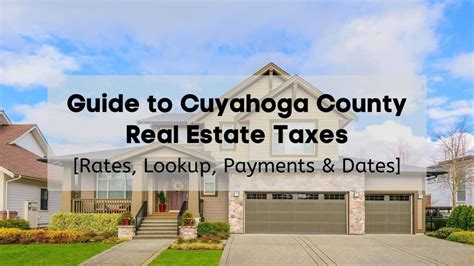

Lorain County Property Taxes

Welcome to an in-depth exploration of the Lorain County property tax system, where we delve into the intricacies of one of the essential aspects of homeownership. Property taxes are a crucial element in the real estate landscape, impacting both homeowners and prospective buyers. This comprehensive guide will provide an insightful breakdown of the Lorain County property tax process, including how it is calculated, paid, and its implications for local residents.

Understanding Lorain County Property Taxes

Lorain County, nestled in the northeastern part of Ohio, employs a unique property tax system that is integral to its economic framework. This system, much like in other counties, plays a pivotal role in funding essential services like education, public safety, and infrastructure development. As such, understanding the property tax landscape is not just beneficial for financial planning but also for comprehending the county’s overall fiscal health and community initiatives.

Tax Assessment Process

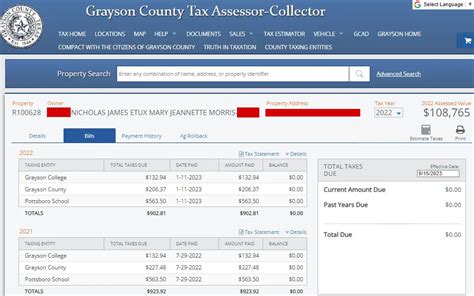

The journey of property taxation in Lorain County begins with a thorough assessment of each property. This process is typically conducted by the Lorain County Auditor’s Office, which determines the market value of properties based on recent sales data, property improvements, and other factors. The assessed value is then subjected to a tax rate, which is determined by the county, city, and school district where the property is located.

| Assessment Category | Description |

|---|---|

| Market Value Assessment | Determining the property's worth based on current market trends and recent sales. |

| Tax Rate Determination | Calculating the rate by which the assessed value is taxed, considering county, city, and school district needs. |

Tax Rates and Calculations

The property tax rate in Lorain County is not a flat rate but varies depending on the location and the type of property. The tax rate is expressed as a millage rate, where one mill is equivalent to one-tenth of a cent. For instance, a millage rate of 100 mills translates to 1.00 for every 1,000 of assessed property value. This rate is applied to the assessed value of the property to calculate the annual property tax liability.

| Property Tax Calculation | Example Calculation |

|---|---|

| Millage Rate x Assessed Value = Tax Liability | 100 mills x $100,000 assessed value = $1,000 annual tax liability |

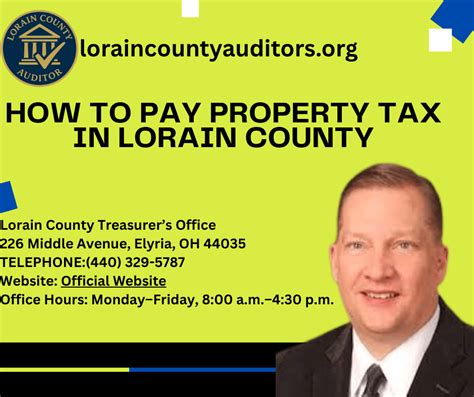

Tax Due Dates and Payment Options

In Lorain County, property taxes are due twice a year, typically in January and July. However, taxpayers have the flexibility to pay their taxes in full or opt for a semi-annual payment plan. The county provides several payment methods, including online payments, credit card payments, and traditional checks or money orders.

Tax Exemptions and Discounts

Lorain County offers a range of tax exemptions and discounts to eligible property owners. These include senior citizen discounts, veteran exemptions, and disability exemptions. Additionally, the county provides a homestead exemption for primary residences, reducing the taxable value of the property. These incentives are designed to support certain segments of the community and encourage homeownership.

Impact on Local Economy and Community

Property taxes are a significant revenue source for Lorain County, contributing to the overall economic vitality of the region. These funds are vital for maintaining and improving the quality of life for residents through investments in education, public safety, and community development projects.

Funding Essential Services

The revenue generated from property taxes goes towards funding a wide array of services, including:

- Public education: Supporting local schools and ensuring a quality learning environment for students.

- Public safety: Financing police, fire, and emergency services to keep the community safe.

- Infrastructure: Maintaining and developing roads, bridges, and other essential public infrastructure.

- Recreation and cultural programs: Funding parks, libraries, and community centers for residents’ enjoyment and enrichment.

Community Development and Investment

Beyond essential services, property tax revenue also plays a crucial role in community development and investment. This includes initiatives such as:

- Economic development: Attracting and supporting businesses to create jobs and boost the local economy.

- Housing initiatives: Programs to encourage homeownership and provide affordable housing options.

- Environmental projects: Efforts to preserve natural resources and promote sustainability.

- Community events: Funding for cultural festivals, sports events, and other community gatherings that foster a sense of belonging and unity.

Navigating the Lorain County Property Tax Landscape

Understanding the property tax system in Lorain County is an essential aspect of homeownership or investment in the area. It provides insight into the financial obligations and the impact of these taxes on the community. For those looking to purchase a property, this knowledge can be invaluable in budgeting and financial planning.

Resources for Homeowners

For homeowners in Lorain County, several resources are available to assist with property tax-related queries. The Lorain County Auditor’s Office provides detailed information on tax assessments, rates, and due dates. They also offer assistance in applying for exemptions or discounts for which homeowners may be eligible.

Future Outlook and Considerations

The property tax landscape in Lorain County is subject to change, influenced by various factors such as economic trends, population growth, and legislative decisions. As such, it is crucial for homeowners and prospective buyers to stay informed about these changes to make informed financial decisions.

How often are property tax assessments conducted in Lorain County?

+Property tax assessments in Lorain County are typically conducted every three years, but the Auditor's Office may conduct reassessments at any time if there are significant changes to a property.

Can property owners appeal their tax assessment?

+Yes, property owners who believe their assessment is inaccurate can file an appeal with the Lorain County Board of Revision within a specified timeframe. The process involves submitting evidence to support the appeal.

What happens if property taxes are not paid on time in Lorain County?

+Late payment of property taxes in Lorain County may result in penalties and interest charges. In severe cases, the county may place a lien on the property, and if taxes remain unpaid, the property could be subject to foreclosure.

In conclusion, the property tax system in Lorain County is a vital component of the local economy, supporting essential services and community development. Understanding this system is crucial for both homeowners and prospective buyers, offering clarity on financial obligations and the impact of these taxes on the community.