Tn State Sales Tax

Welcome to this comprehensive guide on Tennessee's state sales tax. Understanding the intricacies of sales tax is crucial for businesses and consumers alike, as it directly impacts financial transactions and economic activities within the state. In this article, we will delve into the specifics of Tennessee's sales tax, exploring its rates, applicability, exemptions, and the impact it has on the state's economy and consumer behavior.

Unraveling Tennessee's State Sales Tax

Tennessee, known as the Volunteer State, boasts a vibrant economy with a diverse range of industries. Sales tax is a critical component of the state's revenue stream, contributing significantly to the funding of essential public services and infrastructure. Let's navigate through the key aspects of Tennessee's sales tax system.

Sales Tax Rates in Tennessee

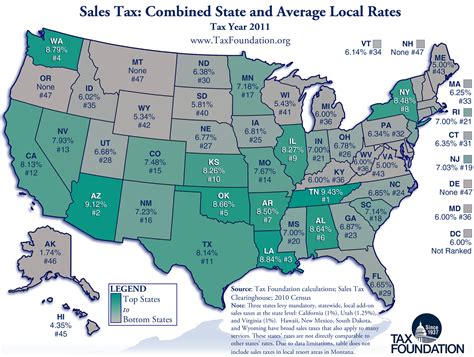

Tennessee operates a relatively straightforward sales tax system with a uniform statewide sales tax rate of 7%. This rate applies to most tangible personal property and certain services. However, it is important to note that local municipalities and counties have the authority to impose additional sales tax rates, creating a more complex landscape for businesses and consumers.

The combined sales tax rate, including both the state and local rates, can vary across different regions within Tennessee. For instance, in the city of Memphis, the combined sales tax rate stands at 9.25%, while in Nashville, it is 9.25% as well. These variations arise from the addition of local option taxes, often referred to as special taxes, which are levied to support specific projects or services within a community.

To provide a clearer picture, here's a table outlining the sales tax rates in some of Tennessee's major cities:

| City | State Tax Rate | Local Tax Rate | Combined Tax Rate |

|---|---|---|---|

| Memphis | 7% | 2.25% | 9.25% |

| Nashville | 7% | 2.25% | 9.25% |

| Knoxville | 7% | 2.25% | 9.25% |

| Chattanooga | 7% | 2.25% | 9.25% |

| Jackson | 7% | 2.25% | 9.25% |

These local tax rates can further vary based on specific jurisdictions within a city, such as special tax districts or urban growth boundaries. It is essential for businesses operating in Tennessee to stay updated on these local variations to ensure accurate tax compliance.

Taxable Goods and Services

Tennessee's sales tax applies to a wide range of tangible personal property and services. This includes items such as clothing, electronics, furniture, and groceries. Additionally, certain services like automotive repairs, legal services, and entertainment admissions are also subject to sales tax.

However, it is crucial to understand that there are specific exemptions and exceptions within the sales tax framework. These exemptions are designed to alleviate the tax burden on certain sectors or to promote specific economic or social objectives. Let's explore some of these exemptions in more detail.

Sales Tax Exemptions and Exceptions

Tennessee has implemented various sales tax exemptions to support certain industries, encourage economic development, and provide relief to specific consumer groups. Here are some notable exemptions and exceptions:

- Food and Drugs: Certain food items, including groceries and non-alcoholic beverages, are exempt from sales tax. Additionally, prescription drugs and medical supplies are also excluded from the sales tax base.

- Manufacturing and Agriculture: To support Tennessee's manufacturing and agricultural sectors, certain raw materials, equipment, and machinery used in these industries are exempt from sales tax.

- Resale and Wholesale Transactions: Sales made for the purpose of resale or wholesale are exempt from sales tax. This exemption applies to businesses engaged in the distribution and supply chain of goods.

- Government Entities: Sales made to state and local government entities, as well as certain non-profit organizations, are generally exempt from sales tax.

- Educational and Research Institutions: Sales to accredited educational institutions and research facilities may be exempt from sales tax, provided the items are used for educational or research purposes.

- Certain Services: Specific services, such as legal, accounting, and medical services, are subject to sales tax. However, there are exemptions for services provided to government entities or non-profit organizations.

It is important for businesses and consumers to familiarize themselves with these exemptions to ensure compliance and take advantage of any applicable tax relief.

Sales Tax Compliance and Administration

Tennessee's Department of Revenue is responsible for the administration and enforcement of the state's sales tax laws. Businesses are required to register with the department, obtain a sales tax permit, and collect sales tax from customers at the point of sale. The collected sales tax must then be remitted to the state on a regular basis, typically on a monthly or quarterly basis, depending on the business's sales volume.

The department provides resources and guidance to help businesses navigate the sales tax system, including online tools for registration, tax rate lookups, and tax filing. It is crucial for businesses to stay informed about their sales tax obligations to avoid penalties and ensure compliance.

Impact on the Economy and Consumer Behavior

Tennessee's sales tax has a significant impact on both the state's economy and consumer behavior. On the economic front, sales tax revenue contributes to the funding of essential public services, infrastructure development, and social programs. It plays a vital role in supporting Tennessee's economic growth and stability.

For consumers, sales tax can influence purchasing decisions and spending habits. The tax burden, particularly in areas with higher combined tax rates, can impact the affordability of goods and services. However, the presence of sales tax exemptions and variations in tax rates across regions can provide opportunities for consumers to make more cost-effective choices.

Additionally, Tennessee's sales tax system, with its uniform state rate and localized variations, can influence business location decisions. Businesses may consider the tax landscape when deciding on their operational hubs or expansion plans within the state.

Conclusion

Tennessee's state sales tax is a critical component of the state's revenue system, contributing to the funding of essential services and economic development. The state's straightforward tax rate, coupled with localized variations, provides a balanced approach to generating revenue while allowing for regional flexibility. Understanding the sales tax system is essential for businesses and consumers to navigate the economic landscape of Tennessee effectively.

As we conclude this comprehensive guide, we hope to have provided valuable insights into Tennessee's sales tax. Stay tuned for more insightful articles and resources on tax-related topics, helping you stay informed and make informed financial decisions.

What is the state sales tax rate in Tennessee?

+The state sales tax rate in Tennessee is 7%.

Are there any local sales tax rates in Tennessee?

+Yes, local municipalities and counties can impose additional sales tax rates, leading to variations in the combined tax rate across the state.

What goods and services are subject to sales tax in Tennessee?

+Sales tax applies to most tangible personal property and certain services, including clothing, electronics, groceries, and automotive repairs.

Are there any sales tax exemptions in Tennessee?

+Yes, Tennessee offers various sales tax exemptions to support industries, encourage economic development, and provide relief to specific consumer groups. These include exemptions for food, drugs, manufacturing, and certain services.

How does sales tax impact businesses in Tennessee?

+Sales tax affects businesses through their tax obligations and the potential influence on customer purchasing decisions. Understanding the sales tax system is crucial for businesses to navigate the economic landscape effectively.