Placer County Tax Collector

The Placer County Tax Collector's Office is an essential government entity responsible for collecting various taxes and fees within Placer County, California. With a focus on efficiency, transparency, and customer service, the office plays a vital role in ensuring the smooth operation of local government and the provision of public services. This article delves into the functions, services, and impact of the Placer County Tax Collector, shedding light on its operations and the significance it holds for the community.

A Vital Role in Local Governance

The Placer County Tax Collector’s Office is an integral part of the county’s administrative framework, entrusted with the crucial task of collecting taxes and fees that fund a wide range of public services and infrastructure. From maintaining roads and parks to supporting schools and emergency services, the revenue generated by the tax collector’s office is the lifeblood of the local government’s operations.

At the helm of this operation is the Placer County Tax Collector, a dedicated professional who oversees the efficient and effective collection of taxes and fees. This individual, appointed or elected based on the county's governance structure, ensures the tax collection process is fair, transparent, and in compliance with state and local laws.

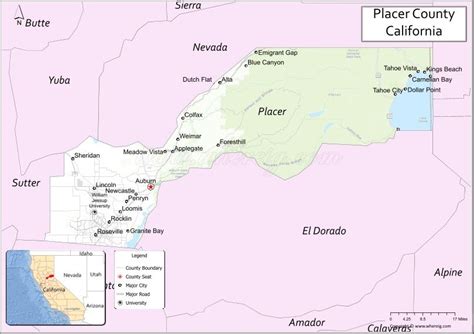

The office's reach extends across the county, encompassing all municipalities and unincorporated areas. This means that regardless of where one lives or conducts business within Placer County, the tax collector's office plays a role in their financial obligations and the services they receive.

Taxes and Fees under the Placer County Tax Collector’s Purview

The Placer County Tax Collector’s Office handles a diverse range of taxes and fees, each playing a unique role in funding specific aspects of local government operations. These include:

- Property Taxes: One of the primary revenue sources for local governments, property taxes are levied on real estate within the county. The tax collector's office assesses property values, calculates tax liabilities, and collects these taxes to support local services and infrastructure.

- Vehicle Registration Fees: When registering a vehicle in Placer County, residents pay fees that go towards maintaining roads, bridges, and other transportation infrastructure. The tax collector's office ensures these fees are correctly assessed and collected.

- Business Taxes: Businesses operating within the county are subject to various taxes and fees, including business license fees, sales taxes, and other industry-specific levies. These funds contribute to local economic development initiatives and support the county's business community.

- Special Assessments: In certain cases, the tax collector's office may collect special assessments to fund specific projects or services that benefit a particular community or group of residents. These assessments could be for infrastructure improvements, maintenance of common areas, or other community-based initiatives.

- Utility Fees: Some utility services, such as water or waste management, may have associated fees that are collected by the tax collector's office. These fees help maintain and improve the county's utility infrastructure and ensure the continuity of these essential services.

Services Offered by the Placer County Tax Collector’s Office

In addition to collecting taxes and fees, the Placer County Tax Collector’s Office provides a range of services to assist residents, businesses, and property owners in fulfilling their financial obligations and navigating the tax system. These services include:

Online Payment Portal

The tax collector’s office offers a secure online platform where taxpayers can conveniently make payments for various taxes and fees. This portal provides real-time transaction updates, allows for scheduled payments, and offers a history of past payments, making it easier for taxpayers to manage their financial obligations.

Payment Plan Options

Recognizing that financial circumstances can vary, the tax collector’s office provides payment plan options for taxpayers who may struggle to pay their taxes or fees in full. These plans allow taxpayers to spread out their payments over time, ensuring they can meet their obligations without undue financial burden.

Tax Information and Assistance

The office provides comprehensive information on tax rates, due dates, and payment methods. This includes online resources, printed materials, and dedicated staff who are available to answer questions and provide guidance on tax-related matters. This assistance ensures that taxpayers understand their obligations and can navigate the tax system effectively.

Property Tax Assessments

For property owners, the tax collector’s office conducts assessments to determine the value of their properties. These assessments are crucial for calculating property tax liabilities and ensuring that the tax burden is distributed fairly among property owners within the county.

Vehicle Registration Renewal

The office facilitates the renewal of vehicle registrations, a process that is essential for maintaining legal vehicle operation within the county. This service includes sending out renewal notices, processing payments, and ensuring that vehicle owners comply with registration requirements.

Business Tax Support

Businesses within the county can access support and guidance from the tax collector’s office on various business taxes and fees. This includes assistance with registering for business licenses, understanding tax obligations, and ensuring compliance with tax regulations.

Community Outreach and Education

The tax collector’s office actively engages with the community through outreach programs and educational initiatives. These efforts aim to increase tax awareness, promote financial literacy, and ensure that residents understand their tax obligations and the importance of tax revenue for local services.

The Impact of the Placer County Tax Collector’s Office

The Placer County Tax Collector’s Office has a profound impact on the community it serves, shaping the local economy, infrastructure, and quality of life. Here are some key ways in which the office’s work influences the county:

Funding Essential Services

The tax collector’s office plays a pivotal role in funding critical public services such as education, public safety, healthcare, and social services. Through the collection of taxes and fees, the office ensures that these services are adequately funded, allowing the county to provide for the needs of its residents.

Economic Development

Tax revenue collected by the office is a significant driver of economic development within the county. It supports initiatives such as infrastructure projects, business incentives, and community development programs, all of which contribute to a thriving local economy.

Infrastructure Maintenance

Taxes collected by the office are essential for maintaining and improving the county’s infrastructure. This includes roads, bridges, public buildings, parks, and other public spaces, ensuring that residents have access to well-maintained facilities and a high quality of life.

Community Support and Initiatives

The tax collector’s office often collaborates with community organizations and local charities, providing financial support for various initiatives. This could range from funding for youth programs and senior services to supporting environmental projects and cultural events, enriching the community’s social fabric.

Transparency and Accountability

By providing transparent and accessible tax information, the Placer County Tax Collector’s Office promotes accountability in local government. Taxpayers can see how their contributions are being used, fostering trust in the local administration and encouraging responsible financial management.

Future Initiatives and Challenges

Looking ahead, the Placer County Tax Collector’s Office faces both opportunities and challenges. With advancements in technology, the office can further enhance its services, offering more efficient and convenient options for taxpayers. However, keeping pace with technological advancements and ensuring cybersecurity measures are a constant challenge.

Additionally, changing economic conditions and demographic shifts within the county may impact tax revenue and the services the office can provide. Adapting to these changes and ensuring that the tax collection process remains fair and efficient will be a key focus for the future.

Conclusion

The Placer County Tax Collector’s Office is a cornerstone of local governance, playing a vital role in funding public services, maintaining infrastructure, and supporting community initiatives. Through its efficient tax collection processes and comprehensive range of services, the office ensures that the county’s residents and businesses can meet their financial obligations while contributing to the growth and well-being of the community.

As Placer County continues to thrive and evolve, the tax collector's office will remain a critical component, adapting to new challenges and opportunities to ensure the county's financial health and the prosperity of its residents.

How can I pay my taxes or fees to the Placer County Tax Collector’s Office?

+The Placer County Tax Collector’s Office offers several payment options, including an online payment portal, in-person payments at the office, and mail-in payments. You can also set up a payment plan if needed.

What happens if I don’t pay my taxes on time?

+Late payments may result in penalties and interest charges. It’s important to stay up-to-date with your tax obligations to avoid additional fees and potential legal consequences.

How can I dispute a tax assessment or fee?

+If you believe there is an error in your tax assessment or fee, you can contact the Placer County Tax Collector’s Office to discuss your concerns. They will guide you through the dispute process, which typically involves providing supporting documentation.

Are there any tax relief programs available for seniors or low-income residents?

+Yes, Placer County offers various tax relief programs for eligible seniors and low-income residents. These programs can provide reduced property tax assessments or exemptions. Contact the tax collector’s office or visit their website for more information on eligibility and application processes.

How can I stay informed about tax rates and changes in Placer County?

+The Placer County Tax Collector’s Office provides regular updates on tax rates and any changes through their website and social media platforms. You can also sign up for their newsletter to receive direct notifications.