County Of Fairfax Property Tax

The County of Fairfax, located in the heart of Northern Virginia, is known for its vibrant communities, diverse population, and thriving economy. One aspect that often captures the attention of both residents and businesses is the property tax system. Property taxes play a significant role in funding essential services and infrastructure, making it a topic of interest and importance for Fairfax County's residents and stakeholders.

Understanding Fairfax County’s Property Tax System

Fairfax County employs a comprehensive property tax system to generate revenue for the county’s operations and services. This system is designed to be fair and equitable, taking into account various factors such as property values, location, and the specific needs of different areas within the county. Let’s delve into the key aspects of Fairfax County’s property tax landscape.

Property Assessment Process

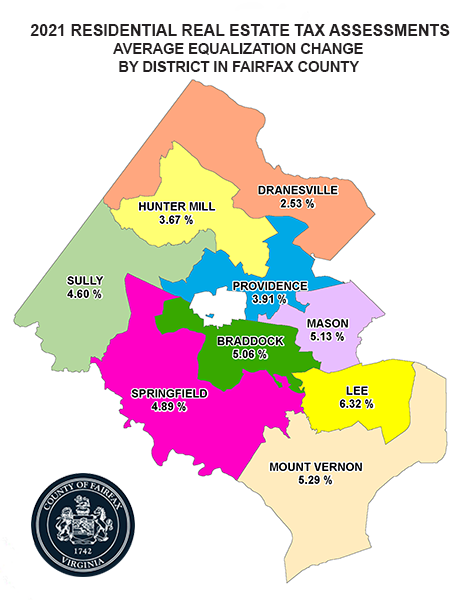

The journey of property taxation in Fairfax County begins with a meticulous assessment process. The Fairfax County Department of Tax Administration (DTA) is responsible for evaluating all real estate properties within the county. This includes residential, commercial, and industrial properties. The assessment process involves determining the fair market value of each property, which serves as the basis for calculating property taxes.

The DTA employs a combination of market analysis, sales data, and property characteristics to arrive at accurate assessments. These assessments are typically conducted every year, ensuring that property values remain up-to-date and reflective of the current real estate market.

Tax Rates and Calculations

Once the assessments are finalized, the county applies specific tax rates to determine the property tax liability for each property owner. These tax rates, expressed in cents per 100 of assessed value, are set by the Board of Supervisors and can vary based on the type of property and its location within the county.</p> <p>For instance, consider a residential property with an assessed value of 500,000. If the applicable tax rate is 0.98 cents per $100 of assessed value, the annual property tax for this property would be calculated as follows:

| Assessed Value | Tax Rate | Property Tax |

|---|---|---|

| $500,000 | 0.98 cents per $100 | $4,900 |

It's important to note that Fairfax County offers various tax relief programs and exemptions to eligible property owners, such as the elderly, disabled individuals, and veterans. These programs aim to provide financial assistance and reduce the tax burden for specific segments of the population.

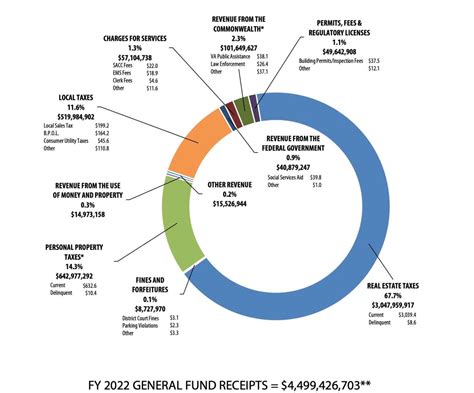

Revenue Allocation and Services

The revenue generated from property taxes in Fairfax County is a crucial component of the county’s budget. It funds a wide array of essential services and infrastructure projects, contributing to the overall well-being and development of the community.

Some of the key areas where property tax revenue is allocated include:

- Education: A significant portion of property tax revenue supports the Fairfax County Public Schools, ensuring quality education for students across the county.

- Public Safety: Property taxes fund police, fire, and emergency services, maintaining a safe and secure environment for residents and businesses.

- Transportation: Investments in road maintenance, public transit, and infrastructure improvements are made possible through property tax revenue.

- Recreation and Parks: Property taxes contribute to the development and upkeep of recreational facilities, parks, and open spaces, enhancing the quality of life for residents.

- Social Services: Fairfax County’s social safety net programs, including healthcare, housing assistance, and community support initiatives, receive funding from property taxes.

Property Tax Relief Programs and Exemptions

Fairfax County recognizes the diverse needs and circumstances of its residents, and as such, offers a range of tax relief programs and exemptions to provide financial assistance to eligible property owners.

Landowner Tax Relief Program

The Landowner Tax Relief Program is designed to assist Fairfax County residents who own and occupy their primary residence. This program provides a credit on the property tax bill, helping to reduce the overall tax liability. Eligibility criteria include being a Virginia resident, occupying the property as the primary residence, and meeting certain income thresholds.

Senior Citizen and Disabled Persons Tax Relief

Fairfax County offers tax relief to senior citizens and disabled individuals who meet specific requirements. This program aims to alleviate the financial burden of property taxes for those who may have limited income or face challenges due to their age or disability. To qualify, applicants must be at least 65 years old (for senior citizens) or have a qualifying disability, and meet income and asset limits.

Veterans’ Tax Relief

As a way to honor and support veterans, Fairfax County provides tax relief to eligible veterans and their surviving spouses. This program offers a reduction in property taxes, ensuring that those who have served our country receive financial assistance. To be eligible, veterans must have served during a period of declared hostilities and meet certain criteria related to their service and discharge.

Homestead Exemption

The Homestead Exemption is available to all Fairfax County residents, regardless of age or disability. This exemption protects a portion of the property’s assessed value from tax increases. By applying for the Homestead Exemption, property owners can ensure that their tax liability remains stable even if property values rise.

Property Tax Payment Options and Deadlines

Fairfax County provides convenient options for property owners to pay their taxes and offers a range of payment methods to accommodate different preferences.

Online Payment Portal

The Fairfax County website offers a user-friendly online payment portal. Property owners can access their tax accounts, view their bills, and make secure payments using credit cards, debit cards, or electronic checks. This portal also provides a history of past payments and tax-related documents, ensuring transparency and easy access to important information.

Mail-In Payments

For those who prefer traditional methods, Fairfax County accepts mail-in payments. Property owners can send their tax payments via check or money order to the specified address provided on the tax bill. It’s important to ensure that payments are mailed in sufficient time to reach the county by the due date to avoid late fees and penalties.

Payment Deadlines and Late Penalties

Fairfax County sets specific deadlines for property tax payments. Failure to pay by the due date may result in late penalties and interest charges. It’s crucial for property owners to stay informed about these deadlines to avoid unnecessary financial burdens.

The county typically sends tax bills in late summer or early fall, with payment due dates falling in November or December. It’s advisable to pay attention to the due dates and plan accordingly to ensure timely payment.

Conclusion: A Transparent and Equitable Property Tax System

Fairfax County’s property tax system is designed to be fair, transparent, and responsive to the needs of its diverse community. The county’s commitment to assessing property values accurately, applying reasonable tax rates, and offering relief programs ensures that property taxes are a sustainable source of revenue for essential services while remaining manageable for property owners.

By understanding the assessment process, tax rates, relief programs, and payment options, Fairfax County residents can navigate the property tax landscape with confidence. The county’s dedication to transparency and community engagement fosters trust and empowers residents to actively participate in shaping their community’s future.

How often are property assessments conducted in Fairfax County?

+Property assessments in Fairfax County are typically conducted annually to ensure that property values remain up-to-date and reflective of the current real estate market. This annual assessment process helps maintain fairness and accuracy in the property tax system.

Are there any tax relief programs for low-income property owners in Fairfax County?

+Yes, Fairfax County offers the Landowner Tax Relief Program, which provides a credit on the property tax bill for eligible low-income property owners who occupy their primary residence. This program aims to assist those with limited income and ensure a more equitable tax burden.

Can property owners appeal their assessed values in Fairfax County?

+Absolutely! Fairfax County provides an appeals process for property owners who believe their assessed values are inaccurate. The process involves submitting an appeal within a specified timeframe, typically accompanied by supporting documentation. The Department of Tax Administration reviews these appeals and makes determinations based on the provided evidence.