Sales Tax Philadelphia

Sales tax is an essential component of the tax system in the United States, and it plays a crucial role in generating revenue for state and local governments. Philadelphia, being the largest city in Pennsylvania, has a unique sales tax structure that influences the economic landscape of the region. This article aims to delve into the intricacies of sales tax in Philadelphia, providing an in-depth analysis of its rates, exemptions, and impact on businesses and consumers.

Understanding Sales Tax in Philadelphia

Sales tax in Philadelphia operates as a percentage of the sale price of certain goods and services. It is a vital source of revenue for the city, contributing to the funding of essential public services and infrastructure projects. The tax rate can vary depending on the type of product or service and the location of the transaction. In Philadelphia, the sales tax system is designed to be progressive, ensuring a fair distribution of tax obligations among residents and businesses.

Sales Tax Rates in Philadelphia

The sales tax rate in Philadelphia consists of a combination of state, county, and city taxes. As of [insert latest available data], the total sales tax rate in Philadelphia is [specific percentage]. This rate is composed of a state sales tax of [state tax percentage], a county sales tax of [county tax percentage], and a city sales tax of [city tax percentage]. These rates are subject to change, and it is essential for businesses and consumers to stay updated with the latest tax information.

For example, let's consider a hypothetical purchase of a laptop worth $1,000 in Philadelphia. With a total sales tax rate of [specific percentage], the buyer would incur a sales tax amount of approximately $[tax amount], making the total cost of the laptop $1,0[total cost]. This illustrates how sales tax can significantly impact the final cost of goods for consumers.

| Tax Component | Rate |

|---|---|

| State Sales Tax | [state tax percentage] |

| County Sales Tax | [county tax percentage] |

| City Sales Tax | [city tax percentage] |

| Total Sales Tax | [specific percentage] |

Sales Tax Exemptions and Categories

Not all goods and services are subject to sales tax in Philadelphia. The city has implemented various exemptions to promote certain industries and support specific causes. These exemptions can significantly impact the tax obligations of businesses and the purchasing power of consumers.

- Food and Beverage Exemptions: Philadelphia offers exemptions on unprepared food items, such as fresh produce, bakery goods, and dairy products. This exemption aims to encourage healthy eating habits and support local farmers and food producers. However, it is important to note that prepared foods, including restaurant meals and take-out items, are subject to sales tax.

- Clothing and Footwear Exemptions: Philadelphia provides tax exemptions on clothing and footwear purchases up to a certain value. This initiative aims to ease the financial burden on families and promote consumer spending. The exemption applies to items like shirts, dresses, shoes, and accessories, making it more affordable for residents to purchase essential clothing items.

- Educational and Cultural Exemptions: To encourage access to education and cultural experiences, Philadelphia exempts sales tax on various educational materials and cultural event tickets. This includes textbooks, school supplies, museum admissions, and concert tickets. By removing the sales tax on these items, the city aims to promote intellectual and artistic pursuits.

It is essential for businesses to understand these exemptions and accurately apply them to their sales transactions. Misapplication of exemptions can lead to legal consequences and financial penalties. Additionally, consumers should be aware of these exemptions to make informed purchasing decisions and maximize their savings.

Impact on Businesses and Consumers

Sales tax in Philadelphia has a significant impact on both businesses and consumers. For businesses, it influences pricing strategies, operational costs, and overall profitability. The tax rate can affect the competitiveness of local businesses compared to online retailers or neighboring states with lower tax rates.

Businesses and Sales Tax Compliance

Businesses operating in Philadelphia are responsible for collecting and remitting sales tax to the appropriate authorities. This process involves registering with the state and local tax agencies, accurately calculating and collecting tax on each transaction, and submitting regular tax returns. Non-compliance with sales tax regulations can result in severe penalties, including fines and legal action.

To ensure compliance, businesses often utilize accounting software and tax calculation tools. These tools help automate the sales tax collection process, reducing the risk of errors and ensuring accurate tax reporting. Additionally, businesses may seek the expertise of tax professionals or consult with legal advisors to navigate the complex sales tax regulations and stay updated with any changes.

Consumer Perspectives and Spending Power

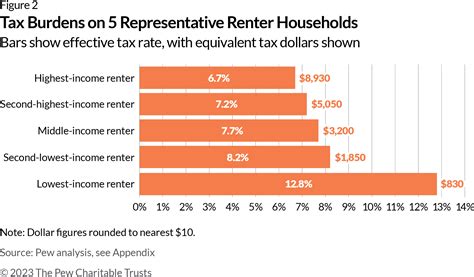

Sales tax directly affects consumers’ purchasing power and decision-making. The tax rate can influence their ability to afford certain goods and services, especially for lower-income households. However, the exemptions and progressive tax structure in Philadelphia aim to alleviate some of these financial burdens.

For instance, the food and beverage exemptions mentioned earlier can significantly impact a family's grocery budget. By eliminating sales tax on essential food items, consumers can allocate their funds more efficiently, improving their overall financial well-being. Similarly, the clothing and footwear exemptions provide relief for families during back-to-school shopping or when purchasing necessary apparel.

Moreover, the educational and cultural exemptions promote access to knowledge and artistic experiences. By removing the sales tax barrier, consumers can more readily invest in their personal growth and enjoyment, benefiting the community as a whole.

Future Implications and Considerations

The sales tax system in Philadelphia is continually evolving, and several factors may influence its future trajectory.

Online Sales and E-Commerce

With the rise of e-commerce, online sales have become a significant aspect of the retail industry. Philadelphia, like many other cities, faces challenges in collecting sales tax from online retailers, especially those based in other states. This situation can create an uneven playing field for local businesses and impact the city’s tax revenue. As online sales continue to grow, finding effective solutions to collect sales tax from online transactions will be crucial for maintaining a fair and sustainable tax system.

Economic Growth and Development

Philadelphia’s economic growth and development can significantly impact the sales tax structure. As the city attracts new businesses and experiences population growth, the demand for public services and infrastructure may increase. To accommodate these needs, the sales tax rates might need to be adjusted to generate sufficient revenue. Additionally, changes in the city’s economic landscape, such as shifts in industry focus or the emergence of new sectors, could also influence the sales tax system.

Community Engagement and Advocacy

Community engagement plays a vital role in shaping the sales tax system in Philadelphia. Residents and businesses have a stake in advocating for tax policies that align with their interests and support the community’s well-being. By actively participating in public discussions and providing feedback, individuals can influence tax exemptions, rates, and the allocation of tax revenue for essential services.

Conclusion

Sales tax in Philadelphia is a complex yet essential component of the city’s economic landscape. It impacts businesses, consumers, and the overall community. By understanding the rates, exemptions, and their implications, stakeholders can make informed decisions and contribute to the city’s sustainable growth. As Philadelphia continues to evolve, staying informed and engaged in the sales tax discourse will be crucial for a prosperous and equitable future.

How often are sales tax rates updated in Philadelphia?

+Sales tax rates in Philadelphia are typically updated annually, effective from the start of the fiscal year. However, it is important to note that unexpected changes or amendments may occur throughout the year due to legislative decisions or other factors. Therefore, it is recommended to regularly check the official sources for the most up-to-date information on sales tax rates.

Are there any online resources to help businesses calculate and manage sales tax in Philadelphia?

+Yes, several online tools and resources are available to assist businesses in calculating and managing sales tax in Philadelphia. These resources include tax calculation software, online tax guides, and official websites of tax agencies. Utilizing these tools can help businesses ensure accurate tax compliance and streamline their tax management processes.

How can consumers stay informed about sales tax rates and exemptions in Philadelphia?

+Consumers can stay informed about sales tax rates and exemptions in Philadelphia by regularly checking the official websites of the Pennsylvania Department of Revenue and the City of Philadelphia’s tax authorities. These websites provide updated information on tax rates, exemptions, and any relevant changes or announcements. Additionally, consumers can subscribe to tax-related newsletters or follow reputable news sources that cover tax-related topics.