Disability Tax Credit Canada

The Disability Tax Credit (DTC) in Canada is a vital program designed to provide financial support and encourage inclusivity for individuals with disabilities. This comprehensive guide aims to explore the intricacies of the DTC, shedding light on its eligibility criteria, application process, and the wide-ranging benefits it offers to Canadians facing various disabilities.

Understanding the Disability Tax Credit

The Disability Tax Credit is a non-refundable tax credit available to individuals who have severe and prolonged physical or mental impairments, or who have conditions that limit their ability to perform basic daily activities. It aims to alleviate some of the financial burdens associated with disability-related expenses and promotes equal access to opportunities.

The Canadian government recognizes that living with a disability often requires additional costs, such as specialized equipment, accessible transportation, or personal support services. The DTC aims to offset these expenses and provide individuals with the necessary resources to lead fulfilling lives.

Eligibility Criteria

To be eligible for the Disability Tax Credit, individuals must meet specific criteria outlined by the Canada Revenue Agency (CRA). The disability must be severe and prolonged, lasting or expected to last for a minimum of one year. It should also significantly impair one or more of the following:

- Walking

- Feeding oneself

- Dressing

- Performing the basic functions of daily life

- Speaking

- Hearing

- Seeing

- Elimination (using the toilet)

- Mental functions

- Ability to exclude the effects of substances

Additionally, individuals with anxiety disorders, autism spectrum disorders, or other mental health conditions may also qualify if their symptoms meet the severity and duration requirements.

It's important to note that the DTC is not restricted to any particular age group; both children and adults with qualifying disabilities can apply and benefit from this program.

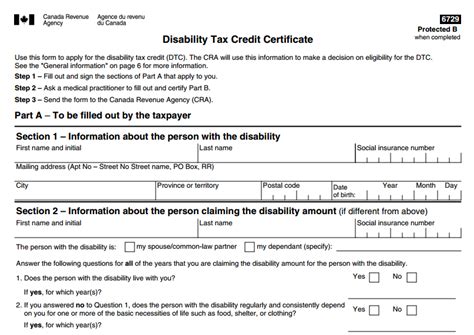

Application Process

The application process for the Disability Tax Credit involves several steps, ensuring a thorough assessment of each applicant's unique situation. Here's a simplified breakdown:

- Medical Practitioner's Certification: Applicants must have their disability certified by a qualified medical practitioner, such as a doctor or specialist. The practitioner completes a form (T2201) detailing the nature of the disability and its impact on the individual's daily life.

- Form Completion: Applicants then fill out the appropriate tax forms, such as the T1 General Income Tax and Benefit Return, including the disability-related sections. This step involves providing detailed information about their disability, expenses, and any relevant support services.

- Supporting Documentation: Along with the completed forms, applicants must submit supporting documents. This may include medical records, prescription histories, or reports from therapists or support workers.

- Submission: The completed forms and supporting documents are then submitted to the CRA, either online through the My Account portal or by mail.

- Review and Approval: The CRA reviews the application, considering the medical practitioner's certification and the provided evidence. If the application meets the eligibility criteria, the CRA will approve the Disability Tax Credit and calculate the applicable amount.

Benefits of the Disability Tax Credit

The Disability Tax Credit offers a range of benefits that extend beyond financial relief, enhancing the overall quality of life for individuals with disabilities and their families.

Financial Support

The primary benefit of the DTC is the financial assistance it provides. The credit amount varies depending on the severity of the disability and the individual's tax situation. For those with severe and prolonged disabilities, the credit can significantly reduce their tax liability, resulting in a substantial refund or a reduced tax bill.

| Tax Year | Maximum Disability Tax Credit Amount |

|---|---|

| 2022 | $8,723 |

| 2023 (Projected) | $8,949 |

Additionally, individuals with disabilities may also be eligible for other tax benefits, such as the Child Disability Benefit and the Canada Caregiver Credit, further reducing their tax burden.

Access to Support Services

The DTC encourages individuals with disabilities to seek and utilize necessary support services. This includes access to assistive devices, home modifications, personal support workers, and specialized therapies. By offsetting the costs associated with these services, the DTC promotes independence and improves overall well-being.

Inclusion and Equality

At its core, the Disability Tax Credit promotes inclusivity and equality. It ensures that individuals with disabilities have the resources to participate fully in society, pursue education and employment opportunities, and lead active lives. The program recognizes that disability should not be a barrier to accessing the same rights and privileges as other Canadians.

Planning for the Future

The DTC can also be a valuable tool for long-term financial planning. Individuals can carry forward unused disability tax credits for up to ten years, allowing them to offset future tax liabilities or receive larger refunds when their circumstances change.

Real-Life Impact

The Disability Tax Credit has had a profound impact on the lives of countless Canadians with disabilities. Here's a glimpse into some real-life scenarios where the DTC made a difference:

- John, a young adult with cerebral palsy, was able to purchase a specialized wheelchair and adapt his home to accommodate his mobility needs, thanks to the financial support received through the DTC.

- Sarah, a single mother with multiple sclerosis, used the DTC to hire a personal support worker, ensuring her independence and allowing her to continue working and caring for her children.

- Michael, a student with autism, was granted access to specialized educational support and assistive technologies, enabling him to excel academically and pursue his dreams.

FAQs

Can I apply for the Disability Tax Credit if I'm not currently working due to my disability?

+Yes, the DTC is not restricted to individuals who are currently employed. As long as you meet the eligibility criteria, you can apply regardless of your employment status.

How often do I need to renew my Disability Tax Credit?

+Once approved, the DTC is typically valid for a lifetime, as long as your disability remains severe and prolonged. However, it's important to inform the CRA of any significant changes to your condition or circumstances.

Can I apply for the Disability Tax Credit on behalf of my child with a disability?

+Absolutely! Parents or legal guardians can apply for the DTC on behalf of their dependent children with disabilities. The process is similar, and the credit can significantly benefit the child's well-being and future.

Are there any age restrictions for applying for the Disability Tax Credit?

+No, the DTC is available to individuals of all ages, from children to seniors. As long as the disability meets the eligibility criteria, age is not a factor in the application process.

The Disability Tax Credit is a crucial initiative that embodies Canada’s commitment to inclusivity and equal opportunities for all. By providing financial support and encouraging access to necessary services, the DTC empowers individuals with disabilities to overcome challenges and lead fulfilling lives.