Marin County Property Tax

Welcome to this comprehensive guide on understanding and managing your property taxes in Marin County, California. Property taxes are an essential aspect of homeownership, and having a clear understanding of how they work can empower you to make informed decisions and potentially save money. In this expert-led article, we will delve into the specifics of Marin County's property tax system, providing you with valuable insights and strategies to navigate this crucial financial obligation.

Unraveling the Marin County Property Tax Landscape

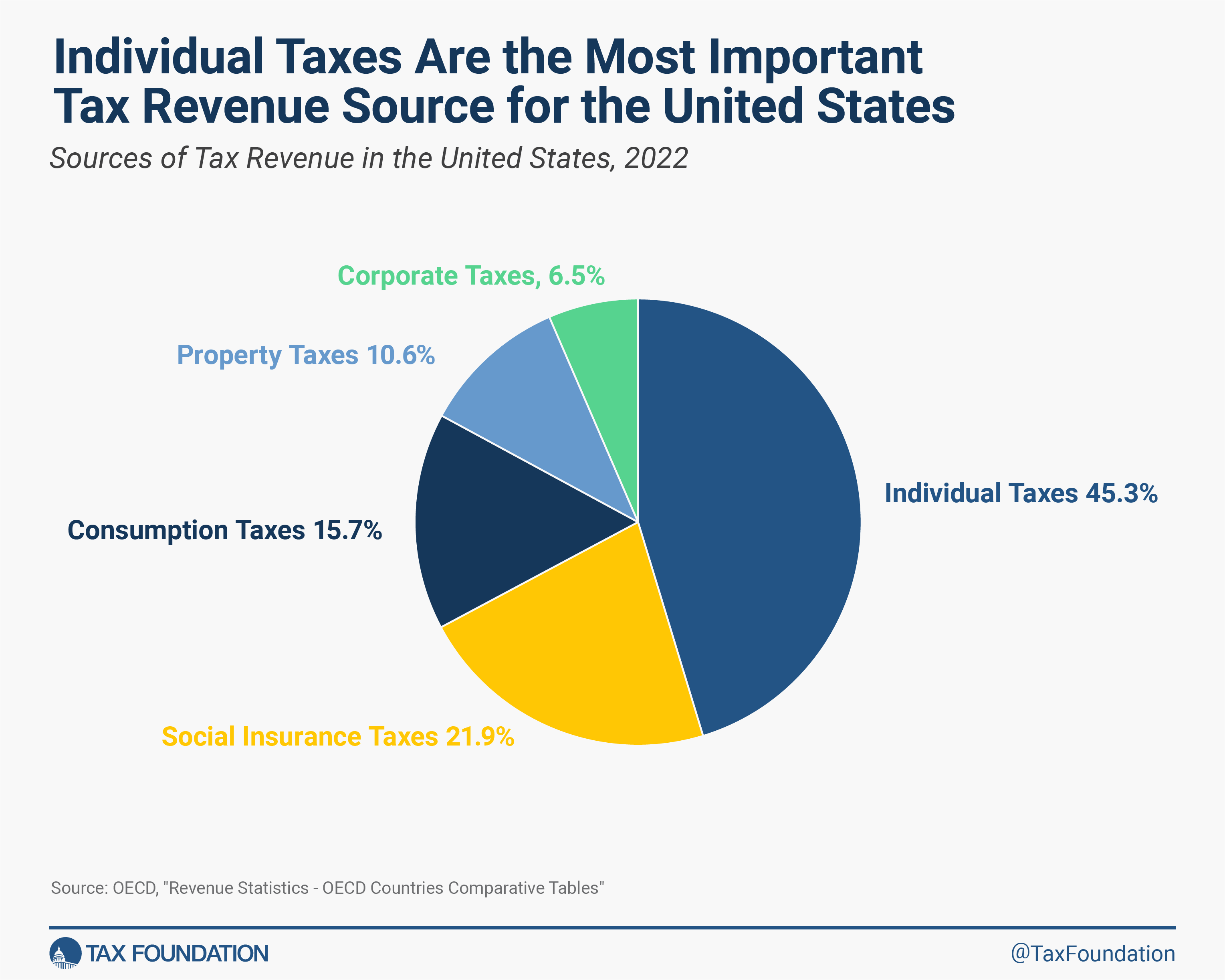

Property taxes in Marin County, like in many other jurisdictions, serve as a significant source of revenue for local governments, funding essential services such as education, public safety, infrastructure, and more. The complexity of the property tax system can often be overwhelming, but with the right knowledge, you can effectively manage your tax obligations and contribute to the thriving community of Marin County.

Marin County, known for its stunning natural beauty and vibrant communities, is home to diverse property owners, from first-time homebuyers to seasoned investors. Understanding the local property tax system is crucial for all residents, as it directly impacts their financial planning and overall cost of living.

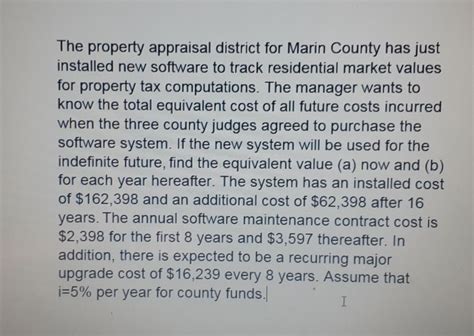

How Property Taxes Are Calculated in Marin County

The property tax calculation in Marin County follows a standardized process, ensuring fairness and transparency. Here’s a breakdown of the key factors involved:

- Assessed Value: The starting point for property tax calculation is the assessed value of your property. This value is determined by the Marin County Assessor's Office, which takes into account various factors such as the property's location, size, improvements, and recent sales data.

- Assessment Ratio: In California, the assessment ratio is a critical component of the property tax formula. Marin County, like many other counties, uses a ratio of 1% of the assessed value as the base for tax calculations. This means that 1% of your property's assessed value is subject to taxation.

- Tax Rate: The tax rate is the second critical factor in determining your property taxes. It is a combination of the general tax rate, which funds county services, and any additional special assessments or district taxes applicable to your property. These rates are set annually by the county and various taxing authorities.

- Prop 13 Protections: California's landmark Proposition 13 (Prop 13) provides significant protections for homeowners. It limits the annual increase in assessed value to a maximum of 2% or the inflation rate, whichever is lower. This ensures that property taxes remain manageable even as property values appreciate over time.

To illustrate, let's consider an example. Suppose your property in Marin County has an assessed value of $1,000,000. With the 1% assessment ratio, the base taxable value would be $10,000. If the general tax rate is 1.25%, your annual property tax bill would amount to $1,250.

| Assessed Value | Assessment Ratio | Taxable Value | General Tax Rate | Annual Property Taxes |

|---|---|---|---|---|

| $1,000,000 | 1% | $10,000 | 1.25% | $1,250 |

This simplified example provides a glimpse into the property tax calculation process. In reality, there may be additional factors, such as supplemental taxes and changes in assessed value, that can impact your tax liability.

Understanding Your Property Tax Bill

Your property tax bill, typically sent out annually by the Marin County Tax Collector’s Office, contains valuable information that can help you understand your tax obligations. Here’s a breakdown of what you can expect to find on your bill:

- Parcel Number: This unique identifier for your property ensures that your tax bill is specific to your real estate. It's crucial for record-keeping and identifying your property for tax purposes.

- Assessed Value: Your property's assessed value is a key component of your tax bill. It represents the value assigned to your property by the Assessor's Office and forms the basis for tax calculations.

- Taxable Value: As mentioned earlier, the taxable value is derived from the assessed value and the assessment ratio. It's the portion of your property's value that is subject to taxation.

- Tax Rates: Your tax bill will list the various tax rates applicable to your property. This includes the general tax rate, as well as any special assessments or district taxes. Understanding these rates can help you identify the specific funding sources for your property taxes.

- Due Dates and Payment Options: The tax bill will provide clear instructions on when your property taxes are due and the various payment methods available. Marin County offers convenient options such as online payments, mail-in payments, and in-person payments at designated locations.

It's essential to review your property tax bill carefully to ensure accuracy and identify any changes or adjustments. If you have questions or concerns about your bill, the Marin County Tax Collector's Office is available to provide guidance and assistance.

Strategies for Managing Your Marin County Property Taxes

Understanding your property taxes is the first step, but there are additional strategies you can employ to manage your tax obligations effectively. Here are some expert tips to consider:

1. Review Your Property Assessment

The Marin County Assessor’s Office is responsible for determining the assessed value of your property. It’s crucial to review your assessment annually to ensure accuracy. If you believe your property’s assessed value is incorrect, you have the right to appeal. The appeal process allows you to challenge the assessed value and potentially reduce your tax liability.

2. Stay Informed About Tax Rates

Tax rates can fluctuate from year to year, and understanding these changes is essential for effective financial planning. Keep yourself informed about the general tax rate and any special assessments or district taxes that may impact your property. This information is typically available on the Marin County website or through local news sources.

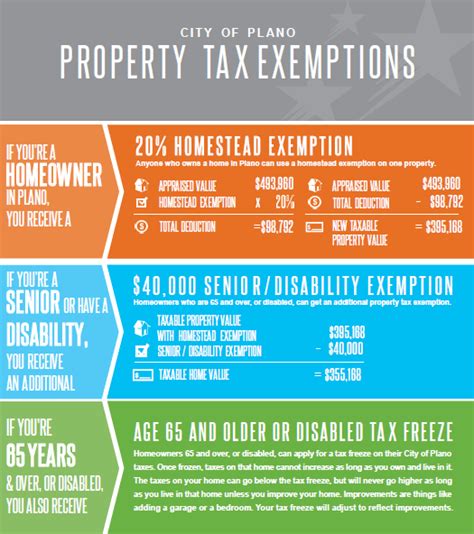

3. Explore Tax Deductions and Credits

Marin County, like many other jurisdictions, offers various tax deductions and credits that can reduce your tax liability. These may include homeowner’s exemptions, senior citizen discounts, or other specific credits. Researching and understanding these opportunities can help you maximize your tax savings.

4. Consider Property Tax Financing Options

For those who prefer a more streamlined approach to property tax payments, property tax financing options are available. These programs allow you to pay your property taxes in installments, spreading out the financial burden throughout the year. This can be particularly beneficial for those with irregular income streams or those who prefer a more manageable payment schedule.

5. Stay Engaged with Local Government

Marin County’s local government plays a crucial role in setting tax rates and allocating funds for essential services. By staying engaged with your local government, you can understand the budgetary decisions that impact your property taxes. Attend public meetings, participate in community forums, and stay informed about the issues that affect your community.

Conclusion: Empowering Marin County Property Owners

Understanding and managing your property taxes in Marin County is an essential aspect of responsible homeownership. By unraveling the complexities of the property tax system, reviewing your assessment, staying informed about tax rates, and exploring tax savings opportunities, you can take control of your financial obligations. Remember, knowledge is power, and with the right information, you can navigate the property tax landscape with confidence and contribute to the vibrant community of Marin County.

When are property taxes due in Marin County?

+Property taxes in Marin County are due in two installments. The first installment is typically due on November 1st, while the second installment is due on February 1st of the following year. Late payments may incur penalties and interest.

How can I appeal my property’s assessed value in Marin County?

+If you believe your property’s assessed value is incorrect, you can file an appeal with the Marin County Assessor’s Office. The appeal process involves providing evidence and supporting documentation to challenge the assessed value. It’s important to note that appeals must be filed within a specific timeframe, typically within 60 days of receiving your assessment notice.

Are there any property tax exemptions or discounts available in Marin County?

+Yes, Marin County offers several property tax exemptions and discounts. These include the homeowner’s exemption, which reduces the taxable value of your property, and the senior citizen exemption, which provides a tax relief program for qualifying seniors. Additionally, there are other specific exemptions and credits available for veterans, disabled persons, and other eligible individuals.