Www.loudounportal/Taxes

Welcome to Loudoun County, Virginia, where efficient and user-friendly online tax management is a reality. The Loudoun Portal, a dedicated online platform, streamlines tax processes for residents, businesses, and property owners, offering a range of services that make tax management a breeze. This article delves into the features, benefits, and user experience of the Loudoun Portal, highlighting its role in simplifying tax obligations for the community.

The Loudoun Portal: A Comprehensive Tax Management Solution

The Loudoun Portal, an initiative by the Loudoun County government, is designed to revolutionize the way residents interact with their tax obligations. It serves as a one-stop shop for all tax-related matters, providing a secure and convenient platform for taxpayers to access information, make payments, and manage their accounts.

One of the standout features of the portal is its user-friendly interface. Navigating the platform is intuitive, allowing users to quickly find the services they need. Whether it's checking tax records, applying for tax relief, or simply understanding the various tax programs, the Loudoun Portal makes it easy for users of all technical abilities.

Key Services Offered by the Loudoun Portal

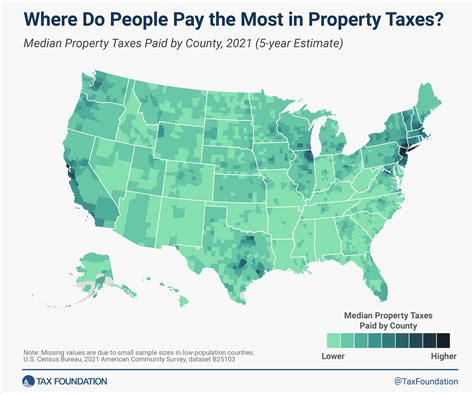

- Property Tax Management: Residents can easily access their property tax records, view assessment details, and make payments online. The portal also provides tools to estimate future tax liabilities, helping homeowners plan their finances effectively.

- Business Tax Services: Businesses in Loudoun County can register, file, and pay their business taxes through the portal. This includes taxes such as business license fees, sales and use taxes, and lodging taxes. The portal simplifies the process, ensuring compliance and timely payments.

- Personal Tax Filing: Individual taxpayers can file their personal property taxes, real estate taxes, and vehicle taxes through the portal. The system guides users through the filing process, making it accessible and stress-free.

- Tax Relief Programs: The Loudoun Portal provides information and applications for various tax relief programs, such as the Elderly or Disabled Real Estate Tax Relief Program and the Land Conservation Tax Credit Program. These programs aim to ease the tax burden on eligible residents.

- Tax Calendar and Reminders: Users can set up tax reminders and stay updated with important tax deadlines. This feature ensures that taxpayers never miss a payment, helping to avoid late fees and penalties.

Benefits of Using the Loudoun Portal

The Loudoun Portal offers a host of advantages to taxpayers:

- Convenience: Users can manage their tax obligations from the comfort of their homes or offices, eliminating the need for in-person visits to government offices.

- Time-saving: The portal’s efficient system allows users to complete tasks quickly, reducing the time spent on tax-related administration.

- Transparency: Taxpayers have easy access to their tax records and information, promoting transparency and understanding of the tax process.

- Cost-effectiveness: By streamlining tax management, the portal reduces administrative costs for both taxpayers and the county government.

- Secure Transactions: The platform utilizes advanced security measures to ensure that all online transactions are safe and secure.

Performance and User Experience

The Loudoun Portal has consistently received positive feedback from users, praising its simplicity and efficiency. The platform’s performance is robust, handling a high volume of users during peak tax seasons without any significant issues.

One notable aspect of the user experience is the portal's personalized dashboard. This feature allows users to customize their view, displaying only the information and services relevant to their specific tax situation. This level of customization enhances the user experience, making tax management more accessible and less daunting.

Looking Ahead: Future Enhancements

The Loudoun County government is committed to continuously improving the Loudoun Portal. Future enhancements may include:

- Integration of more advanced tax planning tools to assist taxpayers in optimizing their tax strategies.

- Introduction of a mobile app to provide users with even greater accessibility and convenience.

- Implementation of machine learning algorithms to further enhance the accuracy and efficiency of the portal’s services.

These potential improvements showcase the county's dedication to staying at the forefront of digital tax management, ensuring that the Loudoun Portal remains a valuable resource for its residents and businesses.

| Portal Feature | Description |

|---|---|

| Property Tax Lookup | Quick access to property tax records and assessment details. |

| Business Tax Registration | Online registration and management of business taxes. |

| Personal Tax Filing | Simplified process for filing personal property, real estate, and vehicle taxes. |

| Tax Relief Applications | Online applications for tax relief programs, such as the Elderly or Disabled Real Estate Tax Relief Program. |

| Tax Calendar and Reminders | Customizable tax deadline reminders to avoid late payments. |

How do I create an account on the Loudoun Portal?

+Creating an account is straightforward. Simply visit the Loudoun Portal website, click on the “Register” or “Create Account” button, and follow the prompts. You’ll need to provide some basic information, such as your name, email address, and a secure password. Once your account is set up, you can access all the tax-related services offered by the portal.

Can I make partial payments for my taxes on the portal?

+Yes, the Loudoun Portal allows for partial payments. This flexibility is particularly useful for taxpayers who may not be able to pay their taxes in full at once. You can choose to pay a portion of your tax bill and then make additional payments at a later date.

Is my personal and financial information secure on the portal?

+Absolutely. The Loudoun Portal employs robust security measures to protect your personal and financial data. The platform uses encryption protocols to ensure that your information is safe during transmission and storage. Additionally, the portal adheres to strict data privacy regulations, giving you peace of mind when managing your tax affairs online.