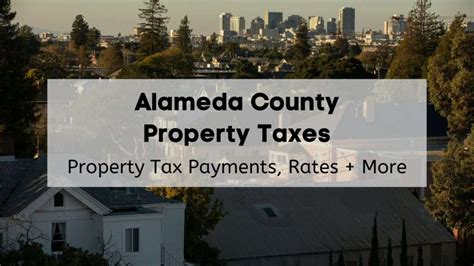

Acgov Property Tax

Property taxes are an essential component of local government finances in the United States, particularly in states like California, where they play a significant role in funding various public services. In this comprehensive guide, we will delve into the intricacies of property taxes in Alameda County, California, with a focus on the AC Gov Property Tax system. We will explore the assessment process, tax rates, payment options, and the online resources available to taxpayers. By the end of this article, you should have a thorough understanding of how property taxes work in Alameda County and the steps you can take to navigate the system efficiently.

Understanding Property Tax Assessments in Alameda County

The property tax system in Alameda County, California, is administered by the Alameda County Assessor’s Office. This office is responsible for evaluating and assessing the value of all taxable properties within the county. The assessment process is a crucial step in determining the property tax liability for each individual property owner.

The Alameda County Assessor's Office employs a team of trained professionals who utilize various methods to determine the assessed value of properties. These methods include sales comparison, cost approach, and income capitalization. The sales comparison approach involves analyzing recent sales of similar properties in the area to estimate the market value of the subject property. The cost approach considers the cost of constructing a similar property, while the income capitalization method assesses the potential income-generating capacity of the property.

Once the assessed value is determined, it is subject to an annual adjustment, known as the inflation factor. This factor accounts for inflation and ensures that property values remain up-to-date. The inflation factor is applied uniformly to all properties within the county, ensuring fairness in the assessment process.

Property owners in Alameda County have the right to appeal their assessed value if they believe it is inaccurate or unfair. The appeals process is managed by the Assessment Appeals Board, which is an independent body separate from the Assessor's Office. Property owners must provide evidence and justification for their appeal, and the Board makes the final decision based on the available information.

Real-Life Example: A Case Study on Property Tax Assessment

Let’s consider a hypothetical case study to illustrate the assessment process. Imagine a residential property located in Oakland, Alameda County. The property was purchased in 2018 for 800,000. The Assessor's Office, using the sales comparison approach, determines that similar properties in the area have recently sold for an average of 900,000. Taking into account factors such as size, location, and condition, the Assessor’s Office assesses the subject property at $850,000.

The property owner, however, believes that the assessed value is too high and decides to appeal. They gather evidence, including recent sales of comparable properties that sold for lower prices, and present their case to the Assessment Appeals Board. After reviewing the evidence, the Board decides to reduce the assessed value to $820,000, taking into consideration the market trends and the owner's arguments.

Property Tax Rates and Calculations

Property tax rates in Alameda County are determined by a combination of factors, including the assessed value of the property, the applicable tax rate area, and any additional levies or assessments. The tax rate area refers to the specific geographical region within the county, as different areas may have varying tax rates.

The basic property tax rate in Alameda County is set by the county's Board of Supervisors. This rate is applied to the assessed value of the property to calculate the base tax liability. However, there may be additional tax levies imposed by various special districts, such as school districts, fire protection districts, and infrastructure improvement districts. These additional levies are typically approved by local voters through ballot measures.

To illustrate the tax rate calculation, let's consider an example. Suppose a residential property in Alameda County has an assessed value of $500,000 and is located in a tax rate area with a base tax rate of 1.2%. The calculation would be as follows:

| Assessed Value | $500,000 |

|---|---|

| Base Tax Rate | 1.2% |

| Additional Levies | 0.5% |

| Total Tax Rate | 1.7% |

| Property Tax Liability | $8,500 |

In this example, the property owner would owe $8,500 in property taxes for the year, calculated by multiplying the assessed value by the total tax rate of 1.7%.

Exploring Different Tax Rate Areas

Alameda County is divided into several tax rate areas, each with its own unique set of tax rates and levies. These areas are established to ensure fairness and reflect the specific needs and services provided within each region. For instance, a tax rate area with a higher concentration of schools may have additional levies dedicated to funding education.

To provide a clearer understanding, let's compare two different tax rate areas in Alameda County. Area A has a base tax rate of 1.1% and additional levies totaling 0.4%, resulting in a total tax rate of 1.5%. On the other hand, Area B has a base tax rate of 1.3% and additional levies of 0.6%, leading to a total tax rate of 1.9%.

Property owners in Area A would generally pay lower property taxes compared to those in Area B, assuming similar assessed values. This differentiation in tax rates allows for a more equitable distribution of tax burdens across the county, taking into account the specific services and infrastructure needs of each region.

Property Tax Payment Options and Due Dates

Property owners in Alameda County have several options for paying their property taxes. The most common method is through the Treasurer-Tax Collector’s Office, which accepts payments by mail, online, or in person. Property owners can choose to pay their taxes in full or opt for installment payments, which are typically due in two installments: one in December and the other in April.

To make the payment process more convenient, the Treasurer-Tax Collector's Office offers an online payment portal. Property owners can access their account, view their tax bill, and make payments securely through the official website. This online platform provides real-time updates on tax balances and payment histories, allowing taxpayers to stay informed and manage their obligations effectively.

In addition to online payments, the Treasurer-Tax Collector's Office also accepts payments by phone, using a secure payment system. This option is particularly useful for those who prefer a more personal approach or encounter difficulties with online transactions. Phone payments can be made during regular business hours, and taxpayers can receive immediate confirmation of their payment.

For taxpayers who prefer traditional methods, the Treasurer-Tax Collector's Office also accepts payments by mail. Property owners can remit their payment along with the remittance stub from their tax bill. It is important to ensure that the payment is received by the due date to avoid penalties and late fees.

Payment Penalties and Late Fees

Property owners who fail to pay their taxes by the due date may incur penalties and late fees. The Treasurer-Tax Collector’s Office assesses a penalty of 10% on the unpaid balance if the first installment is not received by the due date. Additionally, a 1.5% late fee is applied monthly on the unpaid balance, up to a maximum of 18% per year.

To avoid penalties and late fees, it is crucial for property owners to stay informed about their tax due dates and make timely payments. The Treasurer-Tax Collector's Office provides various reminders and notifications, including mailed notices and email alerts, to help taxpayers stay on track with their obligations.

Online Resources for Property Tax Information

The Alameda County government recognizes the importance of providing accessible and transparent information to taxpayers. As such, several online resources are available to assist property owners in understanding their property taxes and navigating the AC Gov Property Tax system.

The official website of the Alameda County Assessor's Office provides a wealth of information, including property records, assessment appeals processes, and frequently asked questions. Property owners can search for their property's assessed value, view historical data, and access valuable resources to better understand the assessment process.

Additionally, the Treasurer-Tax Collector's Office offers an online property tax lookup tool. This tool allows taxpayers to quickly and easily retrieve their tax bill information, including the current year's taxes, past payments, and any outstanding balances. By providing this convenient access to tax data, the county aims to enhance transparency and empower taxpayers to manage their financial obligations efficiently.

Mobile Apps and Digital Tools for Taxpayers

To further enhance taxpayer convenience, the Alameda County government has developed mobile apps and digital tools specifically designed for property tax management. These apps, available for both iOS and Android devices, provide on-the-go access to tax information, payment options, and important reminders.

One such app, the "AC Tax Tracker," allows users to receive real-time updates on their property tax payments, due dates, and assessment changes. It also provides a secure platform for making online payments, ensuring that taxpayers can stay on top of their obligations regardless of their location. The app's user-friendly interface and push notification system make it an invaluable tool for busy individuals who want to stay organized and informed.

Furthermore, the county has implemented an online chat feature on its official websites, enabling taxpayers to seek assistance and clarification on property tax matters directly from trained professionals. This digital support system offers quick responses to common queries and provides personalized guidance based on individual circumstances.

Conclusion: Navigating the AC Gov Property Tax System

Understanding and navigating the property tax system in Alameda County requires a comprehensive understanding of the assessment process, tax rates, payment options, and available online resources. By familiarizing yourself with these aspects, you can ensure that you are well-equipped to manage your property tax obligations effectively.

Remember, the Alameda County Assessor's Office and the Treasurer-Tax Collector's Office are dedicated to providing accurate and transparent information to taxpayers. Their websites and digital tools offer valuable resources to help you stay informed and make timely payments. Additionally, the assessment appeals process ensures that property owners have a fair opportunity to challenge their assessed values if they believe they are inaccurate.

By staying informed and utilizing the available resources, you can confidently navigate the AC Gov Property Tax system and fulfill your property tax obligations in Alameda County.

How often are property values reassessed in Alameda County?

+Property values in Alameda County are reassessed annually to account for inflation and market changes. This ensures that the assessed value remains up-to-date and fair.

Can I pay my property taxes online using a credit card?

+Yes, the Treasurer-Tax Collector’s Office accepts online payments using credit cards. However, a convenience fee is typically charged for this service.

What happens if I miss a property tax payment deadline?

+If you miss a property tax payment deadline, you may incur penalties and late fees. It is important to stay informed about the due dates and make timely payments to avoid additional costs.

Are there any property tax exemptions or reductions available in Alameda County?

+Yes, Alameda County offers various property tax exemptions and reductions, including the Homeowner’s Exemption, Veterans’ Exemption, and Disabled Persons’ Exemption. These exemptions can reduce the assessed value of your property, resulting in lower property taxes.