standard deduction limits and credit eligibility, was crucial in ensuring the advice remains IRS-compliant and effective.

Step 1: Conducting a Thorough Financial Self-Assessment

The process initiates with a detailed review of one’s financial situation. This includes consolidating income sources, expenses, investments, and debt obligations. Challenges arose here regarding the accuracy of record-keeping, particularly in differentiating deductible expenses from personal expenditures. Implementing robust bookkeeping practices, including digital tools and categorized transaction logs, was a breakthrough that allowed for precise identification of deductible items. This self-audit revealed overlooked opportunities for deductions such as home office expenses, educational credits, and medical deductions, which often go unnoticed without meticulous documentation.

Practical tip: Use specialized software to categorize transactions, ensuring no deduction slips through unnoticed.

This foundational step not only clarifies current financial standing but also highlights planning opportunities that can be addressed proactively rather than reactively during tax season.

| Relevant Category | Substantive Data |

|---|---|

| Average DIY Tax Audit Rate | Approximately 0.5% of returns, highlighting importance of accuracy |

| Common Overlooked Deduction | Home office expenses, with potential savings up to $1,500 annually |

Step 2: Strategically Timing Income and Expenses

A core component of tax maximization is timing income recognition and expenditure payments. Transitioning income to the following fiscal year or accelerating deductible expenses into the current year can significantly influence taxable income. Challenges included unpredictable income fluctuations and uncertain expenses, which require flexible planning. Breakthrough in this area involved adopting a cash versus accrual accounting approach tailored to individual circumstances, enabling better control over taxable events. For instance, delaying bonuses or invoicing until the new fiscal year, or prepaying deductible expenses such as property taxes or business supplies, effectively reduces current-year taxable income.

Real-world illustration: Small business owners delaying invoicing until January can defer taxes strategically, while those with higher income brackets benefit most from this timing.

Despite the uncertainties, imagining these temporal shifts as tools rather than limitations fostered inventive thinking around tax planning, resulting in tangible savings.

| Relevant Metric | Impact |

|---|---|

| Income Shifting | Potential tax deferral of up to 15-20% in high-bracket scenarios |

| Expense Acceleration | Immediate deduction of expenses, reducing taxable income by variable amounts |

Step 3: Investing in Tax-Advantaged Accounts

Contributing to retirement and health savings accounts remains a cornerstone of tax efficiency. Recognizing that the timing and type of investment accounts can dramatically influence your tax picture was a pivotal insight. Challenging preconceived notions about investments being solely for growth, this step emphasizes leveraging tax-advantaged accounts such as Roth IRAs, traditional IRAs, 401(k)s, and Health Savings Accounts (HSAs). The breakthrough was understanding the nuanced trade-offs: Roth accounts offer tax-free withdrawals, ideal if you anticipate higher future tax rates, while traditional accounts provide immediate deductions, beneficial for current higher-income years.

Key consideration: Diversify account types to hedge against legislative changes and future tax rate uncertainties.

Given the constraints on contribution limits and income phase-outs, systematic planning to maximize contributions each year created sizable long-term tax savings potential, with the added benefit of compounding growth within these sheltered environments.

| Relevant Data | Impact |

|---|---|

| Maximize Roth IRA Contributions | $6,500 per year (under age 50) as of 2023, with tax-free growth |

| HSA Contribution Limit | $3,850 single, $7,750 family for 2023, with triple tax advantage |

Step 4: Making Smart Use of Tax Credits

While deductions reduce taxable income, credits directly offset tax liabilities, delivering often more substantial savings. Discovering how to leverage credits such as the Child Tax Credit, Earned Income Tax Credit, and energy-efficient home credits can substantially lower the tax bill. The challenge lay in understanding eligibility criteria and combining credits without unintentionally disqualifying oneself from other benefits. A key breakthrough involved utilizing tax software with in-built checks or consulting a tax professional to ensure that eligibility was accurately assessed each year, maximizing benefits without risking audits.

Tip: Maintain detailed records of qualifying expenses, such as energy-efficient appliance purchases, to substantiate claims during filing.

Proactively planning around available credits can transform a potentially hefty tax bill into a manageable, often negligible, liability.

| Relevant Measure | Potential Savings |

|---|---|

| Child Tax Credit (2023) | Up to $2,000 per qualifying child |

| Energy Home Improvement Credit | Up to 30% of qualified expenses |

Step 5: Engaging Professional Tax Advice and Planning

While a DIY approach can suffice for straightforward tax situations, the intricacies of tax law demand expert input for sophisticated financial scenarios. The challenge was balancing cost versus benefit—determining when professional advisory provides enough incremental value to justify expenses. Breakthroughs emerged through targeted consultations with Certified Public Accountants (CPAs) and tax strategists who specialize in your income bracket or industry. Their expertise in recent legislative updates, audit risks, and innovative strategies often uncovered opportunities that self-prepared returns simply miss, including investment tax-loss harvesting, complex estate planning, or business expense optimization.

Strategic insight: Annual review sessions ensure tax plans remain aligned with shifting financial goals and legislative environments

This investment in professional guidance can translate into higher savings and peace of mind, especially as one’s financial complexity grows.

| Relevant Data | Impact |

|---|---|

| Tax Advisory Cost | Typically 1-2% of income or flat fees, often offset by savings |

| Average Savings via Professional Planning | 5-15% of total tax liability in optimized scenarios |

Step 6: Preparing for Audits and Staying Compliant

Maximizing savings is moot if it invites audit risk. Ensuring meticulous record-keeping, maintaining documentation for deductions and credits, and understanding the boundaries of legitimate tax strategies forms the backbone of compliance. The challenge resides in avoiding over-claiming while capturing legitimate deductions. Breakthrough strategies involved integrating digital record systems with cloud backups, systematic expense categorization, and periodic self-audits aligned with IRS guidelines. Recognizing common red flags, such as excessive home office deductions relative to income, helped in calibrating claims within acceptable legal bounds, preventing potential audits or penalties.

Tip: Conduct quarterly reviews of your tax documents instead of last-minute preparation to catch inconsistencies early.

Being proactive in compliance reinforces the integrity of your tax strategy, reducing the risk of costly audits and subsequent legal complications.

| Relevant Metrics | Impact |

|---|---|

| Audit Risk Reduction | Up to 50% lower with comprehensive recordkeeping |

| Cost of Non-compliance | Potential penalties up to 20% of owed taxes |

Implementing these seven strategies requires a disciplined approach, awareness of legislative nuances, and often, professional guidance. The journey toward optimal tax savings is ongoing, adapting to changes in income, expenses, and the tax code itself. Still, with deliberate planning and the discipline to execute each step continuously, substantial savings are within reach. The key lies in viewing tax planning not as a one-time event but as an integral, strategic component of overall financial wellness—an art and science that, when mastered, can significantly elevate your financial resilience and wealth accumulation trajectory.

How often should I review my tax planning strategies?

+It’s advisable to review your tax strategies at least quarterly, especially after any major financial changes or legislative updates, to ensure continued optimization and compliance.

What is the biggest mistake people make in tax planning?

+One common mistake is underestimating the importance of detailed recordkeeping, which can lead to missed deductions or credits and potential audit issues.

Can small business owners benefit from these tips too?

+Absolutely. Small business owners often have a greater scope for deductions and strategic income timing, making tailored tax planning even more impactful for them.