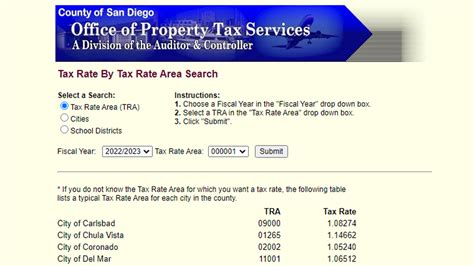

Tax Rate Area

Tax Rate Areas, or TRAs for short, are a fundamental concept in the realm of tax administration, especially in the context of value-added taxes (VAT) and goods and services taxes (GST). These designated areas play a crucial role in determining the applicable tax rates for various goods and services, making them a key consideration for businesses and consumers alike. In this comprehensive article, we will delve into the intricacies of Tax Rate Areas, exploring their definition, purpose, global variations, and their profound impact on the tax landscape.

Understanding Tax Rate Areas

Tax Rate Areas, at their core, are geographical zones established by tax authorities to facilitate the administration of different tax rates for goods and services. These zones are strategically delineated to account for regional disparities in economic development, consumer behavior, and other relevant factors that may influence tax policy.

The primary objective of TRAs is to ensure fairness and efficiency in tax collection by tailoring tax rates to the specific circumstances of each region. This approach recognizes that a one-size-fits-all tax rate may not be equitable or practical, given the diverse economic landscapes that exist within a country or across borders.

Key Characteristics of Tax Rate Areas

TRAs possess several defining characteristics that contribute to their effectiveness as a tax administration tool:

- Geographic Focus: Tax Rate Areas are geographically defined regions, often encompassing specific cities, states, provinces, or even entire countries. The boundaries of these areas are carefully drawn to capture the unique economic characteristics of the region.

- Multiple Tax Rates: Within a single country, there may be multiple TRAs, each associated with a distinct tax rate. These rates can vary significantly, with some areas having reduced or zero tax rates for certain goods or services, while others may impose higher rates to align with regional economic policies.

- Legal Framework: The establishment and maintenance of Tax Rate Areas are governed by specific tax laws and regulations. These legal frameworks outline the criteria for designating TRAs, the process for modifying their boundaries, and the rules for determining the applicable tax rates within each area.

- Dynamic Nature: TRAs are not static entities. Tax authorities regularly review and update these zones to reflect changing economic conditions, demographic shifts, and policy objectives. This dynamic nature ensures that TRAs remain relevant and responsive to the evolving needs of the tax system.

Global Variations in Tax Rate Areas

The concept of Tax Rate Areas is not confined to a single country or region. In fact, it is a global phenomenon, with variations observed across different jurisdictions. Let’s explore some notable examples of TRAs around the world:

European Union (EU) - VAT Rates

Within the EU, the implementation of Value-Added Tax (VAT) is a complex affair due to the diverse economic landscapes of its member states. To address this diversity, the EU has established a system of VAT rates, with different rates applicable to different categories of goods and services.

For instance, essential goods like food, children's clothing, and medical supplies often enjoy reduced VAT rates, while luxury items and services may be subject to standard or even higher rates. This approach aims to promote social equity and support the affordability of essential goods.

| EU Country | Standard VAT Rate | Reduced VAT Rate |

|---|---|---|

| Germany | 19% | 7% |

| France | 20% | 5.5% |

| Italy | 22% | 4% |

Canada - Harmonized Sales Tax (HST)

In Canada, the implementation of Tax Rate Areas is evident through the Harmonized Sales Tax (HST), a combination of the federal Goods and Services Tax (GST) and the provincial sales tax. The HST rates vary across provinces, reflecting the unique economic circumstances of each region.

For instance, the HST rate in Ontario is 13%, while in British Columbia, it stands at 12%. This variation allows provinces to balance their tax policies with their specific economic needs and priorities.

| Canadian Province | HST Rate |

|---|---|

| Ontario | 13% |

| British Columbia | 12% |

| Quebec | 14.975% |

India - Goods and Services Tax (GST)

India’s implementation of Tax Rate Areas is a notable example of a complex and multifaceted tax system. The country’s Goods and Services Tax (GST) regime, introduced in 2017, encompasses multiple tax rates to cater to the diverse economic conditions across its states and union territories.

India's GST rates are divided into five categories: 0%, 5%, 12%, 18%, and 28%. These rates are applied to different goods and services based on their economic importance and the need to promote equitable development across the country.

Impact of Tax Rate Areas on Businesses and Consumers

The establishment and management of Tax Rate Areas have a profound impact on both businesses and consumers, shaping their economic decisions and interactions within the tax system.

Businesses

For businesses, Tax Rate Areas present both opportunities and challenges. On the one hand, TRAs offer a nuanced approach to tax administration, allowing businesses to optimize their pricing strategies and market positioning based on regional tax rates.

However, the dynamic nature of TRAs can also pose challenges. Businesses operating in multiple Tax Rate Areas must navigate complex tax regulations, ensure compliance with varying tax rates, and manage the administrative burden associated with multiple tax jurisdictions.

Consumers

Consumers, too, experience the direct impact of Tax Rate Areas. The variation in tax rates across different regions can influence consumer behavior, with individuals often seeking out lower-tax areas for specific purchases. This phenomenon, known as “tax tourism,” can lead to consumer migration and impact the economic dynamics of regions.

Additionally, Tax Rate Areas can impact the affordability of goods and services, particularly for essential items. Reduced tax rates in certain areas can make these items more accessible to consumers, promoting social welfare and equity.

Future Implications and Potential Reforms

The concept of Tax Rate Areas is a dynamic and evolving aspect of tax administration. As economies continue to grow and diversify, tax authorities will likely face ongoing challenges in balancing the need for regional fairness with the efficiency of tax collection.

Potential reforms in the future may include:

- Harmonization of Tax Rates: There may be a push for greater harmonization of tax rates across Tax Rate Areas to simplify tax administration and reduce the administrative burden on businesses.

- Digitalization and Automation: The integration of technology into tax administration processes can streamline the management of Tax Rate Areas, making it easier for businesses and consumers to navigate the tax landscape.

- Regional Economic Development Initiatives: Tax Rate Areas could be leveraged as a tool to promote regional economic development, with targeted tax incentives and rates aimed at stimulating growth in specific areas.

As the world continues to evolve, so too will the role of Tax Rate Areas in shaping the tax landscape. By understanding the complexities and implications of TRAs, businesses, consumers, and policymakers can navigate this dynamic environment with greater clarity and confidence.

How are Tax Rate Areas determined and established?

+Tax Rate Areas are typically determined and established through a combination of economic analysis, policy objectives, and legal frameworks. Tax authorities consider factors such as regional economic development, consumer behavior, and the need for equitable tax policies when delineating TRAs. The process involves rigorous research, consultation with stakeholders, and the development of regulations to govern the implementation and management of these zones.

Can Tax Rate Areas change over time?

+Yes, Tax Rate Areas are not static and can change over time. Tax authorities regularly review and adjust these zones to reflect changing economic conditions, demographic shifts, and policy priorities. This dynamic nature ensures that TRAs remain relevant and responsive to the evolving needs of the tax system and the regions they serve.

What are the benefits of having multiple Tax Rate Areas within a country?

+Multiple Tax Rate Areas within a country offer several benefits. They allow tax authorities to tailor tax rates to the specific economic circumstances of each region, promoting fairness and equity. Additionally, TRAs can stimulate regional economic development by providing targeted tax incentives and rates to encourage investment and growth in specific areas. Finally, they provide businesses with flexibility in pricing strategies and market positioning, enabling them to adapt to regional tax environments.