Hartford Tax Collector Ct

The role of the Hartford Tax Collector in Connecticut is a crucial position within the city's administration, responsible for ensuring the efficient collection of taxes and managing various financial aspects related to property ownership and municipal services. This article aims to delve into the specific duties, responsibilities, and processes overseen by the Hartford Tax Collector, shedding light on the essential functions that contribute to the city's financial health and stability.

Duties and Responsibilities of the Hartford Tax Collector

The Hartford Tax Collector is tasked with a comprehensive set of duties that are integral to the city’s fiscal operations. Here’s an in-depth look at these responsibilities:

Tax Assessment and Collection

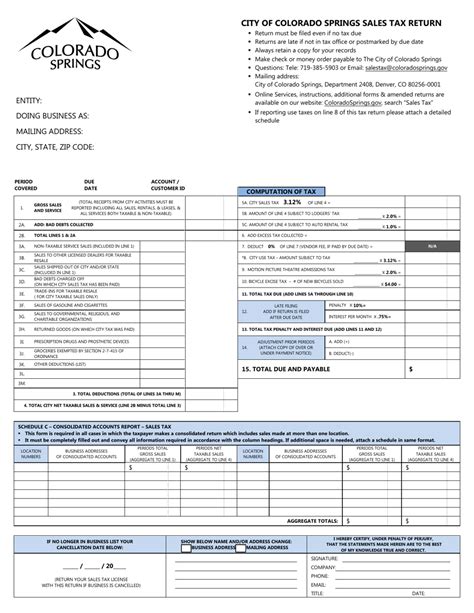

One of the primary roles is to assess and collect property taxes from Hartford residents and businesses. This involves a meticulous process of evaluating property values, issuing tax bills, and ensuring timely payments. The tax collector’s office maintains records of all taxable properties, tracks ownership changes, and calculates tax liabilities based on assessed values and applicable tax rates.

To facilitate tax collection, the office provides various payment options, including online payments, mail-in payments, and in-person payments at designated locations. The tax collector also works closely with property owners to address any concerns or disputes regarding tax assessments, ensuring a fair and transparent process.

Delinquent Tax Enforcement

When taxpayers fail to meet their tax obligations, the Hartford Tax Collector’s office takes a proactive approach to enforce payment. This includes sending reminder notices, initiating collection actions, and, if necessary, pursuing legal remedies to recover delinquent taxes. The office aims to strike a balance between taxpayer compliance and maintaining a positive relationship with the community.

Tax Relief Programs

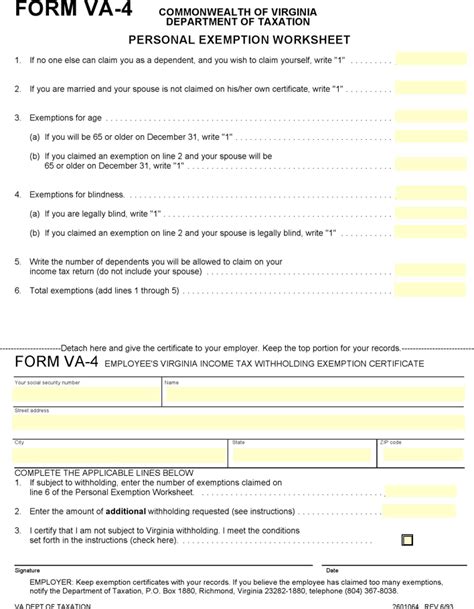

Recognizing the financial challenges faced by some residents, the tax collector’s office administers various tax relief programs. These programs may include property tax exemptions for seniors, veterans, or individuals with disabilities. The office provides information and guidance to eligible residents, ensuring they can access the relief they are entitled to.

Property Lien Management

In cases of prolonged tax delinquency, the Hartford Tax Collector’s office places liens on properties. A lien is a legal claim against a property that can hinder its sale or transfer until the tax debt is resolved. The office maintains a record of all liens, ensuring they are properly recorded and released upon tax payment.

Public Auction of Delinquent Properties

As a last resort, the tax collector’s office may auction off properties with outstanding tax debts. These auctions are public events where properties are sold to the highest bidder, with the proceeds going towards clearing the tax debt. The office manages the entire auction process, including advertising, bidder registration, and the actual sale.

Budget and Revenue Management

The Hartford Tax Collector plays a vital role in the city’s financial planning and budgeting process. They provide accurate revenue projections based on tax assessments and collection trends, helping the city allocate resources effectively. The office also monitors revenue streams and works closely with other departments to ensure financial stability and accountability.

Public Outreach and Education

To foster a culture of tax compliance and awareness, the tax collector’s office engages in public outreach initiatives. This includes hosting information sessions, participating in community events, and providing educational resources to taxpayers. By promoting transparency and understanding, the office aims to minimize tax-related issues and foster a positive relationship with the community.

The Impact of Efficient Tax Collection

The work of the Hartford Tax Collector has a profound impact on the city’s overall financial health and its ability to provide essential services. Efficient tax collection ensures that the city has a stable revenue stream to fund critical initiatives such as infrastructure development, public safety, education, and social services. It also contributes to the city’s creditworthiness, attracting investment and fostering economic growth.

Financial Stability and Economic Development

A well-managed tax collection system instills confidence in investors and businesses, encouraging economic development and job creation. When taxpayers have a positive experience with the tax collection process, it promotes a culture of compliance and trust in the city’s financial management. This, in turn, can lead to increased investment, business expansion, and a thriving local economy.

Efficient Service Delivery

The revenue generated through efficient tax collection directly supports the delivery of essential services to Hartford residents. These services encompass a wide range of areas, including public safety, emergency response, healthcare, education, and social programs. By ensuring a steady flow of revenue, the tax collector’s office enables the city to allocate resources effectively, improving the overall quality of life for residents.

Community Engagement and Trust

The Hartford Tax Collector’s office understands the importance of building and maintaining trust with the community. By offering transparent and accessible services, the office fosters a sense of confidence and cooperation among taxpayers. This trust is essential for the long-term sustainability of the city’s financial health and ensures that residents feel invested in the city’s success.

The Future of Tax Collection in Hartford

As technology continues to advance, the Hartford Tax Collector’s office is embracing innovative solutions to enhance its operations. Here’s a glimpse into the future of tax collection in Hartford:

Digital Transformation

The office is actively working towards a digital transformation, implementing online platforms and mobile apps for taxpayers to access their accounts, make payments, and receive real-time updates. This shift towards digital services not only improves convenience but also enhances data security and efficiency.

Data Analytics and Predictive Modeling

By leveraging advanced data analytics, the tax collector’s office can identify trends, predict tax collection outcomes, and optimize resource allocation. Predictive modeling can help identify potential tax delinquencies, allowing the office to take proactive measures to prevent non-compliance and ensure timely payments.

Partnerships and Collaboration

The Hartford Tax Collector’s office recognizes the value of collaboration with other city departments and external partners. By working together, these entities can streamline processes, share best practices, and improve overall efficiency. This collaborative approach can lead to innovative solutions and a more holistic approach to tax collection and financial management.

Community Feedback and Improvement

The office actively seeks feedback from taxpayers and community members to identify areas for improvement. By listening to the concerns and suggestions of residents, the tax collector’s office can enhance its services, address pain points, and create a more user-friendly and efficient tax collection system.

Training and Professional Development

To stay abreast of industry best practices and technological advancements, the Hartford Tax Collector’s office invests in continuous training and professional development for its staff. This ensures that employees are equipped with the skills and knowledge needed to deliver high-quality services and adapt to changing dynamics in the field of tax collection.

Conclusion

The Hartford Tax Collector’s office is a vital component of the city’s administrative framework, playing a pivotal role in maintaining financial stability and supporting the delivery of essential services. Through its comprehensive set of duties and responsibilities, the office ensures a fair and efficient tax collection process, fostering a culture of compliance and trust within the community. As the office embraces technological advancements and collaborative initiatives, it continues to enhance its operations, paving the way for a more sustainable and prosperous future for Hartford.

How can I make a tax payment to the Hartford Tax Collector?

+Taxpayers can make payments online through the Hartford Tax Collector’s website, by mail, or in person at designated payment locations. The office accepts various payment methods, including credit cards, debit cards, and e-checks.

What happens if I fail to pay my property taxes on time?

+Delinquent taxpayers may receive reminder notices and face late fees. If taxes remain unpaid, the Hartford Tax Collector’s office may initiate collection actions, including placing liens on properties and, in extreme cases, auctioning off properties to recover the tax debt.

Are there any tax relief programs available for eligible residents?

+Yes, the Hartford Tax Collector’s office administers various tax relief programs, including property tax exemptions for seniors, veterans, and individuals with disabilities. To find out if you are eligible, you can contact the office or visit their website for more information.

How can I stay informed about tax-related matters in Hartford?

+The Hartford Tax Collector’s office provides regular updates and announcements on its website. Additionally, they engage in public outreach initiatives, participate in community events, and offer educational resources to keep taxpayers informed about tax-related matters.

What steps is the office taking to modernize its operations?

+The office is actively pursuing digital transformation, implementing online platforms and mobile apps for taxpayers. They are also leveraging data analytics to improve efficiency and exploring partnerships to enhance overall service delivery.