Tax Calculator 2025 Tennessee

Welcome to our comprehensive guide on the Tax Calculator for Tennessee, designed to help you navigate the tax landscape of the Volunteer State for the upcoming tax year 2025. This expert-led article will provide you with all the necessary tools and insights to understand and calculate your tax obligations accurately. As we approach the new year, it's crucial to stay informed about the latest tax regulations and potential changes to ensure a smooth and efficient tax-filing process.

Tennessee Tax Calculator: Unraveling the State’s Tax System

Tennessee’s tax system is unique, offering a simplified approach to taxation compared to many other states. Understanding the fundamentals of this system is essential for accurate tax calculations and effective financial planning.

State Income Tax: A Key Component

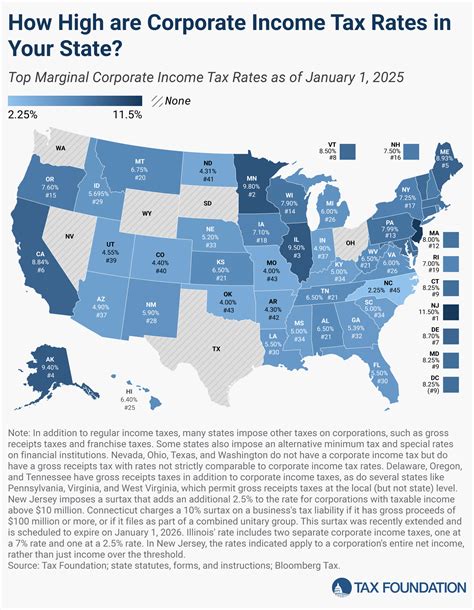

Tennessee imposes a progressive income tax structure, meaning that higher income brackets are taxed at higher rates. This approach ensures that individuals and businesses contribute proportionally to the state’s revenue. As of 2025, the income tax rates in Tennessee are as follows:

| Income Bracket | Tax Rate |

|---|---|

| 0 - 2,500 | 0% |

| 2,501 - 3,500 | 2% |

| 3,501 - 4,000 | 3% |

| 4,001 - 5,000 | 4% |

| Above $5,000 | 6% |

It's important to note that these rates may be subject to change, and taxpayers should always refer to the official Tennessee Department of Revenue website for the most up-to-date information. The income tax rates are applied to taxable income, which is the amount remaining after deductions and exemptions are considered.

Sales and Use Tax: A Dual System

Tennessee employs a sales and use tax system, which means that taxes are levied on the sale or use of goods and services within the state. The sales tax rate in Tennessee is generally 7%, but it can vary depending on the location and the type of transaction. For instance, certain cities and counties may impose additional local sales taxes, resulting in a higher overall rate.

The use tax comes into play when items are purchased from out-of-state vendors and brought into Tennessee for use. This ensures that all goods and services consumed within the state are subject to taxation. The use tax rate is the same as the sales tax rate in the jurisdiction where the item is used.

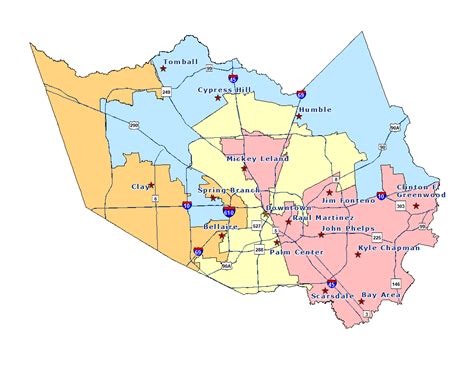

Property Tax: A Local Responsibility

Property taxes in Tennessee are primarily a local matter, with rates set by individual counties and municipalities. These taxes are typically levied on real estate, personal property, and tangible personal property. The assessment process and tax rates can vary significantly across the state, making it essential for property owners to understand their local tax obligations.

To calculate your property tax liability, you'll need to consider the assessed value of your property, the applicable tax rate, and any potential exemptions or deductions. It's advisable to consult with your local tax assessor's office for specific details and guidance.

Other Taxes: A Comprehensive Overview

In addition to the aforementioned taxes, Tennessee has a range of other tax categories that businesses and individuals may encounter:

- Franchise and Excise Taxes: These taxes are levied on businesses, depending on their legal structure and activities. Corporations, partnerships, and limited liability companies (LLCs) may be subject to franchise and excise taxes.

- Inheritance and Estate Taxes: Tennessee has abolished its inheritance tax, but it does impose an estate tax on certain estates. The threshold for estate tax liability is $5.49 million for deaths occurring in 2025.

- Motor Fuel Taxes: Taxes are applied to the sale and use of motor fuels, including gasoline and diesel, to fund transportation infrastructure.

- Severance Taxes: These taxes are imposed on the extraction of natural resources, such as coal, oil, and natural gas.

Using the Tax Calculator: A Step-by-Step Guide

To make the tax calculation process more manageable, we’ve developed a user-friendly Tax Calculator specifically tailored for Tennessee residents and businesses. Here’s a step-by-step guide to utilizing our calculator effectively:

Step 1: Access the Calculator

Visit our dedicated Tennessee Tax Calculator webpage. You can find it by searching for “Tennessee Tax Calculator” on your preferred search engine. Our calculator is designed with a clean and intuitive interface, ensuring a seamless user experience.

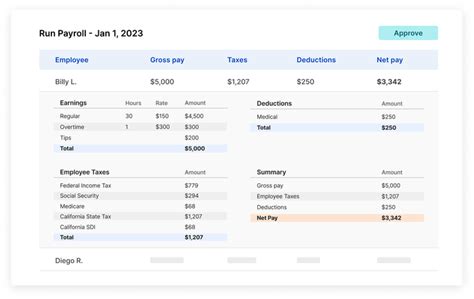

Step 2: Input Your Income Details

Start by entering your annual income. Our calculator considers both earned income (salary, wages, etc.) and unearned income (dividends, interest, etc.). It’s crucial to provide accurate income figures to ensure precise tax calculations.

Step 3: Specify Deductions and Exemptions

Next, you’ll have the opportunity to input any applicable deductions and exemptions. These can include standard deductions, itemized deductions (such as mortgage interest and charitable contributions), and personal exemptions. Our calculator provides a comprehensive list of options to choose from, ensuring you don’t miss any eligible deductions.

Step 4: Calculate State Income Tax

With your income and deductions in place, our calculator will automatically compute your taxable income and apply the appropriate state income tax rates. You’ll receive a detailed breakdown of your tax liability, including the calculation process and the tax rates applied.

Step 5: Explore Other Tax Obligations

Our Tax Calculator doesn’t stop at income tax. It also provides estimates for other relevant taxes, such as sales and use tax, property tax (based on your location), and potential franchise and excise taxes for businesses. This comprehensive approach ensures you have a clear understanding of your overall tax obligations.

Step 6: Review and Adjust

Once you’ve received your tax estimates, take the time to review the calculations and ensure they align with your expectations. If you have any concerns or require further clarification, our calculator offers detailed explanations for each tax category. You can also adjust your income, deductions, or other variables to see how these changes impact your tax liability.

Step 7: Save and Share

Our Tax Calculator allows you to save your calculations for future reference. You can also share the results with your tax advisor or accountant to facilitate a seamless tax-filing process. This feature ensures that you have a record of your tax estimates and can easily access them when needed.

The Benefits of Using a Tax Calculator

Embracing a Tax Calculator for your Tennessee tax needs offers a multitude of advantages, including:

- Accuracy: Our calculator ensures precise tax calculations, reducing the risk of errors and potential penalties.

- Time-Efficiency: By automating the calculation process, you save valuable time that can be dedicated to other financial planning tasks.

- Understanding: The detailed breakdowns and explanations provided by our calculator enhance your understanding of Tennessee’s tax system, empowering you to make informed financial decisions.

- Flexibility: With the ability to adjust variables, our calculator adapts to your unique financial situation, providing tailored tax estimates.

- Peace of Mind: Having a clear overview of your tax obligations alleviates stress and uncertainty, allowing you to focus on other aspects of your financial life.

Staying Informed: Tennessee Tax Updates for 2025

As we approach the tax year 2025, it’s essential to stay abreast of any potential changes to Tennessee’s tax landscape. While the state’s tax system is generally stable, there may be modifications to tax rates, deductions, or exemptions. Keeping an eye on official sources, such as the Tennessee Department of Revenue, ensures you remain informed and can adapt your financial strategies accordingly.

Key Tax Updates for 2025

- The state income tax rates remain unchanged from the previous year, providing stability for taxpayers.

- The estate tax threshold has been adjusted to $5.49 million, in line with the federal estate tax exemption for 2025.

- Certain local sales tax rates may have been adjusted, so it’s advisable to check with your local government for the latest information.

- The Tennessee Department of Revenue has launched a new online portal for tax filing, streamlining the process and enhancing security.

Expert Insights: Maximizing Your Tax Strategy

To help you navigate the intricacies of Tennessee’s tax system and optimize your tax strategy, here are some expert insights and tips:

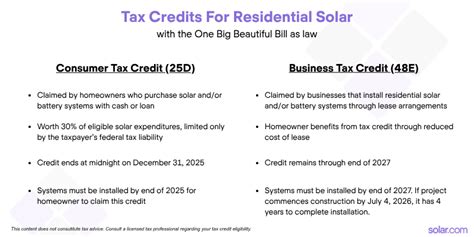

1. Explore Tax Credits and Incentives

Tennessee offers a range of tax credits and incentives to encourage economic growth and support certain industries. These can include credits for research and development, film production, and energy efficiency. By researching and understanding these incentives, you may be able to reduce your tax liability and contribute to the state’s economic development.

2. Optimize Deductions and Exemptions

Maximize your deductions and exemptions to minimize your taxable income. Consider contributing to retirement accounts, such as 401(k)s or IRAs, which offer tax advantages. Additionally, review your itemized deductions annually to ensure you’re taking advantage of all eligible options, such as medical expenses, state and local taxes, and charitable contributions.

3. Stay Informed on Tax Laws

Tax laws can change rapidly, and staying informed is crucial for effective tax planning. Subscribe to tax-related newsletters, follow reputable tax blogs, and consult with tax professionals to ensure you’re up-to-date with the latest developments. Being proactive in your tax education can lead to significant savings and avoidable penalties.

4. Consider Professional Guidance

While our Tax Calculator provides a robust tool for tax calculations, complex tax situations may require the expertise of a tax professional. Engaging the services of a certified public accountant (CPA) or tax attorney can ensure that your tax strategy is optimized and compliant with all applicable regulations.

Conclusion: Empowering Your Financial Journey

As you embark on your tax journey in Tennessee for the year 2025, remember that knowledge is power. By understanding the state’s tax system, utilizing tools like our Tax Calculator, and staying informed about tax updates, you can navigate the tax landscape with confidence and precision. Empower yourself to make informed financial decisions, optimize your tax obligations, and plan for a prosperous future.

Frequently Asked Questions

What is the deadline for filing Tennessee state taxes in 2025?

+

The deadline for filing Tennessee state taxes for the 2025 tax year is April 15, 2026. However, if this date falls on a weekend or a holiday, the deadline is extended to the next business day.

Are there any tax breaks or incentives for remote workers in Tennessee?

+

Yes, Tennessee offers a remote worker tax credit for eligible individuals who work remotely for at least 183 days in a tax year. The credit is available for up to 2,500 per taxpayer and can be claimed on the state income tax return.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Can I deduct my home office expenses if I work remotely in Tennessee?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Yes, Tennessee allows taxpayers to deduct home office expenses if they meet certain criteria. The home office must be used exclusively and regularly for business purposes, and the deduction is calculated based on the percentage of the home used for business.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Are there any changes to Tennessee's estate tax laws for 2025?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Yes, Tennessee's estate tax exemption has been increased to 5.49 million for deaths occurring in 2025. This means that estates with a value below this threshold are not subject to the state’s estate tax.

How can I stay updated on Tennessee tax news and changes?

+

To stay informed about Tennessee tax news and changes, you can subscribe to the Tennessee Department of Revenue’s newsletter, follow their social media accounts, and regularly visit their official website. Additionally, tax professionals and reputable tax publications can provide valuable insights and updates.