What Is Tax Lien Investing

Tax lien investing is an intriguing concept within the realm of real estate and finance, offering investors an alternative avenue for potential profits. This unique investment strategy involves purchasing tax liens, which are essentially financial claims imposed by a government entity on a property when the owner fails to pay their property taxes. By delving into the world of tax lien investing, we uncover a complex yet rewarding process, providing an opportunity to secure substantial returns while navigating the intricacies of property ownership and tax regulations.

The Fundamentals of Tax Lien Investing

At its core, tax lien investing is a method through which investors acquire the right to receive a property’s unpaid taxes, along with a specified interest rate and potential penalties, from the property owner. This right is secured by purchasing a tax lien, a legal claim against the property, during a public auction conducted by the government.

Auction Process

The auction process is a critical component of tax lien investing. Each year, local government authorities hold auctions for properties with delinquent taxes. These auctions are open to the public, providing an opportunity for investors to bid on tax liens. The bidding process is competitive, with investors vying for the right to collect on the delinquent taxes.

During the auction, investors must consider several factors, including the property's location, the amount of delinquent taxes, and the potential interest rate. The interest rate is often predetermined by the government and can vary depending on the jurisdiction. Investors must also be mindful of the redemption period, which is the timeframe within which the property owner can pay their taxes and redeem the lien.

| Key Factors | Considerations |

|---|---|

| Property Location | Market value, rental demand, and potential for property appreciation. |

| Delinquent Taxes | Amount owed, which determines the initial investment and potential returns. |

| Interest Rate | Pre-determined by the government, offering a fixed return on investment. |

| Redemption Period | Timeframe for property owner to pay taxes and redeem the lien, impacting investment timeline. |

Returns and Risks

Tax lien investing offers attractive returns, primarily through the interest earned on the delinquent taxes. The interest rates can range from 6% to 36% annually, depending on the jurisdiction and the auction results. Additionally, investors may receive penalties and fees, further boosting their returns.

However, this investment strategy comes with inherent risks. The primary risk is the possibility of the property owner redeeming the lien, which would result in the investor receiving only the initial investment and interest accrued up to the redemption date. In such cases, the investor would not benefit from the full interest and penalties associated with the lien.

Another risk is the potential for the property to be unredeemed, which would grant the investor the right to foreclose on the property. This process can be complex and time-consuming, and there is no guarantee that the property's value will cover the investor's costs and desired profits.

Benefits of Tax Lien Investing

Despite the risks, tax lien investing offers several advantages that make it an appealing option for many investors:

High Returns

The potential for high returns is a significant draw for investors. The interest rates offered on tax liens can be significantly higher than traditional investments, providing an opportunity for substantial profits within a relatively short timeframe.

Low Entry Barrier

Tax lien investing often has a low entry barrier, allowing investors with varying financial backgrounds to participate. The initial investment required to purchase a tax lien can be relatively small, making it accessible to a wider range of investors.

Secure Investment

Tax liens provide a secure investment, as they are backed by real estate. The property serves as collateral, reducing the risk of loss compared to other investment types. This security is particularly attractive to risk-averse investors.

Potential for Property Ownership

In cases where the property owner does not redeem the lien, investors have the opportunity to gain ownership of the property. This can lead to long-term profits through rental income or property appreciation.

The Process of Tax Lien Investing

The process of tax lien investing involves several steps, each requiring careful consideration and strategic planning.

Research and Analysis

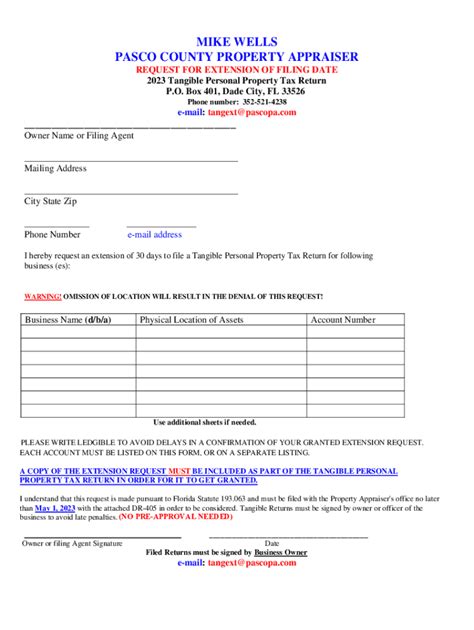

Before diving into tax lien investing, thorough research and analysis are essential. Investors must familiarize themselves with local laws and regulations, as tax lien procedures can vary significantly from one jurisdiction to another. Understanding the redemption process, interest rates, and foreclosure procedures is crucial.

Additionally, investors should analyze the market and identify properties with the potential for high returns. This involves assessing the property's location, condition, and market value. Properties with high rental demand or potential for appreciation are often favored by investors.

Attending Auctions

Attending tax lien auctions is a critical part of the process. Investors must be well-prepared, with a clear strategy and budget in mind. During the auction, investors must make quick decisions, taking into account the factors mentioned earlier, such as property location, delinquent taxes, interest rates, and redemption periods.

Lien Redemption

After purchasing a tax lien, investors must monitor the redemption period. If the property owner redeems the lien, the investor will receive their initial investment plus the accrued interest up to the redemption date. In this case, the investor’s involvement with the property ends, and they move on to the next investment opportunity.

Foreclosure Process

If the property owner does not redeem the lien, the investor can initiate the foreclosure process. This process can be lengthy and complex, involving legal procedures and potential negotiations. The investor may need to work with legal professionals to navigate this process effectively.

Property Ownership

Upon successful foreclosure, the investor gains ownership of the property. At this stage, the investor has several options. They can choose to sell the property, rent it out, or hold onto it for potential appreciation. Each option comes with its own set of considerations and potential profits.

Expert Insights and Strategies

To maximize returns and mitigate risks, tax lien investors employ various strategies and follow best practices.

Diversification

Diversification is a key strategy in tax lien investing. Investors should aim to spread their investments across multiple properties and auctions to reduce the impact of any single investment not performing as expected. By diversifying, investors can minimize their exposure to risk and potentially increase their overall returns.

Focus on Research

Thorough research is paramount in tax lien investing. Investors should dedicate significant time to studying local markets, property values, and auction trends. This research enables investors to identify properties with high potential for returns and avoid those that may carry excessive risks.

Collaborative Approach

Many successful tax lien investors work collaboratively with legal and real estate professionals. By partnering with experts in these fields, investors can navigate the complex processes involved in tax lien investing more effectively. Legal professionals can provide guidance on local laws and regulations, while real estate experts can offer insights into property values and market trends.

Stay Informed

The world of tax lien investing is constantly evolving, with new laws, regulations, and market trends emerging regularly. To stay ahead, investors must stay informed. This involves regularly reviewing local news, attending industry events, and engaging with other investors and professionals in the field.

FAQ

What happens if the property owner doesn’t redeem the tax lien within the redemption period?

+

If the property owner fails to redeem the tax lien within the specified redemption period, the investor has the right to initiate foreclosure proceedings. This process allows the investor to take ownership of the property. However, it’s important to note that foreclosure can be a lengthy and complex process, requiring legal expertise and careful management.

Are there any risks associated with tax lien investing?

+

Yes, tax lien investing carries several risks. The primary risk is the possibility of the property owner redeeming the lien, which would result in the investor receiving only the initial investment and accrued interest. Additionally, the foreclosure process can be time-consuming and uncertain, and there’s no guarantee that the property’s value will cover the investor’s costs and desired profits.

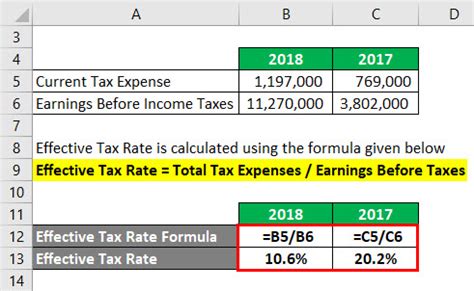

What are the potential returns in tax lien investing?

+

Tax lien investing offers the potential for high returns, primarily through the interest earned on delinquent taxes. Interest rates can range from 6% to 36% annually, depending on the jurisdiction and auction results. Additionally, investors may receive penalties and fees, further boosting their returns. However, it’s important to consider the risks involved and the potential for the property owner to redeem the lien.

How can I get started with tax lien investing?

+

Getting started with tax lien investing involves several steps. First, familiarize yourself with local laws and regulations regarding tax liens. Attend tax lien auctions to gain experience and understanding of the process. Develop a research-backed strategy for selecting properties, and consider working with legal and real estate professionals to navigate the complexities of tax lien investing effectively.

Is tax lien investing suitable for all investors?

+

Tax lien investing may not be suitable for all investors. It requires a thorough understanding of local laws, strategic thinking, and a willingness to manage potential risks. Investors should carefully consider their financial goals, risk tolerance, and available resources before diving into tax lien investing. It’s advisable to seek professional advice if you’re unsure about your suitability for this type of investment.