Utah State Tax

Utah's state tax system is an essential aspect of the state's financial framework, influencing the economic landscape and the lives of its residents. Understanding the intricacies of Utah's tax structure is crucial for individuals, businesses, and policymakers alike. This comprehensive guide aims to delve into the details of Utah's state tax, shedding light on its unique features, impact, and future prospects.

Utah’s State Tax: A Comprehensive Overview

Utah’s state tax system is a critical component of its economic framework, playing a pivotal role in funding public services, infrastructure development, and various state initiatives. With a unique blend of taxes and incentives, Utah has crafted a tax system that influences the state’s economic growth and competitiveness.

The Utah Income Tax

Utah’s income tax is a progressive system, meaning that higher income earners pay a larger percentage of their income in taxes. The state operates on a graduated rate structure, with five tax brackets ranging from 3.05% to 6.45%. This system ensures that those with higher incomes contribute a larger share, fostering a sense of fairness and equity.

For instance, consider a hypothetical scenario where an individual, let’s call them John, earns an annual income of 50,000. Based on Utah's tax brackets, John would fall into the 4.95% tax bracket, paying roughly 2,475 in state income tax. This amount is then used to support vital state functions, from education to healthcare.

Utah’s income tax system also offers various deductions and credits to reduce the tax burden on individuals and families. These include deductions for medical expenses, charitable contributions, and education-related expenses. Additionally, taxpayers can claim credits for having dependents, which further lowers their taxable income.

Sales and Use Tax

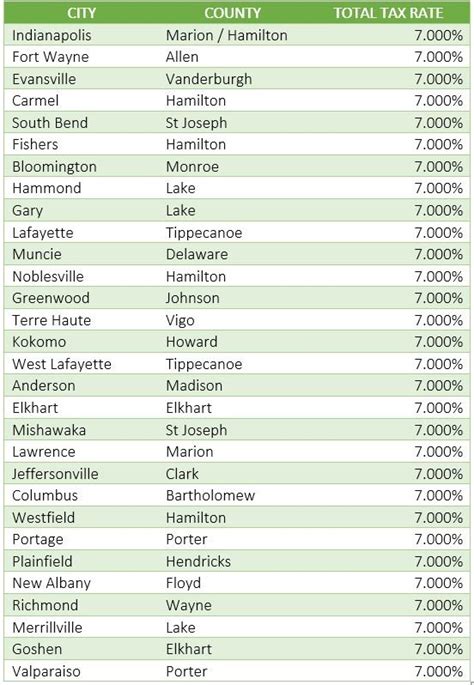

Utah imposes a sales and use tax on the sale of tangible personal property and certain services. The standard sales tax rate is 4.70%, with local jurisdictions having the authority to impose additional sales taxes, leading to variations across the state.

A unique aspect of Utah’s sales tax is the exemption for food items for home consumption. This exemption, though not applicable to prepared foods, soft drinks, and certain other items, provides a significant relief to households’ grocery bills. It’s a thoughtful measure that considers the financial well-being of Utah’s residents.

Utah also has a use tax, which applies to purchases made outside the state and brought into Utah. This ensures that all purchases are taxed fairly, regardless of where they are made, promoting a level playing field for local businesses.

Property Tax

Property taxes in Utah are levied on real and personal property, with the primary responsibility for administration and collection resting with local governments. The tax rate varies across jurisdictions, reflecting the diverse needs and financial realities of different communities.

Utah’s property tax system is designed to be equitable, with assessments based on fair market value. This ensures that property owners pay their fair share, contributing to the maintenance and development of their local communities. The revenue generated from property taxes is vital for funding essential services such as schools, emergency services, and local infrastructure projects.

One notable aspect of Utah’s property tax system is the homestead exemption. This provision allows homeowners to exempt a portion of their home’s value from taxation, providing a financial relief for homeowners and encouraging homeownership.

Other State Taxes

In addition to the aforementioned taxes, Utah levies several other taxes to support specific state programs and initiatives.

- Motor Vehicle Fuel Tax: This tax is imposed on the sale of motor vehicle fuels, with the revenue dedicated to maintaining and improving Utah’s transportation infrastructure.

- Severance Tax: Applied to the extraction of natural resources, the severance tax contributes to the state’s general fund and specific trust funds for environmental protection and natural resource conservation.

- Cigarette Tax: Utah imposes a tax on the sale of cigarettes, with the revenue allocated to healthcare programs, particularly those focused on tobacco prevention and cessation.

Impact and Analysis

Utah’s state tax system has a profound impact on the state’s economy and the well-being of its residents. By examining key performance indicators and analyzing various data points, we can gain valuable insights into the system’s effectiveness and potential areas for improvement.

Economic Growth and Revenue Generation

Utah’s state tax system plays a pivotal role in fueling economic growth and generating revenue for vital state functions. The progressive income tax structure ensures that higher-income earners contribute a larger share, promoting fairness and equity. This, in turn, provides a solid foundation for funding essential services such as education, healthcare, and infrastructure development.

The sales and use tax, while generating significant revenue, also influences consumer behavior and business decisions. The exemption for food items for home consumption, for instance, alleviates the tax burden on households, encouraging spending on other essential goods and services. This, in turn, stimulates economic activity and contributes to a thriving local economy.

Equity and Social Welfare

Utah’s tax system is designed with a focus on equity, ensuring that all residents contribute to the state’s financial health in a fair and balanced manner. The progressive income tax structure, with its graduated rates, ensures that those with higher incomes contribute a larger share, mitigating potential wealth disparities.

The state’s tax system also includes provisions that support social welfare and promote financial well-being. The homestead exemption, for instance, provides a significant relief for homeowners, encouraging homeownership and stability. Similarly, deductions and credits for medical expenses, charitable contributions, and education-related expenses further reduce the tax burden on individuals and families, ensuring that financial constraints do not hinder access to essential services.

Business Competitiveness and Incentives

Utah’s tax system is crafted with an eye on business competitiveness, offering a range of incentives to attract and retain businesses. The state’s relatively low corporate income tax rate, combined with targeted tax credits and exemptions, creates a favorable environment for business growth and investment.

For instance, Utah offers a Research and Development Tax Credit, encouraging businesses to invest in innovation and technology. This credit, combined with other incentives, has contributed to the state’s thriving technology sector and fostered a culture of entrepreneurship.

Additionally, Utah’s tax structure includes provisions for pass-through entities, such as S-corporations and LLCs, which allow for a more favorable tax treatment compared to traditional C-corporations. This has made Utah an attractive destination for small businesses and startups, further boosting economic growth and job creation.

Future Prospects and Considerations

As Utah’s economy continues to evolve and the state’s needs change, the tax system must adapt to ensure its continued effectiveness and fairness. Here are some key considerations for the future of Utah’s state tax system.

Modernization and Efficiency

With the rapid advancement of technology, Utah’s tax system can benefit from modernization and increased efficiency. Implementing digital solutions for tax filing and payment processes can streamline operations, reduce administrative burdens, and enhance transparency.

Furthermore, exploring options for electronic filing and payment systems can improve accuracy and speed, providing taxpayers with a more convenient and secure experience. This modernization effort can also reduce costs associated with manual processing, allowing for a more efficient allocation of resources.

Tax Policy and Economic Development

As Utah seeks to attract and retain businesses, a careful review of its tax policies is essential. While the current system offers competitive advantages, staying abreast of emerging trends and best practices is crucial. This includes monitoring tax structures in other states and regions, particularly those with similar economic profiles and goals.

By staying proactive and adaptable, Utah can ensure that its tax policies remain attractive to businesses, fostering continued economic growth and job creation. This may involve periodic reviews and adjustments to tax rates, incentives, and credits, ensuring that they remain relevant and effective in a dynamic business environment.

Equitable Taxation and Social Justice

Ensuring that Utah’s tax system remains equitable and promotes social justice is of paramount importance. This includes regular reviews of tax policies to identify and address any potential disparities or biases.

For instance, evaluating the impact of taxes on different income groups and communities can help identify areas where adjustments may be needed to maintain fairness. This could involve refining tax brackets, introducing new deductions or credits, or adjusting tax rates to ensure that the burden is distributed equitably across all residents.

Conclusion

Utah’s state tax system is a complex yet vital component of its economic framework, influencing the lives of its residents and the trajectory of its growth. By understanding the intricacies of this system, we can appreciate its impact on economic growth, social welfare, and business competitiveness.

As Utah continues to evolve and adapt to changing economic landscapes, its tax system must remain dynamic and responsive. Through ongoing analysis, modernization, and a commitment to fairness and social justice, Utah can ensure that its tax system remains a cornerstone of its prosperity and a model for other states to emulate.

What is the current sales tax rate in Utah?

+The standard sales tax rate in Utah is 4.70%. However, local jurisdictions may impose additional sales taxes, leading to variations across the state.

Are there any income tax deductions or credits available in Utah?

+Yes, Utah offers various deductions and credits to reduce the tax burden on individuals and families. These include deductions for medical expenses, charitable contributions, and education-related expenses. Additionally, taxpayers can claim credits for having dependents.

How does Utah’s property tax system work, and what is the homestead exemption?

+Property taxes in Utah are levied on real and personal property, with the primary responsibility for administration and collection resting with local governments. The tax rate varies across jurisdictions. The homestead exemption allows homeowners to exempt a portion of their home’s value from taxation, providing a financial relief for homeowners and encouraging homeownership.