How Long To Keep Income Tax Returns

In the realm of financial management and legal compliance, the question of how long to retain income tax returns is a crucial one for individuals and businesses alike. This article delves into the specifics of tax return retention, offering expert guidance and insights to help navigate the complex world of tax regulations and ensure compliance.

Understanding the Importance of Tax Return Retention

Tax return retention is a critical aspect of financial record-keeping. It serves multiple purposes, including ensuring compliance with tax laws, facilitating audits, and providing a historical record of financial activities. For individuals and businesses, the proper retention of tax returns can offer peace of mind and simplify the process of filing future tax returns or addressing any tax-related queries.

Legal Requirements and Compliance

The Internal Revenue Service (IRS) sets guidelines for how long taxpayers must retain their tax returns and related documents. These guidelines are designed to ensure that taxpayers have the necessary records to support their tax filings and to aid in the enforcement of tax laws. Non-compliance with these retention requirements can lead to penalties and legal complications.

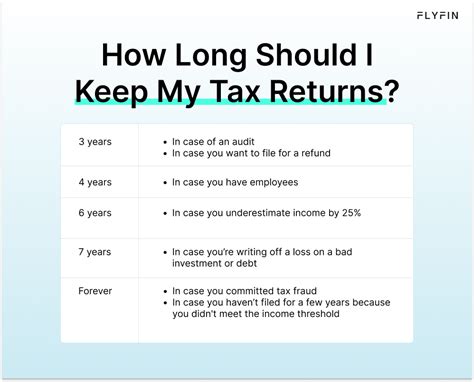

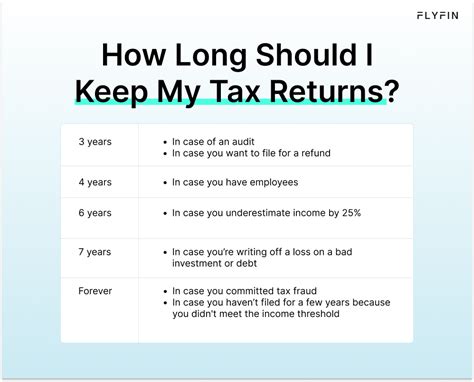

For instance, the IRS requires that taxpayers keep records that support their tax returns for a minimum of three years from the date the original return was filed. This includes supporting documents such as W-2 forms, 1099 forms, and any other records that substantiate income, deductions, and credits claimed on the tax return.

| Record Type | Minimum Retention Period |

|---|---|

| Income Tax Returns (Form 1040) | 3 years |

| W-2 Forms | 3 years |

| 1099 Forms | 3 years |

| Business Records (expenses, receipts) | 3-6 years |

Audit Considerations

Tax returns and their supporting documents can be vital in the event of an audit. The IRS has the authority to examine a taxpayer's records to verify the accuracy of their tax returns. During an audit, the IRS may request specific documents or information related to the tax return in question. If the taxpayer is unable to provide the necessary records, it could lead to additional scrutiny and potential penalties.

Therefore, it is advisable to retain tax returns and related documents for longer than the minimum required period, especially if there are significant changes in income, deductions, or tax credits from year to year. This extra precaution can provide added protection in the event of an audit.

Historical Record and Planning

Beyond legal compliance and audit preparedness, keeping tax returns and financial records can also serve as a valuable historical reference. This record can be particularly useful when tracking long-term financial trends, planning for future investments or major purchases, or even when applying for loans or other financial services.

Additionally, tax returns can provide a snapshot of an individual's or business's financial situation at a given point in time. This information can be crucial when making financial decisions, such as planning for retirement, understanding the impact of tax laws on investment strategies, or evaluating the success of past financial decisions.

Determining the Optimal Retention Period

While the IRS sets minimum retention periods, the optimal duration for keeping tax returns can vary based on individual circumstances. Factors such as the complexity of the tax return, the potential for audits, and the need for historical financial records should all be considered when determining the appropriate retention period.

Factors Influencing Retention

Complexity of Tax Return: Tax returns that are more complex, with numerous deductions, credits, or business-related expenses, may warrant longer retention periods. This is because the IRS may scrutinize these returns more closely, and having detailed records can help support the claimed deductions and credits.

Potential for Audits: Certain factors can increase the likelihood of an audit. These include significant fluctuations in income, claiming large deductions or credits, or operating a business with complex financial transactions. In such cases, retaining tax returns and supporting documents for an extended period can be beneficial.

Statute of Limitations: The IRS generally has a three-year statute of limitations to audit a taxpayer's return. However, this period can be extended to six years if the IRS believes there was a substantial understatement of income. Therefore, in cases where there is a risk of a substantial understatement, it may be prudent to retain tax returns and related documents for at least six years.

Business vs. Personal Returns: Business tax returns often require longer retention periods due to the complexity of business transactions and the need to support various deductions and expenses. Additionally, businesses may be subject to different tax laws and regulations, which can impact the retention requirements.

Best Practices for Tax Return Retention

To ensure proper retention of tax returns and related documents, consider the following best practices:

- Maintain an organized filing system: Keep tax returns and supporting documents in a secure, easily accessible location. Consider using a digital filing system or cloud storage to facilitate quick retrieval of records.

- Scan and digitize documents: Scanning paper documents can provide a digital backup and reduce the need for physical storage space. Ensure that digital copies are stored securely and backed up regularly.

- Use secure storage: For highly sensitive or critical documents, consider using secure storage options such as a safe deposit box or a secure cloud storage service with robust encryption.

- Regularly review and update records: Periodically review your tax returns and supporting documents to ensure they are accurate and up-to-date. This can help identify any discrepancies or missing information that may impact future tax filings or audits.

- Seek professional advice: If you have complex financial situations or are unsure about the appropriate retention period, consult with a tax professional or accountant. They can provide tailored advice based on your specific circumstances.

The Impact of Technology on Tax Return Retention

Advancements in technology have significantly transformed the way tax returns are prepared, filed, and retained. Digital tax software and online filing platforms have made it easier for taxpayers to organize and store their tax returns and supporting documents.

Digital Tax Software and Online Filing

Digital tax software, such as TurboTax and H&R Block, has become increasingly popular for preparing and filing tax returns. These platforms often provide built-in tools for organizing and storing tax documents. They can also help taxpayers track changes in their tax situation from year to year, making it easier to identify trends and plan for future tax obligations.

Online filing platforms also offer secure storage options for tax returns and supporting documents. These platforms often encrypt sensitive data and provide multiple layers of security to protect taxpayer information.

Cloud Storage and Data Security

The use of cloud storage has become a common practice for storing tax returns and financial records. Cloud storage providers offer robust security measures, including encryption and access controls, to protect taxpayer data. Additionally, cloud storage provides easy access to tax records from any device with an internet connection, making it convenient for taxpayers to retrieve their records when needed.

However, it is essential to choose reputable cloud storage providers that prioritize data security and privacy. Taxpayers should also be aware of potential data breaches and take steps to protect their data, such as using strong passwords, enabling two-factor authentication, and regularly updating their security measures.

Electronic Document Retention

The IRS accepts electronic versions of tax returns and supporting documents, provided they are an exact duplicate of the original paper document. This means that taxpayers can retain their tax returns and related documents in digital format without having to worry about physical storage space or potential damage to paper records.

Electronic document retention can simplify the process of providing records during an audit or when responding to a tax-related inquiry. Taxpayers can quickly access and share digital records, reducing the time and effort required to retrieve and provide the necessary information.

Future Implications and Emerging Trends

The landscape of tax return retention is likely to evolve with changing tax laws and technological advancements. As digital tax software and online filing platforms continue to advance, we can expect further improvements in the way tax returns are stored and accessed.

Digital Tax Records and Blockchain Technology

Blockchain technology, with its decentralized and secure nature, has the potential to revolutionize the way tax records are stored and shared. Blockchain-based systems can provide a tamper-proof record of tax returns and supporting documents, enhancing the security and integrity of taxpayer data.

Additionally, blockchain technology can facilitate secure data sharing between taxpayers and tax authorities, streamlining the audit process and reducing the need for manual record-keeping. This technology could also enable taxpayers to have greater control over their data, deciding who can access their tax records and for what purpose.

Data Privacy and Cybersecurity

As tax returns and financial records become increasingly digital, data privacy and cybersecurity will remain critical concerns. Taxpayers must ensure that their tax records are protected from unauthorized access or data breaches. This includes using secure digital storage options, implementing robust cybersecurity measures, and being vigilant about potential phishing attempts or identity theft.

Furthermore, as tax authorities continue to adopt digital technologies, they must also prioritize data security and privacy. This includes implementing strong encryption protocols, regular security audits, and transparent data handling practices to build trust with taxpayers.

Simplifying Tax Compliance

With the increasing complexity of tax laws and regulations, there is a growing need for simplified tax compliance processes. Digital tax software and online filing platforms have already made significant strides in this direction, but further innovations are expected.

Emerging technologies, such as artificial intelligence and machine learning, can play a crucial role in simplifying tax compliance. These technologies can automate various aspects of tax preparation and filing, reducing the need for manual data entry and minimizing the risk of errors. Additionally, they can provide personalized tax advice and guidance, helping taxpayers navigate the complexities of tax laws and regulations.

How long should I keep my tax returns and supporting documents after filing my taxes?

+

The IRS recommends keeping tax returns and supporting documents for at least three years after filing. However, in certain cases, such as if you underreported income by more than 25%, the IRS has up to six years to audit your return. Therefore, it may be prudent to keep records for six years to be safe.

What happens if I don’t keep my tax returns and supporting documents for the recommended period?

+

If you are unable to produce your tax returns and supporting documents during an audit, you may face penalties and additional taxes. It is essential to keep these records to support your tax filings and avoid potential legal complications.

Can I dispose of my tax returns and supporting documents after the recommended retention period has passed?

+

Yes, once the recommended retention period has passed, you can dispose of your tax returns and supporting documents. However, it is advisable to maintain an organized filing system and consider scanning and digitizing your records before disposal to ensure you have a digital backup in case of future needs.