No Overtime Tax Bill

In the world of employment and taxation, the concept of overtime pay is a significant aspect that impacts both employees and employers. The recent proposal for a "No Overtime Tax Bill" has sparked interest and discussions among professionals, sparking debates on its potential impact and implications. This comprehensive article aims to delve into the intricacies of this bill, exploring its potential benefits, challenges, and the broader context within which it operates.

Understanding the No Overtime Tax Bill

The No Overtime Tax Bill, proposed by several industry advocates and policymakers, aims to address a long-standing concern in the labor market: the taxation of overtime earnings. This bill, if passed, would introduce a significant reform in the way overtime pay is treated by the tax system, potentially offering relief to millions of workers who regularly put in extra hours.

Currently, overtime pay is subjected to income tax, social security, and Medicare taxes, similar to regular earnings. However, the proponents of the No Overtime Tax Bill argue that this practice discourages employees from accepting overtime work, as the net pay for these additional hours can be significantly lower due to taxation. They believe that by exempting overtime pay from taxation, workers will be incentivized to work more, leading to increased productivity and economic growth.

Key Provisions of the Bill

The proposed bill includes the following key provisions:

- Overtime Tax Exemption: The bill seeks to exempt overtime earnings from federal income tax, ensuring that workers receive the full amount of their overtime pay without deductions.

- Thresholds and Eligibility: To prevent potential abuse, the bill proposes setting thresholds for overtime eligibility. Only workers who exceed a certain number of regular hours or who work a minimum number of overtime hours may qualify for the tax exemption.

- Social Security and Medicare Contributions: While the bill aims to exempt overtime pay from income tax, it does not propose any changes to the current system of social security and Medicare contributions. These deductions would continue to apply to overtime earnings.

- Implementation Challenges: Implementing such a bill would require careful consideration of various factors, including the potential impact on government revenue, administrative complexities, and the need for a balanced approach to ensure fairness across different income brackets.

Potential Benefits and Impact

The No Overtime Tax Bill, if implemented successfully, could bring about several positive changes for workers and the economy as a whole.

Increased Take-Home Pay

One of the most direct benefits of the bill would be an increase in take-home pay for workers who regularly work overtime. By exempting overtime earnings from income tax, employees could see a substantial boost in their net income, providing them with more financial flexibility and potentially improving their standard of living.

| Pre-Bill Overtime Earnings | Estimated Post-Bill Earnings |

|---|---|

| $500 (Overtime Pay) | $500 (Full Overtime Pay) |

As shown in the table above, an employee earning $500 in overtime pay would receive the full amount without any tax deductions, leading to a significant increase in their disposable income.

Incentivizing Overtime Work

The bill’s proponents argue that removing the tax burden on overtime pay will encourage more workers to accept overtime opportunities. This could lead to increased productivity as companies may find it easier to staff projects requiring extended hours. Additionally, employees who choose to work overtime may experience a sense of financial empowerment, knowing that their extra efforts directly translate into higher earnings.

Economic Growth and Employment

A potential increase in overtime work could have broader economic implications. With more workers choosing to work additional hours, businesses may experience improved output and productivity, leading to potential economic growth. This growth could, in turn, create more job opportunities, contributing to a positive cycle of economic development.

Challenges and Considerations

While the No Overtime Tax Bill presents an intriguing proposal, it is essential to consider the potential challenges and implications it may bring.

Revenue Loss and Budgetary Impact

One of the primary concerns surrounding the bill is the potential loss of revenue for the government. Overtime earnings, when taxed, contribute to federal income tax collections. Exempting these earnings could result in a significant decrease in tax revenue, which may impact government budgets and the funding of various programs and services.

Administrative Complexity

Implementing the bill would require a complex administrative process. Employers would need to track and report overtime hours accurately to ensure compliance with the bill’s provisions. This could add an additional layer of complexity to payroll management, particularly for small businesses with limited resources.

Equity and Fairness

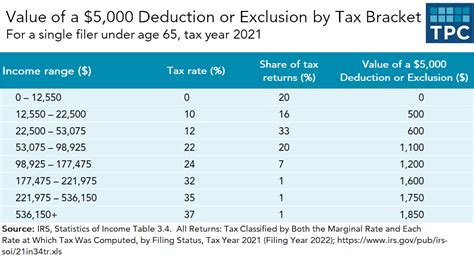

The bill’s potential impact on different income brackets is another crucial consideration. While it aims to benefit workers, there are concerns that it may disproportionately benefit higher-income earners who are more likely to work significant amounts of overtime. Ensuring fairness and preventing potential abuse will be critical aspects of the bill’s design and implementation.

A Comprehensive Analysis

The No Overtime Tax Bill presents a fascinating proposition, offering a potential solution to a long-standing issue in the labor market. By examining the bill’s provisions, benefits, and challenges, we can gain a deeper understanding of its potential impact and the broader implications it may have on the economy and society.

While the bill's proponents argue for its potential to boost worker incentives and productivity, critics highlight the need for a careful balance to ensure fairness and maintain government revenue. As discussions continue, it is essential to consider the diverse perspectives and potential outcomes to craft a policy that benefits workers while maintaining economic stability.

FAQ

How would the No Overtime Tax Bill affect my take-home pay?

+If the bill is passed, your take-home pay from overtime work could increase significantly. Currently, overtime earnings are subject to income tax, reducing the net amount you receive. The bill aims to exempt these earnings from taxation, ensuring you get the full amount of your overtime pay.

Will the bill apply to all workers, regardless of income level?

+The bill proposes setting thresholds for overtime eligibility to prevent potential abuse. This means that only workers who meet certain criteria, such as exceeding a specific number of regular hours or working a minimum number of overtime hours, may qualify for the tax exemption.

What impact could the bill have on government revenue and budgets?

+The bill’s potential loss of revenue is a significant concern. Overtime earnings contribute to federal income tax collections, and exempting these earnings could result in a substantial decrease in tax revenue. This may impact government budgets and the funding of various programs and services.