Orange County Property Tax Lookup

Welcome to our comprehensive guide on the Orange County Property Tax Lookup, a crucial tool for homeowners, investors, and anyone interested in the real estate market in Orange County, California. In this article, we will delve deep into the world of property taxes, providing you with an expert analysis and valuable insights. From understanding the assessment process to exploring tax rates and exploring online resources, we aim to equip you with the knowledge to navigate the Orange County property tax landscape effectively.

Unraveling the Orange County Property Tax System

Property taxes are an essential component of local government revenue in the United States, and Orange County is no exception. These taxes contribute to the funding of vital services such as education, infrastructure development, and public safety. As a property owner in Orange County, it’s important to have a clear understanding of how property taxes are assessed and calculated.

The Assessment Process: A Step-by-Step Guide

The property tax assessment process in Orange County is a meticulous endeavor carried out by the Orange County Assessor’s Office. Here’s a breakdown of the key steps involved:

- Data Collection: The Assessor’s Office gathers information about every property in the county, including physical characteristics, ownership details, and recent sales data.

- Property Valuation: Assessors use various methods, such as the cost approach, income approach, and market comparison approach, to determine the fair market value of each property.

- Tax Base Calculation: Once the assessed value is established, it is multiplied by the applicable tax rate to calculate the tax base for each property.

- Tax Rate Determination: The tax rate is set by the county and is influenced by the budget needs of local governments and special districts.

- Notice of Assessment: Property owners receive a Notice of Assessment, detailing the assessed value of their property and the corresponding tax amount.

- Appeal Process: If a property owner believes their assessed value is inaccurate, they have the right to appeal the assessment through a formal process.

Understanding this assessment process is crucial for property owners, as it forms the foundation for their tax obligations.

Exploring Orange County’s Tax Rates

Tax rates in Orange County can vary depending on the location and type of property. The county is divided into various tax rates areas, each with its own unique tax rate. These rates are typically expressed as a percentage of the assessed value. For instance, in Area 1, the tax rate might be 0.75%, while in Area 2, it could be 0.80%.

| Tax Rate Area | Tax Rate |

|---|---|

| Area 1 | 0.75% |

| Area 2 | 0.80% |

| Area 3 | 0.78% |

| ... | ... |

It's important to note that these tax rates are subject to change annually, and property owners should refer to the latest information provided by the Orange County Assessor's Office for accurate rates.

The Impact of Proposition 13

California’s Proposition 13, passed in 1978, revolutionized property taxation in the state. This landmark legislation limits the annual increase in assessed value to 2% or the inflation rate, whichever is lower. As a result, many property owners in Orange County have enjoyed relatively stable tax bills over the years.

Online Resources: Navigating the Property Tax Landscape

In today’s digital age, the Orange County Assessor’s Office provides a wealth of online resources to assist property owners in understanding and managing their tax obligations. These resources offer convenience, transparency, and accessibility, empowering homeowners to take control of their financial responsibilities.

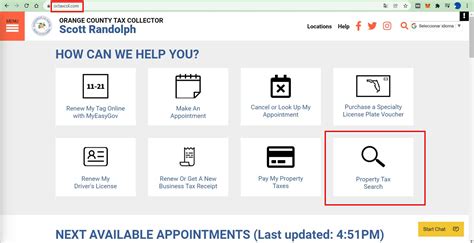

The Orange County Property Tax Lookup Tool

The Orange County Property Tax Lookup Tool is a powerful online resource that allows property owners and interested parties to access a wealth of information about any property in the county. Here’s a glimpse of what this tool offers:

- Property Details: Retrieve comprehensive details about a property, including its address, ownership information, assessed value, and tax history.

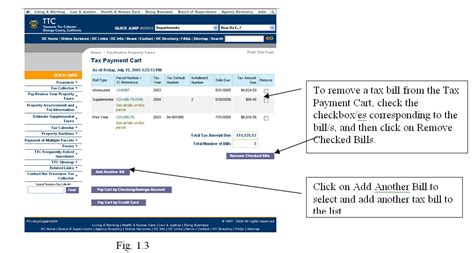

- Tax Bill Information: View the current and previous tax bills, including the due dates, payment amounts, and payment status.

- Assessment History: Explore the assessment history of a property, showing how its value has changed over time.

- Tax Rate Details: Access the specific tax rate applicable to a property, along with any special assessments or exemptions.

- Online Payment: Make tax payments conveniently online, ensuring timely and secure transactions.

By utilizing this tool, property owners can stay informed about their tax obligations, track their payment history, and ensure compliance with local regulations.

Exploring Other Online Resources

In addition to the Property Tax Lookup Tool, Orange County offers several other online resources to assist property owners:

- Assessor’s Office Website: The official website of the Orange County Assessor’s Office provides valuable information, including tax rate schedules, assessment guidelines, and frequently asked questions.

- Property Tax Exemption Programs: Explore the various tax exemption programs available to eligible property owners, such as the Homeowners’ Exemption, Disabled Veterans’ Exemption, and Senior Citizen’s Exemption.

- Online Appeals Process: For property owners wishing to appeal their assessed value, the Assessor’s Office offers an online appeals process, streamlining the submission and tracking of appeals.

- Property Tax News and Updates: Stay informed about the latest news, announcements, and changes in property tax regulations through the Assessor’s Office website and newsletter.

Expert Insights: Navigating the Complexities

Navigating the world of property taxes can be complex, especially for those new to the process or dealing with unique circumstances. Here are some expert insights to help you navigate the complexities of Orange County’s property tax landscape:

Understanding Taxable Value

In Orange County, the taxable value of a property is determined by its assessed value, which is subject to Proposition 13’s limitations. However, it’s important to note that the assessed value may not always reflect the market value of the property. Factors such as recent improvements, changes in the neighborhood, or market fluctuations can impact the property’s true value.

Exemptions and Deductions

Orange County offers a range of tax exemptions and deductions to eligible property owners. These include the aforementioned Homeowners’ Exemption, which reduces the assessed value of a primary residence, as well as exemptions for disabled veterans and senior citizens. Understanding these exemptions and ensuring eligibility can lead to significant tax savings.

Appealing Your Assessment

If you believe your property’s assessed value is inaccurate, you have the right to appeal. The appeal process in Orange County is rigorous and requires thorough preparation. It’s advisable to gather supporting evidence, such as recent sales data of comparable properties, to strengthen your case. Working with a professional tax consultant or attorney can be beneficial in navigating the complexities of the appeal process.

Stay Informed, Stay Compliant

The world of property taxes is constantly evolving, with new regulations, exemptions, and initiatives being introduced. It’s crucial to stay informed about these changes to ensure compliance and take advantage of any opportunities that may arise. Regularly check the Assessor’s Office website, subscribe to their newsletter, and attend community meetings or workshops to stay updated on the latest developments.

Future Implications and Trends

As Orange County continues to grow and evolve, the property tax landscape is likely to experience changes and shifts. Here are some potential future implications and trends to keep an eye on:

Impact of Housing Market Fluctuations

The real estate market in Orange County, like any other market, is subject to fluctuations. Economic downturns or housing bubbles can impact property values, which, in turn, affect tax assessments. Property owners should be prepared for potential changes in their tax obligations during these market shifts.

Proposition 13 Reforms

While Proposition 13 has provided stability to property tax assessments for decades, there have been ongoing discussions about potential reforms. Proposals to modify or repeal certain aspects of Proposition 13 have gained traction, which could lead to significant changes in the way property taxes are assessed and calculated in Orange County.

Advancements in Technology

The digital transformation of the property tax industry is ongoing, and Orange County is no exception. As technology advances, we can expect to see further enhancements to online resources and tools. This could include improved data visualization, enhanced search capabilities, and more efficient payment processes.

Community Engagement and Outreach

The Orange County Assessor’s Office has a strong focus on community engagement and outreach. They actively work to educate property owners about their rights and responsibilities, as well as provide assistance to those facing financial difficulties. This commitment to community engagement is likely to continue and may lead to new initiatives and programs in the future.

Conclusion: Empowering Property Owners

Understanding the Orange County Property Tax Lookup process is an essential step toward becoming a responsible and informed property owner. By utilizing the resources provided by the Orange County Assessor’s Office, property owners can take control of their tax obligations, ensure compliance, and explore opportunities for tax savings. With the right knowledge and tools, navigating the complex world of property taxes becomes a manageable task.

How often are property taxes assessed in Orange County?

+Property taxes in Orange County are assessed annually. The assessment process takes into account various factors, including market trends and property improvements, to determine the taxable value of each property.

Can I pay my property taxes online?

+Yes, Orange County offers an online payment portal for property taxes. Property owners can conveniently make payments through the Assessor’s Office website, ensuring a secure and timely transaction.

What happens if I miss the property tax payment deadline?

+Missing the property tax payment deadline can result in penalties and interest charges. It’s important to stay informed about the payment due dates and make timely payments to avoid additional fees.

How can I appeal my property’s assessed value?

+To appeal your property’s assessed value, you need to submit an appeal application to the Orange County Assessor’s Office. It’s advisable to gather supporting evidence and consult with a professional tax advisor or attorney for guidance.

Are there any tax exemptions available for senior citizens in Orange County?

+Yes, Orange County offers the Senior Citizen’s Exemption, which provides a reduction in the assessed value of a property for eligible senior citizens. To qualify, certain age and income requirements must be met.