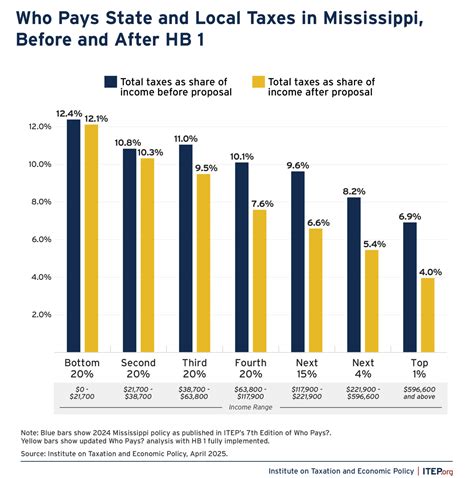

Mississippi Income Tax

Income taxes play a crucial role in shaping the financial landscape of any state, and Mississippi is no exception. With a unique tax system, Mississippi's income tax laws can have a significant impact on individuals and businesses alike. This article aims to delve into the intricacies of Mississippi's income tax, exploring its structure, rates, and how it compares to other states.

Understanding Mississippi’s Income Tax Structure

Mississippi’s income tax system is a vital component of its overall tax structure, contributing to the state’s revenue and influencing economic decisions. Unlike some states with progressive tax systems, Mississippi employs a flat tax rate, applying the same percentage to all taxable income levels.

The current flat tax rate in Mississippi for personal income tax is 4%, which is relatively low compared to many other states. This flat rate applies to all income earned within the state, including wages, salaries, dividends, and interest. The simplicity of this system means that calculating and filing taxes can be more straightforward for residents and businesses.

However, it's important to note that Mississippi also offers certain tax exemptions and deductions that can reduce the taxable income and, consequently, the tax liability. These exemptions and deductions vary based on factors such as income level, family size, and specific expenses, allowing taxpayers to optimize their tax positions.

Key Tax Exemptions and Deductions

Mississippi provides a range of tax exemptions and deductions that can significantly impact an individual’s or business’s tax liability. Some of the notable exemptions and deductions include:

- Personal Exemptions: Mississippi allows a personal exemption amount, which reduces taxable income. This exemption is typically available for each taxpayer, their spouse, and any qualifying dependents.

- Standard Deduction: Similar to the federal tax system, Mississippi offers a standard deduction that reduces taxable income by a set amount. This deduction is especially beneficial for taxpayers who don't have significant itemized deductions.

- Itemized Deductions: Taxpayers in Mississippi can opt for itemized deductions, which include expenses such as mortgage interest, state and local taxes, charitable contributions, and certain medical expenses. These deductions can further reduce taxable income.

- Retirement Savings: Contributions to certain retirement accounts, such as 401(k)s and IRAs, are often eligible for tax deductions, encouraging residents to save for their retirement years.

- Education Deductions: Mississippi recognizes the importance of education and provides tax deductions for qualified tuition and education expenses, helping residents invest in their future and that of their children.

These exemptions and deductions can make a substantial difference in an individual's or business's tax burden, highlighting the importance of understanding and utilizing these provisions effectively.

Comparative Analysis: Mississippi vs. Other States

When it comes to income taxes, Mississippi’s flat tax rate of 4% positions it among the states with the lowest income tax rates. This competitive rate can be an attractive feature for individuals and businesses considering relocation or expansion.

To illustrate the comparative landscape, let's take a look at how Mississippi's income tax rates stack up against a few other states:

| State | Tax Rate | Tax Brackets |

|---|---|---|

| Mississippi | 4% (Flat Rate) | N/A |

| Texas | 0% (No Income Tax) | N/A |

| Florida | 0% (No Income Tax) | N/A |

| Nevada | 0% (No Income Tax) | N/A |

| South Dakota | 4.9% (Flat Rate) | N/A |

As seen in the table, Mississippi's flat tax rate of 4% is competitive, especially when compared to states like Texas, Florida, and Nevada, which have no income tax at all. However, it's worth noting that some states with higher tax rates may offer more extensive social services and infrastructure, which can influence the overall cost of living and business operations.

The Impact on Business and Economic Development

Mississippi’s income tax structure, particularly its low flat tax rate, can have a significant impact on business decisions and economic development within the state. The following are some key considerations:

- Attracting Businesses: The low tax rate can make Mississippi an appealing destination for businesses, especially those looking to reduce their tax liabilities. This can lead to increased investments, job creation, and economic growth.

- Competition for Talent: With a competitive tax rate, Mississippi can attract skilled workers and professionals who may prefer a state with lower income taxes. This talent pool can benefit local businesses and contribute to a thriving economy.

- Tax Incentives: Beyond the flat tax rate, Mississippi may offer additional tax incentives to specific industries or businesses. These incentives can further reduce tax burdens and encourage economic development in targeted sectors.

- Local Economy and Revenues: While a low tax rate can attract businesses and individuals, it also means that the state relies more heavily on other sources of revenue, such as sales tax and property tax. This balance is crucial for maintaining a healthy local economy and funding essential services.

In conclusion, Mississippi's income tax system, characterized by its flat 4% tax rate and a range of exemptions and deductions, plays a vital role in shaping the state's economic landscape. The competitive tax rate can be a significant advantage for businesses and individuals, contributing to economic growth and development. However, it's essential to consider the overall tax structure and how it aligns with the state's economic goals and the needs of its residents.

What are the income tax rates for businesses in Mississippi?

+Mississippi applies the same flat tax rate of 4% to businesses as it does to individuals. This rate applies to corporate income and other forms of business income, providing a straightforward tax structure for businesses operating in the state.

Are there any special tax incentives for specific industries in Mississippi?

+Yes, Mississippi offers various tax incentives and credits to attract and support specific industries. These incentives can include tax breaks for manufacturing, technology, and renewable energy sectors, among others. It’s advisable to consult with a tax professional or refer to the Mississippi Department of Revenue’s website for detailed information on these incentives.

How does Mississippi’s income tax system compare to neighboring states like Alabama or Louisiana?

+Mississippi’s flat tax rate of 4% is lower than Alabama’s, which has a progressive tax system with rates ranging from 2% to 5%. Louisiana, on the other hand, has a higher top marginal tax rate of 6% for incomes above $100,000. Mississippi’s flat rate can make it more attractive for individuals and businesses seeking a simpler and more predictable tax environment.