Nc Vehicle Property Tax Lookup

Welcome to this comprehensive guide on the North Carolina vehicle property tax system. Understanding vehicle property taxes is essential for vehicle owners in North Carolina, as it ensures compliance with state regulations and provides valuable insights into tax obligations. This article aims to provide an in-depth analysis of the NC vehicle property tax process, offering practical tips and expert insights to navigate this crucial aspect of vehicle ownership.

Understanding NC Vehicle Property Tax

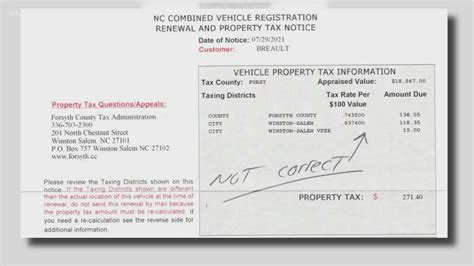

In North Carolina, vehicle property taxes are an annual obligation for vehicle owners. These taxes are based on the value of the vehicle and are used to support various state and local government initiatives. The ad valorem tax system is employed, where the tax amount is directly proportional to the assessed value of the vehicle.

The North Carolina Department of Motor Vehicles (NCDMV) plays a vital role in this process. It is responsible for assessing vehicle values, collecting taxes, and ensuring compliance with state regulations. The NCDMV provides an online platform for taxpayers to calculate and pay their vehicle property taxes, offering convenience and transparency.

Tax Assessment and Valuation

The valuation process is a critical aspect of vehicle property taxes. The NCDMV assesses the value of vehicles using a combination of factors, including the vehicle’s make, model, year, and condition. This assessment is crucial as it determines the tax rate and the overall tax liability for vehicle owners.

North Carolina utilizes a declining balance method for vehicle valuation. This means that the value of the vehicle decreases over time, reflecting its depreciation. The NCDMV employs a schedule that outlines the depreciation rates for different vehicle types, ensuring fairness and consistency in the valuation process.

| Vehicle Type | Depreciation Rate |

|---|---|

| Passenger Vehicles | 3% per year after the first year |

| Motorcycles | 5% per year after the first year |

| Trucks and Trailers | 5% per year after the first year |

Tax Rate and Calculation

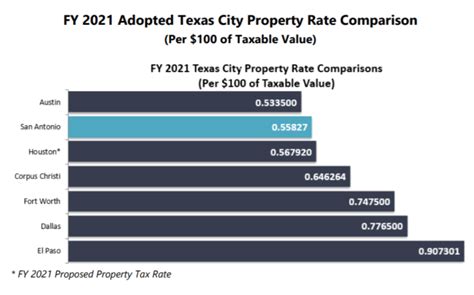

The tax rate for vehicle property taxes in North Carolina varies based on the location of the vehicle’s registration. Each county sets its own tax rate, which can be found on the NCDMV website. The tax rate is applied to the assessed value of the vehicle, resulting in the tax liability for the owner.

For instance, consider a scenario where a passenger vehicle with an assessed value of $20,000 is registered in Durham County. If the tax rate in Durham County is 0.5%, the tax liability would be calculated as follows:

Tax Liability = Assessed Value x Tax Rate

Tax Liability = $20,000 x 0.005 = $100

Thus, the owner of this vehicle would owe $100 in vehicle property taxes for the year.

Payment Options and Due Dates

North Carolina offers several convenient payment options for vehicle property taxes. Taxpayers can pay online through the NCDMV website, by mail, or in person at a local tax office. The due date for vehicle property taxes aligns with the vehicle’s registration renewal date.

It is important for vehicle owners to be aware of the due dates to avoid late fees and penalties. The NCDMV provides a clear calendar of due dates, ensuring transparency and timely payments. Failure to pay vehicle property taxes can result in penalties, interest, and even the suspension of vehicle registration.

Vehicle Property Tax Lookup: A Step-by-Step Guide

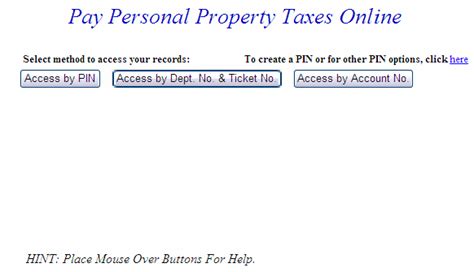

Conducting a vehicle property tax lookup is a straightforward process, thanks to the NCDMV’s online platform. This section will guide you through the steps to easily find your vehicle’s property tax information.

Step 1: Access the NCDMV Website

Start by visiting the official North Carolina Department of Motor Vehicles website. This is the primary source of information and services related to vehicle registration and taxes. The website provides a user-friendly interface, making it easy to navigate and find the necessary tools.

Step 2: Locate the Property Tax Lookup Tool

On the NCDMV website, you will find a dedicated section for property tax information. Look for a link or button labeled “Property Tax Lookup” or “Vehicle Tax Assessment.” This tool is designed to provide instant access to your vehicle’s tax details.

Step 3: Enter Your Vehicle Information

Once you’ve located the property tax lookup tool, you’ll be prompted to enter specific details about your vehicle. This typically includes the vehicle’s make, model, year, and VIN (Vehicle Identification Number). Providing accurate information is crucial to retrieve precise tax data.

Step 4: View Your Vehicle’s Property Tax Details

After submitting the required information, the NCDMV’s system will process your request. Within a few seconds, you should see a detailed breakdown of your vehicle’s property tax information. This includes the assessed value, the applicable tax rate, and the total tax liability for the current year.

The lookup tool may also provide additional information, such as due dates, payment options, and any applicable discounts or exemptions. This comprehensive overview ensures that you have all the necessary details to manage your vehicle property taxes effectively.

Vehicle Property Tax Exemptions and Discounts

North Carolina offers various exemptions and discounts for vehicle property taxes, providing relief to certain categories of vehicle owners. These exemptions and discounts are designed to support specific groups and promote certain behaviors.

Senior Citizen Exemption

North Carolina provides an exemption for senior citizens who meet certain criteria. To qualify for this exemption, the vehicle owner must be at least 65 years old and have an annual income below a specific threshold. The exemption reduces the taxable value of the vehicle, resulting in lower property taxes.

Veteran Discount

As a way to honor and support veterans, North Carolina offers a discount on vehicle property taxes. Eligible veterans can receive a reduction in their tax liability, based on their military service. The discount is applied to the assessed value of the vehicle, providing financial relief to those who have served our country.

Hybrid and Electric Vehicle Incentives

To encourage the adoption of environmentally friendly vehicles, North Carolina provides incentives for hybrid and electric vehicles. Owners of these vehicles may be eligible for a reduced tax rate or a tax credit. This initiative promotes the use of cleaner transportation options and reduces the state’s carbon footprint.

The Impact of Vehicle Property Taxes on North Carolina’s Economy

Vehicle property taxes play a significant role in North Carolina’s economy, contributing to various state and local initiatives. The revenue generated from these taxes is allocated to support critical areas such as education, infrastructure development, and public safety.

Education Funding

A portion of the vehicle property tax revenue is directed towards funding public education. This ensures that schools across the state receive the necessary resources to provide quality education to students. The tax revenue helps cover teacher salaries, infrastructure improvements, and educational programs.

Infrastructure Development

Vehicle property taxes also contribute to the development and maintenance of North Carolina’s infrastructure. This includes roads, bridges, and public transportation systems. The revenue generated helps fund construction projects, repairs, and improvements, ensuring safe and efficient transportation networks.

Public Safety Initiatives

A significant portion of vehicle property tax revenue is allocated to public safety initiatives. This includes funding for law enforcement agencies, emergency response teams, and community safety programs. By investing in public safety, North Carolina aims to create a secure and thriving community.

Conclusion: Navigating NC Vehicle Property Taxes

Understanding and managing vehicle property taxes is an essential aspect of vehicle ownership in North Carolina. By familiarizing yourself with the assessment process, tax rates, and payment options, you can ensure compliance with state regulations and avoid penalties. The NCDMV’s online resources and tools make it convenient to stay informed and up-to-date with your tax obligations.

Additionally, taking advantage of exemptions and discounts can provide significant financial relief. Senior citizens, veterans, and owners of hybrid or electric vehicles should explore these options to reduce their tax liability. By staying informed and proactive, vehicle owners can contribute to the state's economy while enjoying the benefits of a well-funded and thriving community.

Frequently Asked Questions

How often do I need to pay vehicle property taxes in North Carolina?

+

Vehicle property taxes in North Carolina are typically paid annually, aligned with your vehicle’s registration renewal date. This ensures that you stay current with your tax obligations and avoid any penalties or disruptions to your vehicle registration.

Can I appeal the assessed value of my vehicle for property tax purposes?

+

Yes, if you believe that the assessed value of your vehicle is inaccurate, you have the right to appeal. The NCDMV provides a process for vehicle owners to challenge the assessed value. This typically involves submitting documentation and evidence to support your claim. It is important to follow the appeal process guidelines to ensure a fair and successful outcome.

Are there any penalties for late payment of vehicle property taxes in North Carolina?

+

Yes, late payment of vehicle property taxes can result in penalties and interest. It is crucial to pay your taxes on time to avoid these additional charges. The NCDMV provides information on the specific penalties and interest rates, which can vary depending on the duration of the delay. Staying informed about due dates and payment options is essential to avoid any financial burdens.

How can I stay updated on changes to vehicle property tax rates and regulations in North Carolina?

+

To stay informed about changes to vehicle property tax rates and regulations, it is recommended to regularly visit the NCDMV website. The department provides updates and notifications regarding any changes or modifications to the tax system. Additionally, subscribing to their newsletter or following their social media channels can ensure that you receive timely updates and important announcements.

Are there any resources available to help me understand the vehicle property tax system in North Carolina?

+

Absolutely! The NCDMV offers a range of resources to help taxpayers understand the vehicle property tax system. These resources include detailed guides, FAQs, and contact information for tax-related inquiries. Additionally, the NCDMV’s customer service team is available to provide assistance and clarification on any tax-related matters. Utilizing these resources can ensure a smooth and stress-free tax experience.