Alabama Tax Refund Status

The Alabama Tax Refund Status is a topic of interest for many residents of the state, especially during tax season. Understanding the process, timelines, and requirements for claiming and receiving tax refunds is crucial for individuals and businesses alike. This comprehensive guide aims to provide an in-depth analysis of the Alabama tax refund process, offering insights and tips to help navigate the system effectively.

Navigating the Alabama Tax Refund Journey

The Alabama Department of Revenue is responsible for processing tax refunds for both individuals and businesses. The process can vary depending on the type of tax being refunded and the method of filing. Generally, tax refunds are issued for overpayments of income taxes, sales taxes, or other specific tax types. Here’s a detailed breakdown of the key aspects of the Alabama tax refund status.

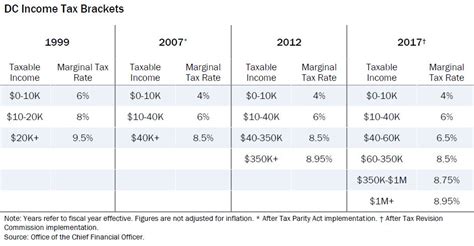

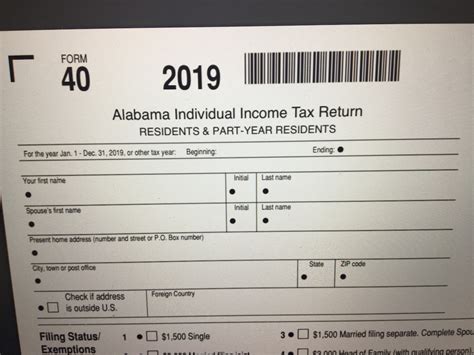

Income Tax Refunds

For income tax refunds, the process begins with the timely filing of tax returns. The Alabama Department of Revenue encourages electronic filing, which can expedite the refund process. Once the return is processed, the department will review it for accuracy and any potential errors. If the return is accepted, the refund status will be updated, and the refund amount will be calculated.

Alabama offers a Refund Status Lookup Tool on its official website, which allows taxpayers to track the progress of their refund. This tool provides real-time updates on the refund status, ensuring transparency and ease of access for taxpayers. The tool requires the taxpayer's Social Security Number or Individual Taxpayer Identification Number (ITIN), along with the refund amount from the tax return.

Income tax refunds are typically issued within 4 to 6 weeks of the return being accepted. However, various factors can influence this timeline, including errors on the return, missing information, or additional reviews required by the department. It's important to note that the refund status may not update immediately after filing, as the department processes returns in batches.

| Income Tax Refund Timeline | Description |

|---|---|

| Week 1 | Return received and accepted by the Department of Revenue. |

| Week 2-3 | Return processed and refund amount calculated. |

| Week 4 | Refund issued and sent to the taxpayer. |

| Week 5-6 | Refund received by the taxpayer. |

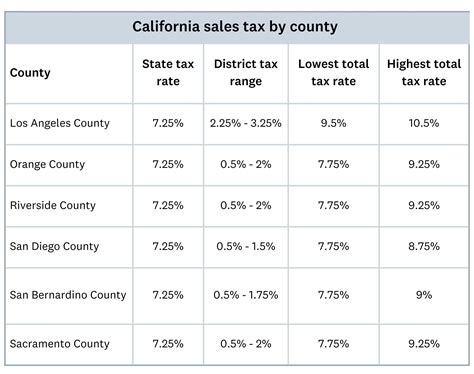

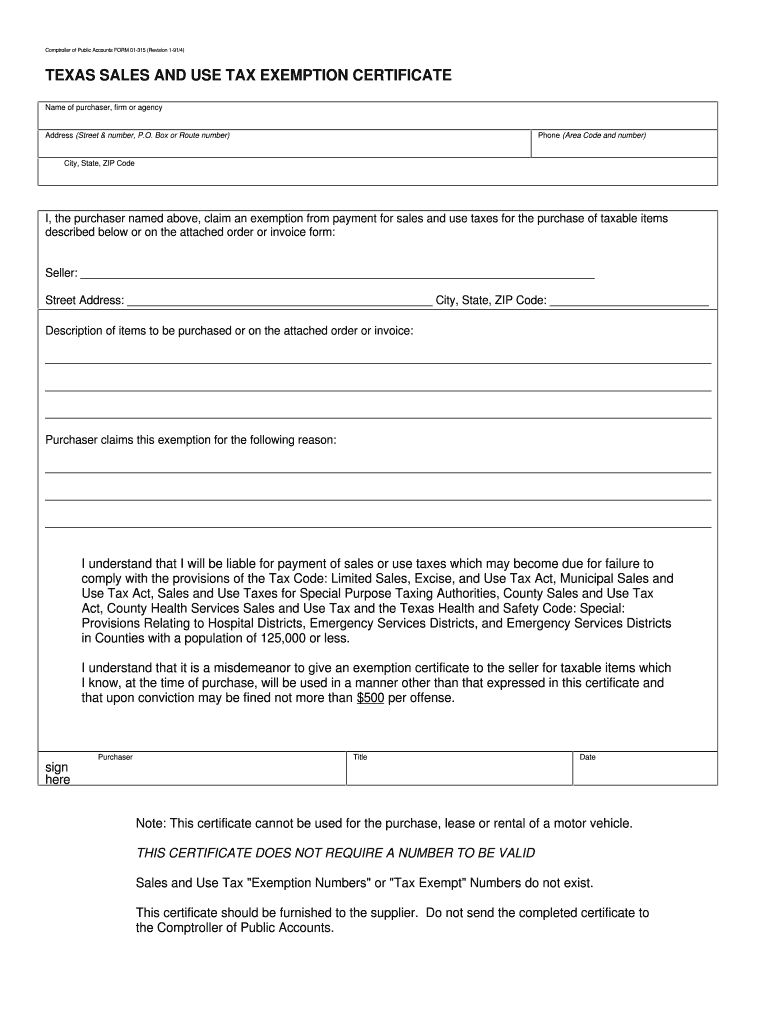

Sales Tax Refunds

Sales tax refunds in Alabama are handled separately from income tax refunds. Businesses that overpay sales tax can claim a refund by filing a Sales and Use Tax Return (Form AUS). The refund process for sales tax is similar to income tax refunds, with a few key differences.

Firstly, sales tax refunds are typically issued within 6 to 8 weeks of the return being accepted. This slightly longer timeline is due to the additional complexities involved in processing sales tax returns. Secondly, the refund status for sales tax can be tracked using the same Refund Status Lookup Tool, but it requires the business's Employer Identification Number (EIN) and the refund amount from the sales tax return.

| Sales Tax Refund Timeline | Description |

|---|---|

| Week 1 | Sales tax return received and accepted. |

| Week 2-4 | Return processed and refund amount calculated. |

| Week 5 | Refund issued and sent to the business. |

| Week 6-8 | Refund received by the business. |

Methods of Refund

Alabama offers taxpayers a choice of refund methods, including direct deposit and paper checks. Direct deposit is the fastest and most secure method, as it eliminates the risk of lost or stolen checks. Taxpayers can provide their bank account information when filing their tax return to receive the refund directly into their account.

For those who prefer a paper check, the refund will be mailed to the address provided on the tax return. It's important to ensure that the mailing address is up-to-date to avoid any delays or issues with receiving the refund. If a taxpayer moves during the refund process, they should notify the Alabama Department of Revenue immediately to update their records.

Common Issues and Solutions

While the Alabama tax refund process is generally straightforward, there can be instances of delays or issues. Some common problems include:

- Missing or incorrect information on the tax return.

- Errors in calculating the refund amount.

- Delays due to additional reviews or audits.

- Technical issues with the Refund Status Lookup Tool.

- Lost or stolen refund checks.

To address these issues, taxpayers can take the following steps:

- Double-check the accuracy of the tax return and provide any missing information.

- Contact the Alabama Department of Revenue's helpline for assistance with calculating the refund amount.

- Be patient during the refund process, especially if the return is under review.

- If the Refund Status Lookup Tool is not working, try accessing it from a different browser or device.

- Report lost or stolen refund checks to the Department of Revenue immediately.

Tips for a Smooth Tax Refund Process

To ensure a smooth and timely tax refund, taxpayers can follow these tips:

- File tax returns as early as possible to avoid potential delays.

- Use electronic filing to expedite the process and reduce errors.

- Provide accurate and complete information on the tax return.

- Choose direct deposit as the refund method for faster and more secure refunds.

- Keep a record of the tax return and refund status for future reference.

Staying Informed and Proactive

The Alabama tax refund process can be complex, but with the right knowledge and preparation, taxpayers can navigate it successfully. By understanding the timelines, methods, and potential issues, individuals and businesses can ensure they receive their refunds promptly and without hassle. Staying informed and proactive throughout the process is key to a positive tax refund experience.

How can I check the status of my Alabama tax refund online?

+You can check the status of your Alabama tax refund online by using the Refund Status Lookup Tool on the Alabama Department of Revenue’s website. This tool requires your Social Security Number or Individual Taxpayer Identification Number (ITIN) and the refund amount from your tax return.

What if I don’t receive my tax refund within the estimated timeline?

+If you don’t receive your tax refund within the estimated timeline, it’s important to remain patient and allow for potential processing delays. However, if you believe there may be an issue with your refund, you can contact the Alabama Department of Revenue’s helpline for assistance.

Can I change my refund method after filing my tax return?

+Changing your refund method after filing your tax return is generally not possible. It’s important to choose your preferred refund method (direct deposit or paper check) when filing your return to ensure a smooth refund process.

How long does it take to receive a tax refund if I file my return electronically?

+Filing your tax return electronically can expedite the refund process. Typically, electronic returns are processed within 4 to 6 weeks for income tax refunds and 6 to 8 weeks for sales tax refunds.

What should I do if my refund check is lost or stolen?

+If your refund check is lost or stolen, you should contact the Alabama Department of Revenue immediately. They can assist you in canceling the original check and issuing a replacement refund.