How To File Local Taxes In Pa

Filing local taxes in Pennsylvania can seem daunting, especially for those who are new to the state or are unfamiliar with the process. Pennsylvania's tax system is unique, with varying requirements and forms depending on your location and circumstances. However, with the right guidance and resources, it can be a straightforward and manageable task. This comprehensive guide will walk you through the process of filing local taxes in Pennsylvania, providing you with the necessary steps, forms, and tips to ensure a smooth experience.

Understanding Local Taxes in Pennsylvania

Pennsylvania, often referred to as the Keystone State, has a diverse tax landscape. Local taxes are primarily handled by counties and municipalities, which means tax rates and requirements can vary significantly across the state. These local taxes are in addition to the state income tax and other federal taxes.

Local taxes typically include property taxes, which are levied on real estate and are often the most significant tax burden for homeowners and businesses. Local services taxes are also common, funding specific municipal services like fire protection or public transportation. Some localities may also impose earned income taxes on residents' earnings, and business privilege taxes on certain business activities.

It's crucial to understand that not all Pennsylvania localities impose all these taxes, and the rates and structures can vary greatly. For instance, the local services tax may be a flat rate or a percentage of earnings, while earned income taxes can have different rates for individuals and businesses.

Key Tax Types in Pennsylvania

- Property Taxes: Based on the assessed value of your property, these taxes fund local services like schools, fire departments, and road maintenance.

- Local Services Taxes: These are often used to support specific services like garbage collection, street lighting, or emergency services.

- Earned Income Taxes: Imposed on wages, salaries, commissions, and other forms of compensation, these taxes can vary based on your residence and employment location.

- Business Privilege Taxes: Applied to businesses operating within a municipality, these taxes are often based on gross receipts or employee headcount.

Determining Your Tax Obligations

The first step in filing local taxes in Pennsylvania is understanding your tax obligations. This involves researching the specific taxes imposed by your county and municipality, as well as any exemptions or discounts for which you may be eligible.

For instance, some localities offer homestead or senior citizen tax exemptions that can significantly reduce your property tax bill. Others might have tax relief programs for low-income earners or veterans.

It's essential to note that Pennsylvania has over 2,500 taxing jurisdictions, so the process of understanding your obligations can be complex. However, many resources are available to help, including county and municipal websites, tax professionals, and online tax preparation services.

Researching Local Tax Rates and Forms

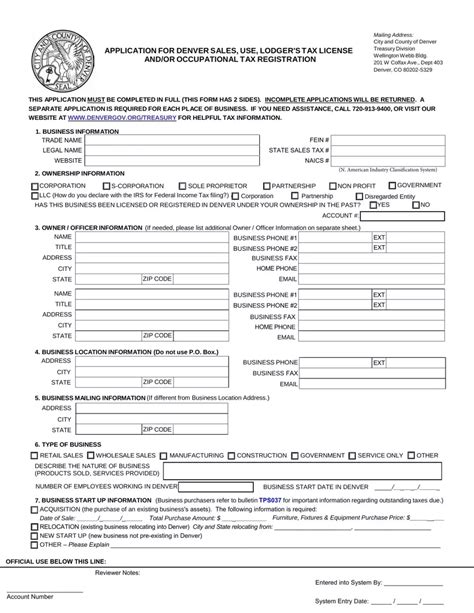

Start by visiting the official websites of your county and municipality. Most localities provide detailed information on their tax structures, including rates, due dates, and the necessary forms. You can often download these forms directly from the website or request them by mail.

For instance, Allegheny County provides an Online Tax Guide that outlines its tax structure, including the Real Estate Tax, Occupancy Tax, and Business Privilege Tax. Similarly, the City of Philadelphia has a dedicated Taxes & Licenses section on its website, detailing taxes like the Business Income and Receipts Tax and the Philadelphia Wage Tax.

Gathering Required Information and Documents

Once you understand your tax obligations, it’s time to gather the necessary information and documents to complete your tax forms.

For property taxes, you'll need information about your property's assessed value, which can usually be found on your most recent property tax bill or by contacting your county assessor's office. You may also need proof of any exemptions or discounts you're claiming.

For earned income taxes and local services taxes, you'll need to provide details about your earnings and, in some cases, your employment status. This may include W-2 forms, 1099s, or other income documentation.

Business owners will need to provide information about their business activities, such as gross receipts, number of employees, and business location(s). This is essential for calculating business privilege taxes and local sales taxes, if applicable.

Common Documents Required

- Property Tax: Recent tax bill, property assessment details, and proof of exemptions (if applicable)

- Earned Income Tax: W-2 forms, 1099s, and other income documentation

- Local Services Tax: Proof of income and, in some cases, employment status

- Business Taxes: Business registration documents, gross receipts, employee headcount, and business location details

Completing and Filing Your Tax Forms

With your research complete and your documents gathered, you’re ready to tackle the tax forms themselves.

Most localities provide fillable PDF forms on their websites, which can be downloaded, completed, and printed. Alternatively, some counties and municipalities offer online filing systems where you can input your information directly and submit your forms electronically.

It's crucial to double-check your forms for accuracy before submitting them. Errors can lead to delays in processing or additional fees, so take the time to ensure all information is correct.

Step-by-Step Guide to Filing

- Download and open the appropriate tax form(s) from your county or municipal website.

- Carefully enter all required information, including your personal details, income figures, and any applicable exemptions or deductions.

- Calculate your tax liability based on the provided tax rates and any applicable discounts or surcharges.

- If you’re filing multiple forms, ensure they’re all correctly filled out and that the information is consistent across all documents.

- Review your forms for accuracy and completeness.

- Submit your forms by the due date, either by mail or electronically, depending on the options provided by your locality.

Payment Options and Due Dates

Understanding your payment options and due dates is crucial to avoid late fees and penalties. Payment methods can vary depending on your locality and the type of tax you’re paying.

Common payment methods include checks, money orders, credit cards, and electronic fund transfers. Some localities also offer payment plans or installment options for large tax bills.

Due dates for local taxes in Pennsylvania can range from quarterly to annual, depending on the tax type. It's essential to note these dates on your calendar to ensure timely payment.

Payment Methods and Due Dates by Tax Type

| Tax Type | Common Payment Methods | Due Dates |

|---|---|---|

| Property Taxes | Check, money order, credit card, electronic transfer | Typically quarterly or semi-annual, aligned with local budget cycles |

| Local Services Taxes | Check, money order, electronic transfer | Often due annually, with specific deadlines set by the locality |

| Earned Income Taxes | Check, money order, electronic transfer | Annual, with varying deadlines depending on the locality |

| Business Privilege Taxes | Check, money order, electronic transfer | Varies by locality and business type; often quarterly or annually |

Filing Deadlines and Late Payment Penalties

Missing filing deadlines or late payments can result in significant penalties and interest charges. It’s essential to be aware of these potential consequences and plan your tax filing and payment process accordingly.

Late filing penalties can range from a small percentage of the tax due to a fixed fee per day, depending on the locality and the tax type. Interest charges on late payments are also common, typically calculated at a set rate per year or per month.

Understanding Late Penalties and Interest Charges

For instance, the City of Philadelphia imposes a 5% penalty on late payments of the Business Income and Receipts Tax, as well as interest charges at a rate of 0.75% per month on the unpaid tax balance.

Allegheny County, on the other hand, charges a 10% penalty on late payments of the Real Estate Tax, with interest accruing daily at a rate of 0.0274% (or 10% annually) on the unpaid tax balance.

It's crucial to note that these penalties and interest charges can quickly add up, making timely filing and payment even more important.

Common Challenges and Troubleshooting

While filing local taxes in Pennsylvania can be straightforward for many, certain challenges can arise. Here are some common issues and troubleshooting tips to help you navigate them.

Dealing with Complex Tax Situations

If you have a complex tax situation, such as multiple properties, businesses, or sources of income, it can be challenging to determine your tax obligations accurately. In such cases, consider seeking professional help from a tax advisor or accountant who can guide you through the process.

Additionally, many localities provide resources and guides for complex tax situations. For instance, the Allegheny County Taxpayer Assistance Office offers personalized help with tax matters, and the City of Philadelphia provides an Individual Taxpayer Help Center with detailed information and assistance.

Handling Disputes and Appeals

If you disagree with a tax assessment or believe you’ve been incorrectly charged a tax, you have the right to dispute it. Most localities have formal processes for appealing tax assessments, which typically involve filing a written appeal with the appropriate tax authority.

For instance, the Philadelphia Tax Review Board handles appeals for various taxes, including the Philadelphia Wage Tax and the Business Income and Receipts Tax. Allegheny County, on the other hand, has a Board of Property Assessment Appeals and Review for property tax disputes.

It's crucial to follow the specific appeal process outlined by your locality, as failure to do so can result in your appeal being denied.

Resources and Support for Taxpayers

Pennsylvania provides numerous resources and support services to help taxpayers navigate the local tax landscape. These resources can be invaluable, especially for those new to the state or those with complex tax situations.

Official Government Resources

Start with the official websites of your county and municipality, which often provide comprehensive tax guides, forms, and contact information for tax authorities. For instance, the Pennsylvania Department of Revenue website offers a Taxpayer Guide with detailed information on various taxes and filing requirements.

Many localities also have dedicated tax offices or departments that can provide personalized assistance. For example, the Allegheny County Treasurer's Office provides a Taxpayer Assistance Line for questions about property taxes, while the Philadelphia Department of Revenue offers an Individual Taxpayer Help Center for residents.

Community and Online Resources

In addition to official government resources, there are numerous community and online resources that can provide valuable insights and support.

Local community centers, libraries, and senior centers often host tax assistance programs, especially during tax season. These programs typically provide free tax preparation services and guidance for low-income individuals and families.

Online resources, such as tax preparation websites and forums, can also be a great source of information and support. However, it's essential to verify the credibility of the source before relying on any advice or information.

Staying Informed and Up-to-Date

Tax laws and regulations can change frequently, so it’s crucial to stay informed about any updates that may impact your tax obligations. Here are some tips to help you stay up-to-date.

Monitoring Tax News and Updates

Subscribe to tax newsletters or follow tax-related news sources to stay informed about the latest tax changes and developments. Many localities also provide email subscription services to notify taxpayers about important updates and deadlines.

For instance, the Pennsylvania Department of Revenue provides a Tax News Service that delivers the latest tax news and updates directly to your inbox. Similarly, many counties and municipalities have social media accounts or email lists where they share tax-related information.

Attending Tax Workshops and Seminars

Attending tax workshops and seminars can be a great way to learn about new tax laws and regulations, as well as to ask questions and receive personalized advice. Many localities and community organizations host these events, especially during tax season.

For instance, the Philadelphia Department of Revenue hosts Taxpayer Education Workshops throughout the year, providing valuable information and guidance on various tax topics. These workshops are often free and open to the public.

Future Implications and Tax Planning

Filing local taxes is not just about compliance; it’s also an opportunity to plan for the future and optimize your tax situation. Here are some considerations for effective tax planning.

Understanding Tax Impacts on Your Financial Goals

Local taxes can significantly impact your financial planning, especially if you’re saving for a major purchase or investment. Understanding how these taxes affect your cash flow and savings can help you make informed decisions and adjust your financial strategy accordingly.

For instance, high property taxes may impact your ability to save for a down payment on a new home, while significant earned income taxes can affect your retirement savings contributions.

Strategies for Tax Optimization

There are various strategies you can employ to optimize your tax situation and potentially reduce your tax burden. These strategies often involve taking advantage of available tax credits, deductions, and exemptions.

For example, homeowners can benefit from homestead exemptions, which reduce the taxable value of their property. Low-income earners and seniors may qualify for tax relief programs, which can significantly reduce their tax liability.

Additionally, business owners can explore various business tax incentives, such as tax credits for hiring or investing in certain industries, or deductions for research and development expenses.

Conclusion: A Comprehensive Approach to Local Tax Filing

Filing local taxes in Pennsylvania requires a comprehensive understanding of your tax obligations, the necessary forms and processes, and the resources available to support you. By following the steps outlined in this guide and staying informed about tax changes, you can ensure a smooth and compliant tax filing experience.

Remember, while this guide provides a general overview, your specific tax situation may require additional research and guidance. Don't hesitate to reach out to tax professionals or utilize the resources provided by your county and municipality for personalized assistance.

What are the common local taxes in Pennsylvania, and how do they vary across the state?

+

Pennsylvania’s local taxes include property taxes, local services taxes, earned income taxes, and business privilege taxes. These taxes can vary significantly across the state in terms of rates, structures, and applicability. For instance, property tax rates can differ greatly between counties, and some localities may not impose certain taxes at all.

How can I determine my tax obligations and find the necessary forms in Pennsylvania?

+

To determine your tax obligations, start by researching your county and municipal websites. These sites often provide detailed information on local taxes, including rates, due dates, and the necessary forms. You can usually download these forms directly from the website or request them by mail.