Airbnb Payout Tax Setting

Welcome to a comprehensive guide on one of the essential aspects of managing your Airbnb hosting journey - the Airbnb Payout Tax Settings. As an Airbnb host, understanding how to navigate the platform's tax settings is crucial for ensuring compliance, managing your finances, and maximizing your earnings. In this expert-level article, we will delve into the intricacies of Airbnb's payout tax system, offering insights, practical tips, and real-world examples to help you optimize your tax management process.

Understanding Airbnb’s Payout Tax Structure

Airbnb, as a global hospitality platform, operates in diverse tax jurisdictions worldwide. The platform’s payout tax settings are designed to help hosts comply with local tax regulations and manage their tax obligations effectively. Here’s an overview of the key components:

Tax Registration and Identification

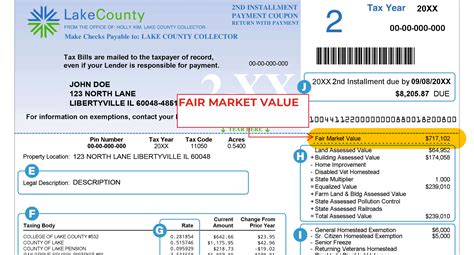

Before diving into tax settings, hosts must first ensure they have the necessary tax registrations and identification numbers. Airbnb requires hosts to provide accurate tax information, including Tax ID or VAT numbers, depending on their location and the applicable tax laws. This step is crucial for accurate tax reporting and compliance.

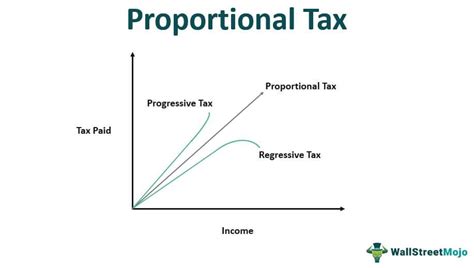

Tax Rates and Calculations

Airbnb’s payout tax system automatically calculates tax rates based on the host’s location and the guest’s billing address. The platform integrates various tax rates, including sales tax, occupancy tax, and value-added tax (VAT), ensuring compliance with local regulations. Hosts can review these rates and understand how they impact their earnings.

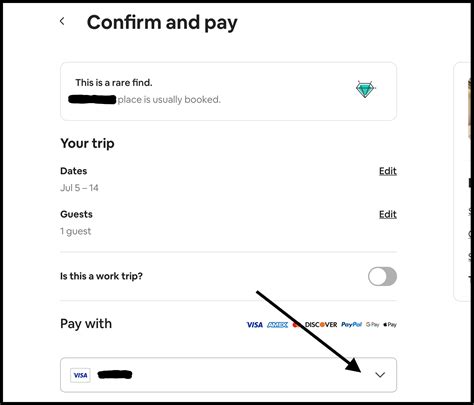

Tax Withholding and Remittance

Airbnb’s payout tax settings allow hosts to set preferences for tax withholding and remittance. Hosts can choose to have taxes withheld from their earnings or opt for direct remittance to the appropriate tax authorities. This feature ensures hosts remain compliant and provides a streamlined process for tax management.

Reporting and Documentation

Airbnb provides hosts with comprehensive reporting tools to track their tax obligations and earnings. Hosts can access detailed reports, including tax summaries, payout statements, and transaction histories. These reports help hosts stay organized, monitor their tax liabilities, and prepare for tax filings.

Optimizing Your Airbnb Payout Tax Settings

Now that we’ve covered the fundamentals, let’s explore strategies to optimize your Airbnb payout tax settings, ensuring efficiency, accuracy, and compliance.

1. Stay Informed about Local Tax Regulations

Each region has its own set of tax laws and regulations. As an Airbnb host, it’s essential to stay updated on the latest tax requirements in your area. Keep an eye on any changes or updates to tax rates, registration processes, and filing deadlines. Airbnb provides resources and guides to help hosts understand their tax obligations, but it’s also advisable to consult local tax professionals for expert advice.

2. Accurate Tax Information Entry

When setting up your Airbnb account, ensure that you provide accurate and up-to-date tax information. This includes your legal name, address, and tax identification numbers. Incorrect or outdated information can lead to delays in payouts, incorrect tax calculations, or even legal issues. Treat this step with the utmost care and attention to detail.

3. Review Tax Rates and Fees

Airbnb’s tax rates and fees can vary based on your location and the type of accommodation you offer. Take the time to review these rates and understand how they impact your earnings. This knowledge will help you set competitive prices and manage your financial expectations. Consider seeking professional advice if you need assistance interpreting complex tax structures.

4. Explore Tax-Efficient Strategies

Consulting with tax professionals or financial advisors can unlock tax-efficient strategies specific to your situation. They can guide you on maximizing deductions, claiming eligible expenses, and optimizing your tax liabilities. Remember, every host’s tax situation is unique, and professional advice can provide tailored solutions to minimize your tax burden.

5. Utilize Airbnb’s Reporting Tools

Airbnb’s reporting tools are powerful resources for hosts to manage their finances and tax obligations. Familiarize yourself with the platform’s reporting features, such as the Payout Statement, which provides a detailed breakdown of your earnings and associated taxes. Use these reports to reconcile your financial records and prepare for tax filings.

6. Stay Compliant with Tax Filings

Timely and accurate tax filings are essential for maintaining compliance and avoiding penalties. Set reminders for tax filing deadlines and ensure you have all the necessary documentation. Consider using tax preparation software or engaging a tax professional to streamline the filing process and ensure compliance.

7. Communicate with Airbnb’s Support Team

If you encounter any issues or have questions about your payout tax settings, don’t hesitate to reach out to Airbnb’s support team. They can provide guidance on tax-related matters, help resolve technical issues, and offer clarification on specific tax regulations applicable to your region.

Real-World Examples: Success Stories and Case Studies

Let’s explore some real-world examples of how Airbnb hosts have successfully navigated their payout tax settings, providing valuable insights and strategies for effective tax management.

Case Study: John’s Journey to Tax Compliance

John, an Airbnb host in New York City, faced a challenge when it came to managing his tax obligations. With multiple listings and a growing guest base, he needed a streamlined approach to tax management. Here’s how he tackled the issue:

- Research and Education: John invested time in understanding New York's tax laws and regulations. He attended webinars, consulted tax professionals, and stayed updated on any changes in tax requirements.

- Accurate Tax Registration: He ensured his Airbnb profile had the correct tax information, including his business name, address, and tax identification number. This step was crucial for accurate tax reporting.

- Tax Withholding Preferences: John opted for tax withholding on his Airbnb earnings. This way, he knew a portion of his income was set aside for tax payments, making it easier to manage his finances.

- Regular Review of Tax Reports: John utilized Airbnb's reporting tools to monitor his tax liabilities. He reviewed his Payout Statements monthly, ensuring he had a clear understanding of his earnings and associated taxes.

- Consulting a Tax Advisor: John sought professional advice to optimize his tax strategy. The advisor helped him identify deductions, such as property taxes and maintenance expenses, resulting in significant tax savings.

Through his proactive approach, John successfully managed his tax obligations, maintained compliance, and even reduced his tax burden. His story highlights the importance of education, accurate tax information, and professional guidance in the Airbnb hosting journey.

Case Study: Sarah’s Experience with Tax Efficiency

Sarah, an Airbnb host in London, aimed to maximize her earnings while staying compliant with tax regulations. Here’s how she achieved tax efficiency:

- Understanding VAT Requirements: Sarah's location in the UK meant she had to deal with Value-Added Tax (VAT). She educated herself on VAT registration, rates, and filing requirements. This knowledge helped her manage her tax obligations effectively.

- Opting for Direct Remittance: Sarah preferred a hands-off approach to tax management. She chose the option of direct remittance, where Airbnb automatically remits the applicable taxes to the tax authorities. This streamlined her tax process.

- Tracking Expenses: Sarah maintained meticulous records of her hosting expenses, including cleaning services, utilities, and maintenance costs. These expenses were crucial for tax deductions, and she used them to reduce her tax liability.

- Utilizing Tax Software: Sarah invested in tax preparation software to simplify her tax filings. The software helped her organize her financial data, generate tax reports, and ensure accurate and timely filings.

- Staying Updated on Tax Changes: Sarah regularly checked Airbnb's tax resources and local tax authority websites for any updates or changes in tax regulations. This proactive approach helped her adapt to new requirements and maintain compliance.

By implementing these strategies, Sarah achieved tax efficiency, minimized her tax burden, and maintained a smooth hosting experience. Her story emphasizes the importance of staying informed, leveraging technology, and staying organized in managing Airbnb's payout tax settings.

Future Implications and Industry Insights

As the hospitality industry evolves, so do the tax landscapes for platforms like Airbnb. Here are some insights and considerations for the future of Airbnb’s payout tax settings:

1. Expanding Global Presence

Airbnb’s global expansion means hosts in new regions will encounter unique tax challenges. The platform must continue to adapt and integrate local tax regulations to support hosts in these emerging markets. This includes providing resources, tools, and guidance specific to each region.

2. Tax Automation and Integration

The future of tax management may involve further automation and integration with third-party tax software. Airbnb could explore partnerships or develop its own advanced tax management tools to streamline the process for hosts, ensuring accurate tax calculations and efficient remittance.

3. Host Education and Support

Airbnb’s success relies on empowered and compliant hosts. The platform should continue investing in host education, providing comprehensive resources, webinars, and support articles to help hosts navigate complex tax landscapes. This approach ensures hosts remain informed and compliant.

4. Collaboration with Tax Authorities

Airbnb’s collaboration with tax authorities is crucial for maintaining a positive relationship and ensuring compliance. The platform can work closely with tax agencies to simplify tax reporting processes, provide accurate data, and promote transparency.

5. Emerging Tax Trends

Staying ahead of emerging tax trends and technologies is essential. Airbnb should monitor developments in tax regulations, such as digital tax reforms, to ensure its platform remains adaptable and compliant with future tax requirements.

| Tax Type | Example Rate |

|---|---|

| Sales Tax | 7.5% |

| Occupancy Tax | 2% |

| Value-Added Tax (VAT) | 20% |

How often should I review my Airbnb payout tax settings?

+It’s recommended to review your payout tax settings at least once a year, especially before tax filing season. This ensures you have accurate information and can make any necessary updates. Additionally, keep an eye on tax law changes in your region, as they may impact your settings.

Can I change my tax withholding preferences at any time?

+Yes, you can adjust your tax withholding preferences in your Airbnb account settings. This allows you to choose between having taxes withheld from your earnings or opting for direct remittance to tax authorities. Make sure to review and update these preferences as needed.

How does Airbnb handle tax reporting for hosts with multiple listings?

+Airbnb provides comprehensive reporting tools that consolidate earnings and tax information for all your listings. You can access detailed reports to track your income, expenses, and tax obligations across your portfolio of listings, making tax management more efficient.

What if I have questions or need support with my Airbnb payout tax settings?

+Airbnb offers dedicated support for tax-related inquiries. You can reach out to their support team through various channels, including live chat, email, and phone. They can provide guidance, troubleshoot issues, and offer clarification on tax matters specific to your region.

Are there any tax-related resources or guides available on Airbnb’s platform?

+Absolutely! Airbnb provides a wealth of resources to help hosts understand their tax obligations. These include articles, webinars, and guides covering various tax-related topics. Explore their Help Center and stay updated on the latest tax information and resources.