Oregon State Tax Rate

Welcome to our comprehensive guide on the Oregon State Tax Rate, a crucial aspect of understanding the financial landscape of this beautiful Pacific Northwest state. In this article, we delve into the intricacies of Oregon's tax system, offering a deep dive into its rates, structures, and implications for both residents and businesses. By the end of this read, you'll have a clear understanding of how Oregon's tax policies impact your financial decisions and overall economic well-being.

Unraveling the Oregon State Tax System

Oregon, known for its stunning natural beauty and progressive ideals, has crafted a unique tax system that reflects its values and priorities. Let’s break down the key components of this system and explore how it functions in practice.

Oregon’s Progressive Income Tax Structure

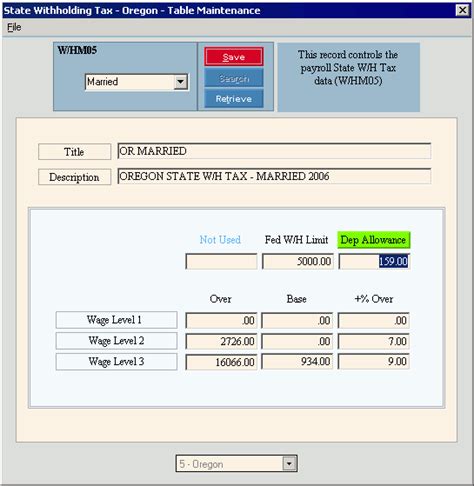

One of the defining features of Oregon’s tax landscape is its progressive income tax structure. This means that as your income increases, so does your tax rate. The state has implemented a graduated tax system with multiple tax brackets, ensuring fairness and contributing to a more equitable distribution of tax burdens.

Here’s a simplified breakdown of Oregon’s income tax brackets for the 2023 tax year:

| Tax Bracket | Tax Rate | Applicable Income Range |

|---|---|---|

| 1 | 5% | 0 - 4,000 |

| 2 | 5.05% | 4,001 - 7,500 |

| 3 | 5.9% | 7,501 - 125,000 |

| 4 | 7% | 125,001 - 250,000 |

| 5 | 9.9% | Over $250,000 |

These rates are subject to change annually, so it’s essential to refer to the latest Oregon Department of Revenue guidelines for the most accurate information.

Oregon Sales and Use Tax

Unlike many other states, Oregon does not impose a general sales tax. Instead, it relies on a use tax, which is applied to the purchase or use of tangible personal property. This tax is often levied on items purchased online or from out-of-state vendors, ensuring that Oregon residents contribute to the state’s revenue stream regardless of where they shop.

The use tax rate in Oregon mirrors the state’s income tax rate, currently set at 5%. However, it’s important to note that certain localities may impose additional taxes, bringing the total rate to a higher percentage.

Property Taxes in Oregon

Property taxes are a significant revenue source for Oregon’s local governments, including cities, counties, and school districts. These taxes are assessed on the value of real property, such as homes, businesses, and land.

The tax rate varies depending on the location and the specific taxing districts in which the property is situated. On average, the effective property tax rate in Oregon stands at approximately 1.14% of the property’s assessed value. This rate is calculated by dividing the total property tax revenue collected by the total assessed value of all taxable properties.

Corporate and Business Taxes

Oregon imposes a corporate excise tax on businesses operating within the state. This tax is calculated based on a company’s taxable income, and the rate varies depending on the business’s legal structure and income level. For most corporations, the rate is 6.6%, while sole proprietors and partnerships are subject to a 6.6% rate on their net income.

Additionally, Oregon has implemented a minimum business income tax to ensure that even low-income businesses contribute to the state’s revenue. This minimum tax is set at 150</strong> for corporations and <strong>50 for sole proprietors and partnerships.

Special Taxes and Exemptions

Oregon’s tax system also includes various special taxes and exemptions. For instance, the state levies a timber excise tax on timber harvested from private lands, supporting the forestry industry and conservation efforts. Additionally, Oregon offers a range of tax incentives and credits to encourage economic development and support specific industries.

The Impact of Oregon’s Tax Policies

Oregon’s tax system has a profound impact on the state’s economy and the financial well-being of its residents. By implementing a progressive income tax structure, the state ensures that higher-income earners contribute a larger share of their income, promoting economic fairness.

The absence of a general sales tax makes Oregon an attractive destination for shoppers, especially those who frequently make online purchases. This tax structure also benefits businesses, as it simplifies tax compliance and reduces administrative burdens.

Property taxes, while variable, contribute significantly to the funding of essential services such as education, public safety, and infrastructure. The corporate and business taxes, coupled with the minimum income tax, help ensure that businesses of all sizes contribute to the state’s revenue, fostering a balanced economic environment.

Navigating Oregon’s Tax Landscape

Understanding Oregon’s tax system is crucial for both individuals and businesses operating within the state. By staying informed about the latest tax rates, brackets, and exemptions, you can make more informed financial decisions and ensure compliance with the state’s tax regulations.

Here are some key takeaways and resources to help you navigate Oregon’s tax landscape:

- Stay updated on the latest tax rates and guidelines by regularly visiting the Oregon Department of Revenue website.

- Seek professional tax advice to ensure you’re taking advantage of all applicable tax credits and deductions.

- Explore Oregon’s tax incentives and credits, especially if you’re a business owner, to reduce your tax liability.

- Familiarize yourself with the state’s tax forms and filing requirements to streamline the tax preparation process.

Frequently Asked Questions

What is Oregon’s income tax rate for the current tax year?

+For the 2023 tax year, Oregon’s income tax rates range from 5% to 9.9%, depending on your income bracket. It’s a progressive system, meaning the rate increases as your income rises.

Are there any sales taxes in Oregon?

+No, Oregon does not have a general sales tax. Instead, it relies on a use tax, which is applied to the purchase or use of tangible personal property, including online purchases.

How do I calculate my property taxes in Oregon?

+Property taxes in Oregon are based on the assessed value of your property. You can estimate your property taxes by multiplying your property’s assessed value by the applicable tax rate, which varies by location.

Are there any tax incentives for businesses in Oregon?

+Yes, Oregon offers a range of tax incentives and credits to encourage business growth and investment. These include the Business Energy Tax Credit, Research and Development Tax Credit, and the Enterprise Zone Program, among others.