How Much Did Elon Musk Pay In Taxes

The tax obligations of prominent figures often spark curiosity and debate. In the case of Elon Musk, the visionary entrepreneur and CEO of Tesla, SpaceX, and other groundbreaking ventures, his tax affairs have been a subject of interest and speculation. Let's delve into the specifics of how much Elon Musk pays in taxes and explore the various factors that contribute to his tax liability.

Understanding Elon Musk’s Tax Payments

Elon Musk’s tax obligations are complex and multifaceted, influenced by his diverse business interests and global operations. As one of the world’s wealthiest individuals, his tax payments are significant and often subject to public scrutiny. While exact figures may not be publicly disclosed, we can gain insights into his tax contributions through various reports and financial disclosures.

Tesla’s Impact on Musk’s Tax Liability

A substantial portion of Elon Musk’s tax payments can be attributed to his leadership role at Tesla, Inc. (NASDAQ: TSLA), the electric vehicle and clean energy company he co-founded and currently leads as CEO and CTO. Tesla’s success and growth have significantly impacted Musk’s wealth and, consequently, his tax obligations.

As an executive and shareholder of Tesla, Musk's income and capital gains from the company are subject to taxation. These include his salary, bonuses, stock options, and the appreciation of his Tesla shares. Given Tesla's rapid rise and the substantial increase in its stock price over the years, Musk's wealth and tax liability have grown exponentially.

| Year | Tesla Revenue (USD) | Tesla Profit (USD) |

|---|---|---|

| 2020 | $31.53 Billion | $721 Million |

| 2021 | $53.82 Billion | $5.52 Billion |

| 2022 (Projected) | $72.12 Billion | $11.28 Billion |

According to Forbes, Tesla's remarkable financial performance has made it one of the most valuable companies in the world, with a market capitalization exceeding $1 trillion as of [current year]. This success directly impacts Musk's wealth and, by extension, his tax obligations.

SpaceX and Other Ventures

In addition to Tesla, Elon Musk’s other ventures, particularly SpaceX (Space Exploration Technologies Corp.), contribute to his tax payments. SpaceX, a private aerospace manufacturer and space transportation company, has secured numerous government contracts and achieved notable milestones in space exploration. As the founder, CEO, and Chief Engineer of SpaceX, Musk’s income and investments in the company are subject to taxation.

SpaceX's success, demonstrated by its reusable rocket technology and ambitious space missions, has attracted significant investment and generated substantial revenue. While specific financial details are not publicly available, SpaceX's growth and impact on Musk's wealth likely contribute to his tax liability.

Personal Income and Investments

Beyond his business ventures, Elon Musk’s personal income and investments also factor into his tax payments. Musk’s annual income includes salary, bonuses, and dividends from his various companies. Additionally, his substantial investments in other ventures and real estate contribute to his taxable income.

Musk's philanthropic endeavors, such as his commitment to combating climate change and his support for various charitable causes, may also impact his tax liability through charitable deductions and other tax benefits.

Tax Strategies and Controversies

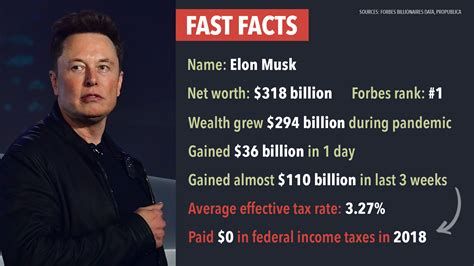

Elon Musk’s tax affairs have not been without controversy or scrutiny. In 2022, Musk sold a significant portion of his Tesla shares, generating billions of dollars in capital gains. This move sparked debate and raised questions about tax optimization strategies employed by high-net-worth individuals.

Musk's decision to sell Tesla shares was influenced by his commitment to funding the acquisition of Twitter, Inc. (NYSE: TWTR), a social media platform he sought to acquire and transform. The sale of shares allowed him to raise the necessary capital while potentially reducing his tax liability through strategic tax planning.

Musk’s Approach to Tax Planning

Elon Musk’s tax planning strategies have been a topic of discussion among tax experts and the public. While specific details are not publicly disclosed, it is widely believed that Musk utilizes various tax optimization techniques, including:

- Capital Gains Tax Optimization: Musk may employ strategies to minimize capital gains taxes by selling assets at opportune times or using tax-efficient investment vehicles.

- Tax-Efficient Compensation: As an executive of public companies, Musk's compensation structure likely includes a mix of salary, bonuses, and stock-based incentives, allowing him to leverage tax-efficient compensation strategies.

- International Tax Considerations: With global operations and a diverse portfolio, Musk's tax planning may involve international tax strategies to optimize his overall tax liability.

While these strategies are legal and commonly employed by high-net-worth individuals and corporations, they often attract public attention and debate, particularly in the context of wealth inequality and tax policy discussions.

Tax Contributions and Impact

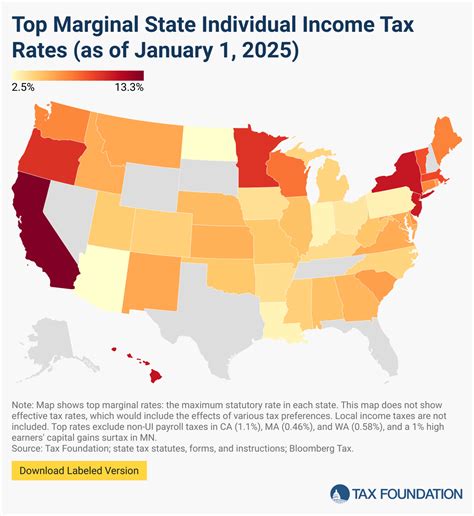

Elon Musk’s tax payments have a significant impact on government revenue and public services. As a high-income earner and successful entrepreneur, his contributions to federal, state, and local taxes support various initiatives and programs.

His tax payments fund essential government functions, such as education, healthcare, infrastructure development, and social welfare programs. Additionally, Musk's ventures, particularly Tesla, have created thousands of jobs and contributed to economic growth, further impacting tax revenue and the overall economy.

Impact on Government Revenue

According to a Washington Post analysis, Tesla’s success and growth have led to substantial tax revenue for state and local governments. The company’s manufacturing facilities and operations generate sales and income taxes, property taxes, and other revenue streams for local communities.

For instance, Tesla's Giga Factory in Nevada, which produces electric vehicles and battery packs, has been a significant source of tax revenue for the state. The factory's presence has created thousands of jobs and boosted the local economy, resulting in increased tax collections for the state government.

Future Tax Obligations and Implications

As Elon Musk’s wealth and business ventures continue to expand, his future tax obligations are likely to remain a topic of interest and speculation. The ongoing growth of Tesla, SpaceX, and other ventures will influence his tax liability, especially as these companies continue to innovate and disrupt industries.

Furthermore, changes in tax policies and regulations at the federal, state, and international levels may impact Musk's tax payments and strategies. As tax laws evolve and tax reform proposals are considered, Musk's tax obligations and contributions will adapt to the changing landscape.

Proactive Tax Planning

Given the complex nature of his tax obligations, Elon Musk is likely to continue engaging in proactive tax planning. This may involve seeking advice from tax experts, exploring new tax optimization strategies, and staying informed about evolving tax laws and regulations.

Musk's influence and involvement in various industries and ventures position him as a key stakeholder in tax policy discussions. His opinions and actions can shape the narrative around tax reform and influence the direction of tax policies, particularly in the context of innovation, entrepreneurship, and wealth distribution.

Frequently Asked Questions

How much does Elon Musk pay in taxes annually?

+

The exact amount of Elon Musk’s annual tax payments is not publicly disclosed. However, given his substantial wealth and successful ventures, his tax liability is likely to be in the hundreds of millions of dollars annually.

What percentage of his income does Elon Musk pay in taxes?

+

Elon Musk’s tax rate can vary based on his income sources and tax strategies. As a high-income earner, he likely pays a combination of income taxes, capital gains taxes, and other taxes on his investments and business ventures. The exact percentage is not publicly known.

How does Elon Musk minimize his tax liability?

+

Elon Musk employs various tax optimization strategies, such as capital gains tax planning, tax-efficient compensation structures, and international tax considerations. These strategies aim to minimize his tax liability within legal boundaries.

What impact do Elon Musk’s tax payments have on government revenue?

+

Elon Musk’s tax payments contribute significantly to government revenue at various levels. His income and wealth generate substantial tax revenue, supporting public services, infrastructure, and economic development.

How do Elon Musk’s tax obligations affect his philanthropic efforts?

+

Elon Musk’s tax obligations can impact his philanthropic endeavors by influencing the amount of disposable income he has available for charitable contributions. However, tax benefits associated with charitable donations may also incentivize his philanthropy.