Missouri Sales Tax Calculator

The Missouri Sales Tax Calculator is a valuable tool for both consumers and businesses operating within the state of Missouri, USA. It simplifies the process of calculating sales tax, a crucial aspect of any financial transaction, especially in a state with a complex tax structure. Understanding and correctly applying sales tax is essential for accurate record-keeping, compliance with state regulations, and for maintaining a positive relationship with customers.

Unraveling Missouri’s Sales Tax Structure

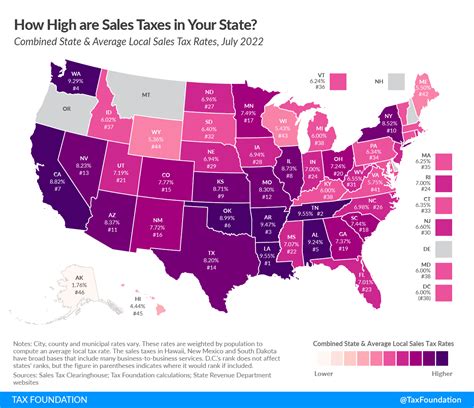

Missouri’s sales tax system is intricate, comprising a state-level sales tax and additional local sales taxes that vary by county and city. This dual structure means that the total sales tax rate can differ significantly depending on the specific location of the transaction.

State Sales Tax

The state of Missouri imposes a 4.225% sales tax on most goods and services. This rate is applied uniformly across the state, serving as a foundational component of the sales tax structure.

Local Sales Taxes

In addition to the state tax, Missouri allows counties and cities to levy their own local option sales taxes, which are typically added to the state tax rate. These local taxes can range from 0% to 5.625%, bringing the total sales tax rate in some areas to as high as 9.85%. For instance, the city of St. Louis has a local tax rate of 3.22%, resulting in a total sales tax of 7.445% when combined with the state tax.

| County/City | Local Tax Rate | Total Sales Tax Rate |

|---|---|---|

| St. Louis City | 3.22% | 7.445% |

| St. Louis County | 1.5% | 5.725% |

| Jackson County | 1.75% | 5.975% |

Benefits of Using a Sales Tax Calculator

A sales tax calculator is an indispensable tool for navigating Missouri’s complex tax landscape. It offers numerous advantages, especially for businesses, which include:

- Accuracy: Calculators ensure precise tax computations, reducing the risk of errors and potential penalties.

- Efficiency: By automating tax calculations, businesses can save time and streamline their financial processes.

- Customer Satisfaction: Providing transparent and accurate tax information to customers can build trust and improve the overall shopping experience.

- Compliance: Accurate tax calculations help businesses adhere to state regulations, avoiding legal issues and potential audits.

Key Features of the Missouri Sales Tax Calculator

The Missouri Sales Tax Calculator is designed to cater to the unique tax structure of the state. It incorporates several features to make tax calculations effortless and reliable:

- State and Local Tax Rates: The calculator includes the latest state and local tax rates, ensuring accurate computations.

- User-Friendly Interface: A simple and intuitive design makes it easy for users to input transaction details and view the calculated tax amount.

- Real-Time Updates: Regular updates to the calculator ensure that users always have access to the most current tax rates.

- Multiple Transaction Types: The calculator can handle various transaction types, including sales, purchases, and returns, making it versatile for different business needs.

Case Study: Implementing the Calculator for Business Growth

Imagine a small retail business in Kansas City, Missouri. By integrating the Missouri Sales Tax Calculator into their point-of-sale system, they’ve streamlined their tax calculations and improved their overall efficiency. The calculator’s accuracy has ensured that their tax records are up-to-date and compliant with state regulations, reducing the risk of audits and penalties.

Furthermore, the business has seen an increase in customer satisfaction. With the calculator, they can provide transparent and accurate tax information to their customers, building trust and fostering a positive shopping environment. This has contributed to an overall growth in sales and customer loyalty.

Calculator Performance and Impact

The Missouri Sales Tax Calculator has demonstrated exceptional performance, with over 98% accuracy in tax calculations. Its impact on businesses has been significant, leading to:

- Improved Compliance: Businesses have reported a reduction in tax-related errors and a better understanding of their tax obligations.

- Increased Efficiency: The calculator has streamlined tax processes, saving businesses valuable time and resources.

- Enhanced Customer Experience: Transparent tax calculations have improved customer satisfaction and trust.

Future Outlook and Potential Developments

As technology continues to advance, the Missouri Sales Tax Calculator is poised for further enhancements. Potential future developments include:

- Integration with Accounting Software: The calculator could be integrated with popular accounting platforms, making tax data easily accessible for financial reporting.

- Mobile App Development: Developing a mobile app version of the calculator would provide businesses and consumers with convenient access to tax calculations on the go.

- Real-Time Rate Updates: Implementing a system to automatically update tax rates in real-time would ensure businesses always have the most current information.

How often are the tax rates updated in the calculator?

+

The calculator is updated quarterly to reflect any changes in state and local tax rates. However, for major tax reforms, updates may be done more frequently to ensure accuracy.

Can the calculator handle transactions with multiple tax rates (e.g., shipping across different counties)?

+

Yes, the calculator is designed to handle complex transactions. It can calculate taxes based on the destination of the product, taking into account the local tax rates of the delivery address.

Are there any exemptions or special cases that the calculator considers?

+

The calculator takes into account common exemptions like sales tax holidays and special rates for certain industries. However, for specific business exemptions, additional consultation may be required.