Gasoline Tax Illinois

The gasoline tax, also known as the fuel tax or gas excise tax, is an essential component of the revenue system in many states, including Illinois. It plays a crucial role in funding transportation infrastructure projects and maintaining the state's road network. This article delves into the specifics of the gasoline tax in Illinois, exploring its history, current rates, and its impact on both residents and the state's economy.

A Historical Perspective on Gasoline Taxation in Illinois

The imposition of a gasoline tax in Illinois dates back to the early 20th century, reflecting the growing importance of automobiles and the need for well-maintained roads. The tax has since evolved, with various adjustments made over the years to meet the changing demands of the state’s infrastructure and to keep up with the rising costs of road construction and maintenance.

One of the earliest iterations of the gasoline tax in Illinois was implemented in the 1920s, with the tax rate set at a modest 2 cents per gallon. This initial tax served as a significant source of revenue for the state, contributing to the development of a robust road network that facilitated trade and travel across the state.

As the years progressed and the demands on the transportation system grew, the state of Illinois recognized the need for a more substantial tax structure. In 1955, a significant overhaul was introduced, increasing the tax rate to 5 cents per gallon. This marked a pivotal moment in the state's history, as the additional revenue generated played a pivotal role in funding the construction of the Illinois Tollway system, a network of highways that provided a crucial transportation backbone for the state.

The 1980s saw another notable change in the gasoline tax structure in Illinois. Recognizing the increasing costs associated with road construction and maintenance, the state implemented a two-tiered tax system. This system differentiated between unleaded gasoline and diesel fuel, with the former being taxed at 13.4 cents per gallon and the latter at 14.4 cents per gallon. This distinction aimed to address the unique needs and costs associated with maintaining different types of vehicles and fuel systems.

Current Gasoline Tax Rates in Illinois

As of my last update in January 2023, the gasoline tax rates in Illinois are as follows:

| Fuel Type | Tax Rate |

|---|---|

| Unleaded Gasoline | 38.7 cents per gallon |

| Diesel Fuel | 41.7 cents per gallon |

These rates include both the state and federal gasoline taxes. The federal tax rate, which is applied uniformly across the United States, is 18.4 cents per gallon for gasoline and 24.4 cents per gallon for diesel fuel. The state of Illinois, on top of the federal tax, imposes an additional tax of 20.3 cents per gallon for gasoline and 27.3 cents per gallon for diesel fuel.

Recent Changes and Future Projections

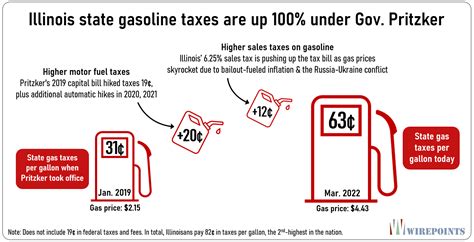

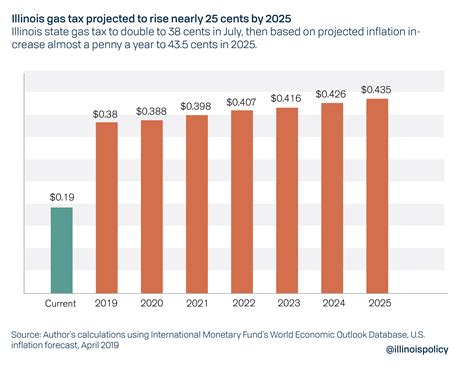

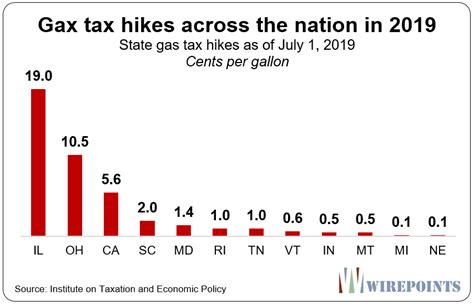

In recent years, the gasoline tax rates in Illinois have undergone several notable changes. In 2019, the state implemented a significant increase in the gasoline tax, with the rate rising to the current 38.7 cents per gallon for unleaded gasoline. This increase, though substantial, was part of a broader effort to address the state’s chronic underfunding of transportation infrastructure projects.

Looking ahead, there are ongoing discussions and proposals for further adjustments to the gasoline tax rates. These discussions are influenced by various factors, including the state's budget constraints, the rising costs of road construction and maintenance, and the need to keep up with the evolving transportation landscape.

One of the key considerations in future projections is the potential impact of electric vehicles (EVs) on gasoline tax revenue. As the adoption of EVs continues to rise, it is expected that the demand for traditional gasoline-powered vehicles will decline. This shift could significantly impact the state's gasoline tax revenue, prompting discussions on alternative revenue streams to fund transportation infrastructure projects.

The Impact of Gasoline Taxes on Illinois Residents

The gasoline tax in Illinois directly affects the state’s residents, impacting their daily commute, leisure travel, and overall cost of living. The tax is a significant component of the price consumers pay at the pump, influencing their purchasing decisions and overall economic well-being.

For residents who rely heavily on their vehicles for work or personal travel, the gasoline tax can represent a substantial portion of their transportation expenses. This is particularly true for those living in rural areas, where public transportation options are limited, and private vehicles are often the primary mode of transportation.

The impact of the gasoline tax is not limited to the price at the pump. It also influences other aspects of the economy, such as the cost of goods and services. As the tax adds to the operational costs of businesses, particularly those involved in transportation and logistics, these costs can be passed on to consumers, resulting in higher prices for goods and services.

Despite these economic considerations, the gasoline tax plays a vital role in funding essential transportation infrastructure projects. These projects, ranging from road repairs to the construction of new highways, directly benefit residents by improving road safety, reducing travel times, and enhancing overall transportation efficiency.

Gasoline Tax Revenue Distribution

The revenue generated from the gasoline tax in Illinois is not solely directed towards road construction and maintenance. A significant portion of this revenue is allocated to various other state funds and initiatives. This distribution ensures that the tax contributes to a broader range of public services and projects.

One notable recipient of gasoline tax revenue is the Illinois Department of Transportation (IDOT). IDOT receives a substantial share of the tax proceeds, which it utilizes to fund a wide array of transportation-related projects. These projects encompass not only road construction and maintenance but also initiatives aimed at enhancing public transit, pedestrian safety, and bicycle infrastructure.

Additionally, a portion of the gasoline tax revenue is directed towards the Illinois Transportation Trust Fund. This fund serves as a dedicated source of revenue for transportation projects, providing a stable stream of funding that is insulated from the fluctuations of the state's general budget.

Other beneficiaries of the gasoline tax revenue include the State Police, which receives funding for highway safety initiatives, and the Illinois Environmental Protection Agency, which utilizes the revenue for environmental protection and remediation projects related to transportation infrastructure.

Gasoline Tax and Its Role in Funding Transportation Infrastructure

The gasoline tax in Illinois serves as a critical funding mechanism for the state’s transportation infrastructure. This infrastructure, encompassing roads, bridges, and public transit systems, is essential for the state’s economic vitality and the well-being of its residents.

The revenue generated from the gasoline tax is directed towards a wide range of transportation projects. These projects include not only the maintenance and repair of existing roads but also the construction of new highways, bridges, and other critical infrastructure. By investing in these projects, the state ensures that its transportation network remains efficient, safe, and well-maintained.

One notable aspect of the gasoline tax's role in funding transportation infrastructure is its focus on equity and accessibility. A significant portion of the revenue is allocated towards improving public transit systems, ensuring that all residents, regardless of their economic status or geographic location, have access to reliable and affordable transportation options.

Furthermore, the gasoline tax revenue is instrumental in funding projects that enhance road safety. These initiatives encompass a wide range of measures, including the installation of traffic signals, the improvement of road signage, and the implementation of innovative technologies aimed at reducing traffic accidents and fatalities.

The Future of Gasoline Taxation in Illinois

As Illinois and the rest of the world navigate the transition towards a more sustainable and diverse transportation landscape, the future of gasoline taxation is likely to undergo significant changes. The increasing adoption of electric vehicles and the development of alternative fuel sources present both challenges and opportunities for the state’s revenue system.

One potential scenario is the gradual decline in gasoline tax revenue as more residents opt for electric vehicles or alternative fuel sources. This decline could lead to a significant reduction in the state's funding for transportation infrastructure, necessitating the exploration of alternative revenue streams.

To address this challenge, Illinois, like many other states, is considering the implementation of a vehicle miles traveled (VMT) tax. This tax, as mentioned earlier, would be based on the number of miles driven by each vehicle, regardless of its fuel type. Such a system would ensure a stable revenue stream for transportation infrastructure funding, even as the state transitions towards a more diverse fleet of vehicles.

Another potential avenue for revenue generation is the exploration of road user charges. These charges, which are based on the weight and distance traveled by vehicles, could be implemented for heavy-duty trucks and other commercial vehicles. By targeting these vehicles, which contribute significantly to road wear and tear, the state could generate additional revenue to support transportation infrastructure projects.

In conclusion, the gasoline tax in Illinois is a vital component of the state's revenue system, playing a critical role in funding transportation infrastructure projects. As the state navigates the changing landscape of transportation, it is imperative to continue exploring innovative solutions to ensure a stable and sustainable funding mechanism for the maintenance and improvement of its transportation network.

What is the purpose of the gasoline tax in Illinois?

+The gasoline tax in Illinois is primarily used to fund transportation infrastructure projects, including road construction, maintenance, and improvements to public transit systems.

How does the gasoline tax revenue benefit Illinois residents?

+The revenue from the gasoline tax is invested in projects that enhance road safety, reduce travel times, and improve overall transportation efficiency, directly benefiting Illinois residents.

Are there any alternatives to the gasoline tax being considered in Illinois?

+Yes, Illinois is exploring alternative revenue streams such as a vehicle miles traveled (VMT) tax and road user charges to ensure a stable funding mechanism for transportation infrastructure as the state transitions to a more diverse fleet of vehicles.