Chatham County Ga Property Tax

Chatham County, located in the coastal region of Georgia, USA, is a vibrant community with a diverse range of properties and a rich history. Property taxes play a significant role in the county's revenue generation and contribute to the maintenance and development of essential services and infrastructure. This article delves into the intricacies of Chatham County's property tax system, providing a comprehensive guide for homeowners, investors, and anyone interested in understanding the local real estate landscape.

Understanding Property Taxes in Chatham County

Property taxes in Chatham County are an essential component of the local economy and are vital for funding public services and maintaining the county’s infrastructure. These taxes are determined by the assessed value of the property and are calculated based on the millage rate set by the county authorities.

The assessed value of a property is determined through a meticulous process conducted by the Chatham County Tax Assessors' Office. This office employs a team of professionals who regularly inspect and evaluate properties to ensure accurate assessments. The assessed value takes into account various factors such as the property's location, size, age, and recent improvements or renovations.

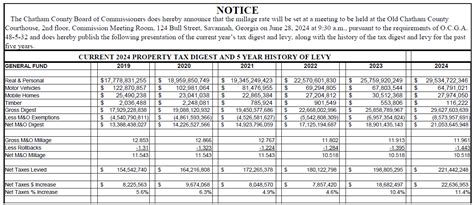

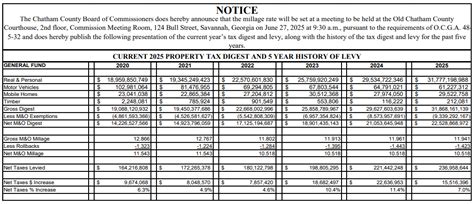

Once the assessed value is established, the millage rate comes into play. The millage rate is the tax rate expressed in mills, where one mill represents $1 of tax for every $1,000 of assessed property value. This rate is set annually by the county authorities, including the Board of Commissioners and various other taxing authorities within the county. The millage rate determines the final property tax bill for each homeowner or property owner.

The Role of Millage Rates

The millage rate is a crucial factor in determining property taxes. It is set through a collaborative process involving the county government and other local taxing authorities. These authorities consider various factors, including the budget requirements for public services, the need for infrastructure development or maintenance, and the impact on taxpayers.

The millage rate is typically divided into two categories: the general fund millage and the special district millage. The general fund millage supports essential services like law enforcement, fire protection, and education. The special district millage, on the other hand, funds specific services or infrastructure within designated areas, such as water and sewer districts or fire protection districts.

| Taxing Authority | Millage Rate (Per $1,000 of Assessed Value) |

|---|---|

| Chatham County | 10.30 |

| City of Savannah | 11.45 |

| School Board | 18.80 |

| Special Districts (Water, Sewer, etc.) | Varies by District |

The combined millage rate for Chatham County, including all taxing authorities, can be calculated by summing up the individual rates. However, it's important to note that the specific rates may vary depending on the location within the county and the services provided by each taxing authority.

Property Tax Calculation Example

To illustrate how property taxes are calculated, let’s consider an example. Suppose a homeowner in Chatham County has a property with an assessed value of $250,000. The millage rate for their specific location is a combined rate of 30 mills, which includes the rates for all taxing authorities.

Using the formula: Property Tax = Assessed Value x Millage Rate

Property Tax = $250,000 x 0.030 = $7,500

Therefore, the homeowner's annual property tax bill would be $7,500.

Property Tax Due Dates and Payment Options

Property taxes in Chatham County are due in two installments, with specific due dates set by the county. The first installment is typically due in January, and the second installment is due in July. It’s important for property owners to be aware of these dates to avoid any late fees or penalties.

The Chatham County Tax Commissioner's Office offers a variety of payment options to cater to different preferences and needs. Property owners can choose from the following methods:

- Online Payment: Property owners can conveniently pay their taxes online through the official website of the Tax Commissioner's Office. This method is secure and allows for quick and easy transactions.

- Mail-In Payment: Taxpayers can also mail their payments to the Tax Commissioner's Office. It's crucial to ensure that the payment is postmarked on or before the due date to avoid any late charges.

- In-Person Payment: For those who prefer a more traditional approach, the Tax Commissioner's Office accepts walk-in payments during regular business hours. This option provides an opportunity for taxpayers to receive immediate assistance if needed.

- Electronic Funds Transfer (EFT): This payment method allows taxpayers to set up automatic deductions from their bank accounts on the due dates. It's a convenient and secure way to ensure timely payments without the need for manual intervention.

It's worth noting that late payments may incur interest and penalties, so it's advisable to stay informed about the due dates and make timely payments to avoid additional charges.

Property Tax Exemptions and Discounts

Chatham County offers various property tax exemptions and discounts to eligible homeowners, which can significantly reduce their tax burden. These exemptions and discounts are designed to provide relief to specific groups of taxpayers and promote homeownership.

Homestead Exemption

The homestead exemption is a popular and widely utilized exemption in Chatham County. It allows eligible homeowners to exclude a portion of their home’s value from taxation, effectively reducing their property tax bill. To qualify for the homestead exemption, homeowners must meet certain criteria, including being the primary resident of the property and not claiming the exemption on any other property.

The homestead exemption in Chatham County provides a $2,000 exclusion from the assessed value of the property. This means that for a homeowner who qualifies, the first $2,000 of their home's assessed value is exempt from property taxes.

For example, if a homeowner's property has an assessed value of $250,000 and they qualify for the homestead exemption, their taxable value would be reduced to $248,000 ($250,000 - $2,000). This reduction in taxable value can lead to significant savings on their annual property tax bill.

Senior Citizen Discount

Chatham County offers a senior citizen discount for homeowners who are 65 years of age or older. This discount provides a reduction in the millage rate for eligible seniors, resulting in lower property taxes. To qualify, seniors must meet certain income requirements and own the property as their primary residence.

The senior citizen discount in Chatham County reduces the millage rate by 4 mills for eligible seniors. For example, if the general millage rate is 10 mills, an eligible senior would pay taxes based on a reduced rate of 6 mills.

This discount can provide significant savings for senior homeowners, especially those on fixed incomes, as it lowers their annual property tax burden.

Other Exemptions and Discounts

In addition to the homestead exemption and senior citizen discount, Chatham County offers several other exemptions and discounts to eligible homeowners. These include:

- Disability Exemption: Provides a reduced millage rate for homeowners with disabilities.

- Veteran's Exemption: Offers a partial or full exemption for qualifying veterans.

- Agricultural Use Valuation: Allows eligible landowners to have their property valued based on its agricultural use, reducing the assessed value.

- Conservation Use Valuation: Provides a reduced assessment for landowners who preserve their property for conservation purposes.

It's important for homeowners to explore these exemptions and discounts to determine their eligibility and take advantage of the savings they offer.

Appealing Property Assessments

In the event that a homeowner disagrees with the assessed value of their property, they have the right to appeal the assessment. The Chatham County Board of Equalization is responsible for hearing and deciding on property tax appeals. The appeal process is a formal procedure that requires homeowners to provide evidence and support for their claim.

Homeowners who wish to appeal their property assessment should start by obtaining the necessary forms and instructions from the Chatham County Tax Assessors' Office. The forms typically require detailed information about the property, including any recent improvements or changes, as well as comparative data from similar properties in the area.

Once the appeal is filed, the Board of Equalization will review the case and may request additional information or documentation. The homeowner will have the opportunity to present their case and provide evidence to support their appeal. The Board will then make a decision, which can be further appealed to the Superior Court if necessary.

Property Tax Relief Programs

Chatham County recognizes the financial burden that property taxes can impose on certain homeowners, especially those with limited incomes. To provide relief, the county offers several property tax relief programs that can help eligible homeowners reduce their tax obligations.

Keep Savannah Beautiful (KSB) Property Tax Relief

The Keep Savannah Beautiful (KSB) Property Tax Relief program is a unique initiative designed to encourage and reward homeowners who actively contribute to the beautification and preservation of their neighborhoods. This program offers a property tax credit to eligible homeowners who participate in community improvement projects, such as neighborhood clean-up events, tree planting initiatives, or historic preservation efforts.

To qualify for the KSB tax relief, homeowners must meet specific criteria, including being a resident of Chatham County, owning the property as their primary residence, and actively participating in approved community improvement projects. The tax credit is calculated based on the homeowner's involvement and the impact of their contributions.

For example, a homeowner who dedicates 50 hours of volunteer work to community improvement projects may be eligible for a tax credit of up to $500. This credit is applied to their annual property tax bill, reducing the amount they owe.

Low-Income Property Tax Relief

Chatham County also offers a low-income property tax relief program to assist homeowners with limited incomes. This program provides a partial or full exemption from property taxes for eligible low-income homeowners. To qualify, homeowners must meet certain income thresholds and own the property as their primary residence.

The low-income tax relief program aims to ensure that low-income homeowners are not disproportionately burdened by property taxes. It helps to maintain affordable housing options within the county and supports the financial stability of vulnerable households.

Conclusion: Navigating Property Taxes in Chatham County

Understanding the property tax system in Chatham County is crucial for homeowners, investors, and anyone with an interest in the local real estate market. From the assessment process to the various exemptions and relief programs, there are numerous factors to consider when it comes to property taxes.

By staying informed about the latest tax rates, due dates, and available exemptions, homeowners can effectively manage their property tax obligations. The Chatham County government and its various departments provide valuable resources and assistance to taxpayers, ensuring a fair and transparent tax system. With the right knowledge and proactive approach, navigating property taxes in Chatham County can be a straightforward and manageable process.

How often are property taxes assessed in Chatham County?

+Property taxes in Chatham County are assessed annually. The assessed value of a property is reviewed and updated each year to reflect any changes in the property’s value due to improvements, renovations, or market fluctuations.

Can I appeal my property tax assessment if I disagree with it?

+Yes, homeowners have the right to appeal their property tax assessment if they believe it is incorrect or unfair. The appeal process involves submitting an appeal to the Chatham County Board of Equalization, providing supporting evidence, and attending a hearing to present their case.

Are there any property tax exemptions available for seniors in Chatham County?

+Yes, Chatham County offers a senior citizen discount for homeowners who are 65 years of age or older. This discount reduces the millage rate for eligible seniors, resulting in lower property taxes. Income requirements and primary residence criteria must be met to qualify.

What happens if I miss the property tax payment deadline?

+Missing the property tax payment deadline can result in late fees and penalties. It’s important to stay informed about the due dates and make timely payments to avoid additional charges. The Chatham County Tax Commissioner’s Office provides various payment options for convenience.

How can I stay updated on the latest property tax information in Chatham County?

+To stay informed about property taxes in Chatham County, homeowners can regularly visit the official websites of the Chatham County Tax Commissioner’s Office and the Chatham County Tax Assessors’ Office. These websites provide up-to-date information on tax rates, due dates, exemptions, and other relevant resources.