Long Island Sales Tax

Welcome to this comprehensive guide on the intricacies of Long Island's sales tax system. Understanding sales tax is crucial for businesses and consumers alike, as it impacts daily transactions and the overall economy. This article will delve into the specifics of Long Island's sales tax structure, its unique aspects, and how it affects various industries and individuals.

The Basics of Long Island Sales Tax

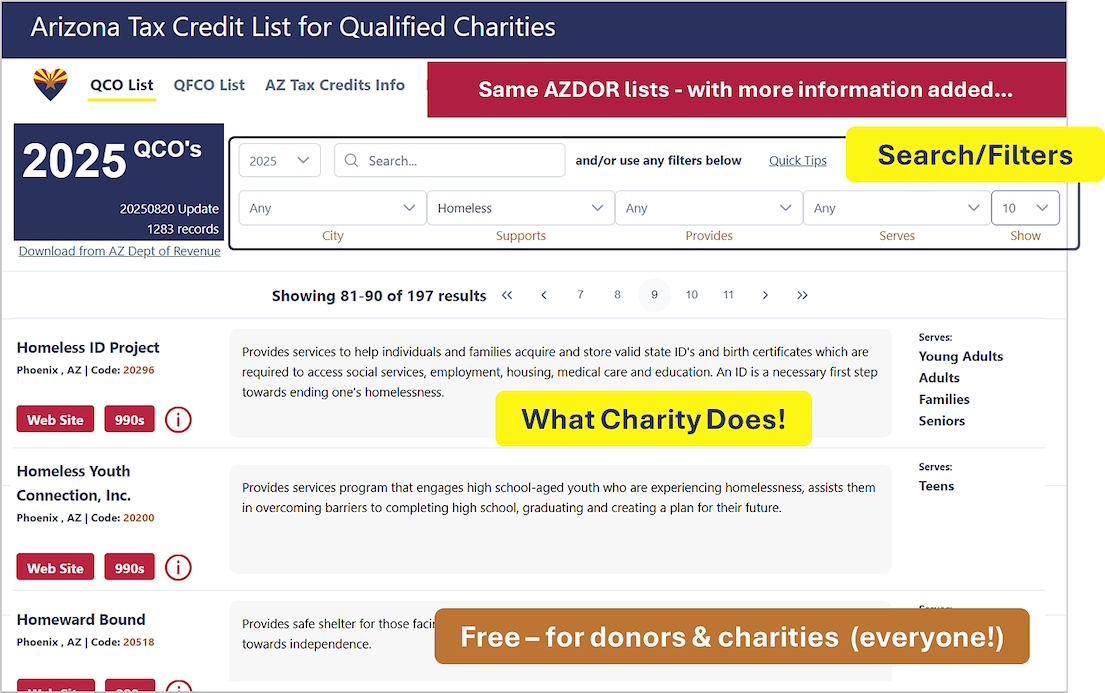

Long Island, a bustling region in New York State, has its own unique sales tax system, which is an important revenue stream for local and state governments. As of 2023, the base sales tax rate in Long Island stands at 8.875%, which includes both the state and local sales tax components. However, it’s important to note that this rate can vary depending on the specific location within Long Island, as certain municipalities and counties have additional sales tax surcharges.

Understanding the Components of Long Island Sales Tax

The sales tax in Long Island is comprised of several layers, each serving a specific purpose. The state sales tax, which is applied uniformly across New York State, forms the foundation of the sales tax structure. On top of this, local sales taxes are imposed by individual counties and municipalities, adding a layer of complexity to the system. These local taxes can vary significantly, with rates ranging from 0% to 4.5% in some areas, depending on the fiscal needs and policies of each jurisdiction.

| Sales Tax Component | Rate |

|---|---|

| State Sales Tax | 4% |

| Nassau County Sales Tax | 4.75% |

| Suffolk County Sales Tax | 4.125% |

| Local Municipality Surcharges | Varies |

For instance, Nassau County, one of the two counties on Long Island, imposes a 4.75% sales tax, bringing the total sales tax rate to 8.875% within this county. Meanwhile, Suffolk County, the other county on Long Island, has a lower sales tax rate of 4.125%, resulting in a total sales tax of 8.275% in this area.

Exemptions and Special Cases in Long Island Sales Tax

While the base sales tax rate applies to most goods and services, there are certain exemptions and special cases that businesses and consumers should be aware of. For instance, many groceries and prescription drugs are exempt from sales tax in New York State, which includes Long Island. Additionally, certain types of clothing and footwear are exempt from sales tax if they fall below a specific price threshold.

However, it's important to note that these exemptions can vary based on local laws and regulations. For example, while groceries are generally exempt, some municipalities on Long Island may impose a local sales tax on certain food items, especially those considered luxury or non-essential.

| Item | Sales Tax Treatment |

|---|---|

| Groceries (Essential) | Exempt |

| Luxury Groceries | Subject to Local Sales Tax |

| Clothing under $110 | Exempt |

| Clothing over $110 | Subject to Sales Tax |

These variations in tax treatment highlight the complexity of the Long Island sales tax system and the need for businesses to stay updated on the latest regulations.

Impact of Long Island Sales Tax on Businesses

The sales tax system on Long Island has a significant impact on businesses, influencing their operational strategies and financial planning. For retailers, especially those with a physical presence on Long Island, the sales tax rate can directly affect their pricing strategies and competitiveness in the market.

Pricing Strategies and Competitive Advantage

Businesses on Long Island must carefully consider their pricing strategies to remain competitive while also complying with the sales tax regulations. For instance, a retailer might choose to absorb the sales tax into their product prices to make their items appear more affordable to consumers. Alternatively, they could pass on the tax to the customer, clearly displaying the tax amount on the receipt, which provides transparency but may impact the perceived value of the product.

Additionally, the varying sales tax rates across Long Island can create opportunities for businesses to promote themselves as more affordable alternatives. For example, a retailer in Suffolk County might highlight their lower sales tax rate compared to Nassau County to attract customers looking for better deals.

Sales Tax Compliance and Reporting

Complying with sales tax regulations is a critical aspect of doing business on Long Island. Businesses must accurately collect, report, and remit sales tax to the relevant authorities. This involves a rigorous process of sales tax registration, collection, and remittance, which can be complex given the varying rates and exemptions.

To ensure compliance, businesses often utilize sales tax software and work closely with tax professionals. These tools and experts help businesses stay updated on the latest regulations, accurately calculate and collect sales tax, and efficiently file sales tax returns.

Consumer Perspective: Navigating Long Island Sales Tax

For consumers on Long Island, understanding the sales tax system is essential for making informed purchasing decisions and managing their personal finances effectively.

Budgeting and Financial Planning

Sales tax can significantly impact a consumer’s budget, especially for large purchases. When planning major expenses, such as buying a car or renovating a home, consumers should factor in the sales tax rate to ensure they have sufficient funds. For instance, on a 50,000 vehicle purchase</strong>, the sales tax alone could amount to <strong>4,437.50 in Nassau County or $4,137.50 in Suffolk County, which is a substantial addition to the base cost.

Shopping Strategies: Navigating Tax Rates

Consumers on Long Island can employ various shopping strategies to navigate the different sales tax rates and potentially save money. For example, if a consumer frequently shops in both Nassau and Suffolk Counties, they could consider timing their purchases to take advantage of the lower sales tax rate in Suffolk County for certain items.

Additionally, consumers can keep an eye out for sales tax holidays, which are designated periods when certain items, often back-to-school supplies or energy-efficient appliances, are exempt from sales tax. These holidays provide an opportunity for consumers to save on essential purchases.

Future Outlook: Trends and Potential Changes in Long Island Sales Tax

The sales tax system on Long Island, like any tax structure, is subject to potential changes and reforms, which can have significant implications for businesses and consumers.

Proposed Reforms and Their Impact

There have been ongoing discussions about reforming the sales tax system in New York State, which could have far-reaching effects on Long Island. One proposed reform is to simplify the sales tax structure by reducing the number of tax rates and exemptions, which could make compliance easier for businesses and enhance clarity for consumers.

However, such reforms can also lead to changes in the tax burden, potentially affecting certain industries or consumer groups disproportionately. For instance, a simplification of the sales tax structure might result in a higher overall tax rate, impacting the affordability of goods and services for consumers.

The Role of Technology and E-commerce

The rise of e-commerce and online sales has brought about a new set of challenges and opportunities for the sales tax system on Long Island. Online retailers must navigate the complex landscape of collecting and remitting sales tax across different jurisdictions, especially when delivering goods to various locations on the island.

To address this, many e-commerce platforms have integrated sales tax calculation and collection tools into their checkout processes, ensuring compliance with the diverse sales tax rates and regulations. This not only simplifies the process for businesses but also provides transparency for consumers, who can see the breakdown of sales tax on their online purchases.

What is the current sales tax rate on Long Island as of 2023?

+The base sales tax rate on Long Island as of 2023 is 8.875%, which includes both the state and local sales tax components. However, this rate can vary depending on the specific location within Long Island, as certain municipalities and counties have additional sales tax surcharges.

Are there any sales tax exemptions on Long Island?

+Yes, there are certain exemptions and special cases in the Long Island sales tax system. For instance, many groceries and prescription drugs are exempt from sales tax. Additionally, certain types of clothing and footwear are exempt if they fall below a specific price threshold.

How do online retailers handle sales tax for Long Island customers?

+Online retailers typically use sales tax calculation and collection tools to determine the appropriate sales tax rate for Long Island customers based on their shipping address. These tools ensure compliance with the diverse sales tax rates and regulations across different locations on the island.

What are some potential future changes to the Long Island sales tax system?

+Proposed reforms to the sales tax system in New York State could have significant impacts on Long Island. Potential changes include simplifying the sales tax structure, which might lead to a higher overall tax rate, or introducing new exemptions to promote certain industries or consumer groups.