Tax On Inherited Ira

Understanding the intricacies of taxes on inherited Individual Retirement Accounts (IRAs) is crucial for beneficiaries navigating the complexities of estate planning and financial inheritance. This comprehensive guide aims to provide an expert analysis of the tax implications surrounding inherited IRAs, offering practical insights and strategies to ensure compliance and optimize financial outcomes.

Tax Treatment of Inherited IRAs

Inherited IRAs are subject to specific tax rules that differ from those applicable to the original account holder. These rules dictate the timing and manner in which the beneficiary must take distributions and pay taxes on the inherited funds. Failure to adhere to these rules can result in significant tax penalties.

Required Minimum Distributions (RMDs)

One of the key obligations for beneficiaries of inherited IRAs is the requirement to take Required Minimum Distributions (RMDs). RMDs are calculated based on the beneficiary’s life expectancy and the value of the inherited IRA. Failure to take the required distributions can result in a 50% excise tax on the amount that should have been distributed.

The Internal Revenue Service (IRS) provides life expectancy tables that determine the distribution period. For example, a beneficiary aged 55 inheriting an IRA would have a life expectancy of 34.7 years, meaning they must distribute the entire IRA over this period.

| Beneficiary Age | Life Expectancy (Years) |

|---|---|

| 55 | 34.7 |

| 60 | 29.4 |

| 65 | 24.8 |

Taxation of Distributions

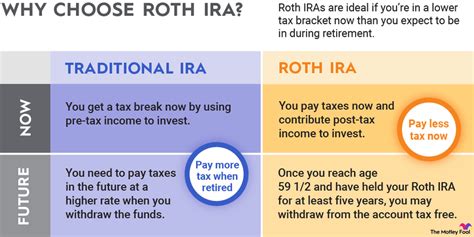

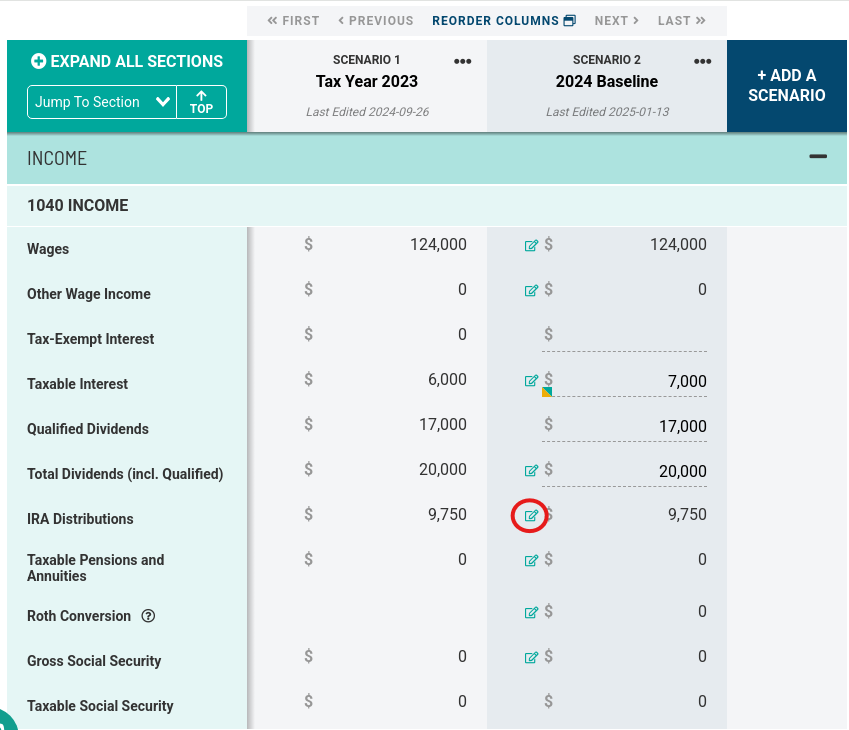

Distributions from inherited IRAs are typically taxed as ordinary income. The tax rate depends on the beneficiary’s overall taxable income for the year. For instance, if the distributions push the beneficiary into a higher tax bracket, the tax rate applied to the distributions will reflect this.

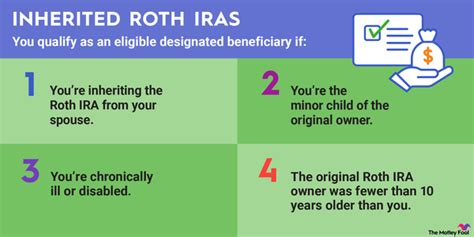

It's important to note that inherited Roth IRAs are treated differently. Distributions from a Roth IRA inherited from a non-spouse are tax-free, provided certain conditions are met. However, if inherited from a spouse, the beneficiary may choose to treat the account as their own, maintaining the tax-free status.

Strategies for Inherited IRA Taxation

Navigating the tax landscape of inherited IRAs requires careful planning and consideration of various factors. Here are some strategies to optimize tax outcomes:

Stretch IRA

A Stretch IRA is a strategy where the beneficiary extends the distribution period over their lifetime, thereby minimizing the taxable income in any given year. This strategy is particularly beneficial for younger beneficiaries as it allows for tax-efficient growth of the inherited IRA.

For example, consider a 30-year-old beneficiary inheriting an IRA. By utilizing the Stretch IRA strategy, they can stretch out the distributions over their lifetime, potentially reducing their tax burden and maximizing the growth potential of the account.

Trustee-to-Trustee Transfer

A Trustee-to-Trustee Transfer involves moving the inherited IRA to a new trustee or custodian, often an institution specializing in managing inherited retirement accounts. This transfer ensures compliance with the required procedures and can provide added benefits such as professional management and investment options.

Institutions like Fidelity, Charles Schwab, and Vanguard offer specialized services for inherited IRAs, providing guidance and tools to navigate the complex tax and distribution rules.

Rollover to a New IRA

In some cases, it may be beneficial to roll over the inherited IRA into a new IRA account in the beneficiary’s name. This strategy can provide more flexibility in managing the account and potentially offer a broader range of investment options.

However, it's crucial to note that a direct rollover is required to maintain the tax-deferred status of the inherited IRA. Any distribution to the beneficiary, even temporarily, could trigger immediate taxation and penalties.

Tax Implications for Spousal Beneficiaries

Spouses who inherit IRAs have unique tax considerations. They have the option to treat the inherited IRA as their own, which can provide significant tax benefits.

Spousal Rollover

A Spousal Rollover allows a surviving spouse to treat the inherited IRA as their own, maintaining the tax-deferred status and potentially combining it with their existing IRA. This strategy can be advantageous for tax planning and estate distribution.

For instance, if a spouse inherits an IRA and has a relatively low income, they can defer taxes on the inherited funds by rolling them over into their own IRA. This strategy can also help manage the overall tax burden and maximize the growth potential of the combined accounts.

Spouse as Beneficiary

Designating a spouse as the primary beneficiary of an IRA offers several advantages. It allows for greater flexibility in managing the account during the original owner’s lifetime and provides the spouse with more options upon inheritance.

For example, if the original IRA owner passes away before taking their RMDs, the spouse can choose to treat the IRA as their own, extending the distribution period and potentially reducing their tax liability.

Conclusion: Navigating Inherited IRA Taxation

Understanding the tax implications of inherited IRAs is essential for effective financial planning and estate management. By adhering to the required distribution rules and utilizing strategic planning, beneficiaries can optimize their tax outcomes and maximize the growth potential of their inherited assets.

It's crucial to consult with tax and financial professionals to navigate the complex landscape of inherited IRA taxation. With careful planning and expert guidance, beneficiaries can ensure compliance, minimize tax burdens, and make the most of their inherited retirement accounts.

Can I avoid taxes on an inherited IRA?

+While it’s not possible to completely avoid taxes on an inherited IRA, there are strategies to minimize the tax burden. These include stretching out distributions, utilizing trustee-to-trustee transfers, or rolling over the IRA into a new account. Consulting a tax professional is crucial to navigate these options effectively.

What happens if I miss a Required Minimum Distribution (RMD) from an inherited IRA?

+Missing a RMD can result in a 50% excise tax on the amount that should have been distributed. It’s essential to stay informed about the distribution schedule and consult with a financial advisor to ensure compliance.

Are there any tax benefits for spouses inheriting an IRA?

+Yes, spouses have the option to treat an inherited IRA as their own, which can provide tax advantages. This includes the ability to defer taxes, combine the IRA with their existing accounts, and potentially extend the distribution period. Consulting a tax professional is recommended to explore these options.