Sales Tax In Ct

Sales tax is an essential component of the revenue system in many states, including Connecticut. It plays a crucial role in funding various public services and infrastructure projects. In this comprehensive guide, we will delve into the intricacies of sales tax in Connecticut, exploring its history, rates, exemptions, and its impact on businesses and consumers alike. By understanding the sales tax landscape in CT, we can navigate the tax obligations and make informed decisions regarding purchases and sales.

Understanding Sales Tax in Connecticut

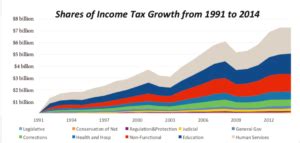

Connecticut’s sales tax system is designed to generate revenue for the state government while ensuring a fair and equitable tax burden on consumers and businesses. The state’s sales tax is imposed on the retail sale of tangible personal property and certain services. It is a vital source of income for the state, contributing to essential services such as education, healthcare, transportation, and public safety.

The sales tax in Connecticut has a rich history, dating back to the early 20th century. The state first implemented a sales tax in 1947, with a rate of 3%. Over the years, the tax rate has undergone several adjustments to meet the changing economic needs and priorities of the state. The current sales tax rate in Connecticut is 6.35%, which is applied to most retail transactions.

However, it's important to note that the sales tax rate can vary across different jurisdictions within the state. Cities and municipalities may impose additional local sales taxes, resulting in a higher overall tax burden for consumers. For instance, the city of Bridgeport has a local sales tax rate of 0.5%, bringing the total sales tax rate to 6.85% for purchases made within the city limits.

Taxable Items and Services

Connecticut’s sales tax applies to a wide range of goods and services. Here are some examples of items that are typically subject to sales tax:

- Clothing and footwear

- Electronics and appliances

- Furniture and home goods

- Groceries (with some exemptions)

- Vehicles (including cars, motorcycles, and boats)

- Entertainment services (e.g., movie tickets, concert tickets)

- Lodging and hotel stays

- Restaurant meals and prepared foods

It's worth mentioning that Connecticut offers certain exemptions from sales tax to promote economic growth and support specific industries. For instance, most non-prepared food items, including groceries, are exempt from sales tax. This exemption aims to reduce the tax burden on essential household items and encourage healthy eating habits.

| Taxable Item | Sales Tax Rate |

|---|---|

| Clothing and Footwear | 6.35% |

| Electronics | 6.35% |

| Vehicles | 6.35% (plus additional registration fees) |

| Restaurant Meals | 6.35% |

Impact on Businesses

Sales tax has a significant impact on businesses operating in Connecticut. Retailers and service providers are responsible for collecting and remitting sales tax to the state. This process involves accurate record-keeping, tax registration, and timely filing of tax returns.

For businesses, sales tax compliance is a critical aspect of their financial operations. They must ensure that they collect the correct tax rate, maintain detailed sales records, and accurately report their taxable sales to the state. Failure to comply with sales tax regulations can result in penalties, interest charges, and legal consequences.

Connecticut provides resources and guidance to help businesses navigate the sales tax landscape. The Connecticut Department of Revenue Services (DRS) offers a comprehensive online portal with information on tax rates, registration processes, and tax filing requirements. Businesses can access educational materials, webinars, and workshops to stay informed about their sales tax obligations.

Sales Tax Registration and Filing

To collect and remit sales tax, businesses in Connecticut must obtain a Sales and Use Tax Permit from the DRS. The registration process involves providing detailed information about the business, including its legal structure, location, and estimated sales volume. Once registered, businesses receive a unique permit number, which must be displayed at their place of business.

Sales tax filing requirements vary depending on the business's sales volume and tax liability. Generally, businesses are required to file sales tax returns on a quarterly basis. However, those with higher sales volumes or specific tax obligations may need to file more frequently. The DRS provides online filing options, allowing businesses to submit their returns electronically and make tax payments securely.

Sales Tax Compliance and Audits

Connecticut’s DRS conducts sales tax audits to ensure compliance with tax laws and regulations. Audits can be triggered by various factors, including random selection, suspicious activities, or non-compliance indicators. During an audit, the DRS examines a business’s sales records, tax returns, and other financial documents to verify the accuracy of reported taxable sales and tax remittances.

Businesses undergoing a sales tax audit should cooperate fully with the DRS and provide the requested information promptly. It is crucial to maintain organized records and have a thorough understanding of the state's sales tax regulations to navigate the audit process effectively. Seeking professional tax advice or consulting with legal experts can also be beneficial during an audit.

Impact on Consumers

Sales tax directly affects consumers in Connecticut, as they are responsible for paying the tax on their purchases. The tax adds to the total cost of goods and services, impacting their purchasing power and overall financial planning.

For consumers, understanding the sales tax rate and how it applies to different items is essential for making informed buying decisions. By being aware of the tax implications, consumers can budget effectively and plan their purchases accordingly. Additionally, consumers should be mindful of any exemptions or special tax rates that may apply to specific items or services, as these can provide opportunities for savings.

Connecticut offers resources to assist consumers in understanding their sales tax obligations. The DRS provides a user-friendly website with information on sales tax rates, exemptions, and frequently asked questions. Consumers can also reach out to the DRS's taxpayer assistance services for personalized guidance and support.

Online Shopping and Sales Tax

With the rise of e-commerce, online shopping has become increasingly popular among Connecticut residents. When purchasing goods online, consumers should be aware that sales tax still applies, even for out-of-state purchases. The state’s sales tax laws extend to online retailers, ensuring that tax obligations are met regardless of the sales channel.

Online retailers are responsible for collecting and remitting sales tax on taxable items sold to Connecticut residents. However, if the online retailer does not have a physical presence in Connecticut, the responsibility of paying sales tax may fall on the consumer. In such cases, consumers are required to self-report and pay the use tax on their out-of-state purchases.

Sales Tax Exemptions and Special Cases

Connecticut provides various sales tax exemptions and special cases to promote economic development, support specific industries, and alleviate tax burdens on certain goods and services.

Exemptions for Essential Goods

Connecticut exempts certain essential goods from sales tax to ensure affordability and accessibility for consumers. These exemptions include:

- Prescription and over-the-counter medications

- Most non-prepared food items, such as groceries and staple foods

- Clothing and footwear items under a certain value threshold

- Certain medical devices and equipment

By exempting these essential goods, Connecticut aims to reduce the tax burden on basic necessities, promoting financial stability for low-income households and supporting healthy lifestyles.

Special Cases: Lodging and Entertainment

Connecticut imposes a sales tax on lodging and entertainment services, but certain special cases apply. For example, the state offers a reduced sales tax rate for certain types of accommodations, such as campgrounds and recreational vehicles. This exemption aims to promote tourism and support the hospitality industry.

Additionally, some entertainment services, such as amusement parks and certain live performances, may be exempt from sales tax or subject to a reduced rate. These exemptions encourage cultural and recreational activities, making them more accessible to residents and visitors alike.

Future Implications and Potential Changes

The sales tax landscape in Connecticut is subject to ongoing discussions and potential changes. As the state’s economic needs evolve, policymakers may consider adjustments to the sales tax rate, exemptions, or the tax structure itself.

One potential area of focus is the taxation of online sales. With the growth of e-commerce, states are exploring ways to ensure a level playing field between brick-and-mortar businesses and online retailers. Connecticut may consider implementing measures to streamline the collection and remittance of sales tax for online purchases, ensuring fair competition and adequate revenue generation.

Additionally, the state may explore the idea of broadening the sales tax base to include certain services that are currently exempt. This could involve extending the sales tax to digital services, such as streaming platforms or software subscriptions, to adapt to the changing nature of the economy.

Potential Benefits and Challenges

Expanding the sales tax base could provide additional revenue for the state, allowing for increased investments in public services and infrastructure. However, it may also face resistance from consumers and certain industries, as it could lead to higher prices for certain services.

Balancing the need for revenue generation with the impact on consumers and businesses is a delicate task. Connecticut's policymakers must carefully consider the potential benefits and challenges of any proposed changes to the sales tax system, ensuring that any adjustments promote economic growth and fairness for all stakeholders.

Conclusion

Sales tax in Connecticut is a complex yet essential component of the state’s revenue system. It plays a vital role in funding public services and infrastructure while impacting businesses and consumers alike. By understanding the sales tax rates, exemptions, and compliance requirements, businesses and consumers can navigate the tax landscape effectively.

As the state continues to evolve and adapt to changing economic conditions, the sales tax system may undergo further modifications. Staying informed and engaged with the latest developments ensures that businesses and consumers can make informed decisions and contribute to the economic well-being of Connecticut.

Frequently Asked Questions

How often do I need to file my sales tax returns in Connecticut?

+The frequency of sales tax filing in Connecticut depends on your business’s sales volume and tax liability. Generally, businesses are required to file sales tax returns on a quarterly basis. However, those with higher sales volumes or specific tax obligations may need to file more frequently. It’s essential to review the filing requirements provided by the Connecticut Department of Revenue Services (DRS) to determine your specific filing schedule.

Are there any exemptions for small businesses in Connecticut’s sales tax system?

+Connecticut does not have specific sales tax exemptions based solely on the size of a business. However, certain industries or specific goods and services may be exempt from sales tax, regardless of the business’s size. It’s important to review the state’s sales tax regulations and consult with tax professionals to understand the applicable exemptions for your business.

How can I stay updated on any changes to Connecticut’s sales tax laws and rates?

+Staying informed about sales tax changes is crucial for compliance and planning. The Connecticut Department of Revenue Services (DRS) provides regular updates and notifications on its website. You can also subscribe to their email alerts or follow their social media channels for timely information. Additionally, staying engaged with industry news and tax advisory services can help you stay abreast of any upcoming changes.