Marginal Tax Rate Meaning

The concept of marginal tax rates is an integral part of understanding one's financial obligations to the government and planning personal finances effectively. A marginal tax rate is not just a percentage, but a key indicator that influences how individuals and businesses approach their income, investments, and overall financial strategies. In this comprehensive guide, we will delve into the world of marginal tax rates, exploring their meaning, implications, and how they impact individuals and the economy at large.

Unraveling the Concept of Marginal Tax Rates

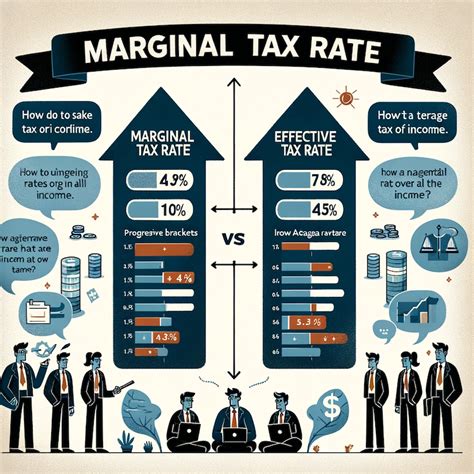

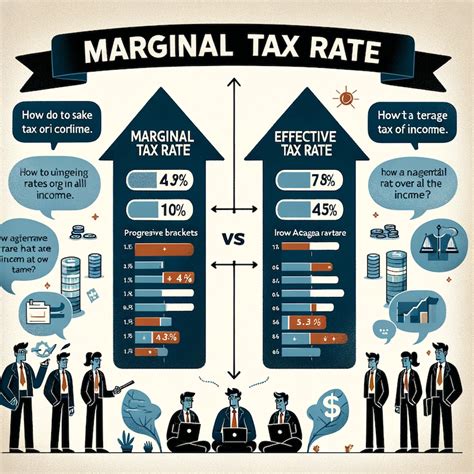

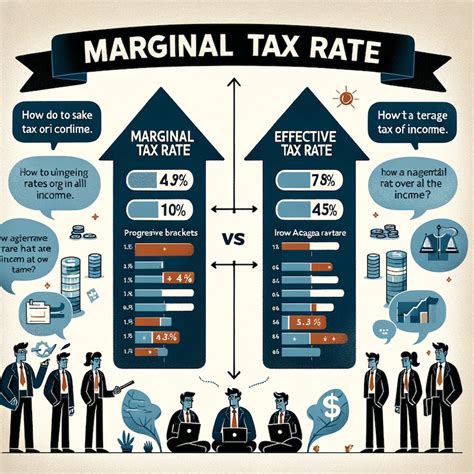

At its core, the marginal tax rate represents the percentage of tax an individual or entity pays on their next dollar of taxable income. This rate is applied to the highest income bracket an earner falls into, hence the term “marginal.”

Unlike average tax rates, which consider the overall tax paid as a proportion of total income, marginal tax rates focus on the tax rate applicable to the additional income earned. This distinction is crucial as it directly influences financial decision-making, particularly regarding earning more or investing.

The Significance of Marginal Tax Rates

Marginal tax rates hold significant implications for individuals and businesses, shaping financial behaviors and strategies. For instance, a higher marginal tax rate can discourage individuals from pursuing additional income, as a larger portion of their earnings will be directed towards taxes.

Conversely, a lower marginal tax rate can incentivize individuals to work more or explore investment opportunities, as they retain a greater proportion of their earnings. This dynamic can influence everything from career choices to savings and investment strategies.

Understanding Tax Brackets and Rates

Tax brackets are a fundamental component of the tax system, defining the boundaries within which marginal tax rates apply. These brackets are established by tax authorities and typically consist of a series of income ranges, each associated with a specific tax rate.

For instance, consider the following simplified tax bracket structure:

| Tax Bracket | Income Range | Marginal Tax Rate |

|---|---|---|

| 1 | Up to $10,000 | 10% |

| 2 | $10,001 - $20,000 | 15% |

| 3 | $20,001 - $50,000 | 20% |

| 4 | Over $50,000 | 25% |

In this example, if an individual's taxable income falls within the third bracket ($20,001 - $50,000), their marginal tax rate would be 20%. This means that any additional income earned beyond $20,000 will be taxed at this rate.

Progressive Tax Systems

Many tax systems, including those in the United States and several other countries, follow a progressive tax structure. This means that as income increases, so does the marginal tax rate, ensuring that those with higher incomes contribute a larger proportion of their earnings to the government.

Progressive tax systems aim to promote social and economic equality, redistribute wealth, and fund government programs and services. They also encourage individuals to plan their finances strategically, often leading to the exploration of tax-efficient savings and investment options.

Marginal Tax Rates and Financial Planning

The knowledge of marginal tax rates is invaluable for individuals aiming to optimize their financial strategies. It allows for informed decisions regarding income generation, savings, and investments.

Income Generation and Tax Efficiency

Individuals can strategically plan their income generation to fall within specific tax brackets, thereby optimizing their tax liabilities. For instance, earning just enough to reach the next higher tax bracket can result in a substantial tax difference, especially when considering the progressive nature of many tax systems.

Moreover, understanding marginal tax rates can influence decisions regarding bonus structures, overtime pay, and other income-boosting opportunities. For instance, an individual may choose to decline additional income if it pushes them into a higher tax bracket, particularly if the net gain is minimal.

Savings and Investment Strategies

Knowledge of marginal tax rates also plays a pivotal role in savings and investment planning. Tax-advantaged accounts, such as 401(k)s or IRAs, offer opportunities to reduce taxable income in the present while providing tax benefits for the future.

For instance, contributing to a traditional IRA allows individuals to deduct contributions from their taxable income, effectively reducing their current tax liability. This strategy is particularly beneficial for those in higher tax brackets, as it lowers their marginal tax rate and defers taxes until retirement, when they may be in a lower bracket.

Impact on Investment Decisions

Marginal tax rates also influence investment decisions, particularly when considering the tax implications of different investment vehicles. For instance, capital gains taxes can vary depending on the holding period of an investment, with long-term gains often taxed at a lower rate.

Understanding these nuances can guide investment choices, encouraging individuals to consider not just potential returns, but also the tax efficiency of their investments. This strategic approach can lead to more substantial net gains over time.

The Impact on the Economy

Marginal tax rates are not just an individual concern, but also have broader implications for the economy as a whole. They influence consumer behavior, business strategies, and overall economic growth.

Consumer Behavior and Spending Patterns

High marginal tax rates can discourage individuals from pursuing additional income, leading to reduced consumer spending. This, in turn, can impact businesses and the overall economy, particularly in consumer-driven sectors.

On the other hand, lower marginal tax rates can incentivize individuals to earn more and spend more, stimulating economic growth and creating a positive cycle of consumption and production.

Business Strategies and Economic Growth

Businesses also consider marginal tax rates when making strategic decisions. They influence investment choices, business expansion plans, and even the location of operations.

For instance, businesses may opt to locate in areas with lower tax rates to optimize their financial performance. This can lead to a concentration of economic activity in certain regions, impacting local economies and potentially creating imbalances.

Economic Inequality and Redistribution

Progressive tax systems, which often lead to higher marginal tax rates for higher earners, play a crucial role in addressing economic inequality. By redistributing wealth, these systems aim to create a more equitable society, providing resources for public services and social programs.

However, the implementation of such systems can be complex, requiring careful consideration of the potential impact on economic growth and individual incentives. Finding the right balance between progressive taxation and economic incentives is a continuous challenge for policymakers.

Conclusion

In conclusion, marginal tax rates are a fundamental aspect of the tax system, shaping financial decisions and strategies for individuals and businesses alike. They provide a framework for understanding the tax implications of earning additional income, saving, and investing.

By understanding marginal tax rates and their role in progressive tax systems, individuals can make informed financial choices, optimize their tax efficiency, and contribute to a more equitable and prosperous society.

FAQs

How does a marginal tax rate differ from an average tax rate?

+

The marginal tax rate refers to the tax rate applicable to an individual’s next dollar of taxable income, while the average tax rate is calculated as the total tax paid as a proportion of total income. In simpler terms, the marginal tax rate focuses on the tax rate for additional income, while the average tax rate represents the overall tax burden.

What is a progressive tax system, and how does it relate to marginal tax rates?

+

A progressive tax system is one where tax rates increase as income increases. This means that individuals with higher incomes pay a larger proportion of their income in taxes. Marginal tax rates are a key component of progressive tax systems, as they determine the tax rate applicable to the highest income bracket an individual falls into.

How can I use marginal tax rates to optimize my financial strategies?

+

Understanding marginal tax rates can help you make informed decisions about income generation, savings, and investments. For instance, you can strategically plan your income to fall within specific tax brackets to optimize your tax liabilities. Additionally, you can explore tax-advantaged accounts and investments to reduce your taxable income and maximize your net gains.